CRO Key Account Management Workflow: Strategic Partner Tracking in Clinical Research

Introduction: The Strategic Imperative of Key Account Management in Clinical Research

In today's clinical research landscape, the relationship between sponsors and Contract Research Organizations (CROs) has fundamentally shifted from transactional vendor arrangements to strategic partnerships. This evolution represents a complete transformation in how clinical trials are conceptualized, executed, and optimized, driving mutual success through collaboration.

Key Account Management (KAM) serves as the operational framework that transforms clinical research from mere service delivery to collaborative value creation. Through systematic partner tracking and relationship optimization, CROs gain unprecedented competitive advantage. Practical implementation begins with these essential steps:

- Account Segmentation 🎯: Identify strategic partners versus transactional clients using criteria like therapeutic expertise alignment, historical performance metrics, and shared innovation goals.

- Relationship Mapping 🤝: Document all stakeholder interactions, decision-making patterns, and communication preferences across sponsor organizations.

- Value Tracking 📊: Implement systems to measure partnership ROI beyond financial metrics—consider innovation contributions, risk mitigation, and accelerated timelines.

- Regular Health Checks 🩺: Schedule quarterly partnership reviews assessing communication effectiveness, problem-solving collaboration, and strategic alignment.

- Competitive Intelligence Integration 🔍: Monitor how partners engage with competitors to identify opportunities for deeper collaboration.

This systematic approach enables CROs to anticipate sponsor needs, proactively address challenges, and co-create solutions that accelerate drug development while reducing costs. The result isn't just better clinical trials—it's sustainable competitive advantage through relationships that deliver measurable value beyond contractual obligations.

Building the Foundation: Identifying and Understanding Strategic Partners

Effective CRO key account management begins with deep partner intelligence. Understanding your partners' organizational dynamics and strategic priorities is crucial for building lasting relationships. Start by analyzing organizational structures: map decision-making hierarchies from executive committees to therapeutic area leads.

Identify who controls budgets, influences vendor selection, and drives strategic direction. Practical tip: Create a stakeholder matrix categorizing influencers, decision-makers, and gatekeepers across clinical operations, finance, and R&D functions.

Proactively track leadership changes and executive movements. When a new Chief Medical Officer joins a partner organization, anticipate potential therapeutic focus shifts. Monitor LinkedIn updates, press releases, and industry announcements to detect early signals of strategic realignment.

Checklist for leadership tracking:

- Set up alerts for C-suite changes

- Track executive career paths

- Analyze new leadership's historical partnership patterns

Map the competitive landscape to identify partnership opportunities and threats. Analyze which CROs currently serve your partners' therapeutic areas and geographic needs. Identify gaps where your capabilities align with unmet partner requirements. Example: If a pharmaceutical company is expanding into oncology but lacks specialized trial expertise, position your CRO's oncology track record as a strategic solution. Regularly update your competitive intelligence to spot emerging threats from niche CROs or new market entrants.

The CRO Key Account Management Workflow: A Systematic Approach

The CRO Key Account Management Workflow requires a systematic approach to strategic partner tracking. Implementing structured processes ensures consistency and effectiveness across all partner engagements. Start by establishing structured engagement models using RACI frameworks (Responsible, Accountable, Consulted, Informed) to clarify roles and responsibilities across both organizations.

This prevents communication gaps and ensures accountability. Next, develop customized solutions by conducting quarterly business reviews to understand each partner's unique needs, objectives, and pain points. Create tailored service packages that address specific therapeutic area requirements, regulatory challenges, and operational preferences.

Implement continuous feedback loops through monthly check-ins, real-time dashboards, and post-study debriefs. Use this data to make real-time strategy adjustments. Practical tip: Create a partner scorecard tracking metrics like study startup time, protocol amendments, and patient recruitment rates. This enables proactive issue resolution and demonstrates value through measurable outcomes.

Checklist for systematic workflow:

- Document RACI matrix for each partner

- Conduct needs assessment every quarter

- Establish feedback collection points at key study milestones

- Review and adjust strategies monthly based on performance data

This systematic approach transforms transactional relationships into strategic partnerships that drive mutual success in clinical research.

Strategic Partner Tracking: Learning from Competitor Intelligence

Strategic partner tracking requires systematic competitor intelligence gathering. By understanding your competitors' moves, you can anticipate market trends and position your CRO effectively. Start by monitoring executive appointments at rival CROs—when a competitor hires a new VP of AI Strategy or Head of APAC Operations, it signals emerging expertise and strategic direction.

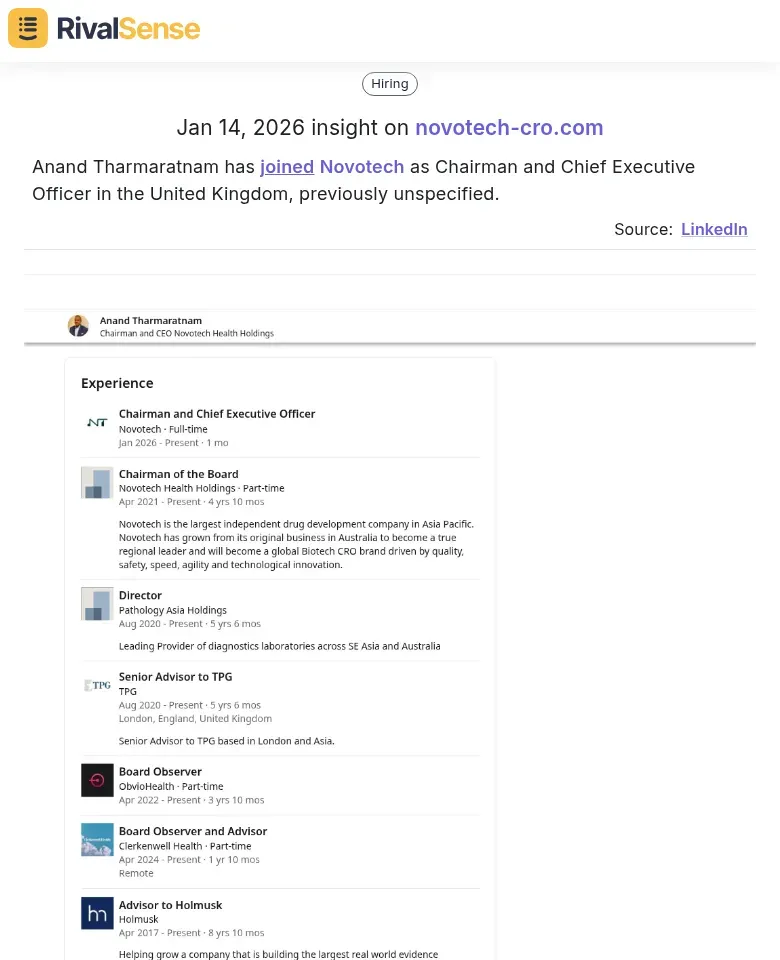

For example, tracking management changes can reveal strategic shifts. Consider this insight from RivalSense:

Why it matters: Monitoring executive appointments helps you identify new decision-makers and anticipate changes in competitor strategy, allowing you to adjust your partnership approaches accordingly.

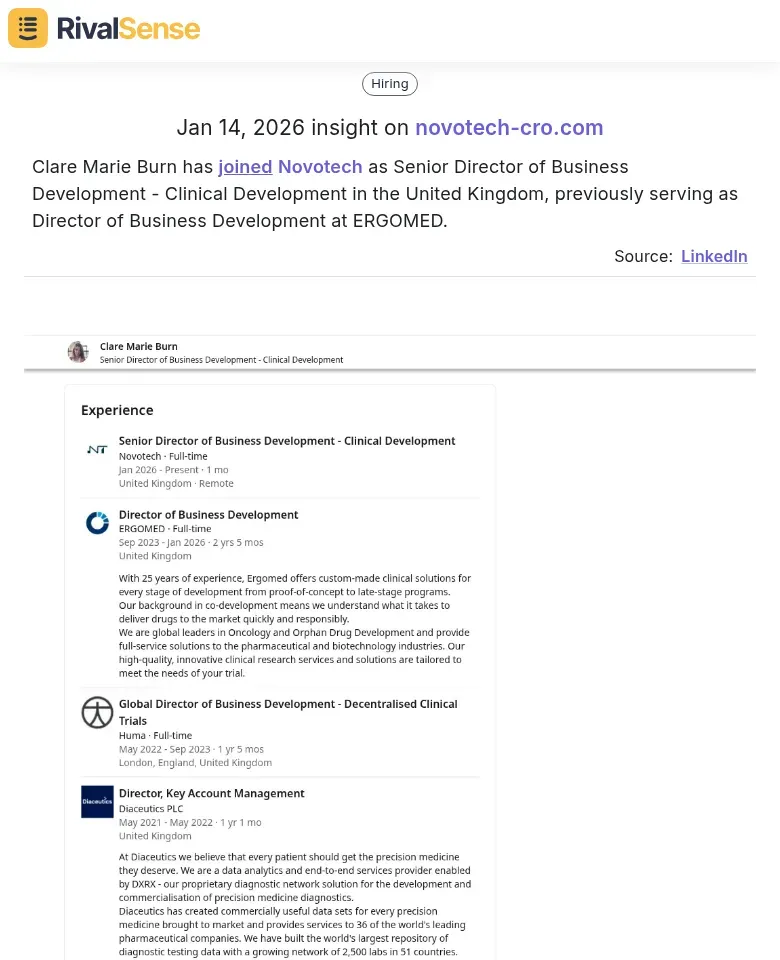

Similarly, tracking role-specific hires can indicate focus areas. Another RivalSense insight:

Why it matters: Following key hires in business development roles can signal expansion plans or new therapeutic focuses, giving you early warning to strengthen your own partner relationships.

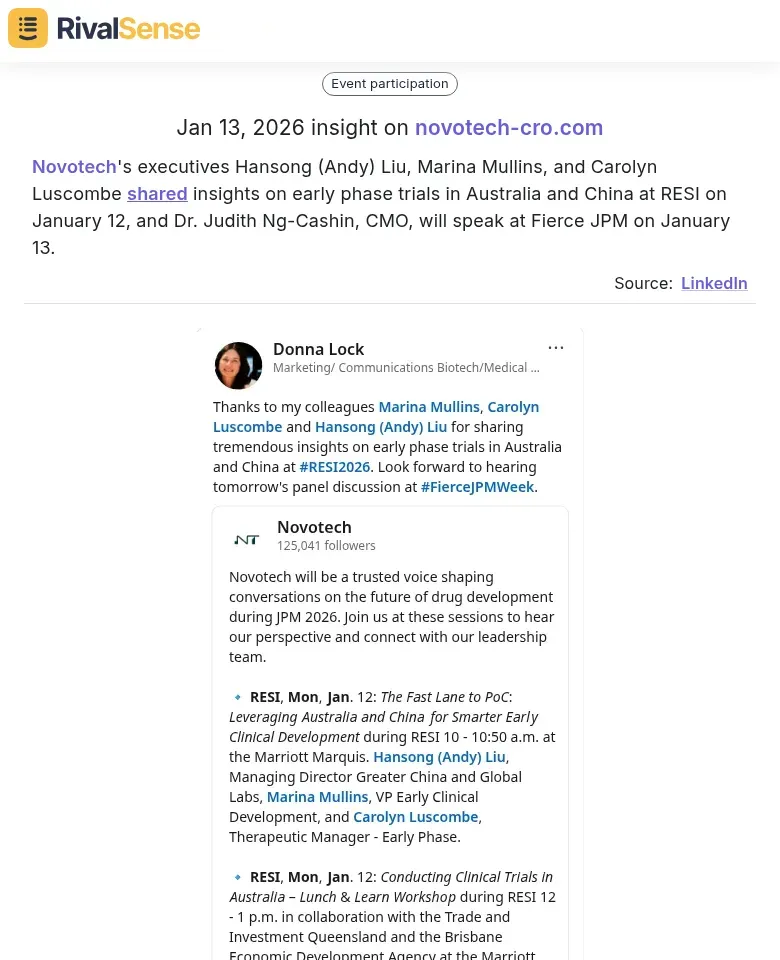

Track thought leadership activities through conference participation patterns. Note which competitors present at industry events and what topics they cover. This reveals market positioning priorities. For instance:

Why it matters: Monitoring event participations and media mentions helps you understand competitors' thought leadership strategies and identify gaps where you can enhance your own visibility.

Analyze geographic expansion patterns systematically. When competitors open new offices or establish partnerships, they're developing regional expertise. Create a tracking matrix showing competitor presence across key markets and update quarterly.

Practical checklist for competitor intelligence:

- Set up alerts for competitor executive appointments

- Track conference presentations and published white papers

- Monitor new office openings and regional partnerships

- Analyze therapeutic area focus shifts

- Document competitor capabilities in emerging technologies (AI, decentralized trials)

Tip: Use this intelligence to anticipate market trends and position your CRO as a strategic partner with foresight into where the industry is heading.

Measuring Success: KPIs and Performance Optimization

Effective CRO key account management requires systematic measurement of partnership value. Establishing clear metrics ensures that both parties understand and achieve mutual goals. Start by creating a balanced scorecard of quantitative and qualitative KPIs:

| Quantitative Metrics | Qualitative Assessment |

|---|---|

| Study delivery performance (timeline adherence, budget variance) | Strategic alignment scores (quarterly surveys) |

| Quality metrics (protocol deviations, data quality scores) | Innovation contribution tracking |

| Business growth (contract value expansion, renewal rates) | Relationship health indicators |

| Operational efficiency (site activation time, patient recruitment rates) | Communication effectiveness ratings |

Implementation Checklist:

- Schedule quarterly strategic business reviews with executive stakeholders

- Conduct monthly operational performance check-ins

- Implement 360-degree feedback mechanisms

- Use partnership scorecards with weighted metrics

- Establish clear escalation protocols for underperformance

Continuous Improvement Process:

- Analyze performance trends against industry benchmarks

- Conduct root cause analysis for recurring issues

- Develop joint improvement action plans

- Track implementation of corrective measures

- Celebrate and replicate successful partnership patterns

Pro Tip: Use a Clinical Trial Management System (CTMS) to automate KPI tracking and generate real-time dashboards for transparent performance monitoring. Regular data-driven reviews transform partnerships from transactional relationships to strategic alliances that drive mutual growth.

Future-Proofing Partnerships: Innovation and Long-Term Value Creation

Future-proofing partnerships requires moving beyond transactional relationships to co-create long-term value. Embracing innovation and adaptability ensures that partnerships remain relevant and productive. Start by establishing structured co-development initiatives where both organizations contribute resources to solve shared challenges.

Create joint innovation committees that meet quarterly to identify emerging needs and pilot new solutions together. Build multi-level relationship resilience by mapping key stakeholders across partner organizations. Develop relationship matrices that track connections at executive, operational, and technical levels.

Implement cross-functional team exchanges where your staff temporarily work within partner organizations to deepen understanding and trust. Adapt partnership strategies proactively to market and regulatory shifts. Conduct quarterly environmental scans to identify emerging trends, then adjust partnership objectives accordingly.

Practical checklist for future-proofing:

- Schedule biannual innovation workshops with partners

- Create stakeholder relationship maps with quarterly updates

- Implement joint risk assessment protocols for regulatory changes

- Develop shared metrics dashboard for partnership value tracking

- Establish clear escalation paths for addressing partnership challenges

Try RivalSense for Free

To effectively track competitor moves, management changes, and event participations as described in this post, try RivalSense for free at https://rivalsense.co/. Get your first competitor report today and gain actionable insights to enhance your key account management strategy.

📚 Read more

👉 Market Entry Analysis: Leveraging Competitor Funding for Strategic Insights

👉 Analyzing Competitor Moves: Allison Loy's Role at OneTrust

👉 How to Track Competitor Pricing Changes: The Complete 2026 Playbook for B2B Leaders

👉 Aviation Fuel System Construction: Best Practices for Competitor Partnership Ecosystems

👉 How Tracking Meta's CTO Departure Gave Competitors an AR/VR Edge