How to Monitor Indirect Competitors: Strategic Guide for Business Leaders

In today's fast-paced business environment, understanding your competition extends beyond direct rivals. Indirect competitors—businesses addressing similar customer needs through different solutions—can disrupt your market position unexpectedly. This comprehensive guide delivers actionable steps to monitor these hidden challengers, complete with practical frameworks and real-world examples to fortify your competitive strategy.

Why Monitor Indirect Competitors? 🔍

Indirect competitors often emerge from adjacent markets or innovative approaches to solving customer pain points. For example, while a project management SaaS competes directly with tools like Asana, note-taking apps like Notion become indirect competitors when they add task-tracking features. Recognizing these players helps you:

- Anticipate market shifts before they impact your revenue

- Identify innovation opportunities from cross-industry approaches

- Prevent customer attrition to alternative solutions

Step 1: Identify Indirect Competitors 🎯

Systematic identification is crucial before monitoring begins. Start by mapping all potential solutions your customers might consider instead of your offering, even if they seem unrelated.

✅ Actionable Checklist:

- Keyword Research: Use SEMrush or Ahrefs to find businesses ranking for your core keywords but offering different solutions (e.g., "team collaboration" revealing both chat apps and document tools)

- Customer Journey Analysis: Interview customers about alternatives they evaluated during decision-making

- Industry Reports: Review Gartner/McKinsey publications for emerging players in your problem space

- Social Listening: Scan Reddit/Quora for phrases like "alternatives to [your product]"

Step 2: Analyze Their Offerings 🧩

Once identified, dissect their value proposition relative to yours. Focus on how they position themselves rather than direct feature comparisons.

| Analysis Dimension | Key Questions to Ask |

|---|---|

| Pricing Strategy | Do they use freemium, subscription, or one-time pricing? |

| Customer Segments | Which demographics/business sizes do they target? |

| Unique Value Props | What core problems do they solve differently? |

| Weakness Indicators | What complaints appear in G2/Trustpilot reviews? |

📌 Pro Tip: Track pricing page changes quarterly—sudden shifts often precede strategic pivots.

Step 3: Track Digital Footprints 🌐

Monitor online activities to detect strategic shifts early. Digital breadcrumbs often reveal plans before official announcements.

- SEO Movements: Use Moz to track new keyword rankings indicating market expansion

- Social Sentiment: Analyze LinkedIn/Twitter engagement spikes around product mentions

- Advertising Shifts: Leverage Similarweb to spot new ad campaigns/channels

- Tech Stack Changes: BuiltWith alerts for new integrations/partnerships

🔔 Automate This: Set Google Alerts for "[competitor name] + launch/update/partner"

Step 4: Leverage Intelligence Tools ⚡

Manual tracking becomes unsustainable at scale. Competitive intelligence platforms aggregate signals across websites, registries, and social media—transforming noise into actionable insights.

Real-World Examples from RivalSense:

-

Product Launches Signal Innovation Direction:

ExpressVPN's redesigned apps (May 2025) revealed UX investments that could reset customer expectations industry-wide. Valuable for benchmarking your own product roadmap. -

Partnerships Uncover New Markets:

Spotify's collaboration with Korean dance show (2025) highlighted expansion into cultural niches. Critical for anticipating cross-industry moves that may affect your audience. -

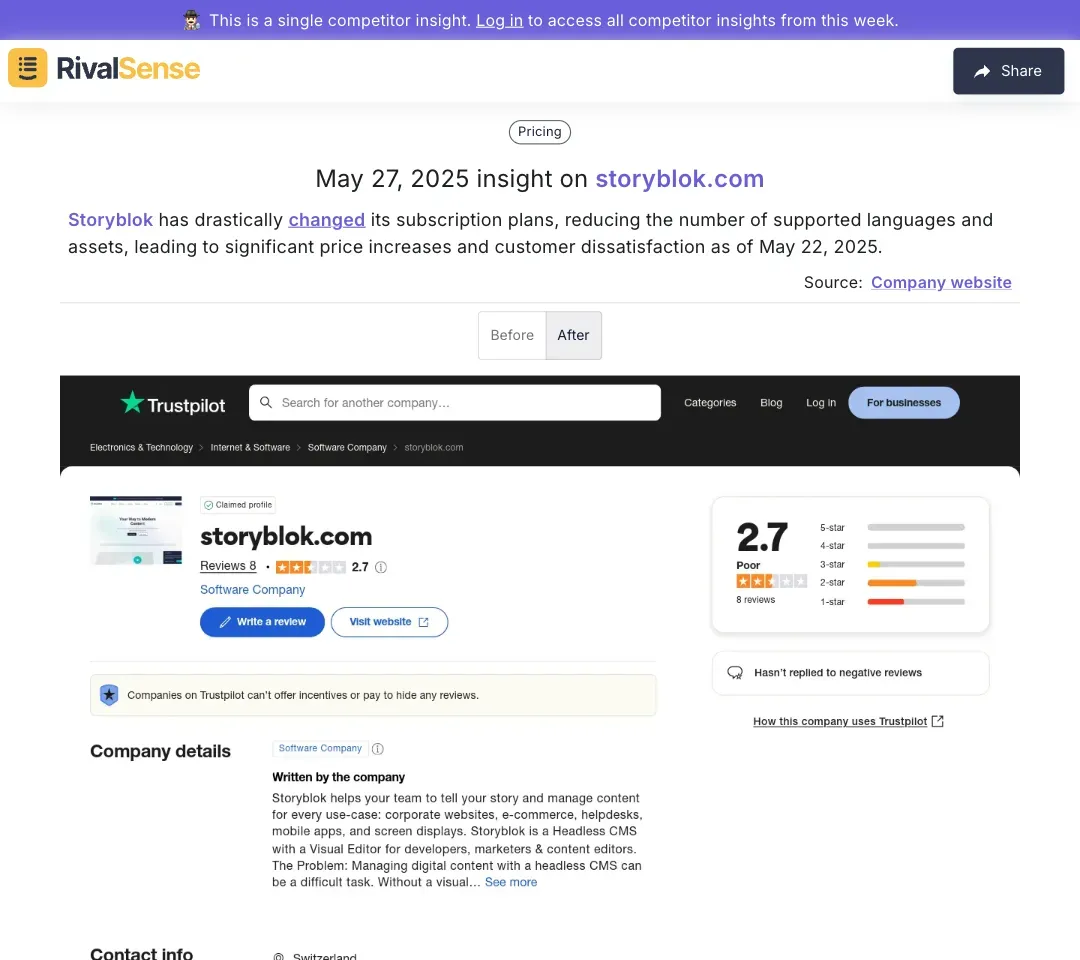

Pricing Changes Indicate Strategic Shifts:

Storyblok's subscription overhaul (May 2025) caused customer backlash—a warning sign to review your own pricing elasticity and support structures.

Tools like RivalSense automate tracking across 80+ sources, delivering weekly reports on product updates, regulatory changes, and leadership moves so you spend less time searching and more time strategizing.

Step 5: Turn Insights into Action 🚀

Convert findings into strategic adjustments through structured analysis:

- Conduct SWOT Workshops: Quarterly sessions mapping findings to Strengths, Weaknesses, Opportunities, Threats

- Gap Analysis: Compare feature sets against emerging competitor capabilities

- Counter-Tactic Development: Create response playbooks for common scenarios (e.g., if competitor slashes prices)

📈 Metrics to Track:

- % of product features lagging behind indirect competitors

- Share-of-voice in emerging solution categories

- Customer retention rate when indirect alternatives emerge

Pro Monitoring Checklist ✅

Maintain vigilance with these operational habits:

- [ ] Dedicate 2 hours monthly for competitive landscape reviews

- [ ] Subscribe to indirect competitors' newsletters

- [ ] Attend their webinars/product demos quarterly

- [ ] Track employee growth/LinkedIn hires for capability clues

- [ ] Monitor regulatory filings for market expansion hints

Transform Intelligence into Advantage 💡

Indirect competitor monitoring delivers early warnings about market disruptions—from emerging technologies to shifting customer expectations. By implementing these steps, you'll gain:

- 360-degree market visibility beyond direct rivals

- Foresight to innovate before disruption hits

- Data to justify strategic investments

Ready to streamline competitor tracking?

Try RivalSense Free and get your first automated competitor report today. Identify threats, spot opportunities, and stay ahead—all from your inbox.

📚 Read more

👉 Competitive Intelligence in Medical Aesthetics: A Tactical Case Study

👉 How Pinter's Trooper Deal Ignited a Wave of Competitive Innovation

👉 5 LinkedIn Tactics for Strategic Competitive Benchmarking

👉 The Ultimate Checklist for Crafting Competitor Profiles in Brewing Tech

👉 Boost Productivity with Strategic Competitor Insights on Partnerships