Competitor Market Entry in Action: Real-World Examples and Strategic Insights

🚀 Did you know that 4 out of 5 market entry strategies fail? McKinsey research reveals that even experienced companies struggle to crack new markets. But what separates the winners from the rest? The answer lies in competitive intelligence—anticipating competitor moves, decoding their strategies, and acting decisively. Let’s dissect real-world market entries uncovered by RivalSense and extract actionable lessons to sharpen your strategy.

🛠️ Strategy 1: Pivot with Purpose (Localization & Currency Adaptation)

Example: SQUATWOLF shifted focus from the UK to the US, switching pricing from GBP to USD for accessories.

Why This Works:

- Currency alignment: Eliminates friction for US customers (no mental math for conversions).

- Localized trust: USD pricing signals commitment to the market, reducing cart abandonment.

- Hidden signal: Currency shifts often precede deeper investments (e.g., localized marketing, logistics).

✅ Actionable Checklist:

| Step | Question to Ask |

|---|---|

| 1. | Does pricing reflect local purchasing habits? |

| 2. | Are payment methods localized (e.g., Apple Pay vs. Alipay)? |

| 3. | Are there hidden taxes/duties affecting perceived value? |

🌌 Strategy 2: Collaborative Entry (Leverage Local Expertise)

Example: The Exploration Company partnered with CIRA and Politecnico di Torino to build a space logistics hub in Italy.

Why This Works:

- Regulatory navigation: Local institutions ease compliance (e.g., EU space regulations).

- Talent pipeline: Universities supply specialized engineers and R&D collaboration.

- Risk-sharing: Partners absorb infrastructure costs and political risks.

💡 Pro Tip:

“Joint ventures reduce failure risk by 34% in regulated industries” (Forbes).

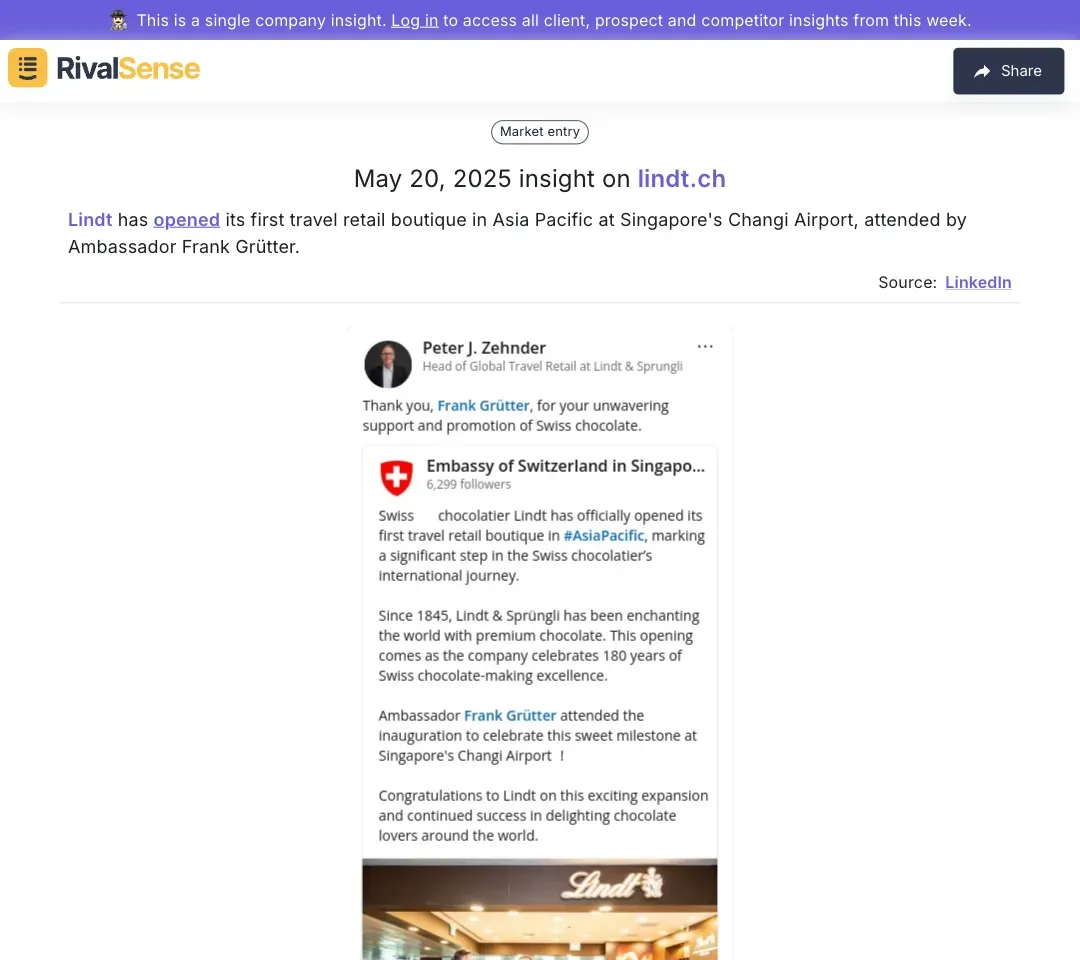

🛍️ Strategy 3: Test Before Scaling (Niche Market Entry)

Example: Lindt opened a travel retail boutique at Singapore’s Changi Airport—a $13B luxury hub.

Why This Works:

- Low-commitment testing: Airports attract high-spending, diverse demographics.

- Brand halo effect: Travelers associate Lindt with premium experiences.

- Data goldmine: Real-time feedback on pricing/packaging for APAC expansion.

📊 Travel Retail ROI:

| Metric | Impact |

|---|---|

| Foot traffic | 65M+ passengers/year at Changi |

| Average spend | 2.5x higher than regular retail |

| Brand recall | 40% increase post-travel (Nielsen) |

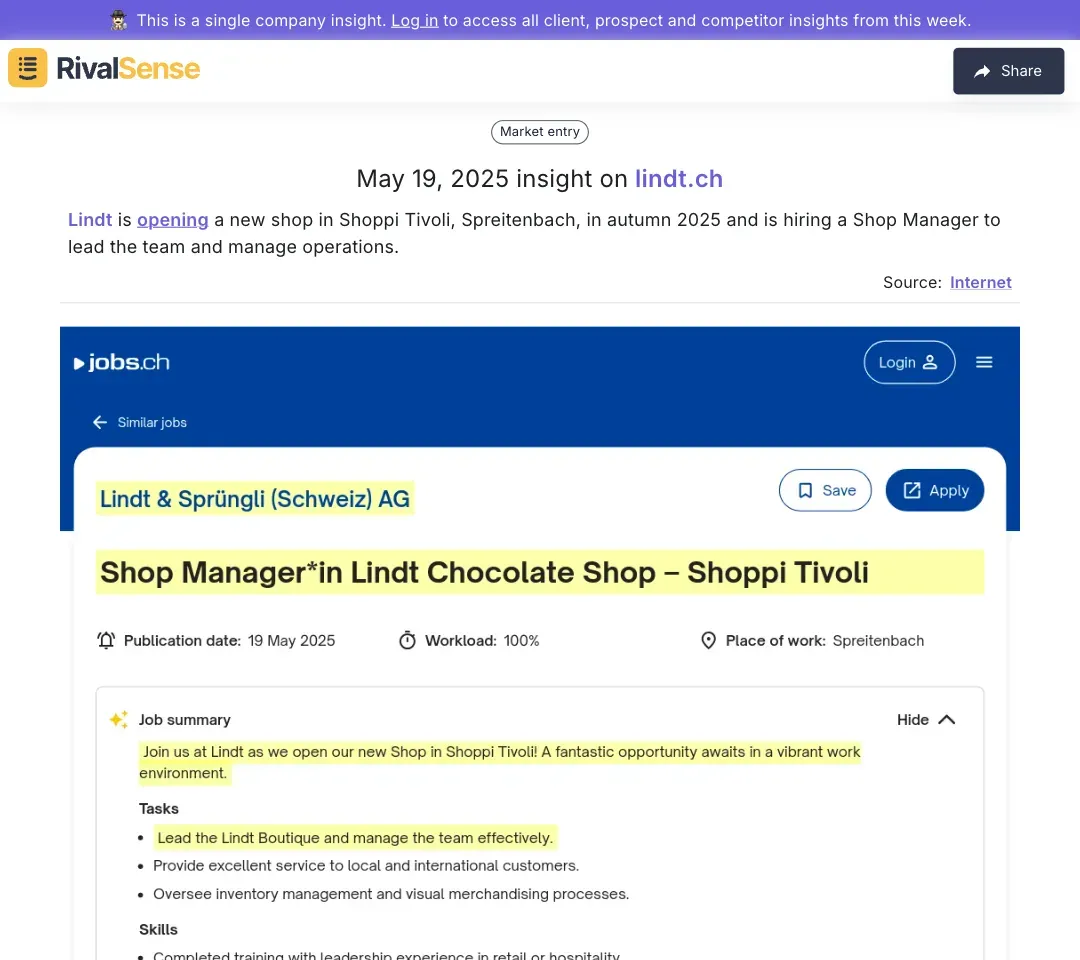

🏗️ Strategy 4: Phased Expansion (Validate Demand First)

Example: Lindt plans a 2025 store in Spreitenbach, Switzerland, hiring a Shop Manager 18 months in advance.

Why This Works:

- Talent-first scaling: Hiring early ensures culture fit and operational readiness.

- Demand validation: Spreitenbach’s 1.5M annual shoppers de-risk the location.

- Supply chain prep: Ample time to localize sourcing (e.g., Swiss dairy for freshness).

⚠️ Red Flags to Avoid:

- Rushing hires → 72% higher turnover (LinkedIn).

- Ignoring local labor laws → Fines up to 4% of revenue (EU Directive 2024).

🔑 Key Takeaway: Competitor Moves = Your Roadmap

Every competitor action—a currency shift, a partnership, a niche launch—is a data point. Reverse-engineer their playbook:

- Decode the ‘Why’: Is SQUATWOLF targeting US millennials?

- Stress-test their strategy: Would a Changi boutique work for your product?

- Preempt their next move: Lindt’s 2025 store signals deeper EU penetration.

🎯 Ready to Outmaneuver Competitors?

RivalSense delivers weekly competitor intel—from pricing shifts to hidden hiring—so you’re never blindsided. Get your first report free and turn their moves into your opportunities.

“The best strategies are built on knowing what your rivals will do before they do it.”