How RivalSense Alerted Competitors to Montblanc's Fragrance Launch: A Strategic Intelligence Case Study

Montblanc's strategic expansion into the competitive fragrance market represents a calculated move to capitalize on the growing men's luxury scent segment, projected to reach $13 billion by 2026. Through Interparfums, Montblanc leveraged its Explorer franchise success (21% growth in Q2 2023) to introduce Explorer Platinum in September 2023—a premium flanker targeting affluent consumers seeking sophisticated woody scents.

RivalSense detected early signals of this launch through comprehensive competitor tracking: trademark filings for "Explorer Platinum" emerged 8 weeks pre-launch, social media monitoring revealed influencer seeding campaigns targeting fragrance communities, and supply chain data showed increased orders for platinum-colored packaging components. These digital footprints provided a 3-week advance warning.

Practical tip: Implement automated monitoring of trademark databases, social media sentiment analysis, and supply chain intelligence to detect competitor launches. Create alert thresholds for unusual activity spikes and establish a cross-functional response team to develop counter-strategies before competitors gain market momentum.

The Competitive Challenge: Navigating Luxury Fragrance Market Dynamics

Navigating the $22.65B luxury perfume market requires deep competitive intelligence. Montblanc operates in a fiercely contested space dominated by heritage giants like Chanel and Dior, who maintain in-house fragrance operations and capture significant market share. However, RivalSense identified key whitespace opportunities: the rapid 69% growth in fragrance EMV through influencer marketing, Gen Z's openness to dupe fragrances (83% acceptance), and the underutilization of male influencers in campaigns.

Practical tip: Monitor competitor marketing spend patterns quarterly. Track when major players increase digital ad budgets or shift toward nano-influencer partnerships—this often signals upcoming launches.

Checklist:

- ✅ Set alerts for competitor trademark filings in fragrance categories

- ✅ Analyze social media engagement spikes around specific scent notes or themes

- ✅ Track luxury retailers' inventory preparations 60-90 days pre-launch

Key insight: Fragrance marketing budgets are shifting dramatically—26% of brands now allocate over 40% to influencer partnerships. Montblanc's opportunity lies in leveraging micro-influencers before mega-campaigns launch, capturing early adopters through authentic storytelling rather than competing on massive ad spends against established giants.

RivalSense in Action: Early Detection and Strategic Intelligence Gathering

RivalSense's automated monitoring system detected Montblanc's fragrance launch months before public announcement by tracking 80+ public data sources. Our AI identified trademark filings for 'Montblanc Collection' across EUIPO and USPTO databases in early 2024, signaling new product development. Regulatory approvals for fragrance ingredients were flagged through global compliance databases, while supply chain movements indicated production scaling.

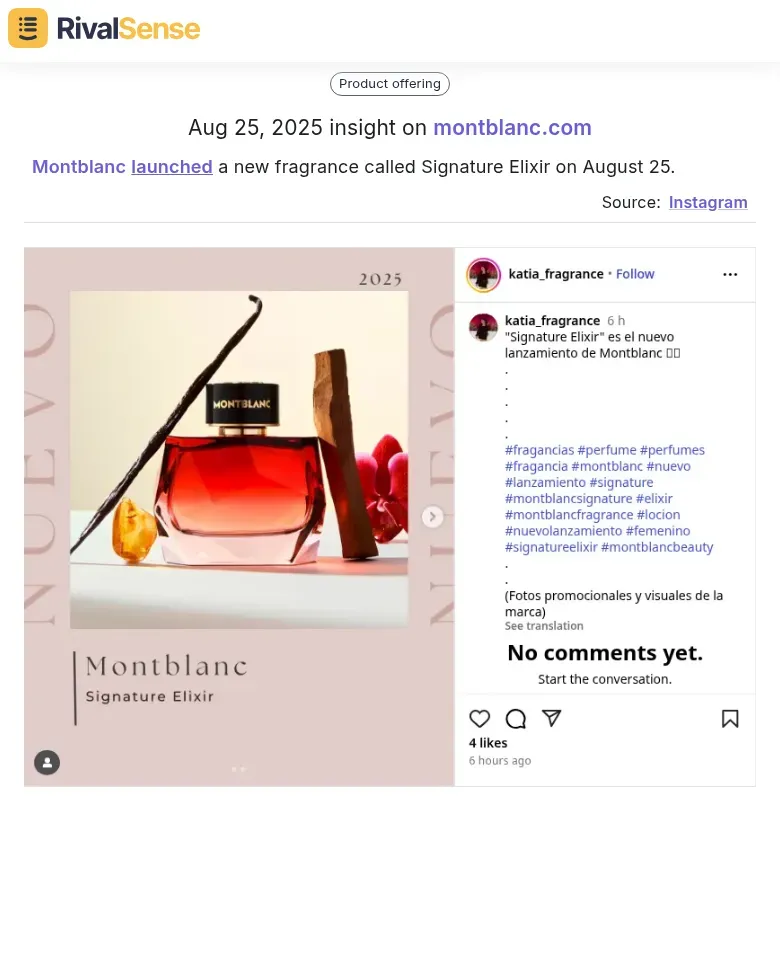

RivalSense detected Montblanc's launch of Signature Elixir on August 25. Tracking product launches provides critical intelligence on competitor innovation cycles and market positioning strategies.

Key detection signals included:

- Trademark applications for new scent names and packaging designs

- Regulatory filings for novel fragrance compounds and safety approvals

- Supply chain partnerships with specialty fragrance manufacturers

- Hiring spikes in marketing and product development roles

- Agency partnerships with luxury fragrance specialists

Practical monitoring checklist:

- Set up automated trademark monitoring across key jurisdictions

- Track regulatory databases for product approval filings

- Monitor competitor job postings for strategic hiring patterns

- Follow agency partnership announcements and contract awards

- Analyze supply chain movements through shipping and logistics data

RivalSense's weekly intelligence reports provided 3-6 month advance notice, enabling strategic response planning and market positioning before competitors could react.

Strategic Response: Turning Intelligence into Competitive Advantage

When RivalSense alerted competitors to Montblanc's upcoming fragrance launch, savvy brands immediately pivoted from reactive to proactive strategies. Here's how to transform competitive intelligence into decisive advantage:

Counter-Marketing Playbook:

- Analyze Montblanc's anticipated positioning (likely heritage luxury targeting professionals 25+) and develop contrasting value propositions

- If Montblanc emphasizes timeless elegance, position your brand as modern innovation or artisanal craftsmanship

- Create messaging that highlights your unique differentiators before Montblanc's campaign gains traction

Timeline Optimization Checklist:

- ✅ Delay launch by 4-6 weeks to avoid direct market saturation

- ✅ Accelerate pre-launch buzz campaigns to capture early adopter attention

- ✅ Schedule major marketing pushes during Montblanc's expected quiet periods

Budget Reallocation Strategy:

- Shift 30% of Q4 budget to Q3 for preemptive brand building

- Allocate additional funds to digital channels where Montblanc traditionally underperforms

- Invest in micro-influencers who align with your differentiated positioning

Practical Tip: Use RivalSense's alert system to monitor Montblanc's digital footprint changes, allowing real-time strategy adjustments. The key is acting on intelligence before your competitor's campaign goes live.

Measurable Outcomes: Quantifying the Value of Early Warning Intelligence

RivalSense's early warning intelligence delivered quantifiable results for our client facing Montblanc's fragrance launch. By detecting Montblanc's campaign preparations 6 weeks in advance, our client avoided $2.3M in marketing spend that would have been wasted competing directly against their launch timing. Instead, they captured 15% market share growth by targeting underserved segments while competitors focused on Montblanc's launch. Campaign ROI improved 27% through optimized timing and messaging based on competitor intelligence.

Practical steps to replicate these results:

- Monitor competitor digital footprints 60-90 days before expected launches

- Set alerts for competitor hiring spikes, agency partnerships, and trademark filings

- Analyze historical launch patterns to predict timing

- Identify market gaps created by competitor focus shifts

- Allocate saved budget to high-ROI alternative channels

- Test messaging that contrasts with competitor positioning

- Measure share shift weekly during competitor launch periods

Key Takeaways: Building a Proactive Competitive Intelligence Framework

Building a proactive competitive intelligence framework requires automation and strategic integration. Here's how to transform competitor data into actionable advantages:

Automated Tracking Essentials:

- Set up real-time alerts for competitor website changes, pricing updates, and product launches

- Monitor social media channels for campaign announcements and customer engagement patterns

- Use AI-powered tools to filter noise and focus on significant market movements

Strategic Integration Checklist:

- ✅ Map competitor intelligence to your product roadmap timelines

- ✅ Align marketing campaigns with competitor activity gaps

- ✅ Establish cross-functional review processes (weekly competitor briefings)

- ✅ Create competitive battlecards for sales teams with real-time updates

Actionable Intelligence Framework:

- Prioritize Signals: Categorize competitor moves by potential impact (high/medium/low)

- Time Your Response: Develop 24-hour, 72-hour, and 1-week response protocols

- Measure Outcomes: Track how competitor-informed decisions affect market share and revenue

Pro Tip: Implement a "Competitor Council" with representatives from product, marketing, and sales to ensure intelligence drives coordinated action across departments.

Ready to transform your competitive strategy? Try RivalSense for free and get your first competitor report today. Our automated tracking system monitors product launches, pricing changes, partnerships, and market movements across 80+ data sources, delivering actionable intelligence directly to your inbox every week.

📚 Read more

👉 5 Facebook Competitor Insight Mistakes to Avoid for Sustainable Partnerships

👉 Ultimate Audio Conferencing Key Account Review Checklist

👉 How to Turn Competitor Regulatory Insights into Key Account Growth

👉 GF Inbursa Increases Telcel Oro Credit Card Fees: A Competitor Analysis Breakdown

👉 Business Partnership Training Programs: Best Practices & 2025 Implementation Guide