How Tungsten Automation's CFO Move Sparked a Rival's Strategic Shift

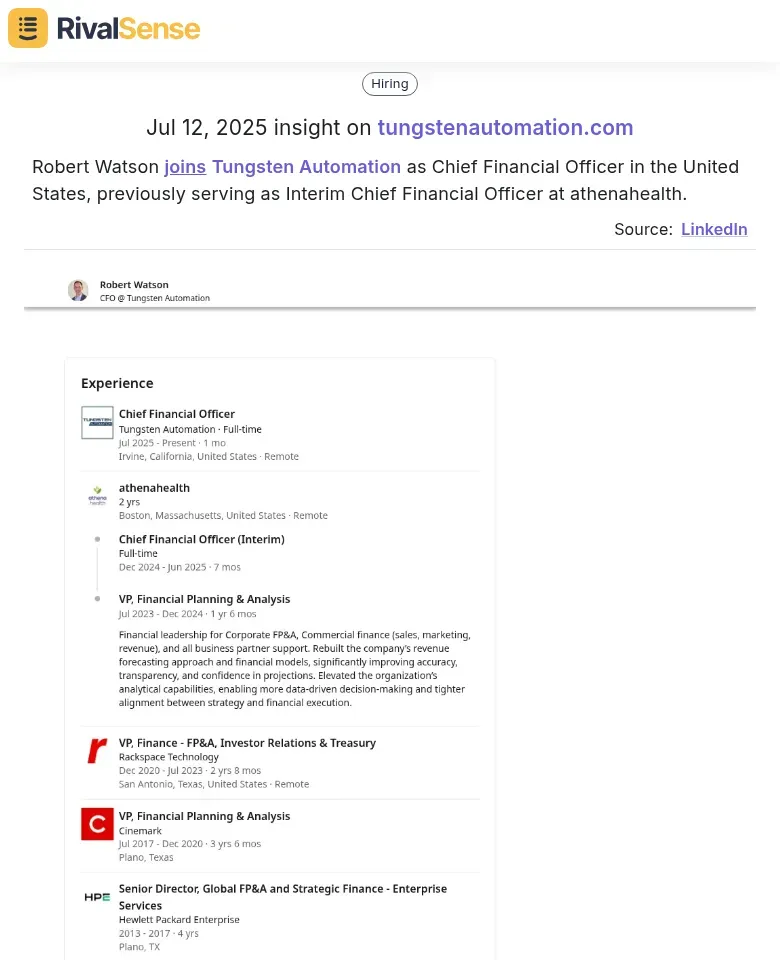

Executive appointments often serve as early indicators of strategic pivots within organizations. When RivalSense detected that Robert Watson joined Tungsten Automation as Chief Financial Officer—bringing experience from his interim CFO role at athenahealth—it signaled more than a routine leadership change. This move hinted at Tungsten's intensified focus on financial restructuring and market expansion, triggering immediate reactions across the B2B financial solutions sector.

Tracking executive changes like this provides invaluable foresight. Such insights reveal strategic priorities—whether cost optimization, market entry, or operational overhaul—allowing competitors to anticipate market shifts weeks before public announcements.

Finova, a key player facing market share erosion, interpreted this appointment as a competitive threat. Stakeholders reacted swiftly: Tungsten's investors expressed confidence in their growth trajectory, while Finova's shareholders questioned their responsiveness. This scenario underscores a critical lesson—monitoring competitor leadership moves isn't just observational; it's foundational for strategic agility.

Practical Advice:

- 🔍 Monitor key personnel changes at rival companies—they often precede strategic redirection

- 📊 Quantify potential market impact through scenario analysis

- 🗣️ Proactively communicate strategic vision to reassure stakeholders

- 💡 Convert competitive signals into innovation catalysts

Analyzing the Strategic Implications

Tungsten Automation's CFO appointment wasn't isolated—it coincided with their digital transformation initiatives, revealing a cohesive strategy toward scalability and cost efficiency. Competitors recognizing this pattern could deduce imminent market aggression: potential pricing reforms, M&A activity, or service expansions. Finova's leadership, alerted to these signals through competitive intelligence, initiated a comprehensive strategic review.

Market dynamics amplified the urgency. Rising demand for AI-driven financial tools and compressed profit margins in legacy services forced Finova to accelerate their own digital roadmap while exploring alternative revenue streams. Ignoring such interconnected signals risks strategic obsolescence.

Actionable Framework:

| Step | Action | Outcome |

|---|---|---|

| 1 | Track executive moves | Identify strategic intent |

| 2 | Map to market trends | Validate competitive threats |

| 3 | Conduct war-gaming exercises | Develop countermeasures |

| 4 | Deploy monitoring tools | Maintain real-time awareness |

The Rival's Strategic Shift: A Deep Dive

Finova's response to Tungsten Automation's move exemplified strategic agility. Within eight weeks, they executed a multi-phase repositioning:

-

Weeks 1-2: Vulnerability Audit

- Assessed financial resilience and innovation gaps

- Benchmarked capabilities against Tungsten's new leadership expertise

-

Weeks 3-4: Strategic Announcements

- 15% operational cost reduction

- 40% R&D budget increase for AI solutions

-

Weeks 5-6: Leadership Restructuring

- Hired CFO with fintech scaling experience

- Created cross-functional innovation task force

-

Weeks 7-8: Strategy Rollout

- Launched premium API banking suite

- Partnered with blockchain security firm

This pivot targeted Tungsten's emerging strengths—countering financial agility with superior product differentiation while maintaining price parity.

Execution Checklist:

- [ ] Conduct capability assessment before reacting

- [ ] Balance cost discipline with growth investments

- [ ] Align leadership hires with strategic gaps

- [ ] Socialize changes internally before external launch

Impact on Market Position and Competitive Landscape

Initially, Finova's market share dipped 3% as investors questioned their responsiveness. However, their strategic recalibration yielded tangible recovery within six months. Tungsten Automation's financial edge now contends with Finova's enhanced product ecosystem—creating distinct value propositions for overlapping customer segments.

Customer sentiment reflects this bifurcation:

- Enterprise clients favor Tungsten's pricing transparency

- Tech-forward SMBs prefer Finova's modular solutions

Analysts note the rivalry intensified innovation velocity across the sector, with both companies capturing niche segments previously dominated by smaller players. This dynamic illustrates how competitive pressure can expand market boundaries when harnessed strategically.

Monitoring Tactics:

- 📉 Track quarterly market share fluctuations

- 🗞️ Analyze earnings call transcripts for strategic cues

- 🧑💻 Survey customer satisfaction quarterly

- ⚡ Set automated alerts for competitor announcements

Lessons Learned and Strategic Takeaways

This case demonstrates that executive moves are strategic weathervanes. Robert Watson's appointment at Tungsten Automation provided rivals with actionable intelligence months before financial results reflected the shift. Companies that institutionalize competitor monitoring gain decisive advantages in timing and strategic precision.

Key Takeaways:

-

Personnel Changes = Strategic Precursors

New executives often drive fresh priorities—track their backgrounds for clues. -

Response Speed Determines Competitive Cost

Finova's 8-week pivot minimized revenue erosion. Delayed reactions compound market penalties. -

Stakeholder Communication is Strategic Armor

Transparent strategy narratives maintain investor confidence during transitions.

Implementation Roadmap:

1. Establish executive monitoring protocol

2. Develop 72-hour impact assessment framework

3. Create modular response playbooks

4. Train leadership in agile decision-making

Conclusion: The Future of Competitive Strategy

Leadership changes like Tungsten Automation's CFO appointment will increasingly dictate market dynamics. Winners will leverage real-time intelligence to transform observations into preemptive strategies—anticipating shifts before they manifest in financial statements.

Sustained Competitive Advantage Requires:

- Predictive tracking of personnel and operational changes

- Embedded agility in strategic planning cycles

- Continuous stakeholder sentiment analysis

💡 Ready to decode competitor moves?

RivalSense delivers actionable insights on executive changes, product launches, and market shifts—curated in weekly reports.

Get your first competitor report today

📚 Read more

👉 Beginner’s Guide to Twitter Competitor Insights & Response Prediction

👉 5 Common Mistakes in Tracking Competitor Breaches in Ride-Hailing

👉 Strategic Competitor Insights: Mastering Partnerships & Client Intelligence

👉 Apify's LinkedIn Scraper Update: Strategic Implications and Action Steps

👉 Competitor Customer Acquisition Analysis: A Practical Guide for Business Leaders