Data-Driven Competitive Intelligence: Winning in Licensed Pop Culture Apparel

The licensed pop culture apparel market presents unique challenges that demand sophisticated competitive intelligence. Unlike traditional fashion cycles, this space operates on a 365-day model where trends emerge overnight from viral moments, new releases, or cultural shifts. Brands must navigate licensing complexities, rapidly changing fan preferences, and intense competition for limited shelf space.

Data-driven competitive intelligence transforms reactive strategies into proactive market leadership. By analyzing real-time market data, brands can anticipate trends before they peak and allocate resources strategically. For example, tracking which licensed characters are gaining traction across different demographics reveals underserved segments.

Practical tip: Implement daily monitoring of competitor assortments, pricing, and stockouts to identify immediate opportunities.

Checklist item: Regularly analyze competitor pricing architectures and discount patterns to optimize your own pricing strategy.

Competitor tracking plays a critical role in identifying expansion opportunities and market gaps. Systematic monitoring reveals where competitors are underperforming or overlooking specific product categories, price points, or demographic segments.

Practical step: Create a competitive matrix tracking key metrics across major players including SKU diversity, price positioning, and category coverage to visualize white space opportunities. This approach enables data-backed decisions about which licenses to pursue, which product categories to expand into, and how to differentiate your offerings in a crowded marketplace.

Product Portfolio Analysis: Decoding Competitor Expansion Strategies

Product portfolio analysis is crucial for understanding how competitors strategically expand their licensed pop culture apparel lines. By tracking their category expansion patterns, you can identify underserved market segments and anticipate their next moves.

For example, if competitors are adding plus sizes to superhero collections but ignoring anime franchises, that's an opportunity. Monitor product line extensions across different franchises and demographics: Are they targeting Gen Z with retro gaming merch while focusing millennials on 90s cartoon revivals? This reveals demographic targeting strategies.

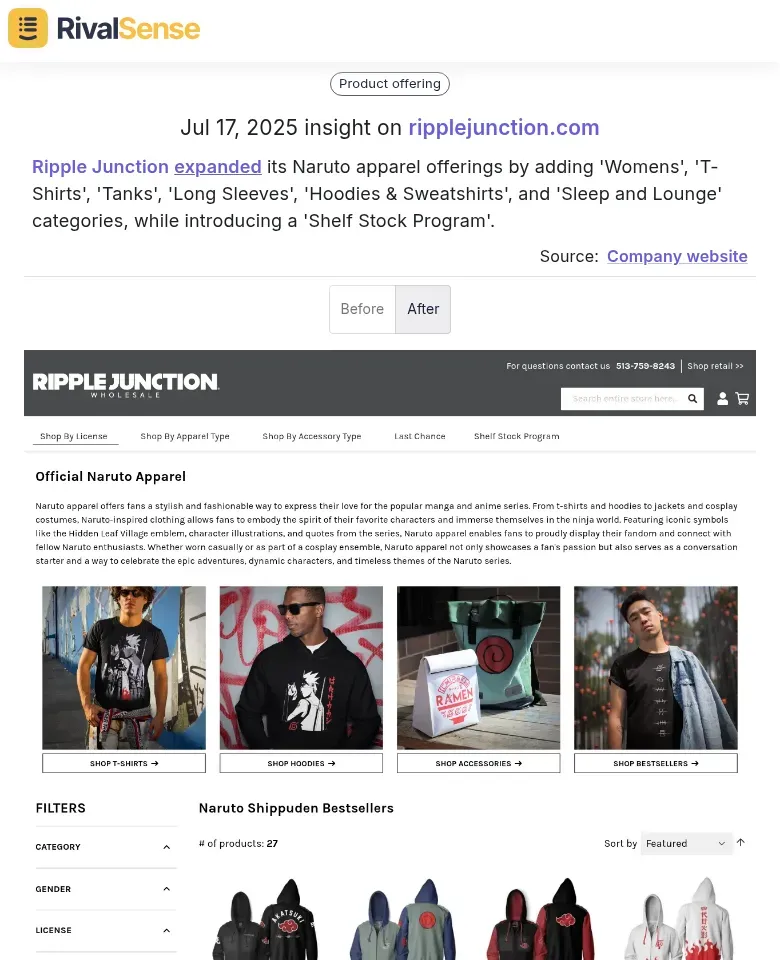

Insight Example: RivalSense tracked that Ripple Junction expanded its Naruto apparel offerings by adding 'Womens', 'T-Shirts', 'Tanks', 'Long Sleeves', 'Hoodies & Sweatshirts', and 'Sleep and Lounge' categories, while introducing a 'Shelf Stock Program'.

This type of insight is valuable because it shows how competitors are diversifying into new categories and implementing operational programs. By monitoring such expansions, you can identify trends in category adoption and adjust your own product portfolio accordingly.

Practical steps:

- 🗂️ Create a competitor expansion matrix tracking new categories (kids, plus-size, accessories) by franchise

- 📊 Analyze seasonal patterns: When do competitors launch holiday-themed collections vs. movie tie-ins?

- 🔄 Identify thematic cycles: Marvel Phase releases typically drive 3-month product development windows

- 💰 Monitor price laddering: How do premium limited editions differ from mass-market basics?

- 🤝 Track cross-franchise bundles: Star Wars + Marvel collaborations signal broader audience targeting

Key insight: Competitors often test new categories with limited releases before full expansion. Watch for small-batch experimental products that precede major line extensions. Successful expansion follows predictable patterns: demographic testing → franchise expansion → category diversification. Map these patterns to anticipate where competitors will move next and position your brand in adjacent underserved segments.

Franchise-Specific Strategy Insights: Learning from Competitor Licensing Approaches

To master franchise-specific licensing, it's essential to implement systematic competitor tracking. This involves analyzing how competitors refresh designs, leverage anniversaries, and balance product types.

First, monitor design refresh cycles by analyzing when competitors update core character designs within specific properties. For example, track how often a competitor refreshes their Spider-Man or Star Wars collections. Create a calendar of competitor releases to identify patterns.

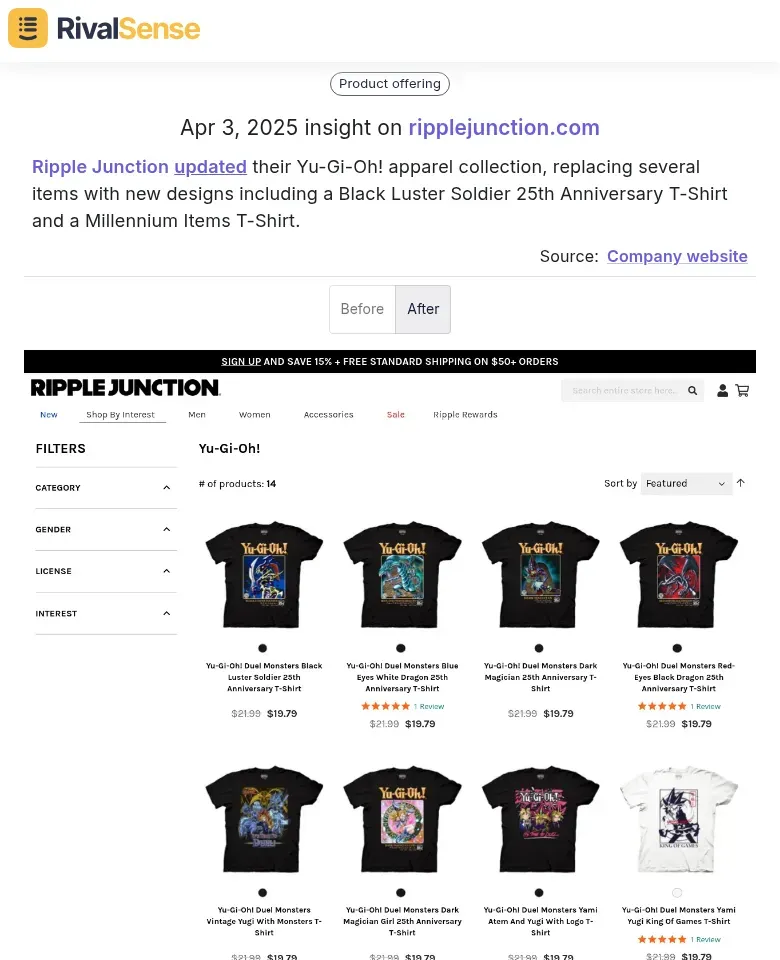

Insight Example: RivalSense observed that Ripple Junction updated their Yu-Gi-Oh! apparel collection, replacing several items with new designs including a Black Luster Soldier 25th Anniversary T-Shirt and a Millennium Items T-Shirt.

This insight is valuable because it highlights how competitors use franchise anniversaries to launch special collections, creating buzz and driving sales. By tracking such updates, you can plan your own anniversary campaigns and design refreshes strategically.

Second, identify anniversary opportunities by tracking competitor product launches around franchise milestones. Note how competitors leverage 10th, 25th, or 50th anniversaries with special collections. Set up alerts for upcoming franchise anniversaries 6-12 months in advance.

Third, analyze the evergreen vs. limited-edition balance by categorizing competitor products. Track what percentage of their licensed apparel is permanent collection versus limited runs. Notice how successful competitors use limited editions to create urgency while maintaining reliable revenue from evergreen designs.

Practical checklist:

- 📅 Create competitor design refresh timelines for each major franchise

- 🎉 Build franchise anniversary calendar with 12-month lead time

- 📦 Categorize competitor products as evergreen/limited edition

- 💸 Track pricing strategies for different product types

- 📱 Monitor social media engagement for limited edition launches

Key insight: The most successful licensed apparel companies maintain 70-80% evergreen designs while using limited editions strategically for hype and margin optimization.

Operational Intelligence: Beyond Products to Business Model Innovation

Operational intelligence goes beyond product features to analyze how competitors optimize their entire business model. In licensed pop culture apparel, this means tracking distribution strategies, inventory patterns, and supply chain efficiencies.

For instance, monitor shelf stock programs where competitors secure prime retail placement through guaranteed inventory commitments. This reveals how they manage relationships with retailers and ensure product availability.

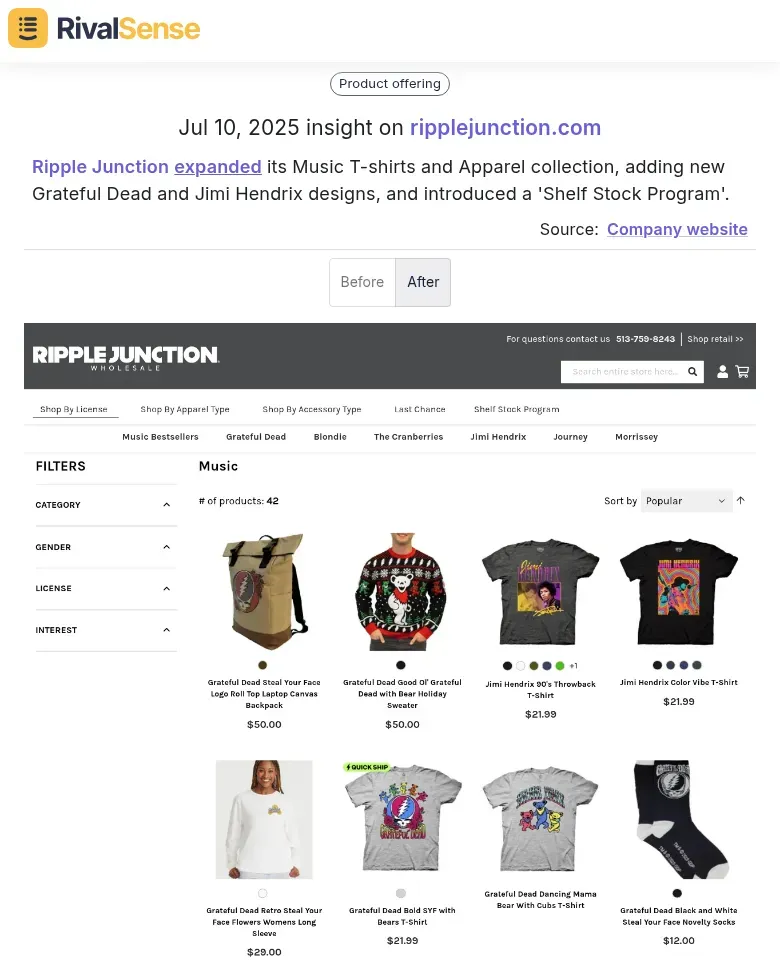

Insight Example: RivalSense detected that Ripple Junction expanded its Music T-shirts and Apparel collection, adding new Grateful Dead and Jimi Hendrix designs, and introduced a 'Shelf Stock Program'.

This insight is valuable because it shows competitors expanding into new music licenses while implementing operational programs to improve retail distribution. By understanding such moves, you can benchmark your own business model innovations and identify areas for improvement.

Practical steps for operational intelligence:

- 🏪 Map competitor retail partnerships: Track which major retailers carry their products and identify exclusive deals

- 📦 Analyze inventory patterns: Monitor stock levels across channels to identify just-in-time vs. buffer stock strategies

- ⚙️ Benchmark supply chain metrics: Compare lead times, fulfillment rates, and return rates against industry averages

- 🔄 Identify cross-line efficiencies: Look for shared warehousing, consolidated shipping, or unified production runs across multiple licensed properties

Key insights to uncover: How do competitors balance fast-moving Marvel merchandise with slower-selling niche licenses? What operational efficiencies do they implement across their portfolio? Do they use centralized distribution for all properties or regional hubs? These operational advantages often create sustainable competitive edges that are harder to replicate than product features alone.

Demographic and Category Targeting: Data-Driven Market Segmentation

Data-driven market segmentation is key to identifying growth opportunities in licensed pop culture apparel. By analyzing where competitors are expanding, you can uncover underserved demographics and categories.

Track when established brands launch women's collections—this signals untapped demographic potential. For example, if a competitor known for men's superhero tees introduces plus-size women's apparel, analyze their sales velocity and customer reviews to gauge market demand.

Monitor category expansion patterns: successful competitors typically move from basic t-shirts to specialized items like hoodies, accessories, or limited-edition collaborations.

Create a tracking checklist:

- 📝 Document competitor category launches quarterly

- 📊 Measure customer engagement across new segments

- 💰 Analyze pricing strategies for different demographics

- 📈 Track inventory turnover rates by category

Cross-category expansion reveals market signals: when multiple competitors simultaneously expand into athleisure or sustainable materials, this indicates broader industry shifts.

Practical tip: Use social listening tools to identify which product categories generate the most organic buzz among different demographic groups. Women's apparel expansions often follow 6-12 months after successful men's launches, providing a predictable expansion roadmap.

Key insight: The most successful licensed apparel brands don't just follow trends—they use competitor data to identify underserved segments before market saturation. By analyzing which demographic combinations (age + gender + product type) competitors are targeting, you can identify white space opportunities with higher margin potential.

Implementation Framework: Turning Competitive Insights into Actionable Strategy

Transforming competitive intelligence into strategic advantage requires a systematic framework. This ensures that insights are consistently applied to drive business decisions and market success.

1. Systematic Competitor Monitoring System

- 📊 Create a centralized dashboard tracking licensed apparel launches, pricing changes, and marketing campaigns

- 🔔 Set up automated alerts for competitor website updates, social media announcements, and press releases

- 📅 Establish weekly review cadences to analyze competitor moves and identify patterns

- 🛠️ Use tools like RivalSense to monitor 24/7 without manual effort

2. Response Framework for Competitive Moves

- New Product Launch Response: Analyze features/pricing → Identify gaps → Accelerate your roadmap or create differentiation

- Pricing Change Response: Evaluate market positioning → Adjust your pricing strategy or enhance value proposition

- Marketing Campaign Response: Monitor engagement metrics → Counter with targeted messaging or promotional offers

- Licensing Partnership Response: Assess exclusivity impact → Explore alternative IP partnerships or niche markets

3. Measurable KPIs for Competitive Intelligence Impact

- Competitive Win Rate: Track deals won against specific licensed apparel competitors

- Market Share Movement: Monitor quarterly changes in licensed category segments

- Response Time Metrics: Measure hours/days to respond to competitor moves

- Revenue Impact: Calculate influenced revenue from competitive intelligence-driven decisions

- Stakeholder Confidence: Survey teams quarterly on decision-making confidence with competitive insights

Practical Checklist:

✓ ✅ Establish clear escalation protocols for different threat levels

✓ ✅ Create response playbooks for common competitive scenarios

✓ ✅ Set quarterly review meetings to refine framework effectiveness

✓ ✅ Document competitive intelligence ROI through specific business outcomes

✓ ✅ Train cross-functional teams on framework implementation

This structured approach ensures competitive insights translate directly into market advantage and measurable business results.

Take Action with RivalSense

Ready to implement data-driven competitive intelligence for your licensed pop culture apparel business? Try RivalSense for free at https://rivalsense.co/ and get your first competitor report today. With RivalSense, you can track competitor product launches, pricing updates, event participations, partnerships, and more—all delivered in a weekly email report. Stay ahead of the competition and make informed strategic decisions effortlessly.

📚 Read more

👉 Avoid These Regulatory Competitor Insight Mistakes That Are Hurting Your ROI

👉 Analyzing Harvey's Shared Spaces Launch: A Practical Competitor Insight

👉 The Ultimate Key Account Tracking Spreadsheet Template: A Practical Guide for B2B Leaders

👉 Predictive Analytics for Engineering Consulting Key Account Management: Free Trial Guide

👉 How Glean's AI Assistant Evolution Revealed Competitor Growth Opportunities