The Strategic Benefits of Tracking Industry Leaders: Your 2026 Guide to Competitive Advantage

Written by the RivalSense Team

Updated January 12, 2026

In today's rapidly evolving business landscape, there's a critical distinction between companies that merely compete and those that dominate. The difference often comes down to one strategic discipline: systematically tracking industry leaders.

As a founder, CEO, or business leader, you know that understanding your competition is essential. But there's a hierarchy in competitive intelligence, and at the top sits the most valuable target: industry leaders. These are the companies setting market trends, establishing customer expectations, and defining what success looks like in your space.

Why Industry Leaders Deserve Your Special Attention

Industry leaders aren't just bigger versions of your direct competitors—they're market shapers. When they move, entire ecosystems shift. Their product decisions influence customer expectations. Their pricing strategies set market benchmarks. Their partnerships create new competitive dynamics.

The Reality Check: Most businesses track their immediate competitors but miss the bigger picture. They're watching the players on their field while ignoring the stadium architects.

The 7 Strategic Benefits of Tracking Industry Leaders

1. Anticipate Market Trends Before They Become Mainstream

Industry leaders have the resources to experiment with emerging technologies and business models. By tracking their R&D investments, pilot programs, and early-stage initiatives, you can spot trends 12-18 months before they reach the broader market. This proactive approach allows you to adapt your strategy early and stay ahead of the curve.

Practical Example: When Salesforce began heavily investing in AI-powered CRM features in early 2025, observant competitors recognized this wasn't just a feature update—it was a market shift. Companies that tracked this move had time to develop their own AI strategies before customers began expecting AI capabilities as standard.

RivalSense Insight Example: Labelbox recently launched Labelbox Applied Research with three flagship pillars: Labelbox Evals for unified model evaluation, Labelbox Agents for building reliable and interpretable agents, and Labelbox Robotics (LBRx) for delivering high-quality training data for advanced robotic manipulation. Tracking such product launches helps you anticipate where AI and robotics markets are heading, enabling you to align your innovation efforts with emerging trends.

Actionable Checklist for Trend Tracking:

- Monitor patent filings and R&D announcements

- Track executive speeches and conference presentations

- Analyze hiring patterns for emerging skill sets

- Watch for pilot programs and beta launches

- Note which technologies get featured in marketing materials

2. Benchmark Your Performance Against Gold Standards

Industry leaders set the performance benchmarks that customers expect. By understanding their service levels, feature sets, and customer experience standards, you can identify where you need to improve—or where you can exceed expectations. This benchmarking process is crucial for staying competitive and meeting evolving customer demands.

Pro Tip: Create a "Gold Standard Matrix" comparing your key metrics against industry leaders across:

- Customer support response times

- Feature completeness

- Pricing transparency

- Integration capabilities

- Documentation quality

3. Identify Innovation Opportunities Through Their Blind Spots

Even industry leaders have weaknesses. Their size often creates innovation gaps—areas they're too established to disrupt or too invested in legacy systems to change quickly. These blind spots represent your greatest opportunities for differentiation and growth. By systematically identifying these gaps, you can carve out a niche or launch disruptive products.

How to Spot Innovation Gaps:

- Look for customer complaints about industry leaders' products

- Analyze what they're NOT doing that emerging startups are

- Identify markets they're ignoring due to scale requirements

- Watch for technology they're slow to adopt

4. Learn From Their Strategic Mistakes (Without Paying the Price)

Industry leaders make expensive mistakes that you can learn from for free. When they launch a product that fails, enter a market that doesn't work, or make a pricing misstep, you gain valuable intelligence about what doesn't work in your industry. This insight helps you avoid similar pitfalls and allocate resources more effectively.

RivalSense Insight Example: Signal's creator is pushing a new end-to-end encrypted AI chat that allows users to import chat history from Claude and ChatGPT. Tracking such product updates can help you learn from their approach to AI integration without investing in similar features prematurely. Understanding their strategic moves allows you to assess market reception and adapt your own AI strategy accordingly.

5. Predict Competitive Moves Across Your Entire Market

Industry leaders don't just compete with you—they compete with everyone. Their strategic moves often trigger chain reactions across the competitive landscape. By understanding their priorities, you can anticipate how your direct competitors will respond and prepare your own counter-strategies.

Strategic Forecasting Framework:

- Track industry leader announcements (product launches, pricing changes)

- Monitor how mid-tier competitors react

- Analyze the timing and nature of responses

- Develop contingency plans for different competitive scenarios

6. Discover Partnership and Integration Opportunities

Industry leaders often create ecosystems around their platforms. By tracking their partnership announcements, API developments, and integration strategies, you can identify opportunities to become part of their ecosystem or create competing ecosystems. This can lead to new revenue streams and enhanced market reach.

Partnership Tracking Checklist:

- Monitor press releases for new partnerships

- Track API documentation updates

- Watch for developer conference announcements

- Analyze integration marketplace expansions

- Note which competitors they're partnering with

7. Optimize Your Resource Allocation

Understanding where industry leaders are investing helps you make smarter decisions about your own resource allocation. If they're pouring resources into a particular technology or market segment, you need to decide whether to compete directly, differentiate, or avoid that space entirely. This ensures you invest in areas with the highest potential return.

Resource Optimization Matrix:

| Industry Leader Focus Area | Your Strategic Options | Recommended Approach |

|---|---|---|

| Heavy investment in AI features | Compete, Differentiate, or Avoid | Differentiate with human+AI hybrid approach |

| Expanding into new geographic markets | Follow, Partner, or Focus Elsewhere | Partner with local players in those markets |

| Developing new pricing models | Match, Innovate, or Maintain | Innovate with usage-based + value-based hybrid |

| Building ecosystem partnerships | Join, Compete, or Create Alternative | Join ecosystem while maintaining independence |

The Modern Challenge: How to Track Industry Leaders Effectively

Here's the reality most businesses face: Tracking industry leaders across all relevant dimensions is incredibly time-consuming. Industry leaders operate across multiple channels, participate in numerous events, make frequent announcements, and have complex organizational structures. Without automation, this process becomes a drain on valuable resources.

The Data Challenge: Industry leaders generate competitive intelligence across:

- Company websites and blogs

- Multiple social media channels

- Investor relations communications

- Regulatory filings

- Industry conference presentations

- Media interviews and coverage

- Partnership announcements

- Product update logs

- Pricing page changes

- Management team updates

Manually tracking all these sources for even one industry leader could be a full-time job. For multiple leaders across different segments? It's simply not scalable for most growing businesses.

How RivalSense Solves the Industry Leader Tracking Challenge

This is where modern competitive intelligence automation transforms from a luxury to a necessity. RivalSense provides the systematic tracking capability that turns industry leader monitoring from an overwhelming task into a strategic advantage. By automating data collection and analysis, you can focus on strategic decision-making.

Here's How It Works:

1. Comprehensive Multi-Source Monitoring

RivalSense tracks 80+ data sources including:

- Company websites and product pages

- Social media channels (LinkedIn, Twitter, etc.)

- News outlets and industry publications

- Regulatory databases and filings

- Event participation records

- Partnership announcements

- Management change notifications

2. Automated Intelligence Categorization

The system automatically detects and categorizes key developments:

- Product Launches & Updates: New features, version releases, product retirements

- Pricing Changes: Tier adjustments, discount strategies, packaging updates

- Strategic Moves: Market expansions, partnership formations, acquisition rumors

- Leadership Changes: Executive appointments, departures, organizational restructuring

- Media & Public Relations: Coverage trends, spokesperson changes, brand positioning shifts

3. Curated Weekly Intelligence Reports

Every week, you receive a digest highlighting the most important developments from the industry leaders you're tracking. No more searching through dozens of sources—just the actionable intelligence you need. This saves time and ensures you never miss a critical update.

Practical Example: Imagine tracking 5 industry leaders. In a typical week, they might:

- Launch 8 new features or products

- Announce 3 pricing strategy adjustments

- Participate in 12 industry events

- Receive 25+ media mentions

- Make 2-3 management changes

With RivalSense, all this intelligence is automatically compiled into a concise, actionable report that takes minutes to review.

Your Step-by-Step Guide to Tracking Industry Leaders

Phase 1: Foundation Setup (Week 1)

Step 1: Identify Your Key Industry Leaders

- List 3-5 dominant players in your market

- Include 1-2 adjacent market leaders who could expand into your space

- Consider global vs. regional leaders

Step 2: Define Your Tracking Dimensions

Choose 6-8 key areas that matter most:

- Product innovation and feature development

- Pricing strategy and packaging

- Market expansion and geographic focus

- Partnership and ecosystem development

- Technology stack and infrastructure

- Leadership and organizational changes

- Marketing and brand positioning

- Customer experience and support evolution

Phase 2: Implementation (Week 2)

Step 3: Set Up Systematic Tracking

Instead of manual monitoring:

- Use RivalSense to automate tracking across all identified sources

- Configure alerts for critical developments

- Establish a weekly review cadence

Step 4: Create Your Intelligence Dashboard

Build a simple tracking matrix:

- Industry leaders across the top

- Tracking dimensions down the side

- Regular updates with latest developments

- Color coding for quick status assessment

Phase 3: Analysis and Action (Ongoing)

Step 5: Weekly Intelligence Review

Every Monday, review your RivalSense report and:

- Identify patterns across multiple leaders

- Spot anomalies that indicate strategic shifts

- Prioritize developments by potential impact

- Document insights in your tracking matrix

Step 6: Monthly Strategic Assessment

At the end of each month:

- Update your competitive landscape map

- Adjust your strategic priorities based on leader movements

- Identify new opportunities or threats

- Share key insights with your leadership team

Step 7: Quarterly Planning Integration

Incorporate industry leader intelligence into your quarterly planning:

- Adjust product roadmap based on feature trends

- Refine pricing strategy based on market benchmarks

- Update marketing messaging based on positioning shifts

- Allocate resources based on investment patterns

Advanced Tracking Techniques for Maximum Insight

1. The Innovation Funnel Analysis

Track how industry leaders move ideas from concept to market. This helps you understand their innovation lifecycle and anticipate future launches. Key phases include:

- Research Phase: Patent filings, academic partnerships

- Development Phase: Beta programs, pilot customers

- Launch Phase: Product announcements, pricing reveals

- Scale Phase: Marketing campaigns, partnership expansions

2. The Executive Influence Map

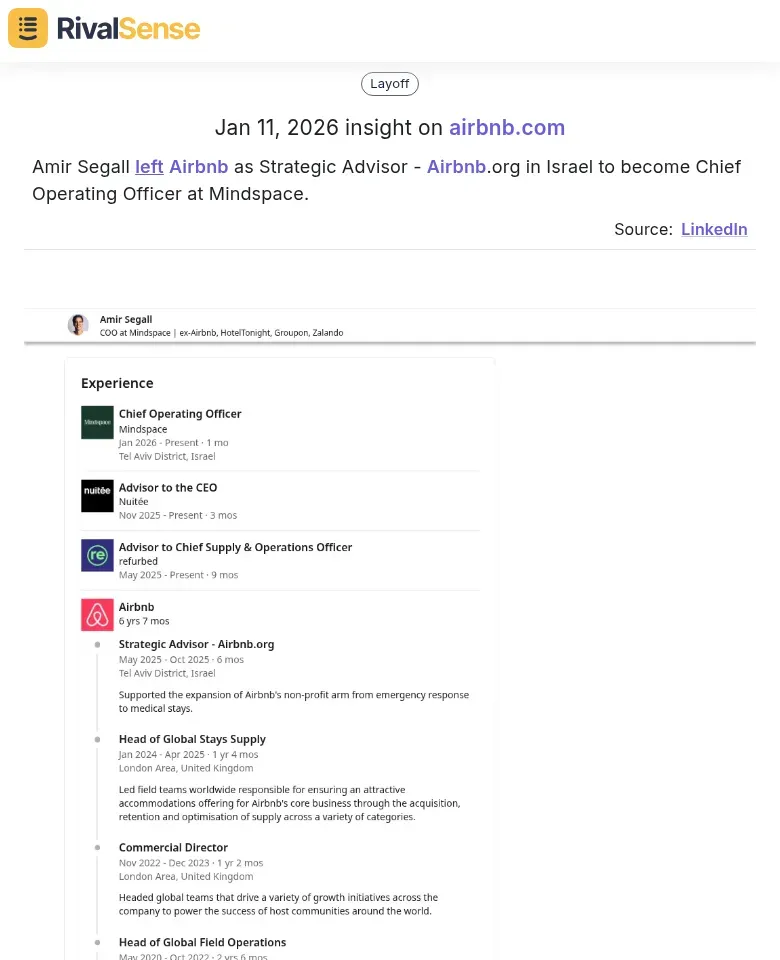

Monitor leadership changes and their implications for strategic direction. Tracking executive movements can reveal shifts in company priorities and potential market expansions. For example, when Amir Segall left Airbnb as Strategic Advisor to become Chief Operating Officer at Mindspace, it signaled a strategic shift for both companies. Such insights help you predict organizational focus and talent flow in the industry.

3. The Partnership Ecosystem Map

Visualize how industry leaders are building their ecosystems. This reveals integration opportunities and competitive threats. Key elements to track:

- Map key technology partners

- Track integration developments

- Monitor acquisition patterns

- Analyze ecosystem expansion strategies

4. The Pricing Evolution Timeline

Document how pricing strategies evolve over time. This helps you anticipate market benchmarks and adjust your own pricing. Focus on:

- Track base price changes

- Monitor packaging adjustments

- Note discount strategy shifts

- Analyze value proposition refinements

Common Pitfalls to Avoid

Mistake #1: Information Overload

Don't try to track everything. Focus on the 20% of developments that drive 80% of impact. Use tools like RivalSense to filter noise and highlight key insights.

Mistake #2: Reactive vs. Proactive Tracking

Don't just document what happened—use insights to predict what will happen next. Integrate competitive intelligence into your strategic planning process.

Mistake #3: Isolated Analysis

Connect industry leader developments to your specific competitive context. Consider how their moves affect your customers, partners, and overall market position.

Mistake #4: No Action Follow-Through

Insights without action are worthless. Assign owners for each strategic response and integrate findings into decision-making workflows.

The Future of Industry Leader Tracking

As we progress through 2026, the most successful companies are evolving their tracking approaches. They are leveraging automation and AI to stay ahead. Key trends include:

- Automation First: Using tools like RivalSense to handle data collection

- AI-Enhanced Analysis: Leveraging machine learning to identify patterns and predict moves

- Real-Time Intelligence: Moving from weekly reports to real-time dashboards

- Integrated Decision-Making: Embedding competitive intelligence into every strategic decision

Your Competitive Advantage Starts Now

Tracking industry leaders isn't about copying them—it's about understanding the market forces they create and the opportunities they leave behind. It's about learning from their successes and failures without paying their tuition. By implementing a systematic approach, you can gain a sustainable competitive edge.

Final Implementation Tip: Start with one industry leader and three tracking dimensions. Use RivalSense to automate the data collection. Build your first intelligence report this week. As you see the value, expand your tracking systematically.

Remember: In the race for market relevance, the companies with the clearest understanding of industry leaders are the ones that can anticipate change, adapt quickly, and seize opportunities before others even see them.

Ready to transform how you track industry leaders? Get your first competitor report today by trying RivalSense for free. It automates competitor intelligence across 80+ sources and delivers actionable insights in a weekly email report. Focus on strategy while we handle the monitoring. Visit RivalSense to start your free trial.

Related Reading:

- The Strategic Benefits of a Competitor Matrix: Your 2026 Guide to Market Dominance

- Competitive Intelligence Automation: The 2026 Playbook

- How to Present Competitive Intelligence Insights to Leadership

- 7 Competitive Intelligence Challenges & Solutions in 2026

📚 Read more

👉 2026 Warehousing Financial Trends: Competitor Analysis for Distribution Leaders

👉 Twitter Competitor Intelligence: A Step-by-Step Guide for B2B Key Account Success

👉 Data-Driven Key Account Strategies: Actionable Competitive Intelligence

👉 Competitor Ad Analysis: Transforming Regulatory Compliance into Strategic Advantage