What is Competitive Product Intelligence and How Can It Transform Your Strategy?

🚨 Did you know that 72% of businesses consider competitive intelligence critical to their strategy, yet only 35% have a systematic process to track it? In a world where competitors evolve faster than ever, relying on guesswork or sporadic Google searches is like bringing a knife to a gunfight. Let’s explore how competitive product intelligence (CPI) can help you anticipate market shifts, outmaneuver rivals, and future-proof your strategy.

What Is Competitive Product Intelligence?

Competitive Product Intelligence (CPI) is the systematic process of tracking, analyzing, and acting on insights about competitors’ product developments, feature updates, and strategic pivots. It’s not just about knowing what your rivals are doing — it’s about understanding why they’re doing it and how it impacts your market position.

The Four Pillars of CPI:

- Product Features: New tools, integrations, or UX enhancements.

- Operational Scaling: Production capacity, partnerships, or supply chain upgrades.

- Positioning: Pricing changes, marketing campaigns, or target audience shifts.

- Strategic Direction: Pivots in R&D focus or long-term roadmaps.

Let’s break these down with real-world examples (disguised for confidentiality):

Pillar 1: Decoding Feature Launches

When a leading AI company launched a collaborative workspace for editing code and text, it wasn’t just about adding another feature. This move signaled a strategic push to dominate the developer tools space by integrating coding assistance directly into their flagship platform.

Actionable Takeaway:

- Track feature release frequency and user feedback

- Compare adoption rates against your own roadmap

- Use gaps to prioritize R&D (e.g., “Do we need collaborative editing?”)

📊 Pro Tip: Monitor 3 key metrics for every competitor feature launch:

| Metric | Why It Matters |

|---|---|

| Time-to-Market | Are they outpacing your development cycle? |

| User Engagement | Is this feature driving real usage spikes? |

| Press Coverage | Are they winning mindshare through media? |

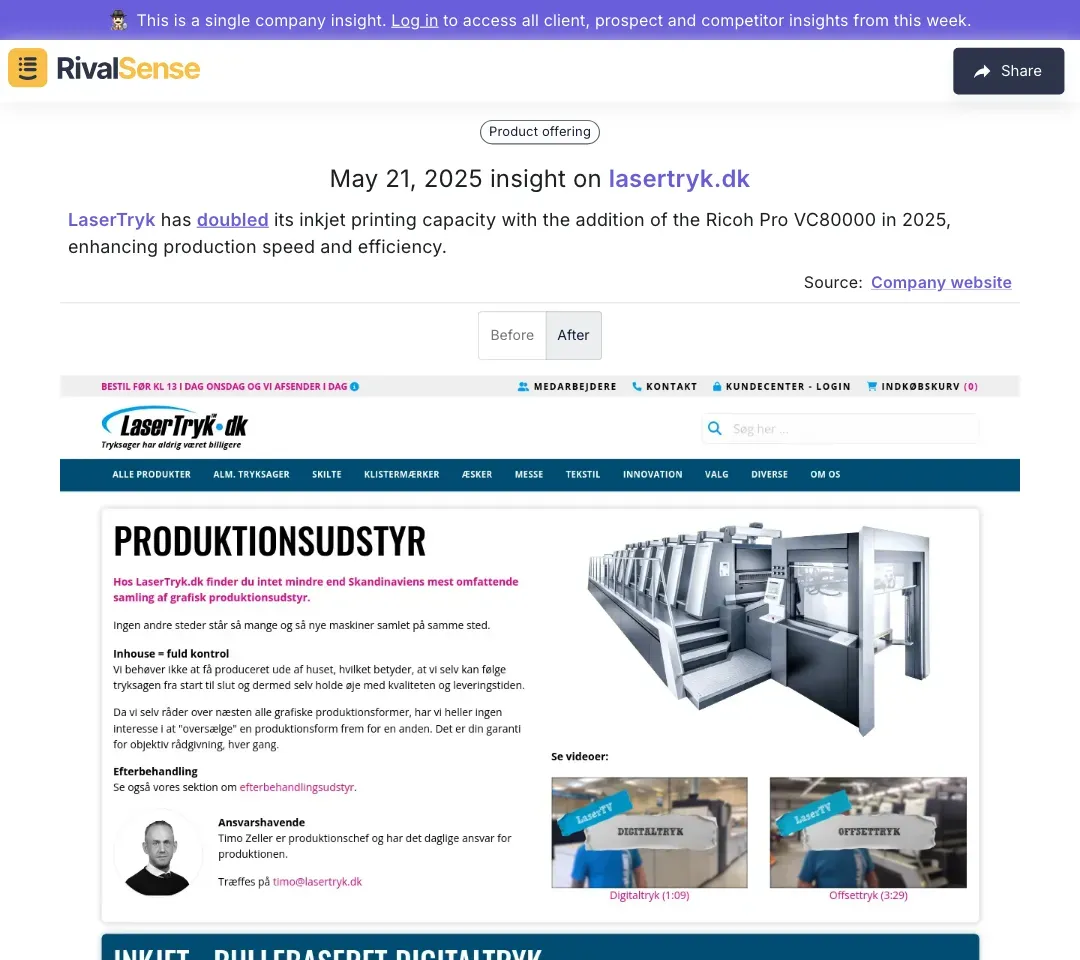

Pillar 2: Operational Scaling Signals

When a printing solutions provider doubled production capacity with industrial-grade equipment, it revealed two critical insights:

- Anticipation of increased demand in specific sectors

- Confidence in long-term contracts to justify capital expenditure

Strategic Questions to Ask:

- ✅ Are they preparing for a pricing war through economies of scale?

- ✅ Is this expansion tied to a new partnership or vertical?

- ✅ How does their new capacity compare to ours in output/hour?

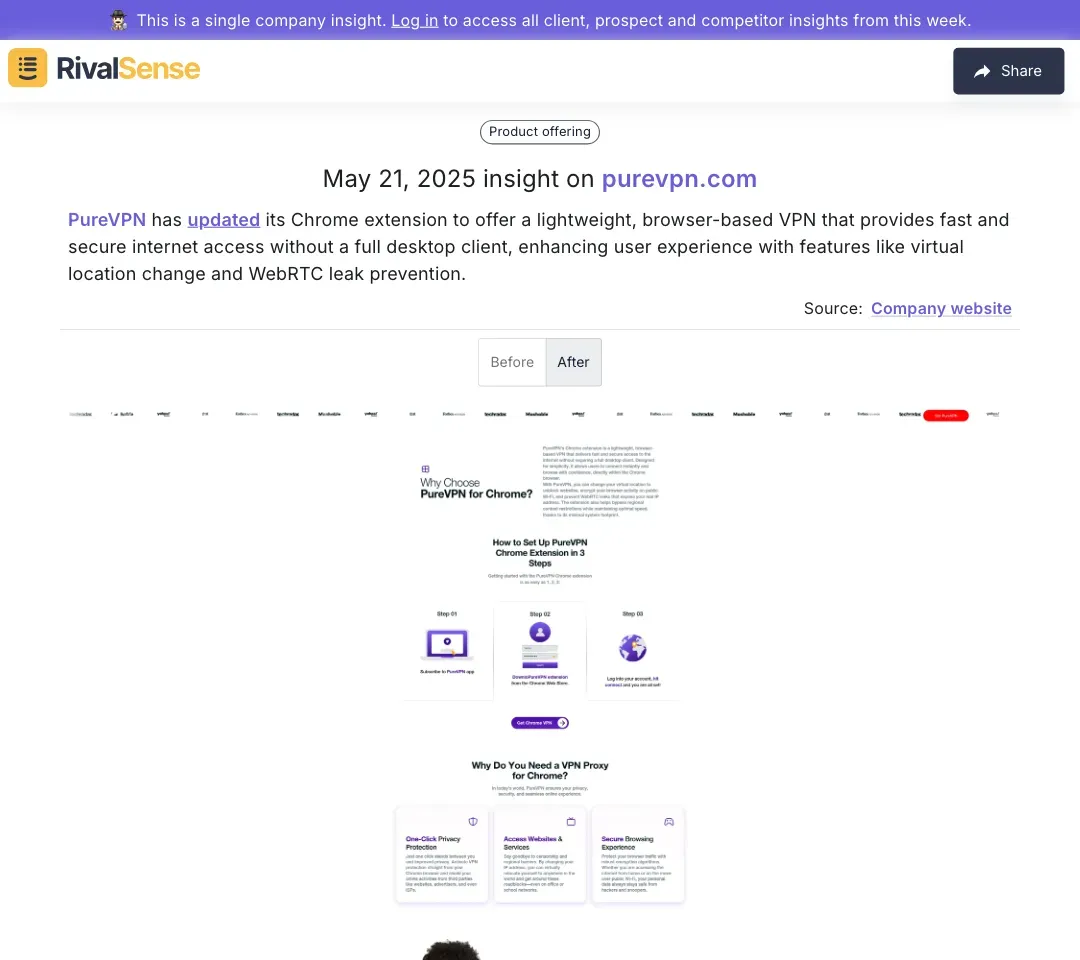

Pillar 3: The Hidden Story Behind UX Changes

A VPN provider’s decision to launch a browser-only extension with location spoofing wasn’t just about convenience. By eliminating the need for desktop software, they:

- Reduced friction for casual users

- Positioned themselves as a “lightweight” alternative

- Indirectly targeted competitors with bulkier installers

Checklist for Analyzing UX Updates:

- 🔍 Installation process changes (desktop vs. web)

- 🔍 Feature parity between platforms

- 🔍 Customer support implications

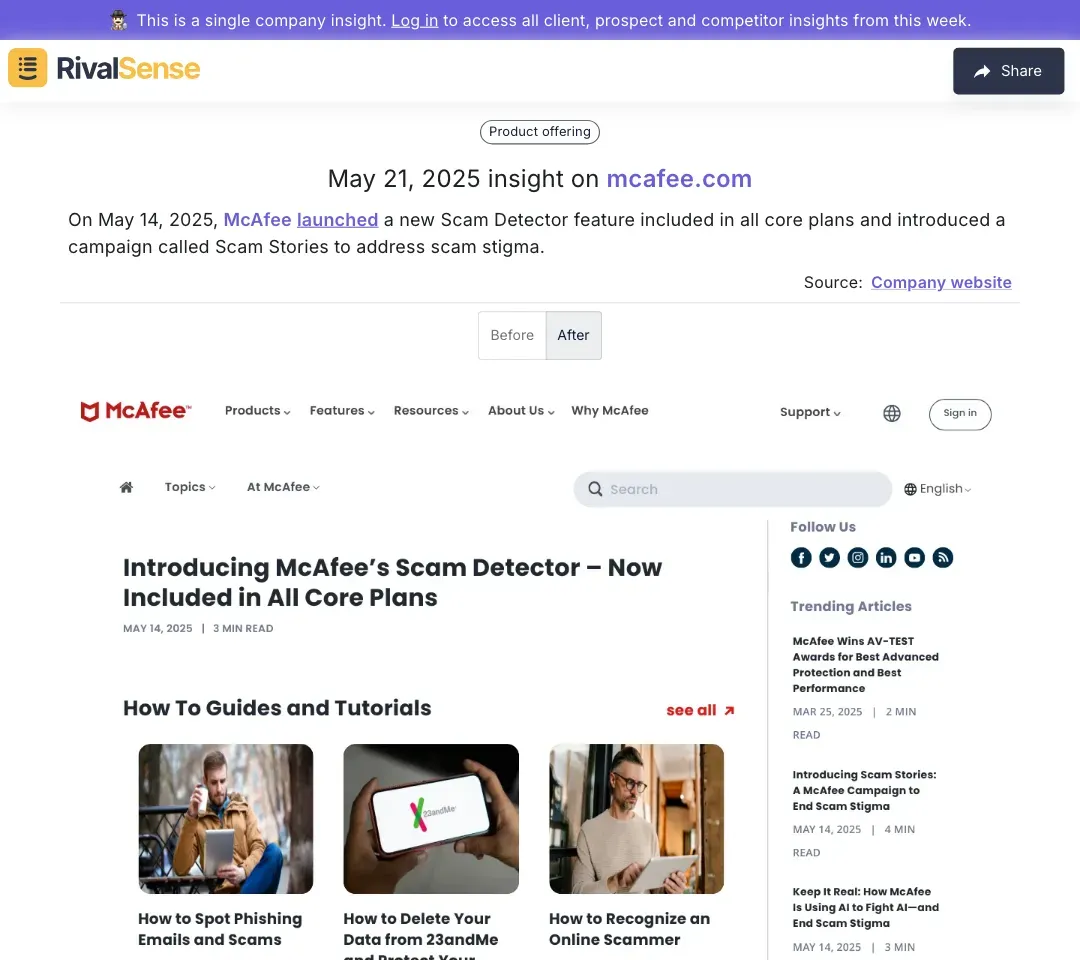

Pillar 4: Pricing and Positioning Shifts

When a cybersecurity firm bundled a scam detector into core plans while running an awareness campaign, they achieved two goals:

- Differentiated from competitors still charging extra for similar features

- Built trust by addressing scam victim stigma

Impact Analysis Framework:

1. Immediate Effect: How does this change price/value ratios in the market?

2. Secondary Effect: Will competitors be forced to match features?

3. Long-Term Effect: Does this create a new baseline expectation?

The Silent Pivot: Reading Between Roadmap Lines

When a developer tools company shifted focus from app-building frameworks to AI agents, their website’s customer stories section told the tale:

- Previous case studies featured app developers

- New ones highlighted autonomous workflow automation

3 Signs of a Strategic Pivot:

- Hiring trends (sudden AI/ML job postings?)

- Investor communications emphasizing new verticals

- Deprioritization of legacy features

Transforming Your Strategy with CPI

Traditional Approach vs. CPI-Driven Strategy

| Traditional | CPI-Driven | |

|---|---|---|

| Product Roadmap | Internal stakeholder opinions | Data on competitor gaps |

| Pricing | Cost-plus models | Value-based (vs. alternatives) |

| R&D Budget | Spread evenly | Focused on differentiators |

| Marketing | Generic "best-in-class" | Counter-positioning |

🔥 Real Results from CPI Adoption:

- 42% faster response to competitor moves (Gartner, 2024)

- 31% higher customer retention through proactive feature updates

- 2.3x ROI on R&D spending

Ready to See What You’re Missing?

The examples you’ve seen here are just the tip of the iceberg. With RivalSense, you get:

- 🕵️ Weekly competitor reports delivered automatically

- 📈 Trend analysis across product, pricing, and positioning

- 🚨 Early warnings about strategic pivots

👉 Get your first report free: https://rivalsense.co/

“After using RivalSense, we identified a competitor’s pricing change 3 weeks before it went public — giving us crucial time to adjust our launch strategy.” — SaaS Founder

🔗 Bookmark This Checklist:

- [ ] Audit competitors’ feature release history

- [ ] Map their capacity/scaling investments

- [ ] Analyze pricing page changes monthly

- [ ] Track leadership team’s public statements

- [ ] Subscribe to automated CPI reports

Competitive advantage doesn’t come from working harder — it comes from seeing first.