Mastering Financial Competitive Intelligence: Tracking Rivals' Funding, Profits, and Ownership Moves

In today's hyper-competitive business landscape, understanding your rivals' financial maneuvers provides critical strategic advantages. Tracking financial changes—from capital raises to ownership shifts—reveals competitors' priorities and market positioning. For instance, sudden investment influxes may signal expansion plans, while M&A activities often indicate industry consolidation efforts.

Shareholder structure adjustments serve as particularly telling indicators. Major stake increases can reflect investor confidence in a company's trajectory, while divestments may foreshadow challenges. Benchmarking against rivals using metrics like revenue growth and profit margins highlights competitive gaps and opportunities:

- Monitor financial announcements regularly for capital structure changes

- Analyze fundraising patterns to gauge market sentiment

- Compare financial KPIs against industry benchmarks

- Track M&A activities that reshape competitive dynamics

Integrating these practices helps anticipate market shifts and make data-driven strategic decisions.

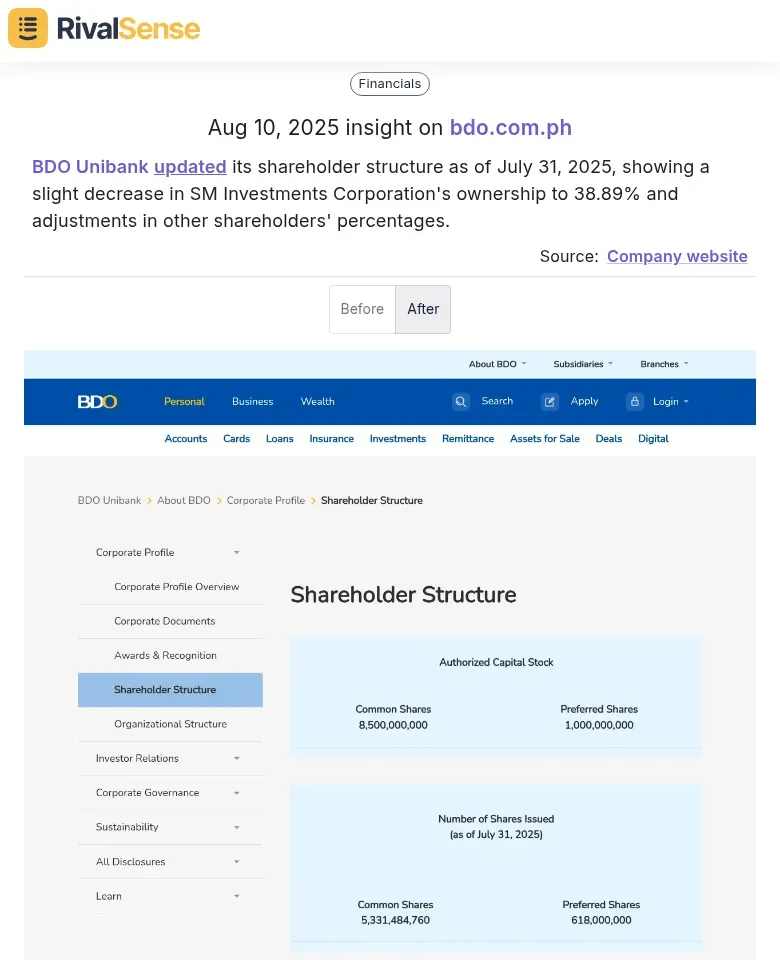

Decoding Shareholder Structure Changes

Shareholder movements offer invaluable windows into competitor stability and investor sentiment. Significant stake changes often precede strategic pivots or market reactions, while subtle percentage adjustments can reveal broader industry trends. Institutional ownership shifts, for example, may indicate growing sector legitimacy or emerging investor concerns.

Consider BDO Unibank's recent shareholder restructuring. When SM Investments Corporation decreased its ownership to 38.89% in July 2025, this signaled potential strategic realignments:

Why this matters: Tracking ownership patterns helps predict competitor financing needs, partnership opportunities, or vulnerability to acquisitions. Practical monitoring approaches include:

✅ Review regulatory filings quarterly (e.g., SEC 13F/13D forms)

✅ Compare ownership structures across rival portfolios

✅ Incorporate changes into scenario planning for market shifts

✅ Update SWOT analyses with shareholder trend insights

Analyzing Profit Surges and Their Drivers

Sudden profit spikes warrant deep examination—they often reveal successful strategies worth emulating. Key drivers typically include product innovations, pricing optimizations, or market expansions. Digital services and third-party partnerships increasingly contribute to these surges by creating scalable revenue streams.

Sony's PlayStation exemplifies this phenomenon. Their 127% YoY profit jump to $1.024 billion in Q1 2025 stemmed from third-party software sales and PlayStation Plus subscriptions:

Why this matters: Identifying profit drivers helps benchmark your performance and uncover diversification opportunities. Reverse-engineer competitor successes with this checklist:

🔍 Audit recent product launches/pricing changes

🔍 Evaluate partnership impact on revenue streams

🔍 Assess subscription/service models for scalability

🔍 Identify diversification gaps in your offerings

Navigating Revenue Drops and Profit Margins

Revenue declines don't necessarily spell disaster—smart competitors maintain margins through operational excellence. Common tactics include supplier renegotiations, workforce optimization, and technology-driven efficiency gains. The real insight lies in how companies balance cost discipline with strategic investments.

Eventbrite's Q2 performance demonstrates this balance. Despite a 14% revenue drop and $2.1M net loss, they maintained better-than-expected margins through disciplined cost management:

Why this matters: Analyzing margin resilience during downturns reveals operational best practices. Implement these defensive strategies:

- Conduct expense audits - cut non-essential costs without compromising core operations

- Deploy efficiency tools - automate processes with CRM/ERP solutions

- Develop ancillary revenue streams - monetize existing customer relationships

- Benchmark monthly against competitor financial statements

Strategic Takeaways for Business Leaders

Integrating financial intelligence into strategic planning transforms raw data into competitive advantages. Begin by tracking rivals' key metrics—fundraising activities, M&A patterns, and ownership changes—to identify industry trends before they mainstream. Agility becomes crucial when responding to significant competitor moves like major funding rounds or acquisitions.

Build a robust intelligence framework with these steps:

- Prioritize competitors - map primary rivals and emerging threats

- Establish monitoring protocols - track financial metrics weekly

- Analyze resource allocation patterns - spot strategic bets

- Benchmark performance gaps - identify improvement areas

- Convert insights into actions - adjust pricing, partnerships, or expansions

Conclusion: The Future of Financial Competitive Analysis

AI and predictive analytics are revolutionizing financial intelligence, enabling real-time tracking and forecasting of competitor moves. These technologies analyze datasets beyond human capacity, identifying patterns like funding round likelihood based on historical patterns and market conditions.

To maintain competitive advantage:

- Adopt AI-driven monitoring tools for real-time alerts

- Train teams in interpreting predictive insights

- Conduct quarterly tech assessments of new analytical capabilities

- Develop proactive response plans for forecasted market shifts

Transform Insights into Action with RivalSense

Manually tracking financial moves across competitors consumes valuable resources. RivalSense automates this process by monitoring product launches, pricing changes, ownership shifts, and financial results across websites, registries, and media—delivering actionable insights in weekly reports.

👉 Try RivalSense free today and receive your first competitor intelligence report:

https://rivalsense.co/

📚 Read more

👉 Decoding Competitor Moves: How Aeschbach's Strategic Product Shift Impacts Your Market Position

👉 How to Track Competitor Experiments: A Step-by-Step Guide for Business Leaders

👉 Market vs Competitive Intelligence: A Dental Practice Owner's Strategic Guide

👉 How boAt's Marvel Move Sparked a Rival's Strategic Discount War