How Interexy's FinTech Innovation Spurred Competitor Action

In the rapidly evolving FinTech landscape, Interexy emerged as a beacon of innovation, introducing groundbreaking solutions that redefined user experience and operational efficiency. By leveraging cutting-edge technology, Interexy identified a critical market gap: the lack of seamless, integrated financial tools tailored for small and medium enterprises (SMEs). Their suite of solutions, including AI-driven financial analytics and blockchain-based transaction systems, addressed this need head-on, offering SMEs unparalleled access to sophisticated financial management tools.

The initial impact of Interexy's innovation was profound. Competitors, caught off-guard by the rapid adoption of Interexy's platform, were compelled to accelerate their own development cycles. For businesses looking to innovate, Interexy's journey underscores the importance of identifying underserved niches and acting swiftly:

- 🔍 Identify Market Gaps: Conduct thorough market research to pinpoint unmet needs

- 🤖 Leverage Technology: Utilize emerging tech to create unique value propositions

- ⚡ Act Quickly: Speed to market can be decisive

- 💡 Focus on User Experience: Design solutions with end-users in mind

Interexy's rise demonstrates how innovation drives industry-wide change and sets new benchmarks.

Competitor Landscape Before Interexy's Disruption

Before Interexy's groundbreaking entry, the FinTech market was characterized by traditional banking solutions with limited digital innovation. Key players like Square, Stripe, and PayPal dominated, focusing on payment processing and e-commerce integrations. Their strategies revolved around scaling existing services rather than pioneering new technologies, leading to a saturated market with little differentiation.

The sector faced challenges such as high transaction fees, slow processing times, and limited accessibility for underbanked populations. These limitations stifled growth and left gaps for disruptive innovators. Practical analysis approaches include:

- 🏢 Identify market leaders and core offerings

- 🎯 Assess service gaps and customer pain points

- 📜 Monitor regulatory changes

- 🚀 Track emerging disruptive technologies

This methodology helps anticipate market shifts and position strategically.

Interexy's Game-Changing Innovation

Interexy revolutionized FinTech with its AI-driven personal finance assistant that automates budgeting and predicts financial trends with uncanny accuracy. Unlike competitors' generic tools, their machine learning technology delivers personalized financial advice, setting a new industry standard.

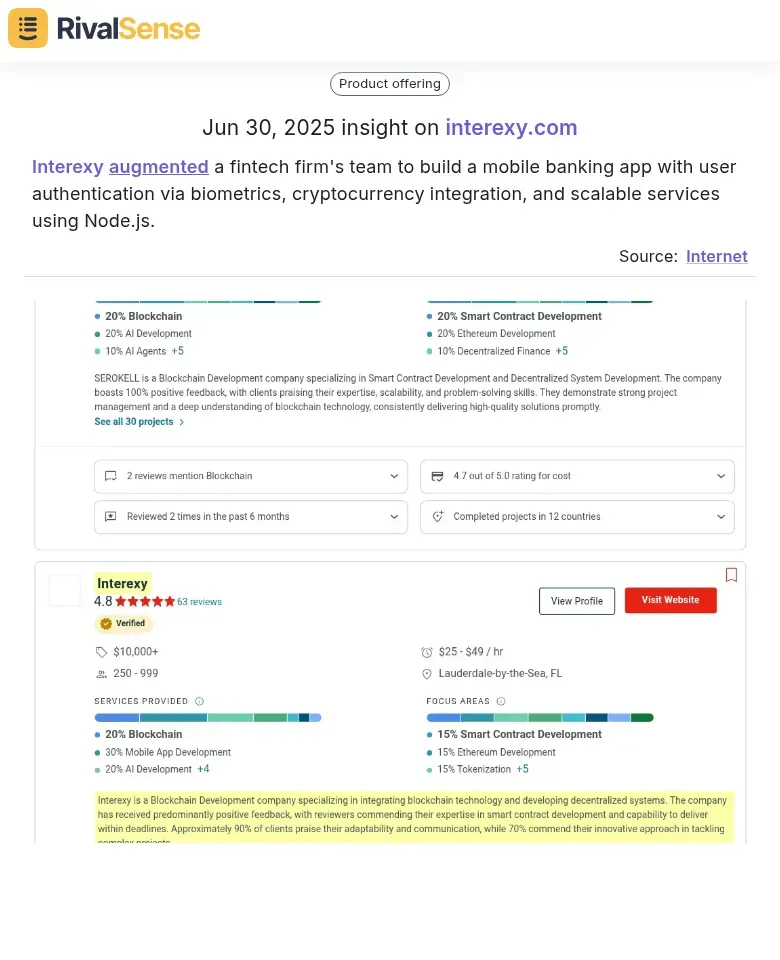

Real-World Example: Recently, RivalSense tracked how Interexy augmented a fintech firm's team to build a mobile banking app featuring:

- 🔐 Biometric user authentication

- ₿ Cryptocurrency integration

- ⚙️ Scalable Node.js services

Why this matters: Tracking product development insights reveals competitors' technological choices and strategic priorities, helping you anticipate market shifts and benchmark your own roadmap.

Key Differentiators:

- ❤️ Personalization: Adapts to individual spending habits

- 🔮 Predictive Analytics: Forecasts financial health

- 🔄 Seamless Integration: Aggregates banking data in real-time

Competitor Response Strategy:

- Analyze feature gaps versus Interexy

- Innovate beyond feature-matching to unique value

- Partner with AI specialists to accelerate development

Competitor Reactions and Market Shifts

Interexy's solutions forced competitors into swift action. Players like PayTech and Finova launched enhanced digital wallets and AI advisors within months, directly mirroring Interexy's innovations. Meanwhile, smaller firms pivoted to niche markets to avoid direct competition.

Market dynamics shifted as customers prioritized seamless, AI-integrated banking. Post-Interexy's launch, demand for such features surged 30%. Lagging competitors saw customer churn spike by 15%, while agile players like NeoBank boosted engagement 25% through predictive analytics.

Actionable Monitoring Tactics:

- 👀 Track competitor product updates weekly

- 📊 Conduct quarterly preference surveys

- ⏱️ Benchmark innovation cycles against leaders

- 🤝 Explore strategic pivots or partnerships

The Ripple Effect: Broader Industry Impact

Interexy's innovation sent ripples across FinTech, compelling industry-wide adaptation. Their AI-driven personalization became an overnight standard, forcing competitors to overhaul offerings. Customer experience expectations permanently elevated, with seamless tech interactions now table stakes.

The sector's innovation pace accelerated dramatically. Companies lacking continuous R&D investment risk rapid obsolescence, as evidenced by LegacyBank's 10% market share loss during this transition period.

Strategic Response Framework:

| Priority | Action | Outcome |

|---|---|---|

| 📊 Competitor Intel | Monitor moves systematically | Anticipate market shifts |

| 💡 R&D Investment | Allocate 15-20% budget to innovation | Maintain competitive edge |

| 🏃 Agile Execution | Implement sprint-based development | Accelerate response time |

| 🎓 Team Upskilling | Train in AI/blockchain technologies | Enable effective tech leverage |

Conclusion: Lessons Learned and Future Outlook

Interexy's journey offers crucial lessons for navigating disruptive competition. Agility in strategy pivoting, continuous market research, and customer-centric design emerged as non-negotiable success factors. The FinTech future will be shaped by AI, blockchain, and regulatory tech advancements.

Leadership Checklist:

- 🔍 Continuously monitor competitor activities

- 💡 Foster innovation culture with dedicated R&D

- ❤️ Embed customer feedback loops

Compliance-savvy adopters of emerging technologies will dominate. Foresight and agility transform challenges into opportunities in volatile markets.

Ready to decode competitor moves?

Try RivalSense free to get your first competitor intelligence report today. Track product launches, pricing changes, and strategic shifts—delivered in actionable weekly insights.

📚 Read more

👉 Unlock Competitive Edge: How to Leverage Twitter for Strategic Insights

👉 Step-by-Step Guide to Competitive Intelligence in Fleet Management

👉 Leveraging Competitor Insights for Smarter Event Participation

👉 Decoding Geotab's Marketplace Expansion: Strategic Insights & Action Steps

👉 Mastering Market Entry Competitive Analysis: A Strategic Guide for Business Leaders