Decoding Competitor Moves: How Aeschbach's Strategic Product Shift Impacts Your Market Position

Understanding competitor product and pricing shifts is crucial for maintaining your competitive edge. Recent changes in Aeschbach's strategy offer valuable lessons in market positioning and assortment optimization that can inform your own business decisions.

🔍 Breaking Down Aeschbach's Strategic Shift

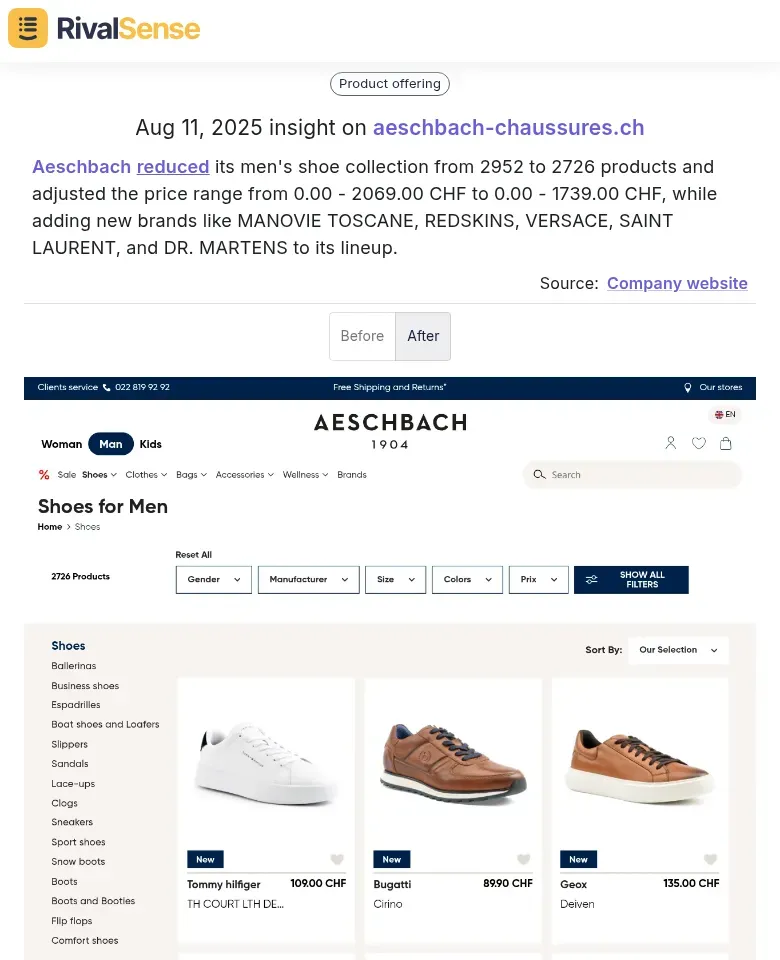

Aeschbach recently streamlined its men's shoe collection from 2,952 to 2,726 products while lowering its maximum price point from 2,069 CHF to 1,739 CHF. Simultaneously, they introduced premium brands like VERSACE, SAINT LAURENT, and DR. MARTENS to their lineup. This dual approach suggests a strategic pivot toward curated premium offerings at more accessible price brackets.

Visualizing assortment changes helps identify competitor positioning gaps

🛠️ Actionable Analysis Framework

When competitors adjust their assortment and pricing, consider these steps:

-

Assortment Gap Analysis

- Map their added/dropped brands against your inventory

- Identify underserved price tiers (e.g., 1,400-1,700 CHF range)

-

Pricing Strategy Reverse Engineering

| Metric | Before | After | Change | |--------------------|--------------|--------------|---------| | Product Count | 2,952 | 2,726 | -7.7% | | Max Price (CHF) | 2,069 | 1,739 | -16% | | Premium Brands | Unknown | 5+ added | + | -

Response Checklist

- [ ] Audit your brand portfolio for overlap with new competitors

- [ ] Test price sensitivity around 1,700 CHF threshold

- [ ] Monitor sales velocity of newly added luxury brands

- [ ] Evaluate whether to match/undercut their price ceiling

💡 Strategic Implications for Your Business

Aeschbach's move indicates a focus on higher-margin branded products while eliminating long-tail items. The lowered price ceiling suggests targeting aspirational shoppers previously priced out of luxury purchases. This creates opportunity for competitors to capture value-focused customers in the 1,740-2,000 CHF range they've vacated.

Leverage tools like RivalSense that automatically track assortment changes, pricing shifts, and brand partnerships across competitors' websites and registries. Their weekly reports deliver structured insights similar to this Aeschbach analysis without manual monitoring.

Pro Tip: When competitors reduce SKU counts while adding premium brands, they're likely optimizing inventory turnover. Counter by analyzing their out-of-stock patterns for potential supply chain weaknesses.

🚀 Turn Insights Into Action

Competitor moves like Aeschbach's require rapid response to protect market share. By systematically analyzing assortment adjustments and pricing corridors, you can identify defensive and offensive opportunities within days of changes occurring.

Ready to automate your competitor tracking?

Try RivalSense for free and get your first competitor report today. Monitor product launches, pricing changes, and brand partnerships with zero manual work.

📚 Read more

👉 How to Track Competitor Experiments: A Step-by-Step Guide for Business Leaders

👉 Market vs Competitive Intelligence: A Dental Practice Owner's Strategic Guide

👉 How boAt's Marvel Move Sparked a Rival's Strategic Discount War

👉 Facebook Competitor Insights Cheat Sheet for Benchmarking

👉 Dark Web Intelligence: Strategic Competitive Differentiation in Cybersecurity