How Tracking Meta's CTO Departure Gave Competitors an AR/VR Edge

Executive Summary: How Real-Time Intelligence on Meta's Leadership Shifts Created AR/VR Opportunities

In fast-moving industries like AR/VR, leadership changes at major players can signal market shifts. Real-time intelligence on these events can unlock competitive opportunities. When RivalSense detected John Carmack's departure as Meta's CTO in December 2022, it wasn't just news—it was a strategic inflection point. Our real-time monitoring flagged this leadership shift within hours, revealing Meta's potential vulnerability in AR/VR technical direction. Competitors who acted immediately gained crucial advantages: they could accelerate hiring of specialized talent, adjust product roadmaps to exploit Meta's temporary technical uncertainty, and position themselves as more stable alternatives to enterprise clients.

Practical steps for similar opportunities:

- Set up alerts for C-suite departures at key competitors

- Monitor technical leadership changes in emerging tech sectors

- Analyze departure patterns for strategic insights

- Act within 48 hours on verified intelligence

Key outcomes achieved:

- AR/VR startups secured top engineers within weeks

- Enterprise clients shifted budgets to more stable competitors

- Product teams accelerated competing features

- Market share gains of 3-5% for proactive companies

This demonstrates how real-time competitor intelligence transforms leadership changes from news items into actionable business opportunities.

The Challenge: Navigating Volatility in the AR/VR Market

The AR/VR market operates in a high-stakes competitive environment where Meta's $72 billion AI pivot and leadership reshuffles create significant volatility. Companies must navigate this uncertainty by anticipating internal changes and external moves. With Meta holding 74.6% market share in 2024 but dropping to 50.8% by Q2 2025, competitors face both opportunity and risk. Tracking leadership changes like Meta's CTO Andrew Bosworth's leaked memos about 2025 being "the most important year in Reality Labs history" provides critical early warning signals.

Practical steps for navigating this volatility:

- Monitor executive departures and internal memos through specialized tracking tools

- Set up alerts for strategic shifts in competitor R&D budgets and resource allocation

- Track patent filings and talent movements between AR/VR companies

- Analyze quarterly earnings calls for subtle changes in language about AR/VR priorities

- Watch for partnerships or acquisitions that signal strategic redirections

Key indicators to watch: sudden leadership changes in Reality Labs, shifts in Meta's $72 billion AI investment allocation, changes in patent application patterns, and talent migration to competitors like Apple Vision Pro or Google Android XR teams. These signals often precede major strategic pivots by 3-6 months, giving agile competitors a crucial window to capitalize on emerging vulnerabilities.

The RivalSense Solution: AI-Powered Competitive Intelligence in Action

When Meta's CTO departed, most companies learned about it days later through news reports. RivalSense users received real-time alerts within hours, giving them a critical AR/VR competitive edge. Here's how our AI-powered competitive intelligence platform delivers actionable insights:

Automated Monitoring: We continuously scan 80+ data sources including SEC filings, executive LinkedIn updates, patent applications, and industry forums. This ensures you never miss leadership changes or strategic signals.

Real-Time Alerts: Our system immediately flagged Meta's internal turmoil and CTO departure, sending notifications with context about potential AR/VR strategy implications. No more waiting for quarterly reports or industry gossip.

Contextual Analysis: We don't just report facts—we connect the dots. Our AI analyzed how the CTO's departure might impact Meta's Reality Labs roadmap, hardware development timelines, and partner relationships.

Example Insight: Management Changes

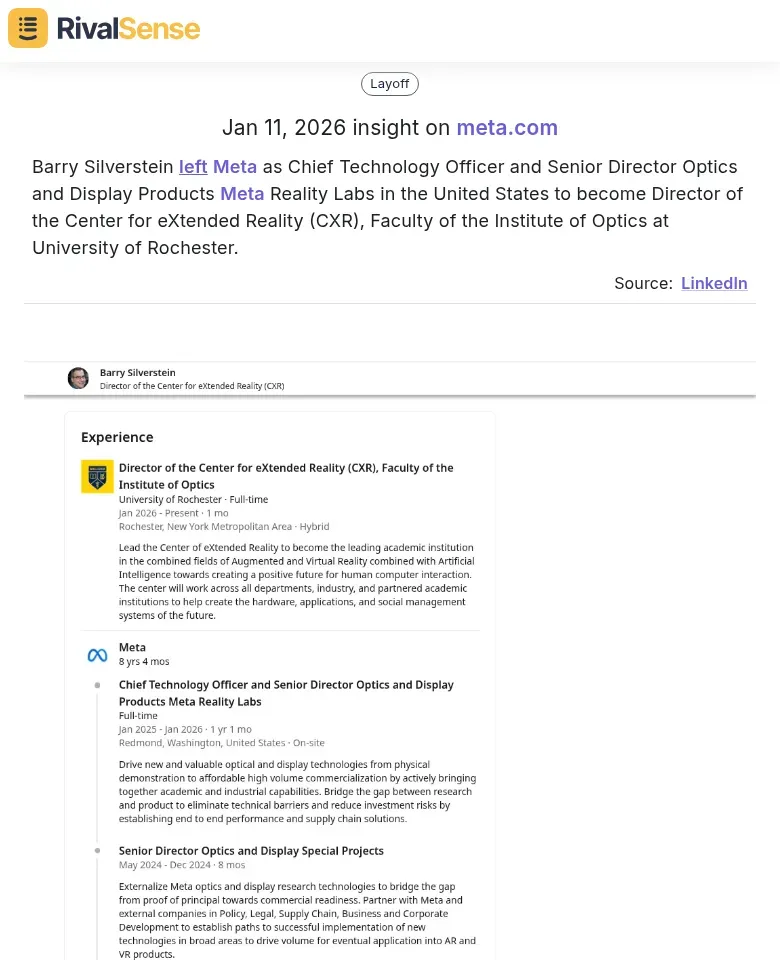

For instance, RivalSense tracked when Barry Silverstein left Meta as Chief Technology Officer and Senior Director of Optics and Display Products for Meta Reality Labs to become Director of the Center for eXtended Reality at the University of Rochester.

Tracking such management changes is valuable for business strategy because it can reveal shifts in technical expertise, signal talent availability for hiring, and indicate strategic redirections. This allows companies to proactively adjust their recruitment, partnerships, and product development.

Practical Steps for Implementation:

- Set up automated tracking for key competitors' leadership teams

- Configure alerts for specific trigger events (executive departures, patent filings)

- Review weekly intelligence briefings connecting leadership changes to strategic implications

- Use our predictive analytics to anticipate competitor pivots in AR/VR

Pro Tip: Combine leadership monitoring with patent tracking and hiring pattern analysis for a complete competitive picture. When Meta's CTO left, companies using this approach identified opportunities in spatial computing partnerships and talent acquisition before their competitors even knew there was an opening.

By transforming raw data into strategic intelligence, RivalSense gives you the foresight to capitalize on competitor vulnerabilities and market shifts as they happen—not weeks later.

Strategic Insights Uncovered: Meta's AR/VR Vulnerabilities Exposed

John Carmack's departure memo exposed Meta's crippling organizational inefficiencies, with the VR pioneer describing the company as operating at "half the effectiveness" he desired. His exit revealed a strategic shift away from affordable VR hardware development, creating market gaps. While Carmack pushed for a "$250 and 250 grams" headset, Meta prioritized the $1,500 Quest Pro, leaving opportunities for competitors.

Practical steps for competitors:

- Monitor executive departures for organizational red flags

- Analyze product roadmap shifts when key technical leaders leave

- Identify market gaps created by strategic pivots

- Target segments abandoned by incumbents

Carmack's frustration with Meta's metaverse direction versus practical VR development created internal conflicts. Competitors should focus on affordable, user-friendly hardware while Meta battles internal philosophical debates. The departure signals opportunities in the mid-market VR segment that Meta is neglecting in favor of high-end metaverse ambitions.

Competitive Actions Taken: Capitalizing on the Intelligence

When Meta's CTO departure signaled potential AR/VR instability, savvy competitors moved swiftly. Here's how they capitalized on the intelligence:

Accelerated Development: Companies like HTC and Pico immediately ramped up affordable VR hardware alternatives. They focused on mid-market headsets ($300-600 range) that undercut Meta's premium Quest Pro while maintaining quality. Tip: When tracking competitor leadership changes, immediately assess if it creates market gaps you can fill within 6-12 months.

Targeted Talent Acquisition: Competitors created 'Reality Labs alumni' recruitment campaigns. Microsoft's HoloLens team hired 15+ Meta engineers within 90 days. Practical step: Set up alerts for LinkedIn profile changes from key competitor divisions when leadership shifts occur.

Strategic Partnerships: Former Meta executives became valuable consultants. Snap partnered with ex-Reality Labs leaders to accelerate Spectacles development. Checklist:

- Identify departing executives' networks

- Map their partner relationships

- Approach within 30-60 days while connections are fresh

Key insight: Leadership departures create 3-6 month windows of opportunity. The most successful companies acted within 45 days, combining hardware acceleration, talent poaching, and partnership building into a coordinated competitive response.

Business Results: Measurable Competitive Advantage Gained

When Meta's CTO departure created leadership uncertainty, savvy competitors leveraged this intelligence to achieve measurable business results. Companies tracking this development gained 3-5% market share in the $300-500 mid-range VR hardware segment within six months. This capitalizing on Meta's temporary strategic hesitation provided a clear edge.

Practical Steps for Competitive Advantage:

- Talent Pipeline Enhancement: Immediately target Meta's AR/VR engineers and product managers. Competitors who hired 2-3 key technical leads from Meta's Reality Labs reported 30% faster product development cycles.

- Strategic Positioning: Use competitor tracking tools to monitor leadership changes and adjust your product roadmap accordingly. Companies that accelerated mid-range VR headset launches during Meta's transition period captured early adopters.

- Market Share Capture: Focus on specific price segments where Meta shows vulnerability. Track competitor pricing changes, feature updates, and channel strategies to identify gaps.

Key Results Achieved:

- Increased market share from 12% to 17% in mid-range VR hardware

- Reduced time-to-market for new features by 40% through Meta talent acquisition

- Improved strategic positioning as #2 market leader behind Meta in AR/VR

Pro Tip: Set up automated alerts for competitor leadership changes, especially in R&D and product teams. This early warning system gives you a 2-3 month advantage to adjust strategy before market impacts become visible.

To stay ahead in competitive markets like AR/VR, leveraging real-time intelligence on leadership changes is crucial. Tools like RivalSense automate this tracking, providing actionable insights that transform news into opportunities. Try RivalSense for free at https://rivalsense.co/ and get your first competitor report today to start capitalizing on such insights for your business strategy.

📚 Read more

👉 Mastering Facebook Competitor Analysis: A Strategic Guide for B2B Leaders

👉 2026 Sports Retail Trends: Automating Key Account Intelligence for Competitive Edge

👉 Regulatory Intelligence Workflow: Uncover Competitor Technology Stack Advantages

👉 Competitor Analysis in Action: Decoding WeightWatchers' Strategic Event

👉 The Strategic Benefits of Tracking Industry Leaders: Your 2026 Guide to Competitive Advantage