Free Tools for Tracking Competitor Hiring and Layoffs: A Practical Guide

Workforce intelligence is a critical but often overlooked component of competitive strategy. By tracking competitor hiring and layoff patterns, you gain real-time insights into their strategic direction, financial health, and market positioning. This isn't just HR data—it's a window into your competitors' next moves.

Hiring patterns reveal expansion plans and strategic priorities. When a competitor suddenly ramps up hiring for AI engineers or opens new regional offices, they're signaling growth initiatives months before public announcements. Conversely, layoff trends serve as early warning signals for organizational restructuring or financial challenges. A series of targeted layoffs in specific departments often precedes strategic pivots or cost-cutting measures.

Practical steps to get started:

- Identify 3-5 key competitors to monitor

- Set up alerts for their job postings and career page changes

- Track LinkedIn company page updates for hiring announcements

- Monitor news sources for layoff reports and restructuring news

- Analyze patterns quarterly to identify strategic shifts

This intelligence helps you anticipate market moves, adjust your own hiring strategy, and identify talent opportunities when competitors downsize.

🔍 Free Tools for Tracking Competitor Hiring Activity

Tracking competitor hiring activity reveals strategic priorities and growth areas. Here's how to leverage free tools effectively to stay informed about their recruitment efforts.

1. LinkedIn for Executive & Key Personnel Monitoring

- Follow target companies and key executives on LinkedIn

- Set up notifications for profile changes (title updates, new positions)

- Use LinkedIn's "People Also Viewed" feature to discover competitor connections

- Monitor company pages for hiring announcements and employee count changes

2. Job Board Aggregators for Recruitment Pattern Analysis

- Use Indeed, Glassdoor, and SimplyHired to track competitor job postings

- Set up saved searches for competitor names + "careers" or "hiring"

- Analyze frequency, departments, and locations of postings over time

- Compare job descriptions to identify skill gaps and strategic focus areas

3. Google Alerts for Real-Time Hiring Intelligence

- Create alerts for: "[Competitor Name] hiring", "[Competitor Name] careers", "[Competitor Name] job openings"

- Include variations with key executive names + "joins" or "appointed"

- Set delivery frequency to "as-it-happens" for time-sensitive intelligence

- Filter results to exclude irrelevant content using minus operators

Pro Tips:

- Combine data from all three sources for comprehensive insights

- Track hiring velocity (posting frequency) as a leading indicator of growth

- Note role types (technical vs. sales) to infer strategic direction

- Monitor seasonal patterns to anticipate competitor resource allocation

📉 Free Tools for Monitoring Competitor Layoffs and Restructuring

Monitoring layoffs and restructuring is crucial for understanding competitor stability and strategic shifts. By tracking these events, you can anticipate market changes and identify potential talent pools available for hiring.

1. Utilize WARN Act Databases & Government Tools

WARN Act databases provide legally-mandated layoff notices 60 days in advance. Practical steps:

- Bookmark WARNTracker.com for nationwide coverage

- Check state-specific databases (California EDD, Texas TWC, Washington ESD)

- Use LayoffData.com for standardized searchable datasets

- Set monthly calendar reminders to review new filings

2. Monitor Industry-Specific & Community Platforms

Different industries have specialized trackers:

- Tech: Layoffs.fyi (free community-driven), TrueUp.io

- Biotech: Fierce Biotech Layoff Tracker

- Fintech: Banking Dive's running list

- Gaming: Industry-specific coverage on gaming news sites

3. Set Up News Alerts for Restructuring Announcements

Create targeted Google Alerts with these best practices:

- Use exact competitor names plus "layoff," "restructuring," "downsizing"

- Add industry terms: "workforce reduction," "job cuts"

- Set frequency to "as-it-happens" for immediate notifications

- Include competitor ticker symbols for public companies

- Monitor SEC filings for 8-K forms announcing material events

Quick Checklist:

✓ Bookmark 3-5 WARN databases

✓ Identify 2-3 industry-specific trackers

✓ Set up 5-10 targeted Google Alerts

✓ Create a monitoring spreadsheet with competitor names and alert status

✓ Schedule weekly review sessions to analyze patterns

👔 Analyzing Executive Movement: What Senior Hires and Departures Reveal

Executive movement provides critical intelligence about competitor strategy. These changes often signal new priorities, organizational realignments, or responses to market pressures, giving you a heads-up on their next moves.

Practical Checklist for Executive Analysis:

- Track C-suite changes - New roles (Chief Growth Officer, Chief Sustainability Officer) reveal strategic priorities

- Analyze hiring patterns - Are they poaching from specific industries or competitors? This indicates market focus

- Monitor departure clusters - Multiple exits from one department signals potential restructuring

- Map reporting structures - New executive reporting lines show organizational shifts

- Check timing - Executive changes before earnings calls or product launches are strategic

Key Insights to Watch:

- New market entry: Hiring regional VPs or country managers

- Product focus: Recruiting specialized engineering leadership

- Talent strategy: Aggressive poaching from specific competitors reveals competitive targeting

Tip: Use LinkedIn's "People Also Viewed" feature and executive announcement press releases to track movement patterns. Set up Google Alerts for competitor executive names and titles to catch departures and hires in real-time.

Real-World Examples: How Executive Moves Inform Strategy

Tracking executive hires and departures is valuable because it reveals where competitors are investing talent and which strategies they might be adopting. Here are real insights from RivalSense that demonstrate this:

-

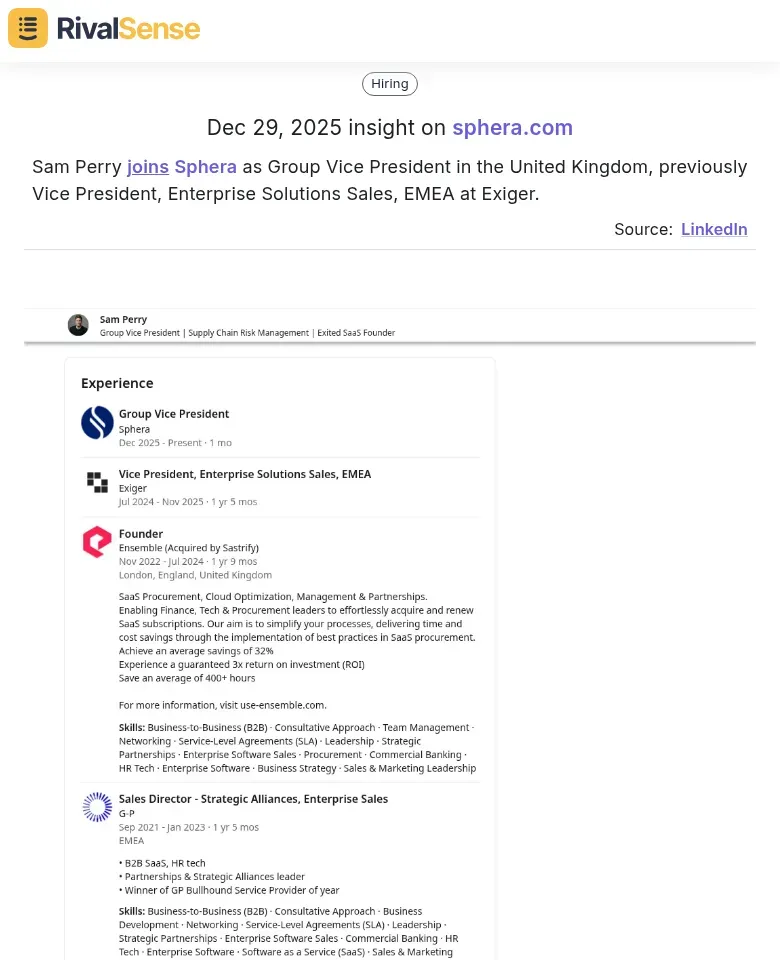

Sam Perry joins Sphera as Group Vice President in the United Kingdom, previously Vice President, Enterprise Solutions Sales, EMEA at Exiger. This hire suggests Sphera is strengthening its leadership in the UK to drive enterprise sales, potentially expanding its market presence or launching new solutions.

-

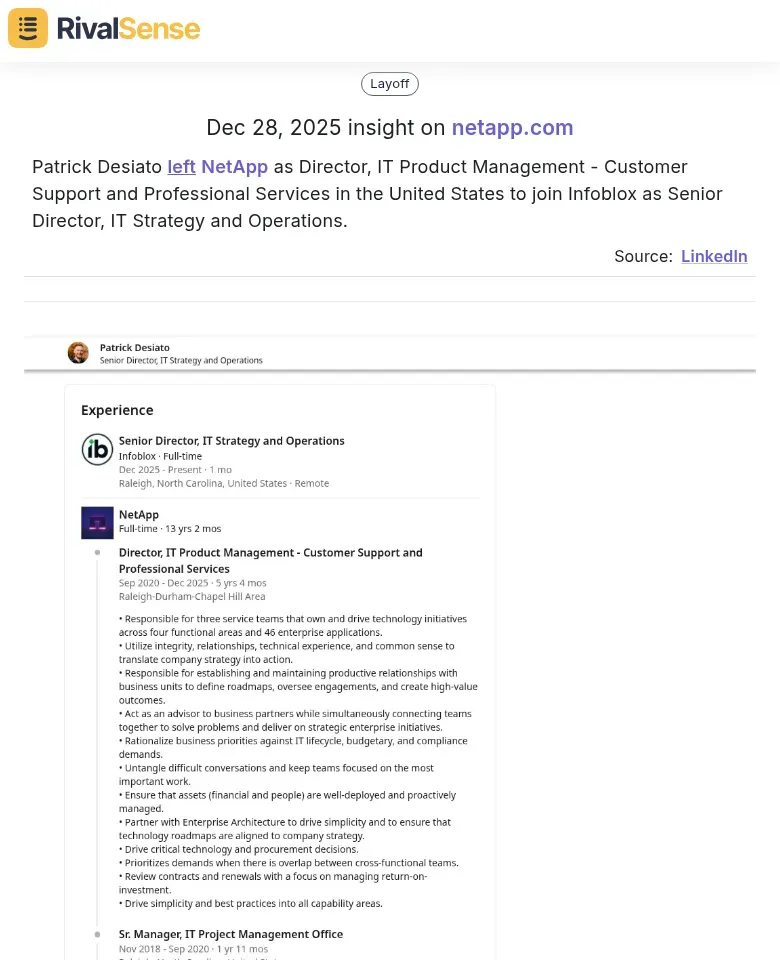

Patrick Desiato left NetApp as Director, IT Product Management - Customer Support and Professional Services in the United States to join Infoblox as Senior Director, IT Strategy and Operations. This move indicates Infoblox is enhancing its IT strategy by bringing in expertise from a competitor, possibly to improve customer support operations or streamline services.

-

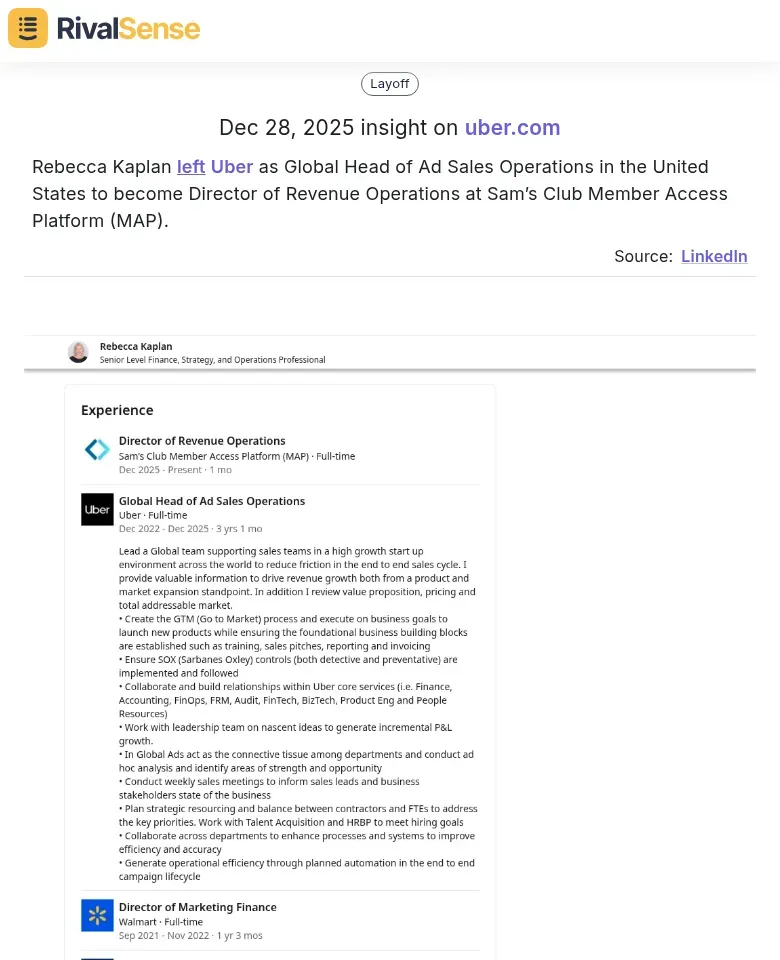

Rebecca Kaplan left Uber as Global Head of Ad Sales Operations in the United States to become Director of Revenue Operations at Sam’s Club Member Access Platform (MAP). This departure and hire highlight a shift in talent between tech and retail sectors, revealing how companies cross-pollinate skills to boost revenue operations in new domains.

By monitoring such executive movements, you can anticipate competitor focus areas, identify talent poaching trends, and adjust your own hiring and business strategies accordingly.

🛠️ Practical Implementation: Building Your Free Monitoring System

Building a free monitoring system requires a systematic approach. Consistency is key to deriving actionable insights from your monitoring efforts, ensuring you don't miss critical signals amid the noise.

Start by creating a weekly review schedule: Monday mornings for hiring alerts, Friday afternoons for layoff analysis. Use Google Alerts for company names + "hiring" or "layoffs," LinkedIn for job postings, and Glassdoor for employee sentiment.

Establish key metrics: hiring velocity (new roles/week), role concentration (engineering vs. sales), and attrition signals (negative reviews spike). Benchmark against industry averages—tech typically shows 5-15% hiring growth quarterly.

Integrate findings into competitive strategy: map hiring surges to product launches, connect layoffs to strategic pivots. Create a simple dashboard in Google Sheets tracking: company, date, event type, department, potential impact. Set quarterly review meetings to correlate workforce moves with market positioning.

Pro tip: Cross-reference with Crunchbase funding rounds—hiring often follows investment. Monitor executive departures as leading indicators of trouble. Remember: consistency beats complexity; 30 minutes weekly yields actionable intelligence.

🎯 Conclusion: Turning Workforce Intelligence into Strategic Action

Workforce intelligence isn't just data—it's a strategic compass. By systematically tracking and analyzing competitor moves, you can stay ahead in the competitive landscape, turning insights into tangible advantages for your business.

When you spot competitor layoffs, immediately identify which departments are affected and which talent might be available. Create a targeted outreach list within 48 hours of major announcements. For hiring surges, analyze which skills they're prioritizing to anticipate their strategic direction.

Practical steps:

- Set up alerts for competitor job postings and layoff announcements

- Map talent flow patterns quarterly to identify trends

- Create a 'talent opportunity' dashboard with key roles to monitor

- Schedule monthly reviews of workforce intelligence with leadership

Use hiring patterns to predict market expansions: if competitors suddenly hire multiple AI engineers, they're likely building new AI products. During competitor restructuring, target their displaced senior talent who bring institutional knowledge. Remember that workforce moves often precede market moves by 3-6 months—giving you crucial lead time to adjust your strategy.

Turn insights into action by assigning specific team members to monitor key competitors and report findings in weekly strategy meetings. This transforms raw data into competitive advantage.

Ready to streamline your competitor tracking? Tools like RivalSense automate the monitoring of product launches, pricing updates, events, partnerships, and executive movements—delivering a weekly email report with curated insights. Try RivalSense for free today to get your first competitor report and turn workforce intelligence into a strategic edge!

📚 Read more

👉 Decoding Competitor Moves: A Real-World Analysis of Orbital Materials' AI Cooling Breakthrough

👉 Benefits of Competitor Feature Gap Analysis: A Strategic Guide for B2B Leaders

👉 Smart Building KAM vs Customer Success: Strategic Framework & Templates

👉 How Competitive Intelligence Uncovered Toggl's Mobile Gap and Created a Market Opportunity

👉 7 Website Change Monitoring Mistakes That Sabotage Competitor SWOT Analysis