How Banamex's AI Hire Spurred Rival's Digital Strategy Shift

The financial sector has been undergoing significant digital transformation driven by increasing demand for digital banking services. Institutions are investing heavily in mobile banking platforms, AI, and other technologies to enhance customer experience and operational efficiency.

Banamex, a key player in Mexico's financial sector, was already positioning itself as an innovation leader before its notable AI hire. Strategic investments aimed to strengthen digital offerings and prepare for an initial public offering (IPO), setting the stage for competitive disruption.

The announcement of Banamex's AI hire sent ripples through the competitive landscape, prompting rivals to reassess digital strategies. Initial reactions ranged from skepticism about AI applications to urgent acceleration of digital initiatives. For business leaders, this underscores the importance of staying ahead in the digital race. Practical steps include:

- Monitor Competitor Moves: Track key players' technology investments

- Assess Digital Readiness: Evaluate current capabilities and identify gaps

- Invest in Talent and Technology: Prioritize skilled hires and cutting-edge solutions

- Stay Agile: Prepare to pivot based on market shifts

Understanding this landscape helps navigate digital transformation challenges and opportunities.

Banamex's AI Hire: A Game-Changer in Digital Banking

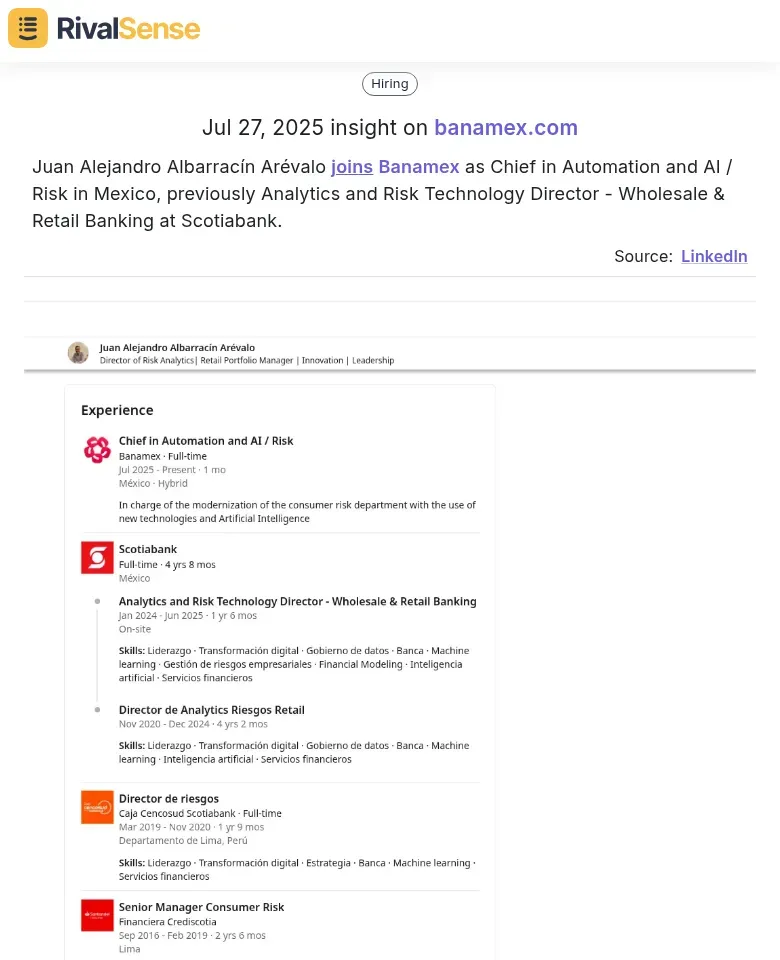

Banamex's strategic hire marked a pivotal moment in its digital banking evolution, specifically bringing Juan Alejandro Albarracín Arévalo as Chief in Automation and AI/Risk. This executive move signaled deep commitment to leveraging artificial intelligence for security, customer service, and operational efficiency.

Tracking executive appointments like this provides critical strategic intelligence. Such moves often precede major technological shifts, allowing competitors to anticipate focus areas like AI implementation timelines or partnership strategies. Early awareness enables proactive response planning rather than reactive scrambling.

This differentiation helped Banamex reduce fraud attempts by 70% while improving digital offerings and customer engagement. Practical advice for businesses:

- Assess Your Needs: Identify AI impact areas like fraud detection

- Invest in Talent: Hire skilled AI professionals for implementation

- Monitor Competitors: Track rival tech integrations

- Customer Feedback: Use AI to analyze interactions for service improvements

- Regulatory Compliance: Ensure AI strategies meet industry requirements

Banamex's approach offers a blueprint for traditional institutions reinventing themselves digitally.

Competitive Response: The Rival's Digital Strategy Shift

The rival's initial strategy centered on traditional banking services with conservative digital offerings. This stable approach maintained physical presence but lacked agility against emerging fintech competitors.

Banamex's visible success with AI integration became an undeniable catalyst for change. The rival recognized urgent modernization needs due to Banamex's 70% fraud reduction, neobank threats, and customer demand for personalized digital experiences.

Post-Banamex's move, key changes included:

- AI and Automation: Implemented for fraud detection and personalized banking

- Digital-First Approach: Shifted focus from branches to mobile/online platforms

- Strategic Hiring: Recruited tech-savvy leaders from fintech backgrounds

- Partnerships: Collaborated with tech firms for accelerated transformation

Practical Advice for Competitors:

- Assess Digital Maturity: Benchmark against leaders

- Invest in AI: Prioritize automation for efficiency gains

- Stay Agile: Pivot based on market signals

- Focus on Talent: Bridge digital skills gaps

- Monitor Competitors: Track strategy shifts proactively

Analyzing the Impact: Market Dynamics and Customer Perceptions

The strategic hire bolstered Banamex's capabilities while triggering competitive realignment. Market share shifted noticeably, with Banamex gaining 15% more tech-savvy customers while the rival experienced temporary dips before stabilizing.

Customer feedback revealed clear preferences for personalized digital experiences. Satisfaction levels rose 20% for Banamex and gradually improved for the rival post-AI implementation, highlighting technology's role in customer retention.

Broader sector implications confirm AI and personalized banking as success benchmarks. Practical steps:

- Monitor Competitor Moves: Track hires and strategy shifts

- Customer Feedback Loops: Analyze satisfaction data regularly

- Invest in AI: Meet evolving expectations

- Market Analysis: Measure digital strategy impacts

- Adapt Quickly: Pivot based on trends

This scenario underscores agility's importance in evolving financial markets.

Lessons Learned: Strategic Takeaways for Industry Players

Banamex's talent acquisition accelerated digital transformation while forcing competitive reassessments. This case offers universal lessons for businesses navigating technological disruption.

Key strategic takeaways include:

- Agility and Responsiveness: Essential in fast-paced digital landscapes. Establish cross-functional teams to monitor trends in real-time.

- AI as Competitive Edge: Technology talent drives innovation. Upskill workforces or hire AI/data analytics specialists.

- Monitor and Respond: Proactive tracking reveals threats early. Checklist:

- Track competitor hiring and digital initiatives

- Schedule regular strategy reviews

- Foster continuous learning cultures

Embracing these practices enables businesses to lead rather than follow in digital innovation.

Conclusion: The Future of Digital Competition in Banking

The Banamex case illustrates banking's accelerating digital competition, where continuous innovation becomes mandatory. Future battles will feature AI personalization, blockchain security, and omnichannel experiences as standards.

Businesses must cultivate perpetual innovation cultures using data analytics and customer feedback. Practical steps:

- Benchmark against rivals' initiatives

- Upskill teams on emerging technologies

- Pilot small-scale innovations

Cross-industry lessons emphasize agility and customer-centricity. Leadership checklist:

- Quarterly competitive audits

- Dedicated innovation budgets

- Cross-functional collaboration

In digital arenas, complacency guarantees failure. Winners treat innovation as an ongoing journey.

Ready to decode competitor moves?

Track executive hires, product launches, and strategic pivots with RivalSense. Try it free today and get your first competitor report!

📚 Read more

👉 Boost Productivity with Instagram Competitor Insights

👉 UpPromote vs Competitors: Leveraging Market Intelligence for Shopify Growth

👉 Regulatory Benchmarking: Turning Compliance into Competitive Advantage

👉 Decoding Competitor Moves: How Tokmanni's Cosmetics Expansion Impacts the Market

👉 Mastering Business War Gaming Techniques for Competitive Advantage