How IT.integro's Strategic Shift Ignited ERP Innovation: Lessons for Business Leaders

Before IT.integro's strategic pivot, the ERP market was characterized by rigid solutions dominated by giants like SAP and Oracle. Mid-tier providers struggled with customization and cloud adaptation, creating innovation gaps across the sector. Businesses faced challenges balancing functionality with affordability while navigating complex implementation processes.

For decision-makers evaluating ERP options during this period, three critical considerations emerged:

✅ Scalability needs: Could the system grow with your business?

✅ Integration capabilities: How well did it connect with existing tools?

✅ Total cost of ownership: Beyond licensing, what were implementation and training expenses?

This stagnant landscape set the stage for IT.integro's transformative approach, proving that market leaders could disrupt established norms through strategic innovation.

IT.integro's Strategic Shift: A Catalyst for Change ⚡

IT.integro's pivot toward cloud-based, AI-driven ERP solutions fundamentally reshaped industry expectations. Their focus on real-time analytics and seamless third-party integrations forced competitors to accelerate their own innovation timelines. Within months, traditional providers began overhauling legacy systems while startups rushed to fill newly created niches.

Practical Advice for Business Leaders:

- 🔍 Audit capability gaps - Identify where legacy systems hinder growth or efficiency

- 📊 Benchmark against innovators - Use competitive intelligence tools to track market leaders

- 🧪 Pilot emerging technologies - Test AI/cloud features in controlled environments before scaling

- 🤝 Secure cross-department buy-in - Demonstrate ROI through department-specific benefit cases

- 🏃 Maintain strategic agility - Build processes that allow quick adaptation to market shifts

Competitor Responses: Innovation and Adaptation 🔄

The ripple effects of IT.integro's strategy manifested in rapid feature upgrades across the ERP ecosystem. SAP embedded AI-driven analytics in S/4HANA, while Oracle integrated machine learning into Fusion Cloud ERP. These weren't cosmetic changes but fundamental rearchitecting of core functionalities to meet new market expectations.

Key innovation areas emerged:

| Focus Area | Examples | Business Impact |

|---|---|---|

| AI & Automation | Predictive forecasting, automated data entry | 30-40% operational efficiency gains |

| Cloud Integration | Flexible SaaS deployments | Reduced IT overhead, faster scaling |

| UX Modernization | Mobile interfaces, simplified workflows | Shorter training cycles, higher adoption |

Implementation Checklist:

- [ ] Conduct quarterly competitor feature analysis

- [ ] Run controlled pilots of new technologies

- [ ] Develop upskilling programs for emerging capabilities

- [ ] Establish trend-monitoring mechanisms

The Role of RivalSense in Tracking Competitor Moves 🔍

Timely competitive intelligence became crucial for businesses navigating post-shift market dynamics. Tracking granular changes—like feature updates and positioning shifts—allowed companies to anticipate market movements rather than react to them. These insights inform strategic planning from product development to marketing messaging.

Consider this real example detected by RivalSense:

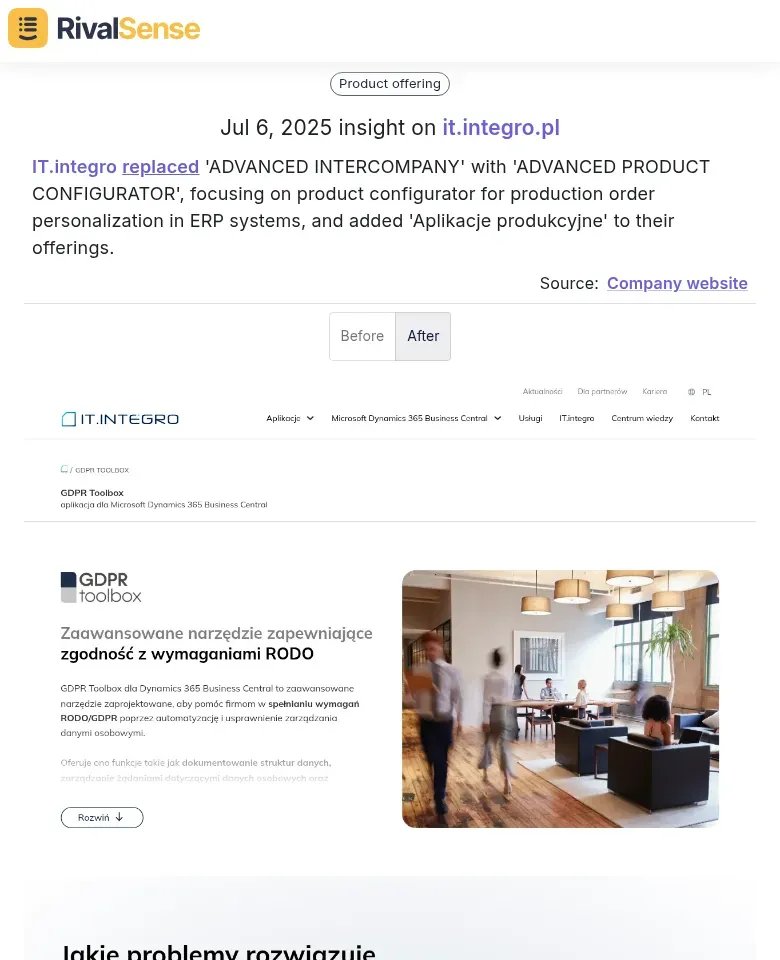

Image: IT.integro's strategic product update tracked by RivalSense

RivalSense identified that IT.integro replaced 'ADVANCED INTERCOMPANY' with 'ADVANCED PRODUCT CONFIGURATOR' while adding 'Aplikacje produkcyjne' to their offerings. This insight reveals their strategic pivot toward production personalization—intelligence competitors used to adjust their own roadmaps. Tracking such product updates is invaluable because it signals strategic priorities before official announcements, allowing for proactive response planning.

Competitive Tracking Framework:

flowchart LR

A[Monitor Feature Changes] --> B[Analyze Strategic Patterns]

B --> C[Adjust Product Roadmap]

C --> D[Align Marketing Messaging]

Outcomes and Lessons Learned 📈

IT.integro's transformation yielded measurable results: expanded market share, increased deal sizes, and stronger brand positioning as an innovator. Competitors who rapidly responded gained similar advantages, while slower movers faced erosion of their customer base. This underscores that in dynamic markets, observation must directly fuel action.

Strategic Implementation Steps:

- 🎯 Embed competitive monitoring - Make it part of weekly leadership reviews

- 🔁 Establish feedback loops - Connect customer insights to development priorities

- 💡 Allocate innovation budgets - Dedicate resources specifically for disruptive tech

- 🚀 Build agile implementation - Create cross-functional rapid-response teams

Conclusion: The Future of Competitive Intelligence in ERP 🚀

The ERP market's evolution demonstrates that sustainable advantage comes from converting competitor insights into strategic action. As AI, IoT integration, and hyper-personalization become table stakes, continuous intelligence gathering grows more critical. The most successful businesses will institutionalize competitor monitoring as a core operational function rather than a periodic exercise.

Ready to transform competitive insights into strategic advantage?

Try RivalSense free and receive your first competitor intelligence report today. Track product launches, pricing changes, and strategic pivots across your market—all delivered in actionable weekly briefings.

📚 Read more

👉 Unlock Competitor Secrets: How Twitter Intelligence Drives B2B Strategy

👉 Real-World B2B Competitive Benchmarking in Roofing Software

👉 Solve Product Gaps with Practical Competitor Insights

👉 Decoding Crowdin's AI Translation Shift: Strategic Implications

👉 How to Conduct Competitor Analysis for B2B Companies: A Step-by-Step Guide