Predict Competitor Wins: LinkedIn Insights Reveal Why Customers Choose Rivals

LinkedIn has evolved into an indispensable goldmine for real-time competitive intelligence, offering unparalleled insights into why customers choose your rivals. With over 750 million professionals actively sharing business updates, talent movements, and strategic shifts, this platform provides a living dashboard of competitor activities that traditional market research often misses.

Practical Steps to Leverage LinkedIn for Predictive Intelligence:

- Follow Competitor Company Pages - Monitor their content strategy, product announcements, and partnership reveals for early signals of market moves

- Track Key Talent Movements - Set alerts for when competitors hire senior executives or specialists in emerging technologies (AI, blockchain, sustainability)

- Analyze Organizational Growth Patterns - Use LinkedIn's search filters to identify hiring surges in specific departments that indicate strategic pivots

- Monitor Employee Advocacy - Observe how competitors' teams engage with content to gauge company culture and morale

Pro Tip: Use Boolean search operators like "Senior Product Manager AND AI" to pinpoint competitors' investment areas before they become public knowledge. This intelligence transforms from reactive monitoring to predictive decision-making, allowing you to anticipate market shifts weeks or months ahead of traditional indicators.

Talent Movement Analysis: Decoding Competitor Hiring Patterns

Talent movement analysis on LinkedIn provides a crystal ball into competitor strategies. Monitoring executive appointments can reveal strategic shifts and new market focuses before they become public knowledge. For instance, when a competitor hires senior leadership with specific industry expertise, it often signals expansion into new verticals or technologies.

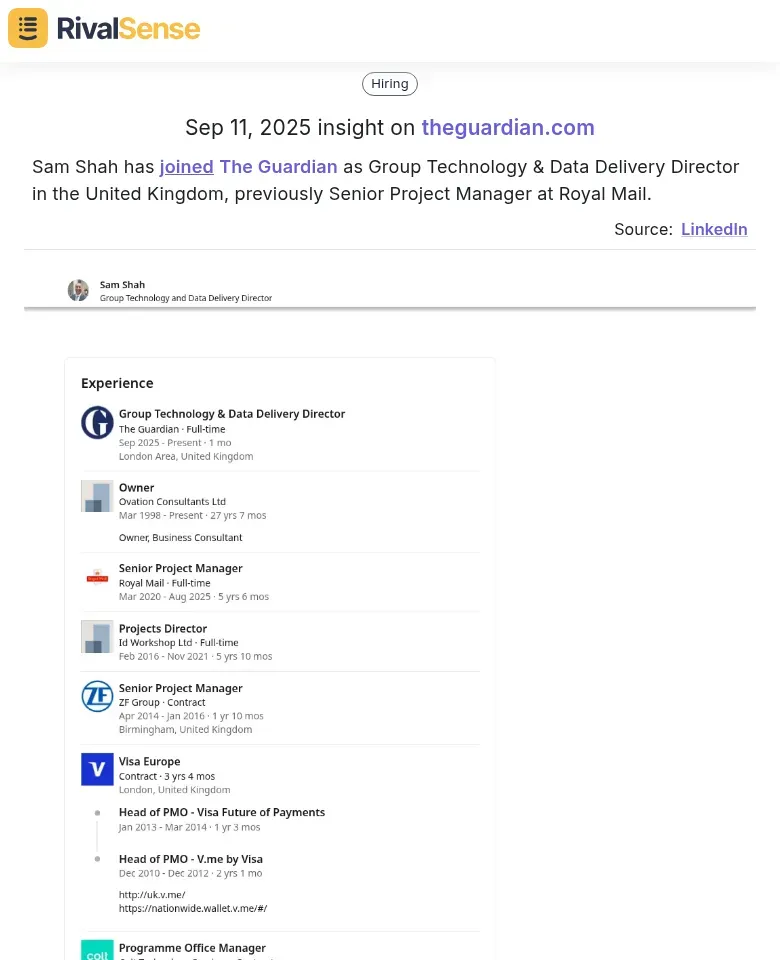

Example: Sam Shah's move to The Guardian as Group Technology & Data Delivery Director indicates a strengthened focus on technology and data capabilities in media publishing.

Practical steps for talent analysis: 1) Use LinkedIn Talent Insights for real-time data on hiring rates and attrition. 2) Create a talent flow map to identify top sources and destinations of employees. 3) Benchmark workforce structures against competitors to spot resource gaps. For example, if a rival hires heavily in a new region, anticipate market entry and adjust your strategy accordingly. This proactive approach turns talent data into competitive foresight.

Event Tracking: Uncovering Competitor Marketing and Business Development Strategies

Event tracking on LinkedIn provides unparalleled insights into competitor strategies. Monitor their event participation to understand market positioning—note which industries and regions they target. For example, if a rival consistently attends fintech conferences, they're likely expanding in financial services.

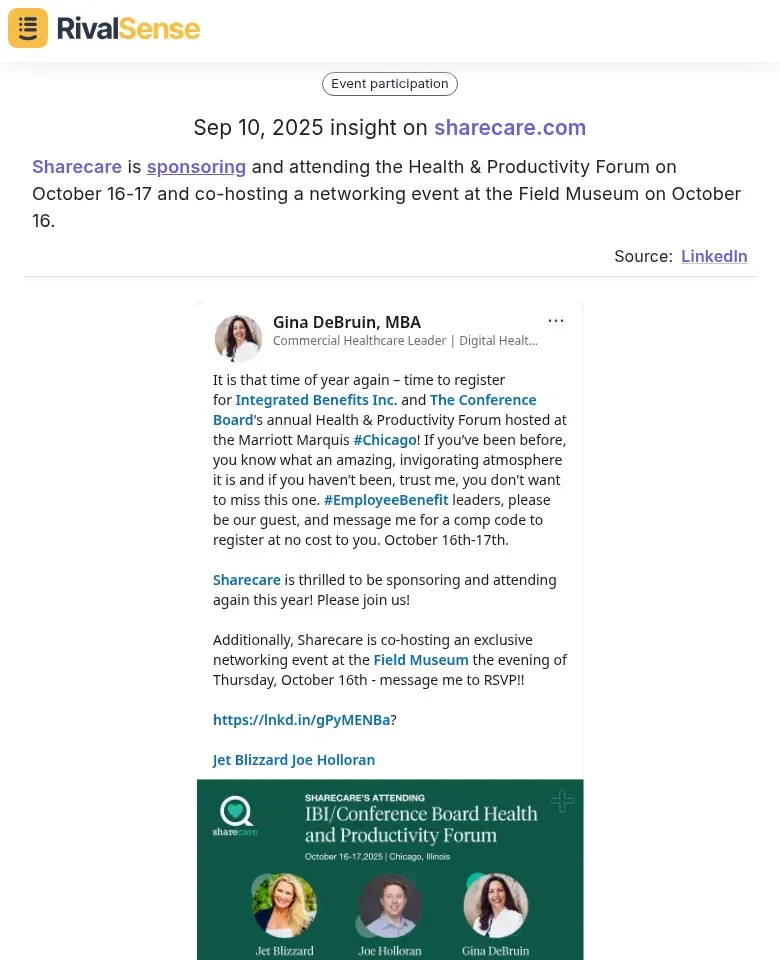

Example: Sharecare's sponsorship of the Health & Productivity Forum signals their strategic focus on corporate health and wellness markets, revealing potential expansion plans.

Analyze sponsorship patterns to identify target markets. Track which events they sponsor at different levels (platinum vs. bronze), revealing budget allocation and priority segments. A checklist: 1) List all sponsored events quarterly, 2) Categorize by industry/region, 3) Note sponsorship tier and estimated costs.

Track networking activities to uncover partnership opportunities. Follow key executives' LinkedIn posts about meetings or collaborations. Practical tip: Set up alerts for competitor mentions in event hashtags. This reveals alliance strategies—e.g., if they partner with complementary tech firms, consider similar co-marketing.

Content and Engagement Analysis: Reading Between the Lines of Competitor Messaging

Decoding competitor content themes on LinkedIn reveals their core value propositions. Analyze their most-shared posts to identify recurring messaging patterns—do they emphasize cost savings, innovation, or customer success? For example, if a rival consistently posts about AI integration, they're likely positioning as tech-forward.

Track engagement metrics like comments-to-impressions ratio; high engagement on specific topics indicates market resonance. Look for thought leadership patterns: frequent industry predictions or original research signals strategic direction. Practical steps: 1) Use LinkedIn's competitor analytics to monitor top-performing content weekly, 2) Create a messaging matrix comparing themes across rivals, 3) Note which expertise areas (e.g., compliance, scalability) drive the most shares—this reveals where they're building authority. Tip: High comment volume on educational content often indicates untapped customer pain points you can address.

Sales Team Movement Tracking: Understanding Market Focus Shifts

Monitoring sales team movements and new hires can provide critical insights into competitor market focus and expansion plans. When competitors hire sales professionals with specific industry or geographic expertise, it often reveals their target markets and growth strategies.

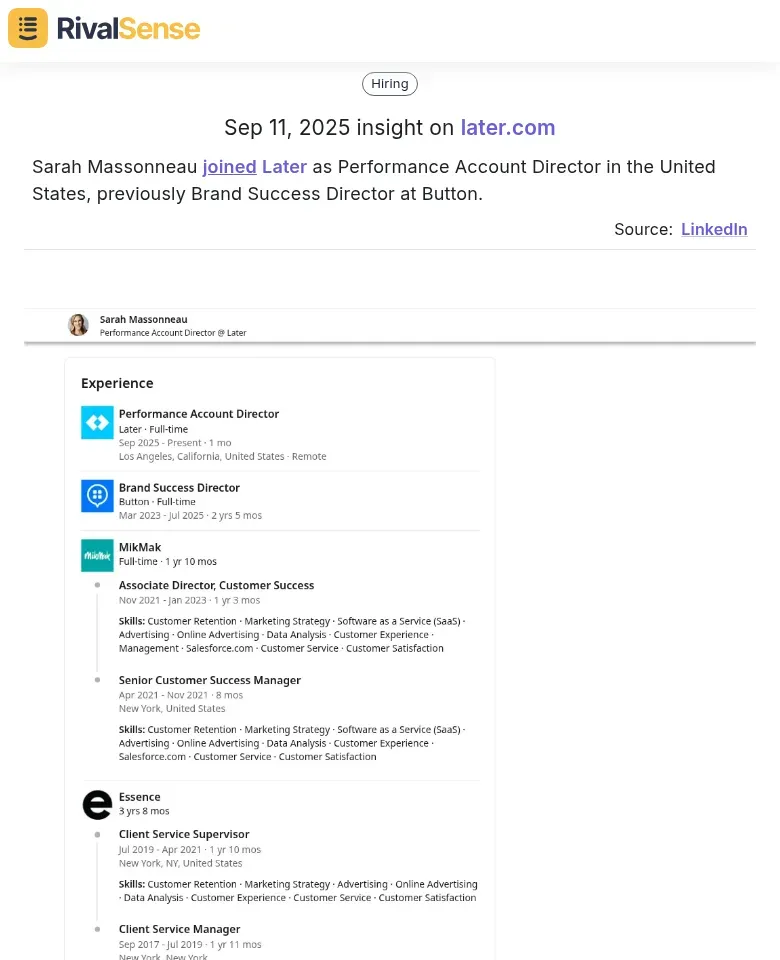

Example: Sarah Massonneau joining Later as Performance Account Director suggests the company is strengthening its US market presence and focusing on performance-driven client relationships.

Key indicators to watch: regional sales hires indicating geographic expansion, industry-specific account executives signaling vertical market focus, and changes in sales leadership suggesting strategy shifts. This intelligence helps you anticipate competitor moves in specific markets and adjust your own sales strategy accordingly.

Practical Implementation: Building Your Competitor Intelligence Framework

Building a robust competitor intelligence framework starts with systematic monitoring. Set up automated LinkedIn tracking using tools to monitor competitor posts, job changes, and customer interactions. Create a weekly cadence for reviewing insights—schedule 30 minutes every Monday to analyze patterns.

For data synthesis, develop a simple scoring system: track win themes (e.g., pricing mentions, feature highlights) and loss reasons from LinkedIn comments. Use spreadsheets or CI platforms to categorize findings by competitor, product, and timeframe. Look for trends: if a rival consistently highlights "ease of use" in wins, it signals a market gap.

Integrate LinkedIn with other sources: combine social insights with CRM data (e.g., Salesforce competitor fields) and review sites like G2. Tip: Use a central dashboard to merge data streams. Checklist: 1) Identify top 5 competitors, 2) Set up automated alerts, 3) Weekly synthesis sessions, 4) Monthly cross-source reports. This holistic approach turns raw data into actionable strategies, like refining your messaging to counter competitor strengths.

Conclusion: Turning Insights into Competitive Advantage

Transform your LinkedIn competitor insights into sustainable competitive advantage with these actionable steps. First, develop proactive strategies by creating a competitor response playbook—document specific counter-moves for each competitor's common tactics, and conduct quarterly scenario planning sessions to anticipate their next moves. Second, measure impact using key metrics: track competitive win rate improvements (aim for 15-20% increase), monitor deal cycle reduction (target 25% faster closures), and calculate ROI by comparing revenue from competitive deals before and after implementing intelligence.

Third, establish continuous improvement processes: implement monthly competitive intelligence reviews to update battlecards and positioning, conduct bi-annual win-loss analysis interviews to validate insights, and create feedback loops between sales and marketing teams to ensure intelligence remains current. Remember, the goal isn't just to collect data—it's to create a culture where competitive intelligence drives daily decision-making and strategic pivots.

Ready to transform your competitive intelligence? Try RivalSense for free and get your first competitor report today. Our platform tracks competitor movements across websites, social media, and various registries, delivering actionable insights directly to your inbox every week.

📚 Read more

👉 Optimizing VPN Partnership Monitoring for Competitive Cybersecurity

👉 Optimize Market Entry with Competitor Insights for Key Accounts

👉 How Fincantieri's Media Showcase Demonstrates Strategic Competitor Positioning

👉 Competitor Thought Leadership Analysis: The Ultimate 2025 Guide to Uncover Hidden Opportunities

👉 Predictive Monitoring: How Insurance Brokers Can Anticipate Competitor Moves