How Competitor Hiring & Layoffs Reveal Financial Strategies

In today's dynamic business environment, competitor staffing changes serve as a transparent window into their financial priorities and strategic direction. Hiring surges or layoffs provide actionable intelligence about market pivots, innovation investments, or cost optimization efforts. Executive movements particularly act as early-warning systems for major strategic shifts, letting you anticipate market disruptions before they become public knowledge.

Practical steps to leverage this intelligence include:

- 🔍 Regularly monitor job postings and layoff announcements

- ⏰ Set automated alerts for executive departures/new hires

- 📊 Analyze affected departments to infer strategic priorities

- 💡 Cross-reference trends with financial performance data

Integrating these practices helps you stay ahead of competitors' moves and make informed strategic decisions.

Executive Movements: Decoding the Signals

Executive transitions often reveal unspoken truths about a company's health and trajectory. High-profile departures may indicate internal challenges, while strategic hires signal new market ambitions or technological pivots. Understanding these patterns allows you to anticipate competitive threats months in advance.

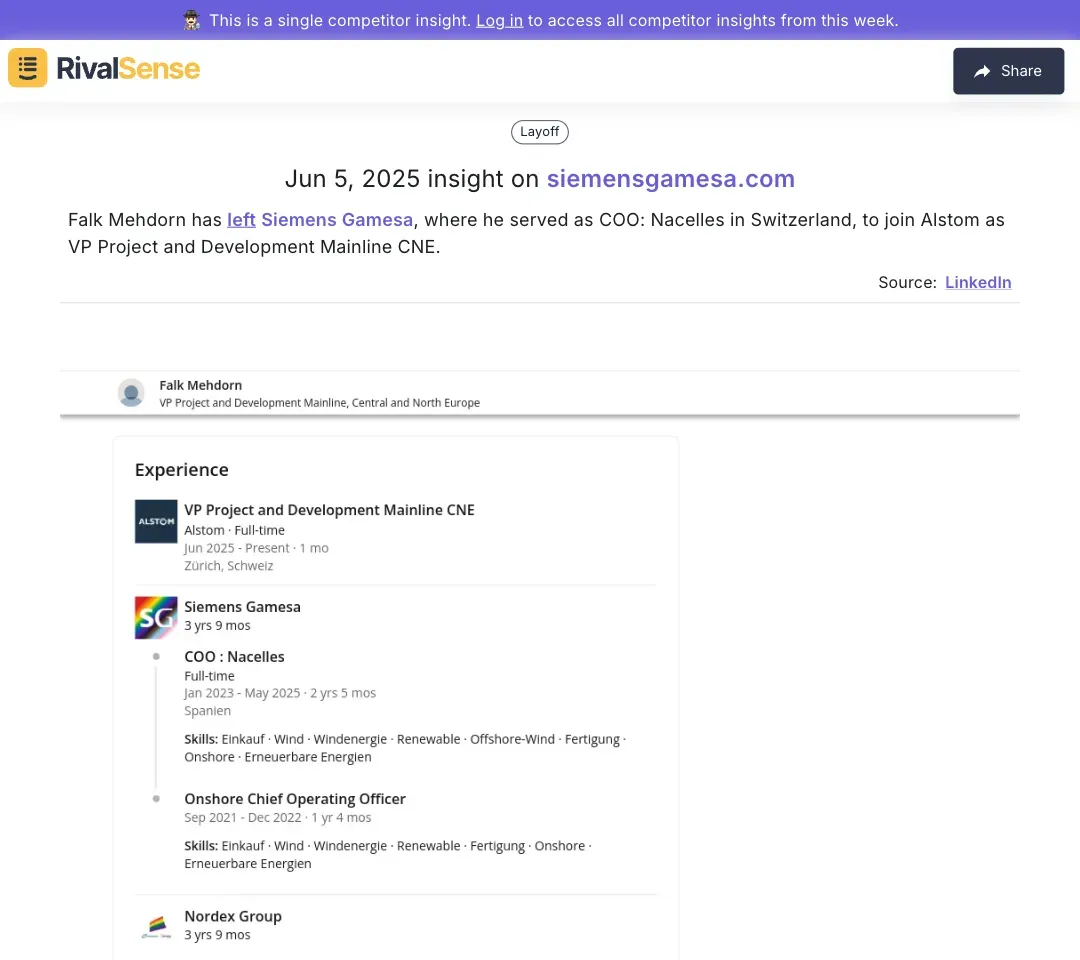

For example, tracking executive career moves like this provides critical context:

Falk Mehdorn left Siemens Gamesa as COO to join Alstom as VP Project and Development – signaling potential strategic shifts at both companies.

Why this matters: Such insights reveal talent redistribution patterns and emerging competitive alliances in your industry.

Actionable decoding framework:

- Monitor announcements: Track LinkedIn and press releases for C-suite changes

- Assess role significance: Does the new position align with emerging technologies?

- Map timelines: Correlate with product launches or market entries

- Network strategically: Leverage industry connections for context

Regional Leadership Changes and Market Strategy

Geographic leadership appointments are reliable indicators of global expansion or contraction strategies. New regional executives often precede market entries, while consolidated roles may signal retreat. These changes directly impact competitive positioning in local markets.

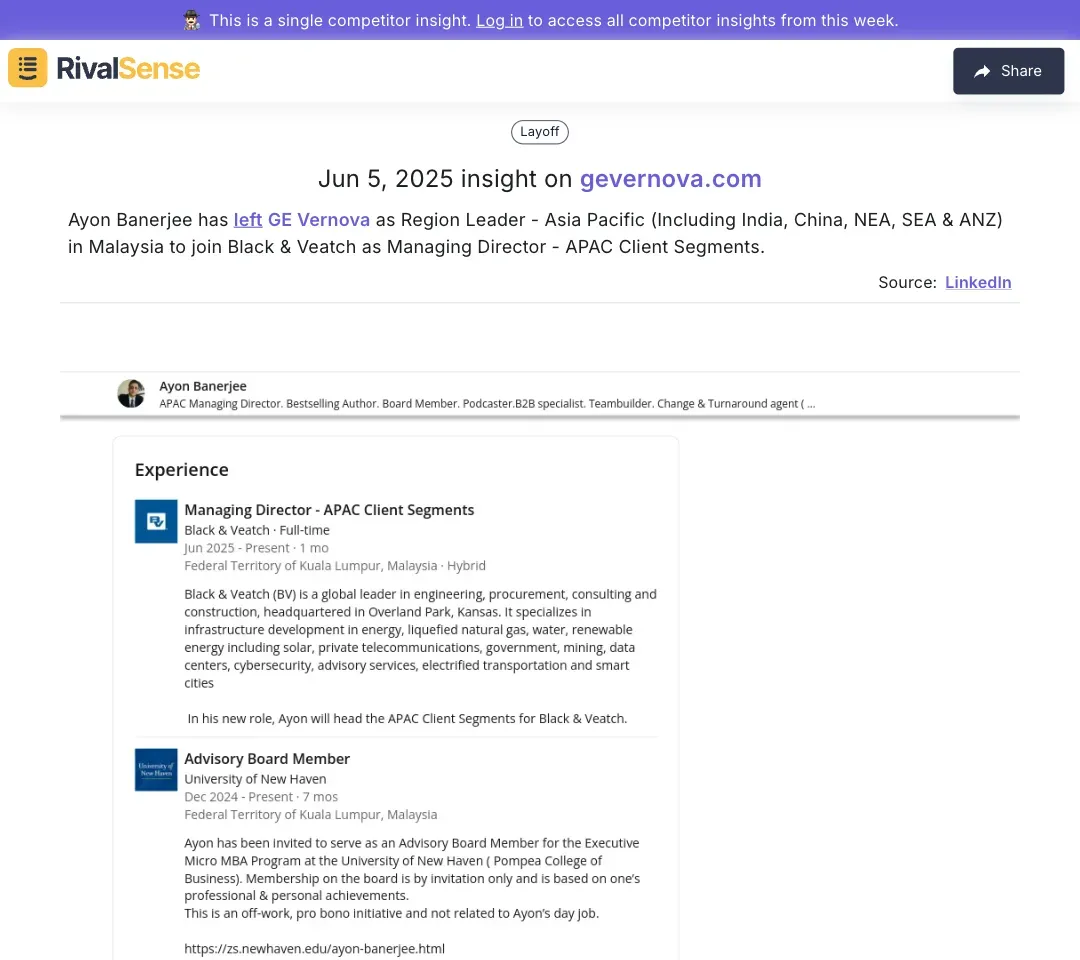

Consider how this regional leadership shift reflects strategic intent:

Ayon Banerjee moved from GE Vernova to Black & Veatch as APAC Managing Director – highlighting energy sector competition in Asia-Pacific markets.

Why this matters: Tracking cross-border executive moves helps predict where competitors will intensify market efforts.

Practical monitoring steps:

- 🗺️ Map leadership changes against growth markets

- 📈 Compare hiring patterns across competitors

- 🔗 Correlate with regulatory changes in specific regions

- 💼 Identify skill gaps through new hire expertise

Strategic Alliances and Partnerships Through New Hires

Dedicated partnership hires signal imminent collaborative growth strategies. These roles often precede major alliances that reshape market dynamics through technology sharing, sustainability initiatives, or data collaborations. Recognizing these early indicators helps you anticipate competitive ecosystem shifts.

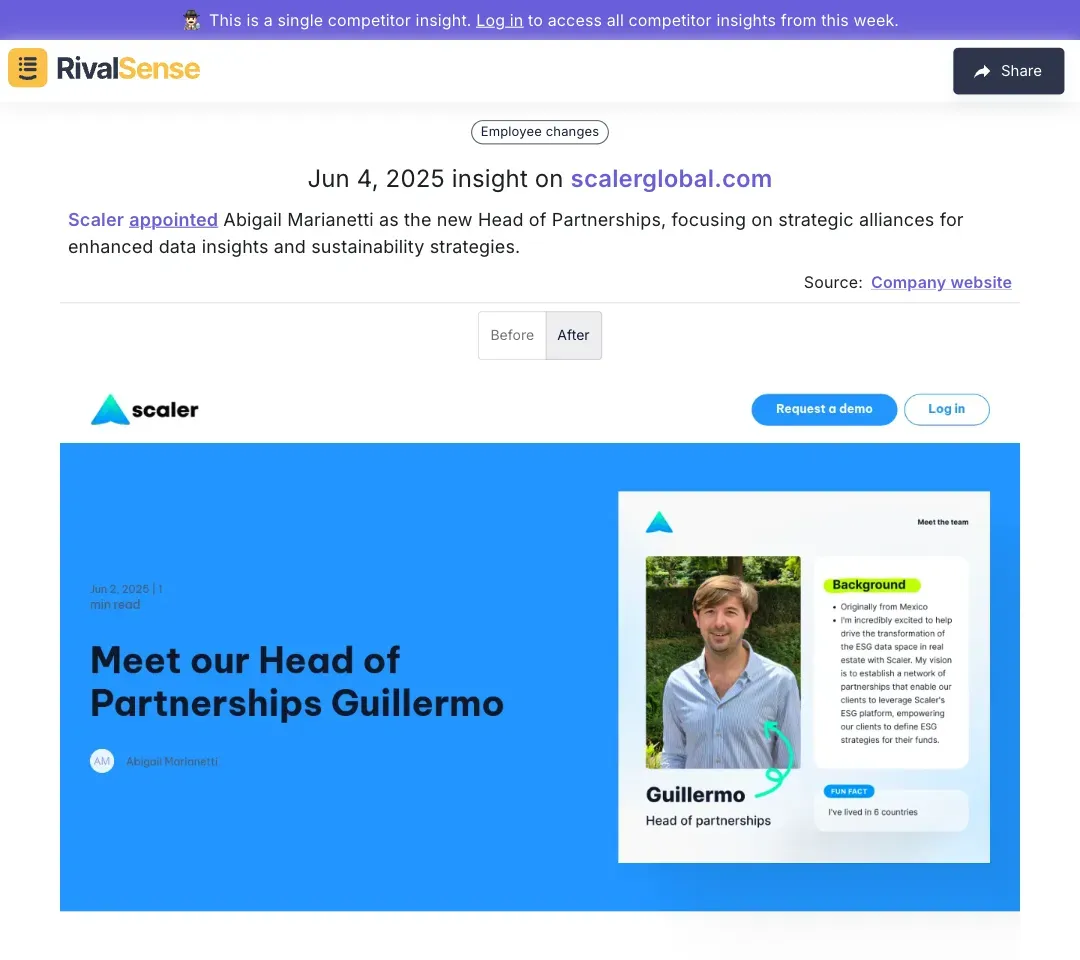

Appointments like this reveal partnership priorities:

Scaler appointed Abigail Marianetti as Head of Partnerships to drive data and sustainability alliances – indicating strategic collaboration focus.

Why this matters: Such hires provide early signals about emerging competitive ecosystems before formal announcements.

Actionable framework for capitalizing on alliances:

- Identify capability gaps competitors might fill through partnerships

- Analyze hire backgrounds to predict alliance types (tech/data/sustainability)

- Evaluate partnership impact on market positioning

- Develop counter-alliances based on intelligence

Layoffs as a Window into Financial Strategy

Workforce reductions provide transparent insights into financial pressures and strategic pivots. The departments affected reveal priorities: R&D cuts suggest innovation slowdown, while sales reductions may indicate market retreats. These signals create tangible competitive opportunities.

Practical interpretation guide:

| Layoff Pattern | Strategic Implication | Competitive Response |

|---|---|---|

| Engineering/Product | Reduced innovation spend | Accelerate R&D investment |

| Sales/Marketing | Market contraction | Target displaced customers |

| Cross-departmental | Financial distress | Acquire top talent |

Proactive steps:

- 📉 Track layoff announcements in real-time

- 🎯 Recruit displaced specialists to strengthen your team

- 💬 Survey affected customers for conversion opportunities

- 📌 Pinpoint service gaps created by competitor downsizing

Conclusion: Leveraging Competitor Insights for Strategic Advantage

Competitor staffing changes form a mosaic revealing financial health and strategic direction. Executive moves signal market pivots, regional appointments expose geographic priorities, partnership hires foreshadow collaborations, and layoffs expose vulnerabilities. Consistently decoding these patterns transforms reactive observation into proactive strategy.

Implement this ongoing intelligence framework:

✅ Automate tracking of key personnel changes

✅ Benchmark hiring patterns against industry peers

✅ Integrate insights into quarterly planning

✅ Update competitive assessments bi-weekly

Discover your competitors' strategic shifts before they impact your market: Try RivalSense Free and get your first competitor intelligence report today. Our platform tracks executive movements, regional appointments, partnership hires, and layoffs – delivering actionable insights directly to your inbox weekly.

📚 Read more

👉 Decoding Meta's Bangkok Training: Actionable Insights for Competitors

👉 How to Respond When Competitors Restructure: Multitude Case Study

👉 Turning Competitor Pricing Shifts into Your Advantage: The 1Password Case

👉 Decoding Numerade's Flashcard Update: A Competitor Analysis Blueprint

👉 Arby's Ad Surge: How to Respond to Increased Competitor Advertising