How Emirates' Fleet Upgrade Revealed Competitors' Strategic Moves

Emirates has long dominated the Middle East aviation market, leveraging its hub in Dubai to connect global travelers. In this highly competitive sector, even minor changes in fleet composition can have major implications for market dynamics. Its recent fleet upgrade—investing billions in next-generation aircraft like the Boeing 777X and Airbus A350—underscores a strategic push to maintain this edge through superior fuel efficiency, passenger comfort, and operational range. Such moves are critical in a region where rivals like Qatar Airways and Etihad Airways fiercely compete for market share. Fleet modernization isn't just about newer planes; it's a calculated effort to reduce costs, enhance service, and signal strength to competitors. For instance, Emirates' shift hints at preempting Qatar's expansion into African routes, a subtle clue picked up by competitor tracking tools like RivalSense. These platforms monitor fleet changes, route announcements, and financial disclosures, offering early warnings of strategic pivots.

Practical tip: Use RivalSense to set alerts for competitor fleet orders or retirements—this can reveal expansion plans months before public launches.

Checklist: Regularly track key metrics like aircraft age, new route filings, and capacity changes to anticipate competitive threats. By acting on these insights, businesses can adjust their strategies proactively, much like Emirates did to counter rival moves in the Gulf's volatile skies.

Emirates' Fleet Upgrade Strategy: The $5 Billion Retrofit Initiative

Emirates' $5 billion fleet retrofit initiative represents a strategic masterclass in competitive positioning. This initiative is not just about aesthetics; it's a deep-rooted strategy to stay ahead in the premium travel market. The airline is upgrading 120 aircraft—including 67 Boeing 777s and 53 Airbus A380s—with premium economy cabins and enhanced business class suites. This massive investment directly targets revenue optimization: premium economy typically generates 30-40% higher margins than economy, while upgraded business class justifies premium pricing.

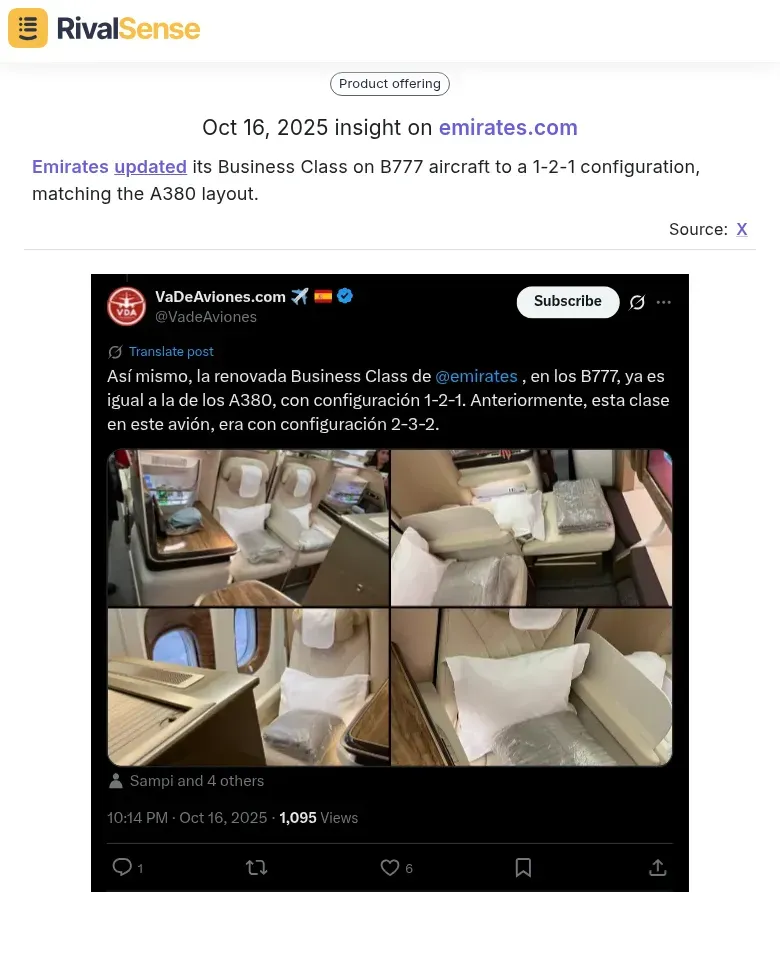

For example, RivalSense recently tracked that Emirates updated its Business Class on B777 aircraft to a 1-2-1 configuration, matching the A380 layout.  This type of insight is valuable for business strategy because it reveals how competitors are standardizing premium offerings across fleets, signaling efforts to enhance customer loyalty and compete on service quality—key factors in maintaining market leadership.

This type of insight is valuable for business strategy because it reveals how competitors are standardizing premium offerings across fleets, signaling efforts to enhance customer loyalty and compete on service quality—key factors in maintaining market leadership.

Practical Competitive Intelligence Steps:

- Track Fleet Investments: Monitor competitor CAPEX announcements and aircraft modification programs

- Analyze Cabin Configurations: Study seat density changes and premium cabin expansions

- Calculate Revenue Impact: Model how premium seating affects per-flight profitability

- Assess Hub Strategy Alignment: Evaluate how fleet changes support route network optimization

For Emirates, these retrofits perfectly complement their Dubai hub-and-spoke model. The A380 upgrades maintain capacity on high-demand routes while premium cabins increase yield. The 777 modifications allow for more flexible deployment across their global network.

Key Takeaway: When competitors make significant fleet investments, analyze not just the cost but the strategic revenue implications and how it strengthens their operational model.

Competitor Response Analysis: Qatar Airways' Strategic Counter-Move

When Emirates announced its massive fleet upgrade strategy in late 2024, pushing Airbus and Boeing for larger A350 and 777X variants to replace its A380s, competitor intelligence revealed Qatar Airways' strategic counter-move. Competitive intelligence tools can capture these responses in real-time, providing early warnings of market shifts. Just months after Emirates' announcement, Qatar unveiled its 'Qsuite Next Gen' business-class product at the Farnborough International Airshow in July 2024, specifically designed for its Boeing 777-9 aircraft set to debut by 2025.

This timing wasn't coincidental. While Emirates focused on fleet scale and capacity, Qatar chose product differentiation—enhancing its award-winning Qsuite with taller privacy dividers, wider lie-flat double beds, wireless charging, and companion suites that convert window seats into shared spaces. The response demonstrated Qatar's strategy: compete on premium experience rather than aircraft quantity.

Practical Intelligence Tips:

- 🕵️ Monitor competitor announcements at major industry events like airshows

- ⏱️ Analyze timing gaps between your moves and competitor responses

- 🔍 Track whether competitors focus on product innovation vs. operational scale

- 📈 Use competitor intelligence to anticipate strategic shifts before they're publicly deployed

Etihad Airways' Strategic Pivot: Narrowbody Luxury Innovation

While Emirates doubles down on its widebody-only strategy, Etihad Airways is pioneering a different competitive approach with its Airbus A321LR narrowbody aircraft featuring first and business class cabins. This approach highlights how competitors can find niches by innovating in overlooked areas, offering valuable lessons for business leaders. This strategic pivot represents a fundamental shift toward premium service on short-to-mid-haul routes where Emirates' large-fleet approach is less practical.

Etihad's A321LR introduces two private First Suites with sliding doors and 20-inch 4K screens, plus 14 lie-flat business pods in a 1-1 configuration - amenities typically reserved for widebody aircraft. This allows Etihad to serve premium markets like the Seychelles, Chiang Mai, and Algiers that lack demand for Emirates' larger jets, while also increasing frequency on business routes like Paris without overcapacity.

Practical Competitive Intelligence Tips:

- 📊 Monitor fleet diversification strategies to identify underserved market segments

- 💡 Track premium service innovations on smaller platforms as market differentiators

- 🗺️ Analyze route deployment patterns to understand capacity optimization strategies

- 🔄 Watch for technology transfer between product categories (widebody to narrowbody)

This narrowbody luxury innovation demonstrates how competitors can carve out strategic niches by rethinking traditional fleet deployment models.

Market Impact and Strategic Implications

Emirates' $5 billion fleet upgrade, including A350s and retrofitted 777s with premium economy, directly challenges competitors like Qatar Airways and Turkish Airlines in the premium passenger segment. The ripple effects of such moves can reshape entire market segments, making proactive monitoring essential. This strategic move has enabled Emirates to capture high-margin travelers, contributing to its record $6.2 billion profit in 2024-25 while competitors face delivery delays.

Geographic positioning plays a crucial role - Emirates leverages Dubai's hub status and continued Russian airspace access (unlike many Western carriers) to maintain profitable routes to Moscow, giving it a competitive edge in connecting Europe-Asia traffic. Turkish Airlines benefits similarly from Istanbul's strategic location.

Long-term implications include:

- ✅ Emirates strengthening its position as the world's most profitable airline

- ⚡ Competitors needing to accelerate fleet modernization to match premium offerings

- 🌍 Market share consolidation among carriers with strategic geographic advantages

Practical steps for business leaders:

- Monitor competitor fleet investments and delivery timelines

- Analyze geographic advantages and airspace access in route planning

- Track premium cabin capacity changes across key competitors

- Assess how competitor upgrades impact your market positioning

- Develop contingency plans for supply chain disruptions affecting fleet strategies

Conclusion: Lessons in Competitive Intelligence and Strategic Response

Emirates' fleet upgrade story demonstrates why real-time competitor tracking is essential for strategic decision-making. By learning from these examples, businesses can better prepare for competitive shifts and turn insights into actionable strategies. By monitoring competitor fleet strategies, business leaders can anticipate market shifts before they happen. RivalSense could have provided early insights into fleet modernization trends, revealing competitor moves months in advance.

Key takeaways:

- Implement continuous monitoring of competitor announcements and industry developments

- Use competitive intelligence tools to track strategic patterns

- Develop response protocols for different competitor scenarios

Practical steps: Create a competitor dashboard tracking key metrics, set up alerts for strategic announcements, conduct regular competitive analysis reviews. The lesson is clear: proactive intelligence gathering transforms reactive responses into strategic advantages, turning competitor moves into opportunities for market leadership.

To stay ahead of your competitors, try out RivalSense for free at https://rivalsense.co/ and get your first competitor report today! This tool tracks product launches, pricing updates, and more, delivering weekly insights to help you make informed decisions.

📚 Read more

👉 Optimize Competitor Insights from Instagram Thought Leadership

👉 AI vs. Traditional Key Account Management: Comparative Analysis

👉 Predict Hiring Trends: Track Key Account Employee Changes

👉 How to Leverage Competitor Insights: Analyzing Dust's Frames Launch

👉 Free Competitor Analysis Tools: The Ultimate Guide to Staying Ahead in 2025