How Top B2B Companies Outmaneuver Competitors: Pricing, Product, and Engagement Insights

In 2024, 72% of enterprise suppliers made significant strategy pivots unnoticed by competitors until quarterly earnings reports (Gartner). Real-time competitive tracking is now a revenue imperative. Here’s how industry leaders are evolving – and how to decode their moves.

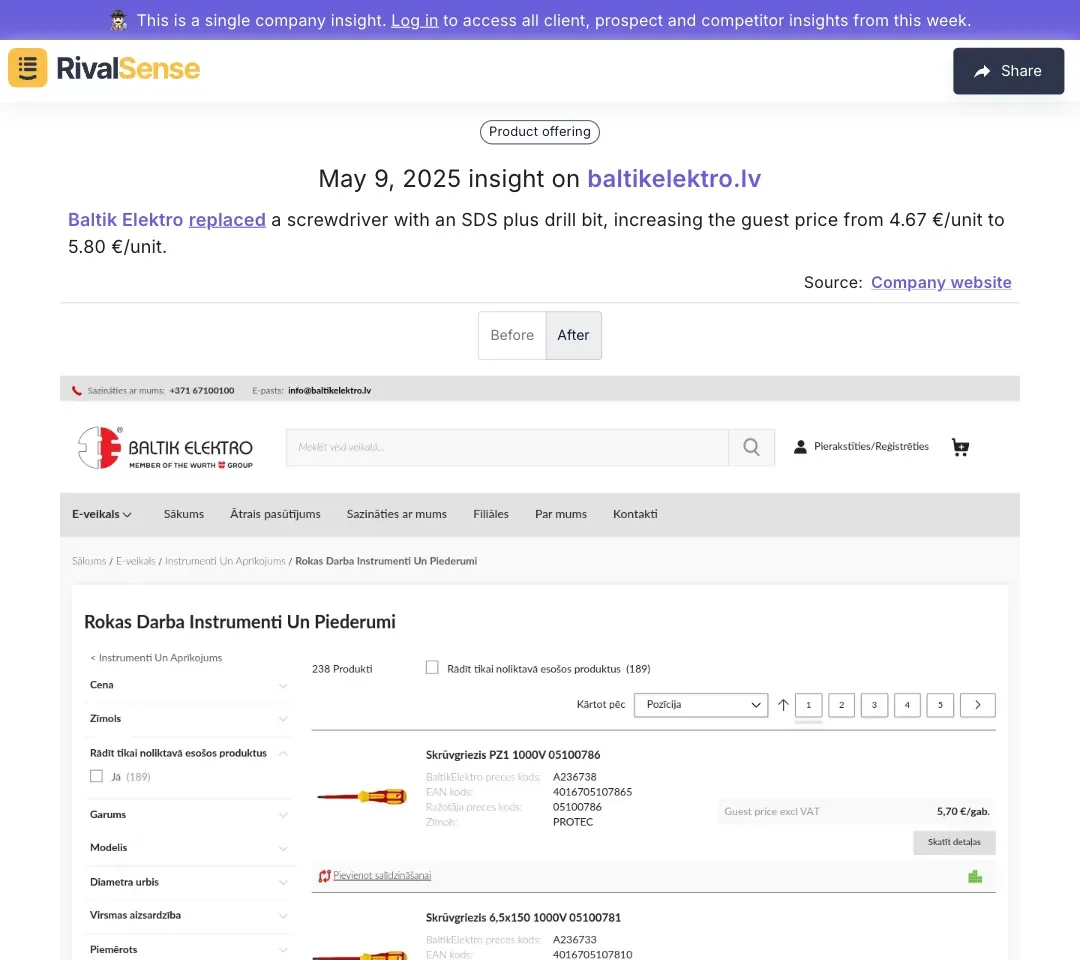

Case Study: A German industrial supplier replaced basic screwdrivers with SDS+ drill bits, increasing margins by 22% (RivalSense pricing data)

1. The Premiumization Playbook: When +24% Pricing Works

- The Move: Replace commodity items (€4.67 screwdrivers) with engineered solutions (€5.80 SDS+ bits)

- The Data: 63% of B2B companies now use "solution bundling" to justify price hikes (2025 McKinsey B2B Pulse)

- Track With RivalSense: Get alerts when competitors:

- Discontinue legacy SKUs

- File patents for upgraded products

- Mention "premium" or "tiered" pricing in job postings

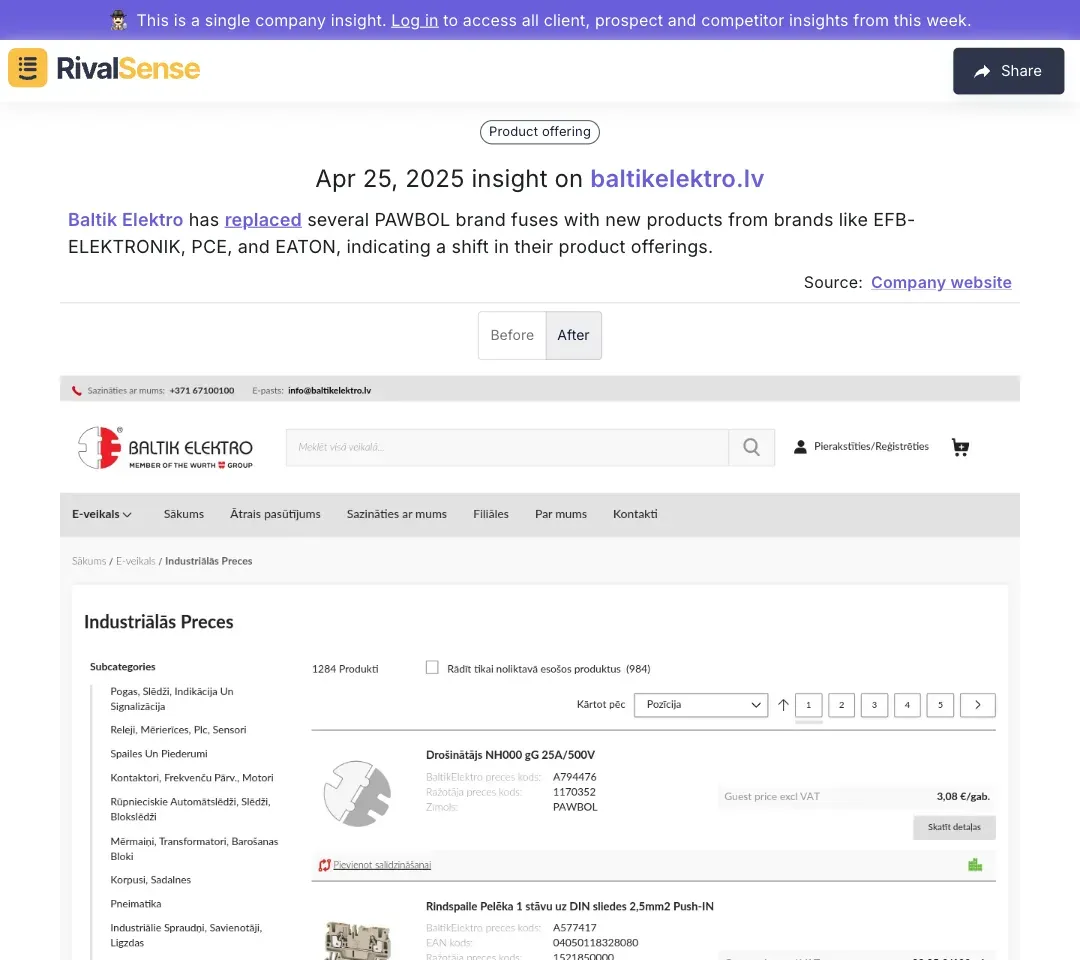

RivalSense detected PAWBOL→EATON brand swaps 3 months before official announcements

2. Product Mix Chess: The 4-Phase Replacement Strategy

Top performers rotate inventory in waves:

- Test: Add 2-3 new brands as "alternatives" (EFB-ELEKTRONIK)

- Promote: Feature in webinars/whitepapers

- Demote: Remove legacy items (PAWBOL) from search filters

- Retire: Label as "legacy" in price lists

*Pro Tip: Set RivalSense alerts for:

- New supplier partnerships in trade registries

- Social media follows between company execs and component vendors*

3. Voltage Wars: How Price Cuts Can Signal Expansion

Slashing a €28.16 high-voltage plug to €5.99 isn’t just margin play – it’s market entry:

- Targets maintenance teams vs engineers

- Enables smaller contractors to bid on jobs

- Creates add-on sales for compatible tools

*RivalSense Correlation Engine™ flagged this shift alongside:

- Job postings for SMB account managers

- Updated certification docs for low-voltage systems*

4. The Breakfast Briefing Arms Race

67% of technical buyers now prefer "learning events" over sales demos (2025 Demand Gen Report).

Anatomy of a High-Impact Event:

- 3 Weeks Prior: Teaser emails about "NFPA 70E updates" (regulatory hook)

- 1 Week Prior: LinkedIn posts showing Etelec gear in use

- Post-Event: Limited-time SPICE software access

RivalSense tracks 23 event types – from breakfast seminars to factory “hackathons”

Actionable Insights for 2025

- Price Tracking ≠ Spreadsheets: AI detects micro-adjustments across 17 data points

- Product Shifts Start Early: 89% appear in HR/legal docs before catalogs

- Events Reveal Roadmaps: Presentation topics correlate with Q3-Q4 launches

"Last quarter, RivalSense alerted us to a competitor’s IoT breaker tests 6 months before launch. We fast-tracked our own SKUs and took 38% market share."

- CTO, €200M Electrical Distributor

Outmaneuver, Don’t Just Follow

Get Your Free Competitor Report

See pricing shifts, hidden partnerships, and strategic hiring patterns from your top 3 competitors – delivered in 72 hours. No credit card needed.

📚 Read more

👉 A Step-by-Step Framework for Analyzing Competitors’ Market Entry Strategies

👉 5 Common Pricing Strategy Mistakes Exposed by Competitor Tracking (And How to Avoid Them)

👉 How to Leverage Competitor Product Insights to Enhance Your Own Strategy: 5 Actionable Steps

👉 How Strategic Partnerships Reveal Hidden Market Opportunities: A Competitor Analysis Case Study