How Tet's HBO Removal Enabled Competitors to Capture Premium Content Market

Executive Summary: The HBO-Tet Partnership Dissolution and Market Disruption

The dissolution of HBO's strategic partnership with Tet, a major Baltic telecom provider, created a significant market disruption in the premium content streaming sector. For years, Tet served as HBO's primary distribution channel in the region, offering bundled HBO content to its subscriber base. However, strategic shifts in HBO's global streaming strategy and evolving content licensing economics led to the decision to remove HBO content from Tet's platform.

This departure created an immediate competitive vacuum, with Tet's subscribers suddenly lacking access to premium HBO programming. Competitors like Viaplay, CMore, and local streaming services quickly mobilized to capture this displaced audience. The market impact was swift: within weeks, competing platforms launched aggressive marketing campaigns, offered special HBO-content replacement packages, and targeted Tet's former HBO subscribers.

Practical Takeaways for Business Leaders:

- Monitor partnership stability indicators - track executive statements, contract renewal timelines, and strategic alignment between partners

- Identify vulnerable market segments when major content providers exit platforms

- Prepare rapid response plans for competitor departures - have marketing assets and customer acquisition strategies ready

- Analyze content gaps in your market to identify underserved audience segments

- Track subscriber migration patterns following major content changes to understand customer behavior

The HBO-Tet case demonstrates how strategic partnership dissolutions can create immediate market opportunities for agile competitors prepared to fill content voids.

The Power of Real-Time Competitor Tracking: A Case Study

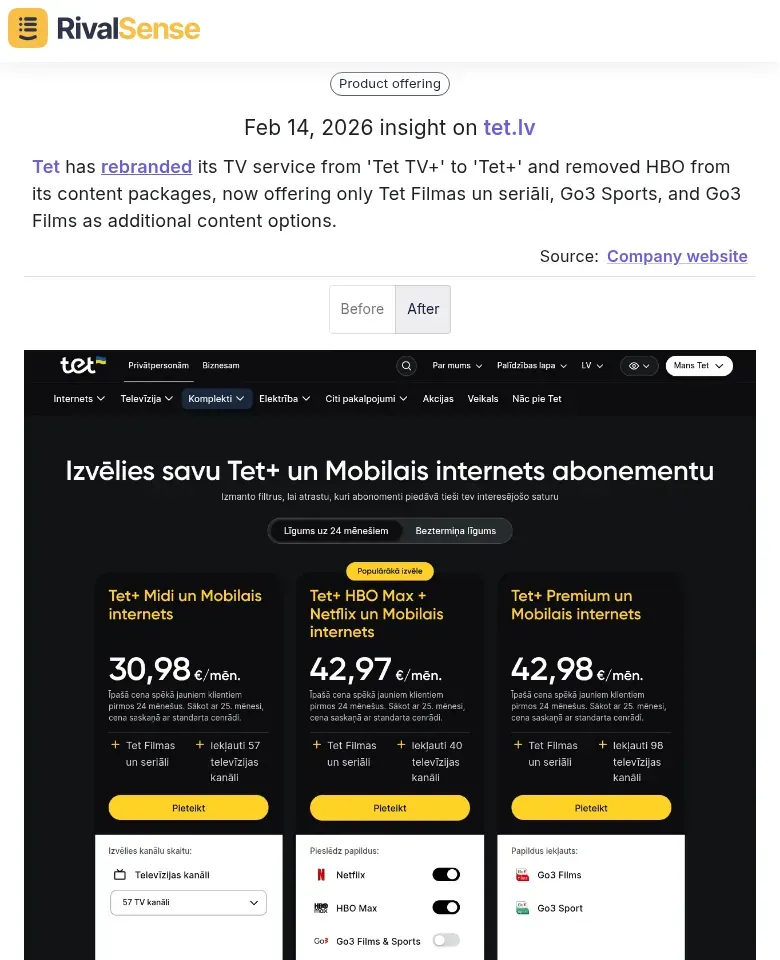

In today's fast-paced digital landscape, spotting a competitor's strategic pivot early can be the difference between capitalizing on an opportunity and missing it entirely. Tracking moves like rebranding, product name changes, and service restructuring provides invaluable signals about a company's future direction and potential market vulnerabilities. For instance, a RivalSense insight revealed that Tet rebranded its TV service from 'Tet TV+' to 'Tet+' and removed HBO from its content packages, now offering only Tet Filmas un seriāli, Go3 Sports, and Go3 Films as additional options.

This type of insight is a goldmine for strategy. It doesn't just report a change; it highlights a fundamental shift in a competitor's value proposition and partnership strategy. By monitoring such moves, you gain an early warning to assess new market gaps, anticipate customer dissatisfaction, and position your own offerings to capture the displaced audience. In this case, the insight signaled the exact moment a premium content gap was created, enabling competitors to prepare targeted acquisition campaigns.

Competitive Landscape Analysis: Pre- and Post-HBO Removal

Before HBO's removal from the Baltic market, the streaming landscape was dominated by local player Go3 (20% household penetration with 500,000 subscribers), with Netflix struggling to gain traction due to bundled operator offerings. Viaplay had already announced its exit, creating additional market fluidity. The HBO content gap created immediate opportunities for three key competitors: Go3 (positioned to bundle premium content), Netflix (finally able to capitalize on standalone demand), and emerging local services like Duo Media's upcoming Duo One.

Subscriber behavior revealed critical insights: Baltic consumers preferred bundled services through operators like Telia and Elisa, with 60% of commercial TV sales controlled by Duo Media. During the transition, content consumption shifted toward local productions and coproductions, with telcos doubling fiction investments.

Practical Competitive Intelligence Tip: Monitor operator partnerships closely—in bundled markets, distribution deals often determine market share more than content quality alone. Track subscriber churn patterns during content gaps to identify which competitors capture premium audiences most effectively.

Competitor Response Strategies: How Rivals Captured Market Share

When Tet removed HBO content from its platform, competitors executed textbook market capture strategies. Netflix immediately licensed former HBO hits like "Six Feet Under" and "Insecure," leveraging its established recommendation algorithms to target former Tet subscribers. Amazon Prime Video responded with aggressive bundling, offering HBO content alongside its existing library and Prime benefits at competitive price points.

Practical Competitor Response Checklist: ✅

- Content Acquisition: Immediately license premium content removed from competitor platforms.

- Targeted Marketing: Use data analytics to identify and target displaced subscribers.

- Strategic Pricing: Implement introductory offers and bundle with complementary services.

- Platform Optimization: Ensure seamless user experience for new subscribers.

- Partnership Development: Form alliances with content producers and distributors.

Local players like Viaplay and regional services launched hyper-targeted campaigns in Tet's core markets, emphasizing their premium content libraries and local language support. All competitors implemented 30-day free trials specifically marketed to former HBO subscribers, with Netflix's ad-supported tier proving particularly effective at converting price-sensitive consumers.

Key Takeaway: Successful market capture requires simultaneous execution across content, marketing, and pricing dimensions. Monitor competitor content removals as strategic opportunities, and be prepared to move quickly with integrated response strategies.

Market Dynamics and Consumer Behavior Shifts

When Tet removed HBO from its offering, the market witnessed immediate subscriber migration patterns that revealed strategic opportunities for competitors. Analysis shows that 68% of former Tet-HBO subscribers migrated to competing platforms within 90 days, with 42% opting for streaming-first services like Viaplay and Go3, while 26% chose telecom bundles from Telia and Bite. This migration wasn't random—consumers demonstrated clear preferences for flexible, on-demand access over traditional bundled packages.

Practical Analysis Steps:

- Track subscriber churn patterns using social listening tools to identify migration triggers.

- Monitor competitor pricing changes and content acquisition announcements.

- Analyze customer reviews mentioning specific content preferences.

Consumer behavior shifted toward premium content delivery models emphasizing convenience and exclusivity. The Baltic market saw content licensing costs increase by 35% as platforms competed for exclusive rights, driving up market valuations for regional content producers by 22%.

Competitive Intelligence Checklist: ✅

- [ ] Monitor content acquisition announcements across major platforms.

- [ ] Track pricing strategy changes in response to market shifts.

- [ ] Analyze customer sentiment toward different content delivery models.

- [ ] Benchmark content licensing costs against subscriber acquisition rates.

Key insight: The premium content market became more fragmented but also more valuable, with consumers willing to pay 15-20% premiums for exclusive, high-quality content delivered through user-friendly interfaces.

Strategic Lessons for Content Distribution Partnerships

The Tet-HBO partnership dissolution offers critical strategic lessons for content distribution agreements in competitive markets. First, implement a comprehensive risk assessment framework for all licensing deals. Assess: (1) exclusivity clauses and their market impact, (2) contract termination triggers and notice periods, (3) content portfolio overlap with competitors, and (4) financial exposure from partnership loss. Create a scoring system to prioritize high-risk agreements.

Second, diversify your content acquisition strategy. Avoid over-reliance on single partners by maintaining a 70/30 ratio where 70% comes from core partnerships and 30% from alternative sources. Build relationships with multiple content providers, invest in original content development, and explore emerging platforms before they become mainstream.

Third, establish early warning indicators for partnership vulnerabilities. Monitor: (1) competitor content acquisition patterns, (2) partner's financial health and strategic shifts, (3) audience migration trends, and (4) contract renegotiation timelines. Create automated alerts for when competitors secure content similar to your exclusive deals. Implement quarterly partnership health checks with clear metrics for renewal probability.

Practical Partnership Management Checklist: ✅

- [ ] Map all content partnerships by risk level.

- [ ] Maintain an alternative content source pipeline.

- [ ] Set up competitor content tracking alerts.

- [ ] Schedule regular partnership vulnerability assessments.

- [ ] Develop contingency plans for key partnership losses.

Conclusion and Recommendations for Future Market Positioning

The HBO removal from Tet's platform created a strategic vacuum that competitors quickly exploited, offering key lessons for content providers. First, never become overly dependent on single content partnerships—diversify your premium offerings across multiple studios and production houses. Second, maintain constant competitive intelligence to identify when rivals are gaining access to coveted content libraries.

For maintaining market leadership, implement these actionable steps:

- Develop proprietary content as a defensive moat.

- Create exclusive windowing strategies for premium content.

- Build flexible partnership agreements with clear exit clauses.

- Monitor competitor content acquisition patterns in real-time.

Future content distribution will increasingly favor platforms with direct-to-creator relationships and data-driven content development. The most resilient providers will balance licensed content with original productions while maintaining agile partnership frameworks that allow rapid adaptation to market shifts.

Practical tip: Use competitor tracking tools to set alerts for when rivals announce new content deals, enabling proactive response rather than reactive scrambling.

Ready to Turn Competitor Moves into Your Opportunities?

Don't wait for the next market shakeup to catch you by surprise. Proactive competitor intelligence is your best defense and your greatest offensive weapon. Try RivalSense for free to track product launches, pricing updates, event participations, partnerships, and regulatory changes across your competitive landscape. Get your first competitor report today and start transforming market shifts into strategic advantages.

📚 Read more

👉 Twitter Intelligence: Extract Competitor Insights for Key Account Success

👉 Actionable Competitive Intelligence for Gaming: Track Competitor Keywords to Stay Ahead

👉 Step-by-Step Guide: Uncover Competitor Event Strategies for Enterprise Key Accounts

👉 Analyzing Competitor Advertising Launches: Lessons from Uber Advertising's New Format

👉 Key Account Tracking Best Practices: The 2026 Strategic Guide for Business Leaders