Strategic Workforce Intelligence: How to Track Competitor Hiring & Layoffs for Key Account Automation

Tracking competitor hiring and layoffs isn't just HR intelligence—it's strategic foresight. Workforce changes reveal competitor priorities months before public announcements. For example, hiring surges in AI departments often signal upcoming product launches, while mass layoffs in specific regions may indicate market exits or financial distress.

Practical steps to leverage this intelligence:

- ✅ Set automated alerts for competitor job postings and LinkedIn employee movements

- ✅ Correlate hiring spikes with quarterly earnings and product roadmap timelines

- ✅ Benchmark layoff patterns against industry averages to spot outliers

- ✅ Map executive departures to strategic vulnerabilities you can exploit

Key insight: Companies that hire data scientists typically launch AI products within 6-9 months. By monitoring these patterns, you gain predictive power to adjust your own strategy proactively—whether that's accelerating product development, targeting newly available talent, or avoiding markets competitors are exiting.

Key Signals to Monitor: Decoding Executive Moves and Title Changes

Executive moves and title changes reveal critical strategic shifts that can impact your competitive landscape. Monitoring C-suite transitions helps identify talent valuation gaps—when competitors hire externally (44% of S&P 1500 CEOs in 2024), they're often addressing capability deficiencies or pursuing new directions.

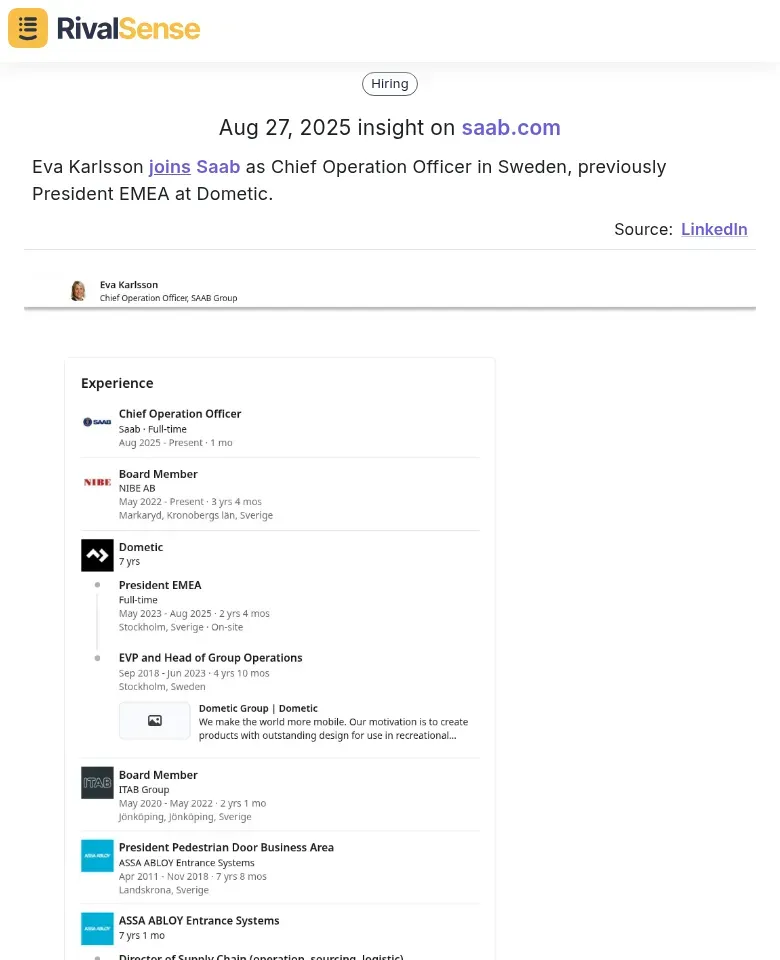

Example: Eva Karlsson joins Saab as Chief Operation Officer in Sweden, previously President EMEA at Dometic. Such cross-industry executive moves often signal diversification strategies or new market focus.

Tracking title changes like 'Chief Digital Officer' or 'VP of AI' serves as indicators of organizational restructuring for growth preparation. These executive insights provide early warnings about strategic pivots months before public announcements.

Practical monitoring steps:

- Set up alerts for competitor executive changes on LinkedIn and news sites

- Analyze patterns (e.g., increased external hires may indicate internal talent gaps)

- Compare title evolution across competitors to spot emerging focus areas

- Document cross-industry moves to predict new market entries

International Expansion Insights: Tracking Global Hiring Patterns

Tracking global hiring patterns provides invaluable early signals of international expansion before official announcements. Location-specific hires can reveal geographic roadmaps—when competitors post roles in new cities or countries, it often precedes market entry by 6-12 months.

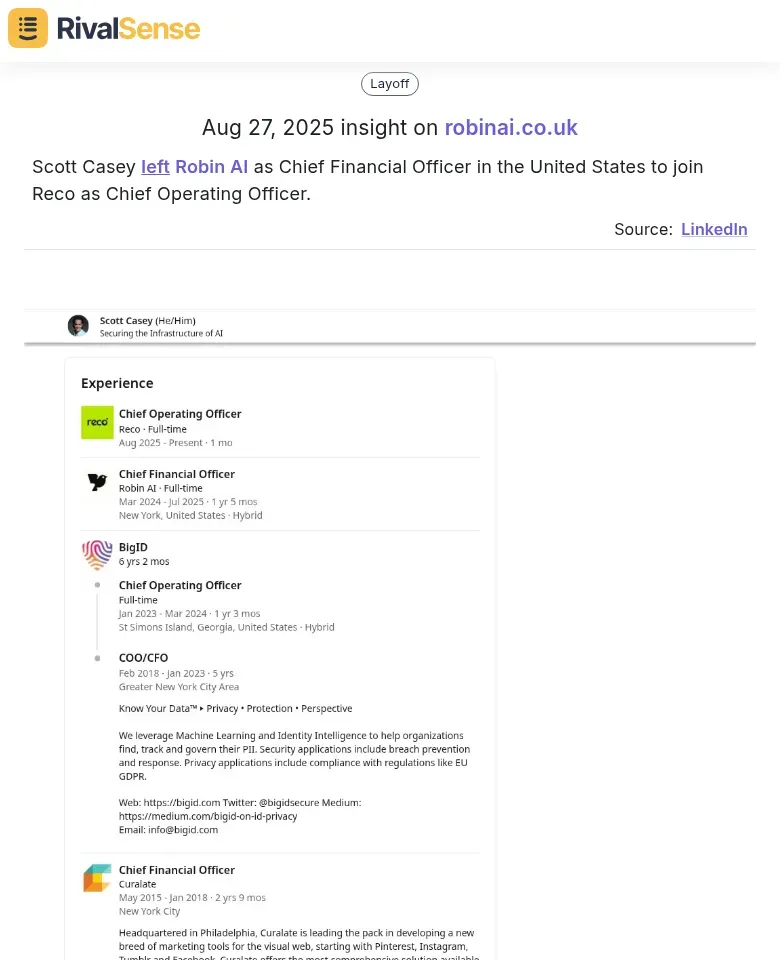

Example: Scott Casey left Robin AI as Chief Financial Officer in the United States to join Reco as Chief Operating Officer. Such financial executive moves between companies can indicate funding changes, strategic shifts, or preparation for international scaling.

Analyze specialized regulatory or legal roles as critical signals. Positions like "Compliance Manager - APAC" or "Regulatory Affairs Specialist - Brazil" suggest market entry preparations, as companies build local expertise to navigate legal frameworks.

Practical expansion tracking:

- Set up automated monitoring for competitor job boards

- Filter by location and specialized roles

- Maintain a dashboard tracking hiring trends across key markets

- Watch for industry crossover moves that signal diversification

Automation Tools and Best Practices for Efficient Tracking

Implementing automated alert systems is crucial for real-time monitoring of competitor job postings and employee movements. Modern tools can track hiring spikes, department exits, and title changes automatically, saving countless hours of manual research.

Organize data with systematic tracking frequencies: monitor hiring spikes weekly to predict expansions, department exits bi-weekly to identify weaknesses, and title changes in real-time to spot restructures. Correlation is key—cross-reference personnel data with financial reports and product roadmaps for comprehensive analysis.

Efficient tracking checklist:

✅ Configure automated alerts for immediate notifications on urgent events

✅ Aggregate minor updates in weekly summaries

✅ Use dashboards to visualize trends

✅ Integrate alerts into Slack or Teams for team coordination

✅ Correlate layoffs with quarterly earnings to assess financial health

✅ Map new hires to product launches to anticipate market moves

Role-Specific Insights: Understanding Strategic Hiring Patterns

Different roles carry different strategic significance when tracked across competitors. Technical hires often signal product development acceleration, while sales and marketing expansions indicate market penetration strategies.

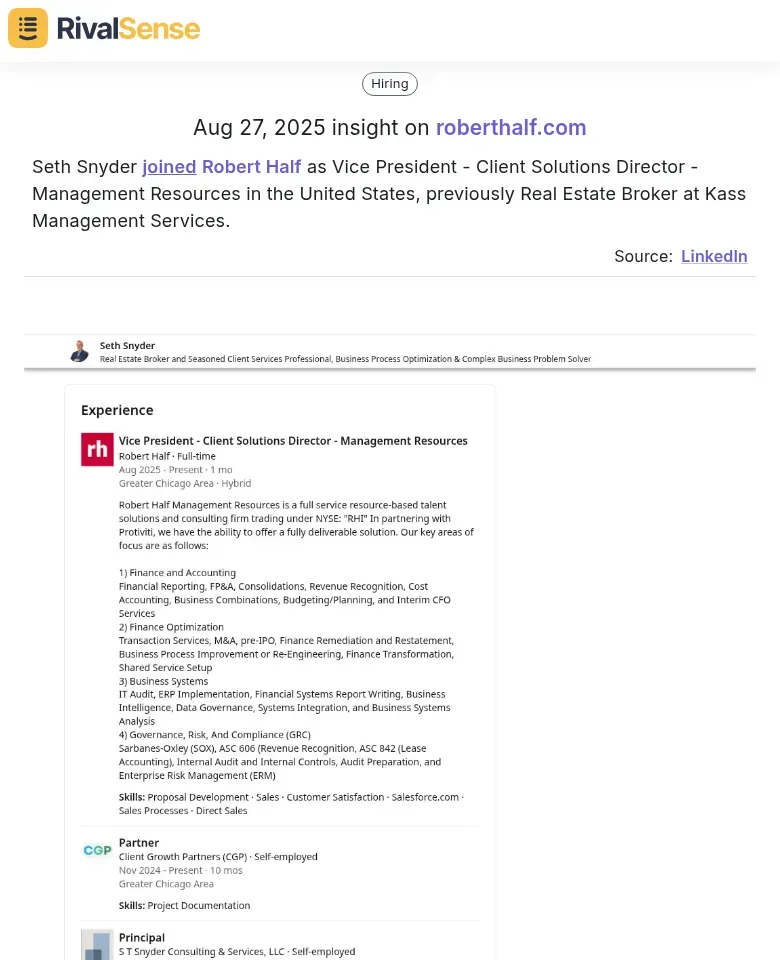

Example: Seth Snyder joined Robert Half as Vice President - Client Solutions Director - Management Resources, previously Real Estate Broker at Kass Management Services. Such role changes and industry crossovers can indicate new service offerings or strategic repositioning.

Strategic role monitoring focus:

- Executive hires: Signal major strategic direction changes

- Technical roles: Indicate product development priorities

- Sales positions: Reveal market expansion plans

- Regulatory specialists: Suggest new geographic markets

- Cross-industry hires: Point to diversification strategies

Actionable Intelligence: Turning Insights into Strategic Decisions

Transform competitor workforce intelligence into strategic advantage with these actionable steps:

Talent Acquisition & Retention Strategies:

- Monitor competitor layoffs to identify available talent pools

- Analyze hiring patterns to anticipate skill shortages

- Use sentiment analysis from employee reviews to identify cultural weaknesses

Product Development & Market Timing:

- Track department-specific hiring spikes: 20+ new engineers often signals product launches within 6-12 months

- Monitor executive moves between competitors for technology stack changes

- Benchmark R&D hiring against industry standards

Industry Benchmarking & Vulnerability Identification:

- Create quarterly workforce health scorecard comparing attrition rates

- Identify outliers in hiring velocity and skills composition

- Use cross-industry talent flows to spot diversification strategies

Action Checklist:

✓ Set automated alerts for competitor job postings and layoff announcements

✓ Quarterly benchmark against industry hiring ratios by department

✓ Map talent flows between competitors to identify key personnel movements

✓ Correlate workforce changes with financial results and product launches

✓ Develop talent acquisition playbooks for each competitor's vulnerability scenario

Conclusion: Building a Sustainable Competitive Intelligence Framework

Building a sustainable competitive intelligence framework requires integrating automated hiring and layoff tracking with broader market analysis. Establish a systematic approach that combines personnel data with financial metrics, product launches, and market trends.

Implement weekly trend reviews and monthly executive briefings to maintain 6-12 month visibility into competitor moves. Develop actionable executive plans with quarterly SWOT analyses and prioritize key initiatives based on intelligence findings.

Pro tip: Use centralized dashboards to visualize data and facilitate cross-departmental collaboration, ensuring intelligence translates into tangible business outcomes.

Ready to transform your competitive intelligence? Try RivalSense for free and get your first competitor report today. Track product launches, pricing changes, executive moves, and more—all delivered in a comprehensive weekly email report that keeps you ahead of the competition.

📚 Read more

👉 How Tracking Competitor Production Shifts Can Reveal Market Opportunities

👉 Key Account KPIs Tracking: The Ultimate 2025 Guide for Strategic Growth

👉 5 Advanced HR Consulting Tactics to Transform Key Account Decision-Making

👉 5 Facebook Competitor Insight Mistakes to Avoid for Sustainable Partnerships