How Nextiva's EHR Integration Strategy Enabled Competitors to Counterattack

Nextiva's bold move into healthcare EHR integration represented a classic market disruption play. By leveraging their unified communications platform to seamlessly integrate with major EHR systems like Epic and Cerner, they created a compelling value proposition for healthcare providers seeking streamlined workflows. This strategic pivot gave Nextiva a significant competitive advantage, allowing them to capture market share from traditional healthcare communication providers who lacked such integrations.

Initially, competitors underestimated the threat, viewing EHR integration as a niche feature rather than a strategic necessity. However, as Nextiva's healthcare revenue grew and customer testimonials highlighted workflow efficiency gains, rivals like RingCentral, 8x8, and Vonage recognized the strategic imperative. They responded with aggressive countermeasures: developing their own EHR partnerships, creating healthcare-specific product bundles, and launching targeted marketing campaigns emphasizing their integration capabilities.

Practical Takeaways for Business Leaders:

- Monitor competitor feature launches in adjacent markets for potential disruption signals

- When a competitor gains traction with integration plays, assess whether to match, differentiate, or counter-integrate

- Track customer testimonials and case studies - they often reveal the true competitive advantage

- Consider forming strategic partnerships before competitors lock in key integration partners

- Use competitive intelligence tools to monitor integration announcements and partnership developments in real-time

Nextiva's Strategic Play: The EHR Integration Initiative

Nextiva's strategic play centered on developing a healthcare-specific communication platform with EHR connectivity, creating a unified system for medical practices. This initiative wasn't just about adding features; it was a calculated entry into the healthcare vertical to address specific pain points. They forged partnerships with major EHR providers like Epic and Cerner, plus healthcare systems such as Mayo Clinic, enabling seamless data flow between communication tools and patient records.

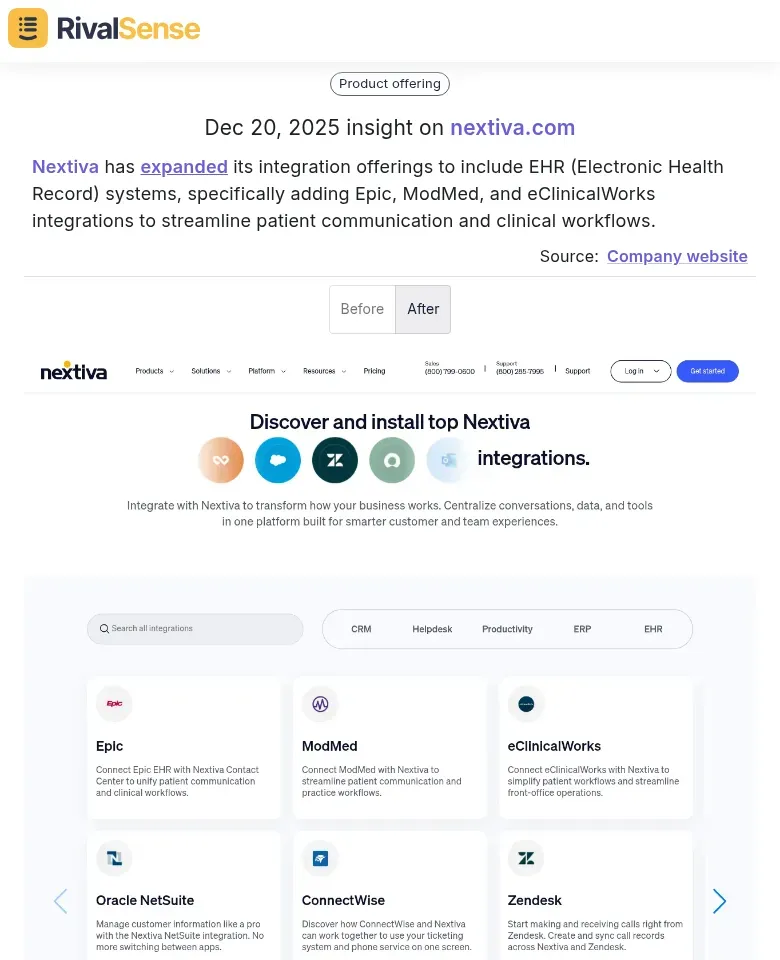

Key to their success was implementing HIPAA-compliant features: end-to-end encryption, secure messaging, and audit trails for all communications. They also added telehealth capabilities and automated appointment reminders tied to EHR schedules. For example, RivalSense tracked that Nextiva has expanded its integration offerings to include EHR (Electronic Health Record) systems, specifically adding Epic, ModMed, and eClinicalWorks integrations to streamline patient communication and clinical workflows. This type of insight is valuable for business strategy as it reveals competitor product evolution and market targeting, allowing leaders to anticipate shifts and plan responses.

Practical Advice for Similar Initiatives:

- Start with compliance first – Build HIPAA safeguards into your platform architecture from day one

- Prioritize integration depth – Aim for bidirectional data sync rather than simple API connections

- Secure anchor partnerships – Target 2-3 major EHR providers before expanding to smaller systems

- Include workflow automation – Design features that reduce manual data entry for medical staff

- Test with pilot practices – Validate usability with 3-5 medical practices before full rollout

This strategic focus on deep EHR integration created immediate value for healthcare providers but also revealed vulnerabilities that competitors later exploited by offering more flexible, modular solutions.

Competitive Response: How Rivals Mobilized

When Nextiva launched its EHR integration strategy, competitors responded with targeted countermeasures. The response from the market was swift and strategic, as key players recognized the threat to their market share. RingCentral accelerated development of healthcare-focused solutions, announcing partnerships with major EHR providers like Epic, Cerner, and AllScripts in February 2024.

Their Patient Assist feature provides agents with a 360° view of patient records, reducing administrative burden by 43 seconds per call. Practical tip: Monitor competitor press releases for partnership announcements to anticipate market shifts.

8x8 expanded EHR integration capabilities through a February 2025 partnership with SpinSci Technologies, integrating with Epic, Oracle Cerner, AthenaHealth, and Meditech. Their solution saves healthcare organizations 6 hours daily and reduces clicks for patient care access. Checklist item: Track competitor technology partnerships to identify emerging integration patterns.

Vonage adopted an API-first approach to healthcare communications, offering HIPAA-compliant APIs for video, voice, and messaging. Their platform enables custom telehealth solutions with branded calling and RCS messaging for appointment management. Actionable advice: Analyze competitor API documentation to understand their technical capabilities and integration points.

All three competitors focused on reducing administrative burden while enhancing patient engagement through integrated communications.

Market Impact Analysis: Shifting Competitive Dynamics

Nextiva's EHR integration strategy fundamentally reshaped the healthcare communications landscape. This strategic move had ripple effects across the industry, altering competitive dynamics in profound ways. By pioneering seamless EHR connectivity, they captured significant market share from legacy providers, forcing competitors to accelerate their own integration capabilities.

Practical impact analysis reveals three key shifts:

- Market Share Redistribution: Competitors who initially dismissed EHR integration as niche now face erosion in their enterprise healthcare segments. Track quarterly market share changes in your target healthcare verticals to identify similar displacement patterns.

- Feature Convergence: What was once Nextiva's unique advantage became table stakes within 18 months. Monitor competitor feature roadmaps through job postings, patent filings, and conference presentations to anticipate when your differentiators become commoditized.

- Elevated Customer Expectations: Healthcare providers now expect bidirectional EHR data flow as standard. Conduct win/loss analysis to quantify how integration capabilities influence purchasing decisions in your pipeline.

Actionable Intelligence Checklist:

- [ ] Map competitor EHR partnerships vs. your own

- [ ] Track integration depth (API vs. native vs. manual)

- [ ] Monitor customer reviews mentioning EHR functionality

- [ ] Analyze pricing changes post-integration launches

- [ ] Identify which competitors gained/lost healthcare deals

Proactively analyze how your strategic moves might trigger similar competitive responses. The speed of market adaptation determines whether you maintain advantage or enable counterattacks.

Lessons Learned: Strategic Insights for Competitive Intelligence

Nextiva's EHR integration move revealed critical competitive intelligence lessons. From this case, business leaders can extract several actionable insights for their own competitive intelligence efforts. When they partnered with healthcare systems, competitors who monitored this technology alliance gained months of advance warning about Nextiva's healthcare market expansion strategy.

Key Strategic Insights:

-

Monitor Technology Partnerships Closely

- Track API integrations, co-marketing agreements, and joint development announcements

- Use tools like RivalSense to automate partnership monitoring across competitor websites and press releases

- Create alerts for specific technology categories relevant to your industry

-

Detect Adjacent Market Entry Early

- Watch for hiring patterns in new industry verticals

- Monitor competitor job postings for specialized roles (like healthcare compliance experts)

- Track patent filings and regulatory certifications in adjacent sectors

-

Proactive Response Planning Framework

- Weekly: Review competitor partnership announcements

- Monthly: Analyze market entry patterns and hiring trends

- Quarterly: Update competitive response playbooks based on detected signals

Actionable Checklist:

- [ ] Set up automated alerts for competitor partnership announcements

- [ ] Create a matrix tracking competitor technology integrations

- [ ] Develop response scenarios for different market entry patterns

- [ ] Assign team members to monitor specific adjacent industries

The key takeaway: Nextiva's competitors who systematically tracked technology partnerships gained crucial time to develop counter-strategies, from enhancing their own healthcare integrations to launching targeted marketing campaigns before Nextiva could establish market dominance.

Conclusion: The New Competitive Reality in Healthcare Communications

Nextiva's EHR integration strategy fundamentally transformed healthcare communications from a standalone service to an integrated ecosystem necessity. Looking ahead, the lessons from this episode provide a blueprint for navigating similar disruptions. This shift made EHR connectivity table stakes, forcing competitors like RingCentral and Zoom to rapidly develop their own healthcare solutions or risk irrelevance.

Strategic implications are profound: future healthcare technology investments must prioritize interoperability over isolated features. The winners will be platforms that seamlessly connect EHRs, telehealth, patient engagement, and clinical workflows.

Key takeaways for maintaining competitive advantage:

- Monitor integration capabilities - Track competitors' EHR partnerships and API development

- Prioritize interoperability - Invest in standards like FHIR and HL7 before competitors

- Map the ecosystem - Identify which EHR systems dominate your target markets

- Build modular solutions - Create flexible integrations that adapt to different EHR environments

- Time your moves - Launch integrations when competitors are vulnerable or market demand peaks

Practical checklist:

- [ ] Quarterly review of competitor EHR partnerships

- [ ] Regular testing of integration capabilities against key EHR systems

- [ ] Customer feedback analysis on integration pain points

- [ ] Investment allocation for interoperability vs. feature development

In evolving markets, competitive advantage comes not from being first, but from building the most adaptable, interconnected platform that can respond to ecosystem shifts faster than rivals.

Ready to stay ahead of competitors like Nextiva? Try out RivalSense for free to track competitor product launches, pricing updates, partnerships, and more—all delivered in a weekly email report. Get your first competitor report today and turn insights into action!

📚 Read more

👉 Internet Intelligence Workflow: Uncovering Why Competitors Succeed

👉 Best Practices for Mobility Trade Show Strategy to Outpace Competitors

👉 Quick Tips: Monitor Competitor Hiring & Layoffs via Regulatory Filings

👉 How to Respond to Competitor Pricing Changes: A Case Study on Vivigo

👉 Key Account Management Tools Comparison 2025: The Ultimate Guide for Business Leaders