How Salesforce's Hoa Sen Partnership Enabled Competitors to Target CRM Gaps

In January 2026, Hoa Sen Group's strategic partnership with Salesforce for CRM implementation at its new Hoa Sen Home subsidiary revealed critical gaps in Salesforce's capabilities for Vietnam's construction materials market. While Salesforce promised standardized customer data and enhanced sales management, the implementation exposed limitations in handling Vietnam's unique construction supply chain complexities, local payment systems, and multi-tier distributor networks.

This partnership created a competitive intelligence goldmine for rival CRM providers in Southeast Asia. Savvy competitors can now analyze where Salesforce fell short and develop targeted solutions. Practical steps for competitors include: 1) Monitor implementation timelines and user feedback from Hoa Sen Home's 400+ stores, 2) Identify specific pain points in construction materials workflows, 3) Develop localized features addressing Vietnam's market nuances, and 4) Create migration pathways for companies experiencing similar gaps. The key insight: major enterprise implementations often reveal market-specific weaknesses that agile competitors can exploit by offering tailored solutions that global platforms overlook.

The Hoa Sen Home Initiative: A Digital Transformation Case Study

The Hoa Sen Home initiative represents a massive digital transformation challenge in Vietnam's construction materials retail sector. With ambitions to expand to 400+ stores and manage 15,000+ product SKUs, Hoa Sen Home required a sophisticated CRM system that could handle complex B2B relationships, project-based sales cycles, and localized Vietnamese market requirements. Their partnership with Salesforce revealed critical gaps in global CRM platforms when applied to specialized industries in emerging markets.

Key Industry-Specific Requirements:

- ✅ Project-based sales tracking for construction projects with multiple stakeholders

- ✅ Integration with local Vietnamese payment systems and tax regulations

- ✅ Complex inventory management across 400+ physical locations

- ✅ B2B customer hierarchies for contractors, architects, and developers

- ✅ Localized customer service workflows for Vietnam's business culture

Practical Advice for Evaluating CRM Platforms:

- 🔍 Create a checklist of industry-specific workflows before platform selection

- 🔍 Test localization features including language, currency, and regulatory compliance

- 🔍 Map your unique sales cycle against platform capabilities

- 🔍 Evaluate integration capabilities with local business systems

- 🔍 Consider industry-specific competitors who may offer specialized solutions

Salesforce's partnership with Hoa Sen Home demonstrated that even leading global platforms can struggle with localization and industry-specific functionality, creating opportunities for specialized competitors to address these gaps.

Competitive Intelligence Analysis: Identifying Salesforce's CRM Gaps

The Hoa Sen partnership reveals critical CRM gaps that competitors can exploit. Salesforce's implementation for Vietnam's largest construction materials distributor exposed three key vulnerabilities:

📌 Localization Challenges: Salesforce lacks comprehensive Vietnamese language support, creating workflow inefficiencies. Local payment integrations (VNPay, MoMo, ZaloPay) require custom development, and regional compliance requirements for Vietnamese tax reporting (VAT invoices, e-invoicing) aren't natively supported.

📌 Industry-Specific Gaps: Construction materials distribution requires specialized functionality missing from standard Salesforce: bulk material ordering systems, project-based pricing for B2B clients, inventory management for 15,000+ SKUs across 400+ stores, and contractor relationship management tools.

📌 Integration Limitations: Salesforce struggles with existing Vietnamese business systems like 1C:Enterprise ERP, local supply chain platforms, and government e-portals for import/export documentation.

Competitive Intelligence Checklist:

- 🔎 Monitor localization gaps in emerging markets

- 🔎 Analyze industry-specific workflow requirements

- 🔎 Test integration capabilities with local systems

- 🔎 Track custom development costs for regional compliance

- 🔎 Identify opportunities for specialized vertical solutions

Practical Tip: Use RivalSense to track how competitors address these gaps - whether through localized versions, industry-specific modules, or strategic partnerships with local tech providers.

RivalSense Insight Example:

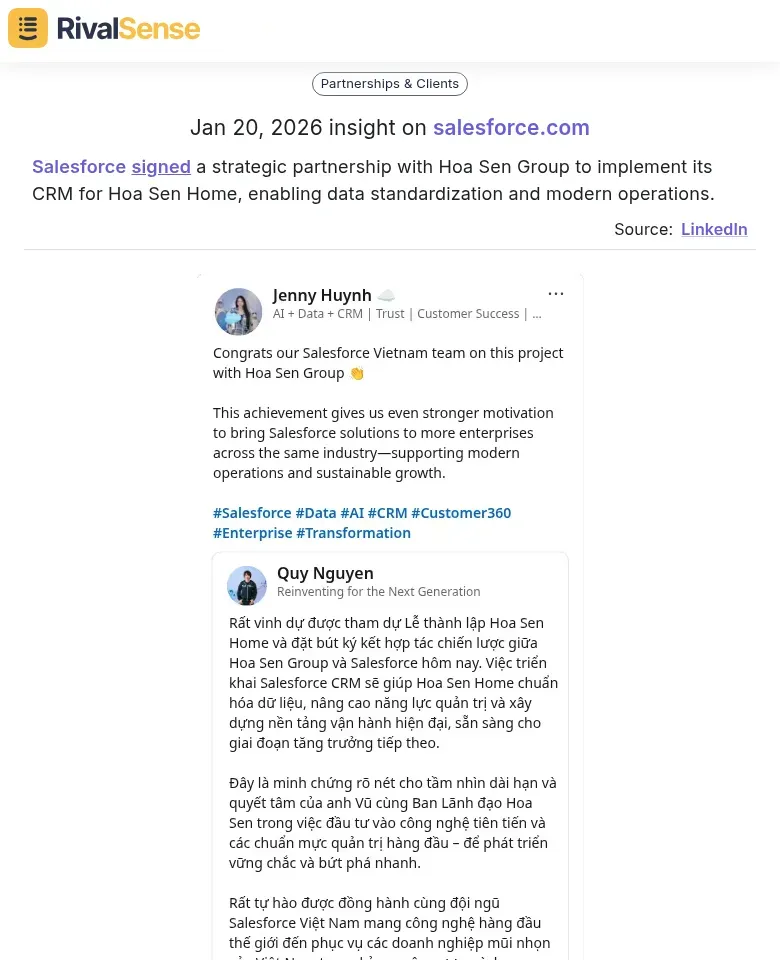

Tracking strategic partnerships can provide early warnings of market shifts. For instance, RivalSense captured this insight: "Salesforce signed a strategic partnership with Hoa Sen Group to implement its CRM for Hoa Sen Home, enabling data standardization and modern operations."

This type of insight is valuable for business strategy because it reveals where competitors are investing resources and which market segments they're targeting, allowing you to anticipate gaps and position your solutions accordingly.

Competitor Response: How Rivals Capitalized on the Opportunity

When Salesforce partnered with Hoa Sen Home in January 2026, competitors quickly analyzed the implementation to identify CRM gaps in Vietnam's construction sector. Regional providers like TNO Systems and local CRM developers created Vietnam-specific solutions with Vietnamese language support, local payment integrations, and construction industry modules for project management, material tracking, and contractor coordination.

Practical Steps for Competitor Response:

- 📊 Analyze Implementation Details: Study partnership announcements to identify specific requirements (Hoa Sen needed standardized customer data, sales/marketing automation, and after-sales service management)

- 📊 Develop Industry-Specific Modules: Create construction-focused features like material inventory tracking, project timeline management, and contractor relationship management

- 📊 Localize for Regional Markets: Add Vietnamese language support, integrate local payment gateways (MoMo, ZaloPay), and comply with Vietnam's data regulations

- 📊 Position as Regional Experts: Market solutions as "built for Southeast Asian construction businesses" with case studies showing understanding of local business practices

Alternative platforms like HubSpot and Zoho leveraged this intelligence to enhance their construction industry templates, while regional competitors positioned themselves as more culturally aligned with Vietnam's business environment. The key insight: when global players enter new markets, their implementations reveal specific gaps that agile competitors can fill with targeted solutions.

Strategic Lessons for B2B Companies in Emerging Markets

Salesforce's partnership with Vietnam's Hoa Sen Group revealed critical insights about CRM gaps in emerging markets. When global platforms like Salesforce announce partnerships, they often expose specific market needs they're struggling to address - in this case, localized workflows, industry-specific integrations, and pricing models suited for Vietnam's manufacturing sector. This creates a strategic window for competitors to target these revealed weaknesses.

Practical Steps for B2B Companies:

- 🚀 Monitor Partnership Announcements: Track when global players announce local partnerships - these often signal market-specific challenges they're trying to solve.

- 🚀 Analyze Implementation Details: Study what features are being customized or added. Salesforce's Hoa Sen implementation required extensive localization that competitors could replicate more efficiently.

- 🚀 Identify Unmet Needs: Look for gaps between what's promised in press releases and what's actually delivered. Early Hoa Sen users reported integration challenges that created opportunities for alternative solutions.

- 🚀 Build Targeted Solutions: Develop CRM features addressing the specific gaps revealed - in this case, manufacturing workflow automation and local payment integrations.

- 🚀 Time Your Market Entry: Launch your solution when the global platform's implementation is still incomplete but market awareness is high.

Competitive intelligence transforms partnership announcements from marketing noise into actionable market intelligence. By systematically analyzing competitor implementations in emerging markets, you can identify underserved segments and build solutions that address real, validated needs.

Conclusion: Turning Competitive Intelligence into Market Advantage

The Salesforce-Hoa Sen partnership reveals a critical truth: competitor partnerships are market intelligence goldmines. By tracking such alliances, you gain actionable insights into underserved CRM gaps in specific industries and regions. This isn't just about monitoring moves—it's about identifying where your competitors see opportunity, allowing you to anticipate market shifts and position your solution strategically.

To turn this intelligence into market advantage, follow these practical steps:

- 📈 Monitor partnership announcements across your competitive landscape to spot emerging market needs

- 📈 Analyze the industry/region focus of each partnership to identify CRM gaps competitors are targeting

- 📈 Map these gaps against your capabilities to find your strategic entry points

- 📈 Develop targeted messaging that addresses these specific pain points before competitors fully establish themselves

B2B companies should leverage competitive intelligence not just for defense, but for proactive market positioning. By understanding where competitors are investing partnership resources, you can identify underserved segments and craft solutions that address those exact needs. This transforms competitive tracking from reactive monitoring into a strategic tool for market leadership.

Put Competitive Intelligence into Action with RivalSense

Keeping track of competitor partnerships, product launches, and market moves can be overwhelming. Tools like RivalSense automate this process by monitoring competitor activities across websites, social media, and registries, delivering concise weekly reports straight to your inbox.

For example, RivalSense helps you spot strategic partnerships like Salesforce-Hoa Sen early, giving you a head start in analyzing gaps and crafting responses.

Ready to turn competitive insights into advantage? Try RivalSense for free and get your first competitor report today to start identifying opportunities in your market.

📚 Read more

👉 Best Practices: Extract Competitor Insights from Website Changes for Key Account Success

👉 Competitive Edge in Professional Services: A Practical Guide to Monitoring Regulatory Filings

👉 Boost Key Account Win Rates with Competitor Product Intelligence

👉 Turning Competitor Management Changes into Strategic Advantages: A Real-World Example

👉 How to Conduct Competitor Research in 2026: A Step-by-Step Guide