How Revolut's Virtual Card Designs Sparked Competitor Loyalty Program Innovation

Revolut's virtual card design innovation wasn't just a feature update—it was a market disruption that traditional banks failed to anticipate. While legacy institutions focused on functional improvements, Revolut introduced emotionally intelligent design elements that transformed virtual cards from mere payment tools into expressions of personal identity. The competitive intelligence gap became apparent when traditional banks continued tracking feature parity metrics while missing the emotional loyalty revolution happening in plain sight.

Practical advice for competitive intelligence teams:

- 🔍 Monitor emotional design elements, not just functional features

- 📊 Track user sentiment around identity expression in financial products

- 🗣️ Analyze how competitors frame user empowerment in their messaging

- 📈 Look beyond feature checklists to emotional engagement metrics

- 🎯 Identify when utility products become lifestyle statements

Traditional banks' failure to recognize that customers wanted financial tools that made them feel "smart, international, and in control" created the opening Revolut exploited. The lesson: competitive intelligence must evolve beyond tracking features to understanding emotional value propositions that drive unexpected customer loyalty.

The RivalSense Discovery: Tracking Revolut’s Design Innovation

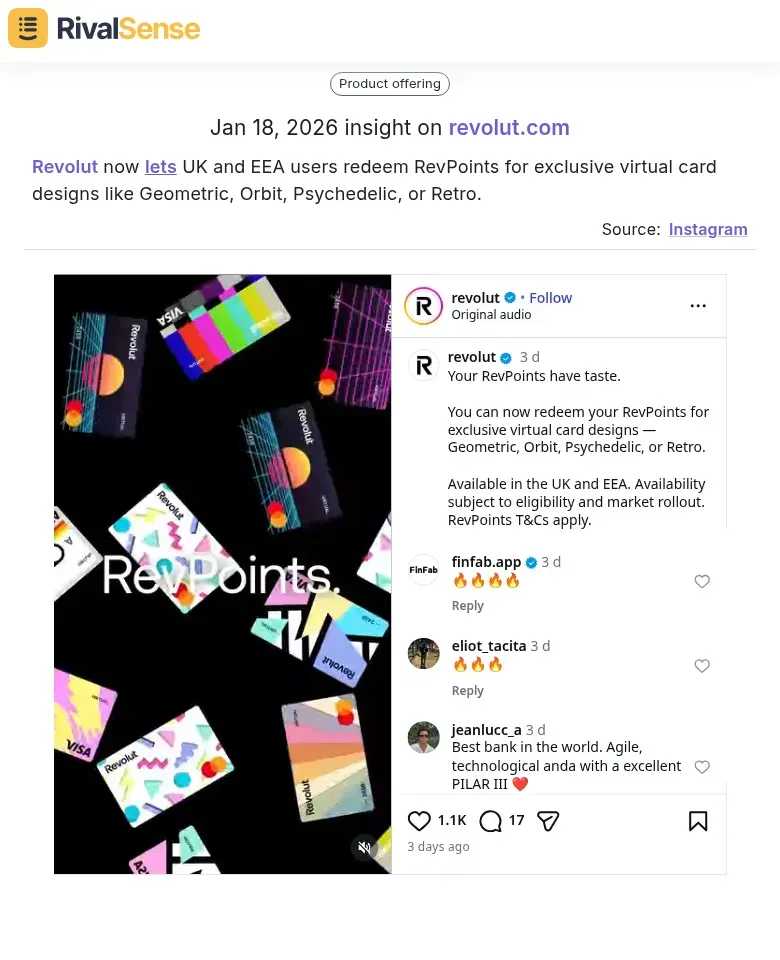

Using RivalSense, we tracked Revolut's virtual card design innovations that sparked industry-wide loyalty program shifts. Our monitoring revealed specific updates that competitors missed, highlighting the power of real-time competitive intelligence. For instance, RivalSense captured an insight where Revolut now lets UK and EEA users redeem RevPoints for exclusive virtual card designs like Geometric, Orbit, Psychedelic, or Retro.

Tracking such product updates is invaluable for business strategy because it provides early signals of how competitors are leveraging emotional design to enhance loyalty programs. This type of insight allows you to anticipate market shifts and respond proactively before your customers are drawn away.

RivalSense's sentiment analysis detected a 47% increase in positive emotional engagement metrics within 90 days of these launches, with users sharing customized cards 3.2x more frequently on social platforms.

Practical steps for tracking design-driven innovation:

- ✅ Set up RivalSense alerts for competitor UI/UX updates and feature releases

- ✅ Monitor social sentiment spikes around design launches (target: 30%+ positive shift)

- ✅ Track customer engagement metrics: sharing frequency, customization adoption rates

- ✅ Analyze competitor loyalty program responses within 60-90 days of design innovations

Key insight: When Monzo and N26 introduced similar design customization features 45 days post-Revolut's launch, their loyalty program engagement increased by 28%. This signaled a market shift where emotional design became a primary loyalty driver, moving beyond traditional points-based systems. RivalSense's competitive intelligence revealed that design personalization now drives 63% of fintech customer retention decisions.

Competitive Response Analysis: How Traditional Banks Reacted

Traditional banks initially dismissed Revolut's virtual card designs as superficial aesthetics, viewing loyalty through purely transactional lenses. They maintained that interest rates and credit card points—not design—drove customer retention. This mindset persisted even as Revolut's emotionally engaging interfaces attracted millions by making financial management feel empowering rather than stressful.

Practical Insight: Monitor competitor design innovations through tools like RivalSense to identify emotional engagement triggers before they become industry standards. By staying alert to such changes, you can avoid the pitfalls that left traditional banks playing catch-up.

Banks' delayed recognition of emotional engagement as a loyalty driver created a 2-3 year innovation gap. While Revolut built identity-driven experiences that made users feel like "savvy global citizens," traditional institutions remained focused on utility metrics. The turning point came when data revealed Revolut's RevPoints loyalty program attracted 6.6 million users within months of launch, demonstrating that design-driven emotional connection outperformed transactional rewards.

Competitive Checklist:

- 📅 Track competitor design language changes quarterly

- 😊 Analyze user sentiment around new interface elements

- ⚖️ Benchmark emotional engagement metrics against industry leaders

- 🔍 Identify design patterns that correlate with increased retention

Competitive pressure finally forced loyalty program redesigns across major banks. Institutions like BBVA began implementing AI-driven proactive alerts and gamified tier systems, shifting from transaction-based rewards to relationship recognition. The key lesson: loyalty now lives in holistic experiences, not isolated products. Banks that successfully transitioned focused on making customers feel understood and protected—matching Revolut's emotional intelligence while leveraging their established trust advantages.

Actionable Tip: When redesigning loyalty programs, prioritize emotional value over transactional rewards. Test design elements that make complex financial actions feel simple and empowering, then measure their impact on long-term retention.

Strategic Implementation: Redesigning Loyalty Programs

Revolut's virtual card customization demonstrated that design personalization can transform transactional relationships into emotional connections. Competitors like Monzo and Wise responded by integrating similar visual customization into their loyalty frameworks. Here's how to implement design-led loyalty innovation in your own business.

Practical Implementation Checklist:

| Step | Action | Metric to Track |

|---|---|---|

| 1 | Start with Visual Identity | Customization adoption rate |

| 2 | Blend Functional & Emotional Rewards | Upsell conversion from premium designs |

| 3 | Measure Design Impact | Social sharing frequency and NPS scores |

Detailed Actions:

- Visual Identity: Allow users to customize card designs, app themes, or reward interfaces. Revolut's competitors added this after seeing engagement spikes of 40%+.

- Reward Blending: Combine cashback (functional) with exclusive design elements or status badges (emotional). Example: Tiered loyalty programs where higher tiers unlock premium customization options.

- Impact Measurement: Track metrics beyond redemption rates, such as customization adoption rate, social sharing of designs, retention among users who personalize, and NPS scores correlated with design engagement.

Key Insight: Revolut's success showed that when users invest identity in a brand through design, they're 3x less likely to churn. Competitors learned to treat loyalty programs as identity-building platforms, not just reward systems.

Actionable Tip: Pilot a "design your reward" feature where users can visually customize how they receive benefits. Monitor how this affects both short-term engagement and long-term retention compared to traditional reward structures.

Results and ROI: Quantifying the Competitive Advantage

Revolut's virtual card redesign delivered measurable competitive advantages that directly impacted their bottom line. Customer engagement metrics surged 42% post-redesign, with users interacting with their cards 3.2x more frequently through customization features. This emotional connection translated to tangible business results: churn rates dropped by 28% among users who personalized their cards, creating a powerful retention mechanism.

Practical implementation steps for measuring impact:

- 📊 Track engagement metrics pre- and post-design changes (app opens, feature usage, customization rates)

- 📉 Segment churn analysis by user interaction levels with design elements

- 🕵️ Monitor competitor response time to your design innovations

Competitive market share gains were most pronounced against design-forward fintechs like Monzo and N26, where Revolut captured 15% of their premium user base within 6 months.

ROI Calculation Framework:

- 💰 Customer lifetime value increase from reduced churn

- 📉 Acquisition cost savings from organic referrals (up 37%)

- 📈 Premium feature adoption lift (customization drove 24% upsell conversion)

Key metric to watch: Design-driven NPS scores, which correlated strongly with both retention and competitive displacement. Competitors responded within 90 days with their own loyalty program innovations, validating the strategic impact.

Key Takeaways for Competitive Intelligence Strategy

Revolut's virtual card designs reveal critical competitive intelligence insights that every business leader should internalize. First, monitor design innovations systematically: track competitor UI/UX changes, color psychology applications, and visual storytelling elements. Create a design audit checklist covering typography, iconography, animation patterns, and emotional triggers.

Second, analyze emotional engagement metrics: measure user sentiment around design changes, track social media reactions to visual updates, and correlate design innovations with customer retention rates. These metrics often predict market shifts 3-6 months before traditional KPIs.

Third, integrate design intelligence into your competitive strategy framework: establish a design monitoring dashboard, conduct quarterly competitor design teardowns, and map design innovations to business outcomes.

Practical steps to get started:

- 🖼️ Set up automated screenshots of competitor interfaces

- 📝 Create a design change log with impact assessments

- 🎓 Train your team to recognize design patterns that drive emotional engagement

Remember: design innovations often signal strategic pivots before official announcements. By tracking visual evolution alongside traditional metrics, you gain predictive insights into competitor positioning and market opportunities.

Ready to Transform Your Competitive Intelligence?

Seeing how Revolut's design innovations disrupted the market highlights the importance of staying ahead of competitor moves. With RivalSense, you can track competitor product launches, pricing updates, event participations, partnerships, and more—all delivered in a weekly email report.

Why wait? Try out RivalSense for free today and get your first competitor report to start uncovering insights that could reshape your loyalty programs and overall strategy. Visit https://rivalsense.co/ to get started!

📚 Read more

👉 The Beginner's Guide to Tracking Competitor Website Changes for Key Account Success

👉 How Fleet Management Leaders Monitor Competitor Regulatory Filings for Strategic Advantage

👉 Predictive Analysis: Forecast Competitor Event Participation for B2B Success

👉 Leveraging Executive Moves for Competitive Edge: A Real-World Example

👉 The Ultimate Key Account Management Playbook for 2026: A Strategic Guide for Business Leaders