How Systems Software Leaders Win with Competitor Feature Gap Analysis

In the high-stakes world of systems software, where complex infrastructure, security, and performance demands define success, feature gap analysis isn't just a tactical exercise—it's a strategic imperative. Today's competitive landscape demands more than reactive development; it requires proactive intelligence that reveals where your product truly stands against rivals. By systematically comparing your feature set with competitors', you uncover critical insights that drive smarter innovation and sharper market positioning.

Why is this so critical? Systems software buyers—CTOs, DevOps leaders, infrastructure architects—make high-value, long-term decisions based on capability comparisons. A single missing integration, security feature, or performance optimization can cost you enterprise deals. Competitor feature analysis transforms guesswork into data-driven strategy, revealing where to innovate (not just imitate) and how to differentiate your value proposition.

This analysis directly fuels sustainable competitive advantage. When you identify gaps before customers do, you can prioritize development that delivers maximum market impact. Practical steps include:

- Map core competitor features across security, scalability, integration, and monitoring.

- Score each feature by customer importance and implementation difficulty.

- Identify 'quick wins' versus 'strategic differentiators'.

- Align gap closure with your product roadmap and marketing messaging.

The result? A product that doesn't just keep pace but sets the pace—turning competitive intelligence into lasting market leadership.

🏗️ The Framework: Building a Systematic Feature Gap Analysis Process

A systematic feature gap analysis begins with competitor identification. To ensure comprehensive tracking, leverage tools that automate competitor monitoring across various channels. In systems software, categorize competitors as:

- Direct competitors (same target market, similar solutions)

- Indirect competitors (different approaches solving similar problems)

- Emerging threats (startups with innovative approaches)

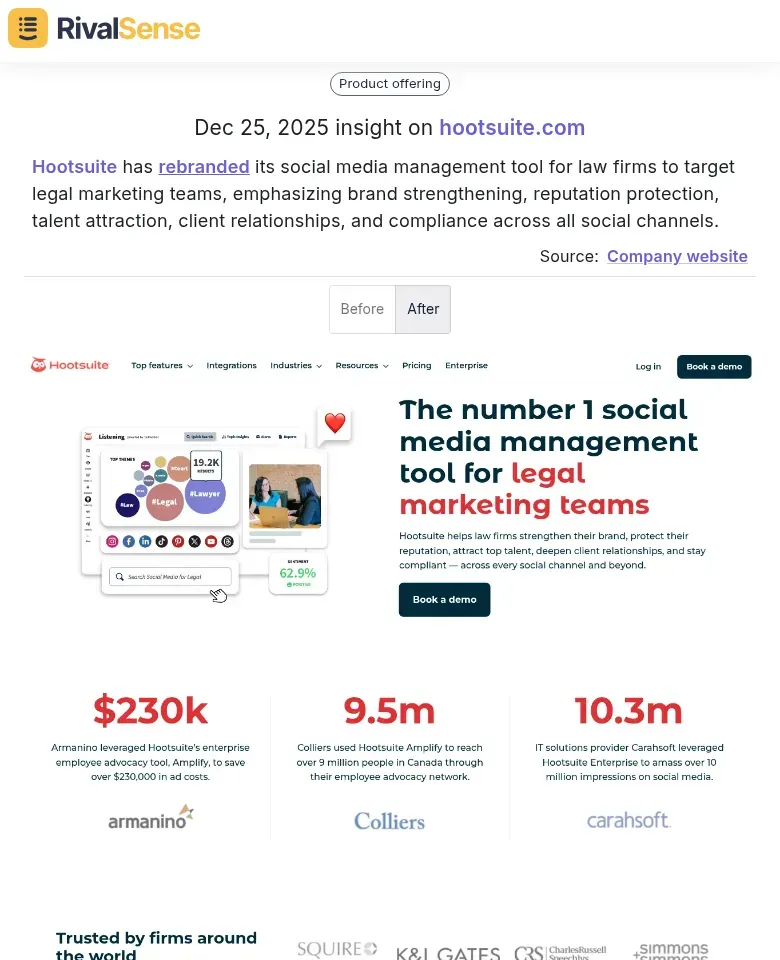

Create a competitor matrix with columns for company, product, target segment, and core differentiators. For example, monitoring tools like RivalSense can alert you to significant competitor moves, such as Hootsuite rebranding its social media management tool for law firms to target legal marketing teams, emphasizing brand strengthening, reputation protection, talent attraction, client relationships, and compliance across all social channels.

This type of insight is valuable for business strategy as it reveals how competitors are pivoting to capture niche markets, helping you anticipate shifts in positioning and adjust your own targeting accordingly.

Next, establish evaluation criteria. Use a weighted scoring system across categories:

- Core functionality (40%)

- Performance & scalability (25%)

- Developer experience (20%)

- Ecosystem integration (15%)

Within each category, define specific metrics like API response times, container support, or observability features. 📌 Tip: Involve your product and engineering teams to ensure criteria reflect real customer priorities.

For structured data collection, implement a competitor tracking dashboard with these components:

- Automated monitoring of competitor changelogs and release notes

- Regular competitive testing cycles (quarterly)

- Customer feedback analysis from review sites

- Sales team win/loss reports

- Industry analyst reports

✅ Practical checklist:

- [ ] Maintain a centralized competitor database

- [ ] Assign ownership for each competitor

- [ ] Schedule monthly review meetings

- [ ] Update scoring quarterly

- [ ] Share insights across product, marketing, and sales teams

🎯 Pro tip: Track not just what features competitors have, but how they're implemented and positioned. The implementation quality often matters more than feature checkboxes.

⚙️ Analysis in Action: Conducting Comprehensive Feature Comparisons

To conduct comprehensive feature comparisons, start by building a feature matrix that maps your capabilities against competitors'. Partnerships and integrations are critical components of the ecosystem, and monitoring these can reveal strategic gaps. Create columns for each competitor and rows for key features, scoring each on a 1-5 scale for technical implementation, performance, and user experience.

For instance, Zapier partnered with RMS in December 2025 to integrate with its hospitality cloud platform.

This insight is valuable for business strategy as it highlights how competitors are expanding their integration networks, which can inform your own partnership decisions and integration roadmap.

Analyze technical capabilities by benchmarking performance metrics like latency, throughput, and resource consumption. Evaluate integration ecosystems by mapping API coverage, SDK availability, and third-party connector support. Don't just check boxes—assess implementation quality and documentation depth.

For user experience, conduct hands-on testing across installation, configuration, daily workflows, and troubleshooting. Compare documentation quality, tutorial availability, and community resources. Assess support infrastructure through response time SLAs, escalation paths, and premium support options.

✅ Practical checklist:

- [ ] Identify 5-7 core feature categories

- [ ] Score each feature across technical, performance, UX dimensions

- [ ] Map integration ecosystem breadth vs. depth

- [ ] Test competitor products hands-on for 2+ hours

- [ ] Document gaps where you can differentiate

- [ ] Prioritize gaps by customer impact vs. development effort

📌 Tip: Focus on gaps where you can deliver 10x better performance or significantly simpler user experience—these create sustainable competitive advantages.

🎯 From Insights to Strategy: Translating Gaps into Competitive Advantages

Once you've identified feature gaps through competitor analysis, the real work begins: translating these insights into strategic advantages. Here's a practical framework for systems software leaders, incorporating financial signals from the market.

Prioritization Matrix: Create a 2x2 grid plotting market impact (customer demand, competitive pressure) against technical feasibility (development effort, architectural fit). Focus on high-impact, feasible features first. For example, if competitors lack a critical API integration that your enterprise customers demand, prioritize it.

Competitor funding events can signal market confidence and competitive strength. Tracking these helps in strategic prioritization. For instance, Glean closed a $150M Series F in June 2025, bringing the company to a $7.2B valuation.

This type of insight is valuable for business strategy as it indicates a competitor's financial backing and growth trajectory, which can influence your gap closure priorities and competitive responses.

Differentiation Opportunities: Look beyond parity features. Identify gaps where you can create unique value propositions. If all competitors offer basic monitoring, could you add predictive analytics or automated remediation? These become your competitive moats.

Roadmap Alignment: Map your findings to quarterly planning cycles. Use competitive intelligence to validate roadmap decisions and adjust timelines based on competitor releases. Create a "competitive watchlist" of features to monitor.

✅ Actionable Checklist:

- [ ] Score each gap (1-10) on market impact and technical feasibility

- [ ] Identify 2-3 differentiation opportunities that align with your core strengths

- [ ] Schedule monthly competitive intelligence reviews with product and engineering teams

- [ ] Create a "fast-follow" list for parity features and an "innovation" list for differentiation

- [ ] Document the business rationale for each roadmap decision tied to competitive analysis

📌 Remember: The goal isn't to match every competitor feature, but to strategically choose where to compete and where to differentiate.

🛠️ Implementation Best Practices for Systems Software Leaders

For systems software leaders, effective competitor feature gap analysis requires systematic implementation. Start by establishing continuous monitoring systems that track competitor feature evolution across multiple channels. Set up automated alerts for competitor product updates, release notes, and technical documentation changes.

Use tools like RivalSense to monitor competitor pricing pages, changelogs, and support documentation for feature announcements. Create a centralized dashboard that aggregates competitor intelligence for easy team access.

Integrate gap analysis findings into cross-functional workflows through regular sync meetings. Share competitor feature insights with product, engineering, and marketing teams during sprint planning sessions. Create a standardized template for documenting feature gaps that includes: competitor feature details, your current capability, gap severity (critical/moderate/minor), and recommended action items. This ensures alignment across departments and prioritizes development efforts based on competitive threats.

Measure ROI by tracking key metrics before and after implementing gap-driven features. Monitor adoption rates of new features developed in response to competitor gaps, customer satisfaction scores for those features, and any resulting market share changes. Calculate the revenue impact of features that directly counter competitor advantages. Establish a quarterly review process to assess whether gap analysis initiatives are delivering expected business outcomes and adjust your monitoring strategy accordingly.

🚀 Conclusion: Sustaining Leadership Through Continuous Competitive Intelligence

Sustaining leadership in systems software requires more than periodic competitor analysis—it demands embedding competitive intelligence into your organizational DNA. Build a culture where every team member understands competitor movements and their strategic implications. Establish a monthly competitive intelligence review where product, marketing, and sales teams share insights and coordinate responses.

Adapt your feature gap analysis methodology as markets evolve. Move beyond static feature comparisons to dynamic capability assessments. Track not just what competitors have today, but their development velocity, technical debt, and architectural constraints. Use this intelligence to anticipate their next moves and position your roadmap accordingly.

✅ Practical steps for continuous competitive advantage:

- [ ] Assign competitive intelligence champions in each department

- [ ] Implement automated competitor tracking for real-time alerts

- [ ] Conduct quarterly strategic gap analysis workshops

- [ ] Map competitor capabilities against emerging market trends

- [ ] Translate insights into actionable product roadmap decisions

Leverage competitive insights for long-term market leadership by making them central to your strategic planning. Use feature gap analysis to identify whitespace opportunities where you can build sustainable differentiation. Remember: the goal isn't just to match competitors, but to anticipate market needs they haven't recognized yet. By institutionalizing competitive intelligence, you transform reactive responses into proactive market leadership.

Ready to turn competitor insights into strategic advantage? 🚀 Try out RivalSense for free at https://rivalsense.co/ to automate your competitor tracking and get your first competitor report today. With weekly email reports on product launches, pricing updates, event participations, partnerships, regulatory changes, management shifts, and media mentions, you'll stay ahead of the competition.

📚 Read more

👉 How Early Regulatory Alerts Enabled VPN Competitors to Capture Market Share

👉 Competitor Website Changes: A Strategic Guide for Key Account Planning

👉 AI Platform Competitive Intelligence: Decoding Advertising Strategies for Strategic Advantage

👉 Predictive Regulatory Intelligence: Anticipate Competitor Moves for Key Account Wins

👉 Turning Competitor Moves into Business Opportunities: A Guide to Management Change Analysis