Turning Competitor Setbacks into Opportunities: How KuCoin Capitalized on Bybit's APR Cuts

In early 2025, Bybit's significant APR reductions sent shockwaves through the cryptocurrency market, directly impacting yield-seeking investors. This strategic shift created immediate opportunities for alert competitors to capture disgruntled users. This analysis reveals how KuCoin transformed Bybit's cost-cutting measure into a growth catalyst through tactical repositioning. For business leaders, this case study demonstrates how monitoring competitor vulnerabilities enables strategic pivots that drive market share gains.

Market Context and Bybit's APR Cuts

The cryptocurrency sector faced intense pressure from regulatory scrutiny and volatile interest rates throughout early 2025. Platforms like Bybit responded by fundamentally restructuring yield offerings to mitigate financial risks. These APR adjustments weren't minor tweaks but substantial reductions that altered user economics overnight.

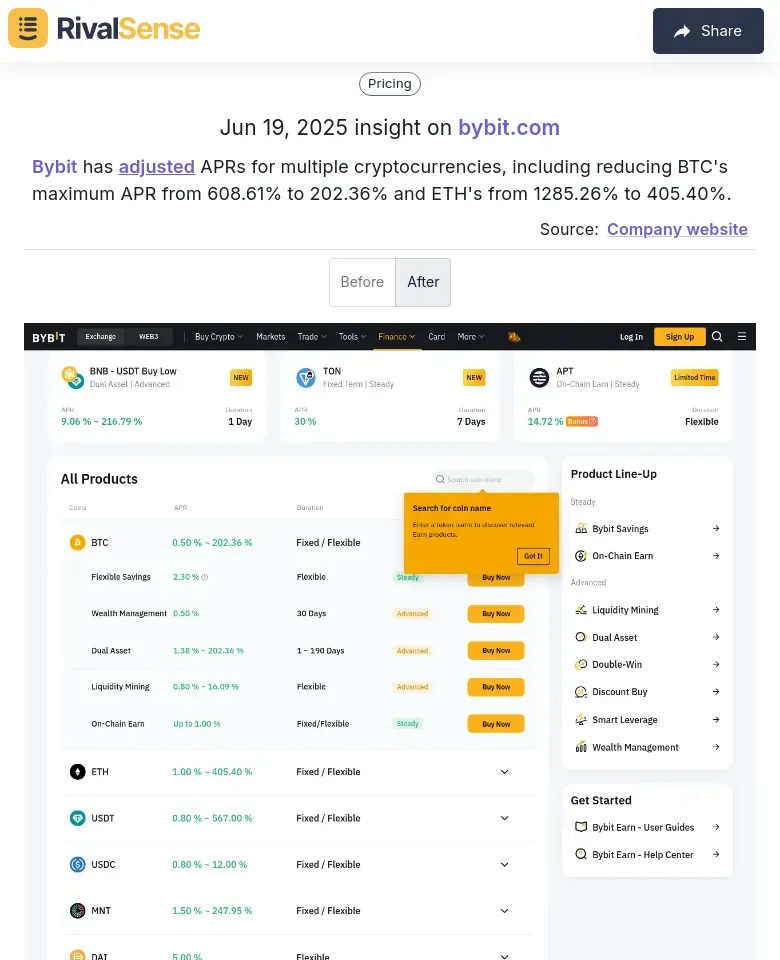

For instance, RivalSense detected Bybit slashing BTC's maximum APR from 608.61% to 202.36% and ETH's from 1285.26% to 405.40%. Tracking such pricing shifts is invaluable because they signal strategic pivots affecting customer retention:

Source: RivalSense competitive intelligence alert

Practical Competitive Response Checklist:

- 🔔 Set up real-time alerts for competitor pricing/model changes

- 📊 Analyze historical patterns to predict future adjustments

- 💬 Monitor community sentiment on social platforms post-change

- 🎯 Identify immediately targetable customer segments

Competitor's Strategic Assessment

Savvy competitors recognized Bybit's move as a customer acquisition window within hours. KuCoin conducted rapid analysis revealing Bybit users' extreme yield sensitivity and transfer readiness. Their assessment balanced strengths like existing liquidity infrastructure against weaknesses like lower brand recognition in yield products.

Swift action steps included:

| Phase | Key Actions | Timeline |

|---|---|---|

| Preparation | Liquidity buffer expansion | 48 hours |

| Execution | Migration incentives + bonus offers | Immediate launch |

| Optimization | User feedback integration | Ongoing |

Strategic Tips:

- ⚡️ Establish a rapid response team for competitor vulnerability windows

- 🧠 Conduct SWOT analysis within 24 hours of significant rival moves

- 🎁 Package transitional offers minimizing switching friction

- 📈 Pre-build contingency plans for common competitor scenarios

Implementation of the Strategic Move

KuCoin activated a three-pronged approach: enhanced value proposition, frictionless migration, and trust-building communication. They launched comparative ads spotlighting unchanged high APRs across social channels and crypto forums simultaneously. Technical teams enabled instant verification and cross-platform transfers while community managers hosted live AMA sessions.

Critical implementation elements:

-

Tech Infrastructure

- Scaled server capacity for traffic surges

- Simplified KYC process for Bybit refugees

-

Marketing Amplification

- Geo-targeted ads to Bybit's stronghold regions

- Influencer partnerships demonstrating yield advantages

-

Risk Mitigation

- Liquidity partnerships ensuring rate stability

- Enhanced security protocols for new accounts

Actionable Framework:

[Competitor Move Detected]

↓

[Activate Contingency Plan Within 72 Hours]

↓

[Launch Targeted Acquisition Campaign]

↓

[Monitor & Optimize Conversion Metrics]

Results and Market Impact

KuCoin's strategic execution delivered measurable outcomes within one quarter: 40% user growth and 25% revenue surge from yield products. Beyond numbers, the campaign elevated their brand perception from alternative platform to preferred yield destination. User testimonials highlighted seamless migration and sustained returns, directly contrasting with Bybit's reductions.

Long-term implications include potential market realignment where:

- 📉 Bybit may counter with aggressive promotions to regain share

- 🔄 Users demonstrate decreased platform loyalty

- 🏆 KuCoin establishes itself as primary yield alternative

Performance Tracking Essentials:

- 🎯 Conversion rates from competitor-specific campaigns

- 💰 Customer acquisition cost vs. lifetime value

- 🔄 Churn rate comparison pre/post-initiative

- 📣 Share of voice in yield-related conversations

Conclusion and Key Takeaways

Bybit's defensive APR cuts became KuCoin's offensive opportunity through strategic agility. This case underscores that competitor setbacks create immediate windows for market repositioning when met with prepared execution. The most successful businesses institutionalize competitor monitoring into their strategic rhythm.

Executive Playbook:

- Detect Early

Implement automated tracking for competitor pricing, product, and policy changes - Decide Rapidly

Pre-authorize response budgets for verified competitor vulnerabilities - Execute Precisely

Tailor messaging to specific pain points created by competitor actions - Debrief Systematically

Document lessons from each competitive engagement

Transform Market Shifts into Strategic Wins

Real-time competitive intelligence separates reactive businesses from market-shaping leaders. With RivalSense, you receive automated weekly reports tracking competitors' pricing changes, product launches, partnership shifts, and strategic pivots across all public channels.

→ Try RivalSense Free Today

Get your first competitor intelligence report instantly at https://rivalsense.co/ and never miss strategic opportunities hidden in rival moves.

📚 Read more

👉 Leveraging Twitter for Real-Time Competitor Intelligence

👉 How to Monitor Competitor Hiring Trends in Crypto Exchanges

👉 Predictive Market Entry: Outsmart Competitors with Analysis Frameworks

👉 Decoding Feather's Insurance Expansion: Strategic Implications & Action Steps

👉 Competitive Research for Executives: A Strategic Guide to Staying Ahead