Market Entry Competitor Intelligence Cheat Sheet for Business Leaders

Market entry failures cost businesses an average of $2-5 million in wasted resources, according to Harvard Business Review research. Yet 70% of companies enter new markets with minimal competitor intelligence, essentially flying blind into competitive battlefields. Competitor intelligence transforms market entry from expensive guesswork into calculated strategy.

When Netflix expanded internationally, they didn't just analyze local preferences—they studied how competitors like Sky and Canal+ were positioning themselves, identifying gaps in premium content and pricing strategies that became their entry wedge. Competitor movements are market signals. When established players suddenly increase R&D spending or hire aggressively in specific regions, they're telegraphing where they see growth opportunities. Smart investors track these patterns to time their own entries.

The critical distinction: reactive monitoring versus proactive intelligence gathering.

Reactive monitoring tracks what competitors did yesterday—useful but limited.

Proactive intelligence predicts what competitors will do tomorrow by analyzing:

- Patent filings and R&D investments

- Key executive movements and board appointments

- Supply chain partnerships and vendor relationships

- Customer acquisition patterns and pricing experiments

Quick Action Steps:

- ✅ Set up automated alerts for competitor funding rounds, partnerships, and leadership changes

- ✅ Track competitor job postings to identify expansion plans 6-12 months early

- ✅ Monitor patent applications to spot product development directions

- ✅ Analyze competitor customer reviews to identify market gaps

The companies that succeed in new markets aren't necessarily the best—they're the best informed.

Geographic Expansion Signals: Reading Between the Lines

Competitors' physical footprints are strategic goldmines that reveal untapped opportunities and market dynamics. Expansion patterns provide tangible evidence of market confidence and growth priorities. Here's how to decode their moves:

Location Intelligence Checklist:

• 🏢 Premium vs. cost-effective locations: High-rent districts signal confidence in market profitability and affluent target demographics

• 🌍 Proximity to industry hubs: Tech companies near innovation clusters indicate talent acquisition priorities

• 🎯 Regional headquarters placement: Central locations suggest plans for broader market coverage

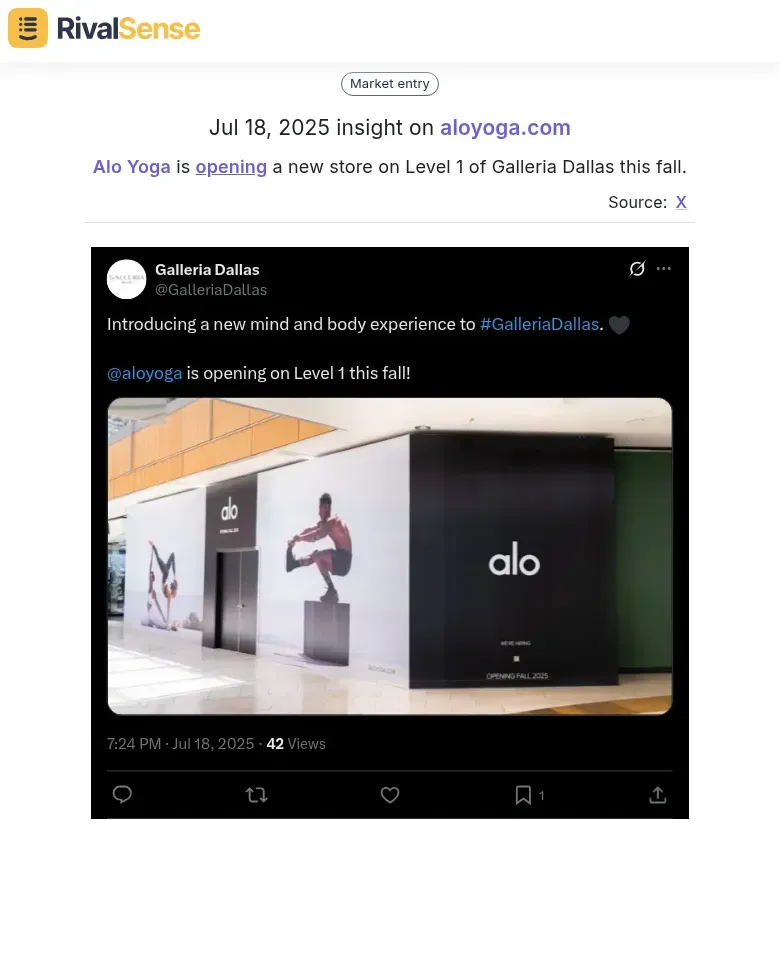

Real-World Insight

When Alo Yoga announced a new Dallas store, it signaled targeted expansion into affluent markets. Tracking such physical expansions helps identify high-potential regions early.

Market Demand Indicators:

• 📏 Office size and type: Co-working spaces suggest testing phases; dedicated offices indicate commitment

• ⏱️ Timing patterns: Rapid expansions reveal high-growth markets

• 🚚 Support infrastructure: Distribution centers signal serious market penetration intent

Opportunity Identification Framework:

- 🗺️ Map competitor presence gaps: Visualize coverage holes using mapping tools

- 🧭 Analyze expansion sequences: Follow geographic rollout patterns

- 📊 Cross-reference demographic data: Match locations with population density and income levels

Red Flag Signals:

• 🚩 Competitors avoiding regions despite favorable demographics (regulatory barriers?)

• 🚩 Multiple players clustering in one area (market saturation)

• 🚩 Downsizing in expanded markets (demand miscalculation)

Product and Service Innovation Intelligence: Spotting Market Gaps

New service launches reveal unmet customer needs and strategic positioning gaps. Analyzing these moves helps identify white space opportunities before markets saturate. Competitors' product evolution directly reflects their market confidence and customer insights.

Tracking Launch Signals:

• 🔍 Monitor press releases and beta announcements

• 📅 Analyze timing patterns (Q4 launches target budget cycles)

• 🎯 Study feature emphasis in marketing copy

• 🔄 Watch for pivot indicators into new verticals

Real-World Insight

Yango's corporate taxi launch in Abu Dhabi revealed an untapped B2B niche. Such innovations highlight differentiation opportunities in crowded markets.

Decoding Value Propositions:

Competitors' messaging reveals differentiation strategy. Look for:

• ⚡ Speed/efficiency claims ("50% faster deployment")

• 💰 Cost positioning ("enterprise features at SMB prices")

• 🔌 Integration advantages ("works with existing stack")

• 🛡️ Compliance emphasis in regulated industries

White Space Identification Checklist:

✓ Map competitor service portfolios by segment

✓ Identify underserved niches

✓ Spot feature gaps

✓ Analyze pricing tiers

✓ Track geographic expansion patterns

Actionable Intelligence:

When competitors rush to fill the same gap simultaneously, it validates market demand. When they avoid segments despite opportunity, investigate barriers.

Strategic Partnership and Sponsorship Analysis: Understanding Market Dynamics

Sponsorship deals and partnerships serve as intelligence goldmines, revealing competitors' strategic priorities and market entry tactics. These collaborations often indicate confidence in specific demographics or regions. Relationship patterns expose hidden market barriers and resource gaps.

Decoding Sponsorship Intelligence:

• 🎯 Target Audience Mapping: Analyze sponsored events/teams to understand customer profiles

• 💎 Brand Positioning Signals: Premium sponsorships indicate upmarket positioning

• 🧪 Market Testing: New sponsorships often precede market entry

Real-World Insight

Blue Water Shipping's rugby sponsorship + Darwin office opening signaled dual focus on community engagement and APAC expansion. Such insights reveal localized market entry strategies.

Partnership Analysis Checklist:

✓ Note local relationship requirements

✓ Identify barrier indicators

✓ Spot resource gaps through alliances

Ecosystem Mapping Strategy:

- 🕸️ Create alliance network diagrams

- 🔍 Identify partner overlap (critical players)

- ⭕ Spot partnership gaps (acquisition opportunities)

Pro Tip: Monitor partnership press releases quarterly. Failed partnerships signal market challenges for your own strategy.

Timing and Market Readiness Assessment Framework

Smart investors use competitor intelligence to time market entry with surgical precision. Activity patterns create predictable windows for successful market penetration. Recognizing these signals prevents premature or delayed entries that drain resources.

Competitor Activity Pattern Analysis:

• 📈 Track funding rounds and hiring sprees

• 🔬 Monitor patent filings—sudden increases signal market heating

• 💥 Watch for pricing wars (indicates saturation)

• 🚀 Analyze expansion velocity (3+ markets = high growth)

Rapid Expansion Signals Decoder:

✓ 🌍 Geographic expansion in 12 months = validation

✓ 🧩 Multiple product launches = untapped demand

✓ 👥 Aggressive talent acquisition = disruption opportunity

✓ 🤝 Enterprise partnerships = B2B readiness

Early Warning System Setup:

- 🤖 Automated Monitoring: Set alerts for executive moves

- 💸 Financial Triggers: Track Series B+ funding (18-month expansion window)

- ⚙️ Technology Markers: Monitor emerging tech roles in job postings

- 📡 Market Signals: Watch regulatory changes

Timing Sweet Spots:

• 🎯 Enter when 2-3 competitors show expansion signals

• ⚠️ Avoid pricing wars or hyper-competitive phases

• 📅 Best window: 6-12 months after first-mover validation

Building Your Competitor Intelligence System for Strategic Decisions

Effective intelligence requires systematic tracking across critical channels. Automated monitoring replaces guesswork with data-driven insights. This infrastructure transforms raw data into actionable investment theses.

Essential Data Sources & Monitoring Setup

Establish automated tracking across:

- 💰 Financial databases: Crunchbase, PitchBook

- 🛠️ Product intelligence: G2, Capterra reviews

- 📊 Market positioning: SEMrush, LinkedIn Sales Navigator

- 📰 News monitoring: Google Alerts, Mention.com

Intelligence Report Structure

Create standardized reports with:

- 📌 Executive Summary: Key threats/opportunities (3 bullet points)

- 📊 Market Position Matrix: Revenue estimates, customer overlap

- 🚀 Strategic Movements: Partnerships, launches, expansions

- ⚠️ Risk Assessment: Competitive moats, disruption timelines

Due Diligence Integration Checklist

✓ Validate target's market position vs. competitors

✓ Survey customers about competitor preferences

✓ Compare pricing strategies

✓ Identify technology gaps

✓ Track talent acquisition patterns

Pro tip: Schedule weekly intelligence briefings 48 hours before key meetings for fresh competitive context.

Stop Flying Blind in New Markets

Competitor intelligence transforms market entry from costly gamble to calculated strategy. The examples shown—from Alo Yoga's retail expansion to Yango's service innovation—demonstrate how real-time insights create advantage.

🔍 See Your Competitive Landscape Clearly:

Try RivalSense Free to automatically track competitor moves across products, expansions, partnerships and pricing. Get your first competitor report today and enter your next market with confidence.

📚 Read more

👉 Oracle Overtakes SAP in ERP Revenue: Turning Market Shifts into Strategic Wins

👉 Strategic Competitive Positioning: A Complete Guide to Outmaneuvering Your Competition

👉 Telehealth Benchmarking: Actionable Strategies to Outperform Competitors

👉 How Real-Time Product Refresh Alerts Transformed Lawcris' Competitor Strategy

👉 LinkedIn Trends: Competitive Differentiation Insights for B2B Leaders