Best Practices in Competitive Intelligence for Wood-Based Panel Leaders

In today's rapidly evolving wood-based panel market, competitive intelligence (CI) has transitioned from optional to essential for sustainable growth. By systematically gathering competitor insights, industry leaders can anticipate market shifts, identify opportunities, and mitigate risks before they impact operations. This proactive approach transforms raw data into strategic advantages, enabling informed decision-making that drives long-term success.

Understanding competitor activities—from product launches to supply chain adjustments—provides actionable intelligence. When rivals expand into new geographic markets, it often signals untapped potential worth exploring. Similarly, analyzing their marketing campaigns reveals gaps in your strategy and opportunities for differentiation.

Key intelligence areas for wood-based panel leaders include:

- 📊 Market Positioning: How competitors position products and brands

- 💡 Innovation Trends: New technologies or materials adoption

- 🗣️ Customer Feedback: Sentiment analysis of competitor offerings

- ⚙️ Operational Efficiency: Production and distribution insights

Actionable first steps:

- Identify 3-5 key competitors impacting your market share

- Implement automated tracking tools for continuous monitoring

- Schedule monthly CI analysis sessions

- Translate findings into tactical adjustments

Leveraging Industry Events for Competitive Insights

Industry events serve as strategic windows into competitor priorities and emerging market trends. Tracking participation patterns reveals where rivals are investing resources and which market segments they're targeting. This intelligence helps you benchmark your own event strategy and allocate resources more effectively.

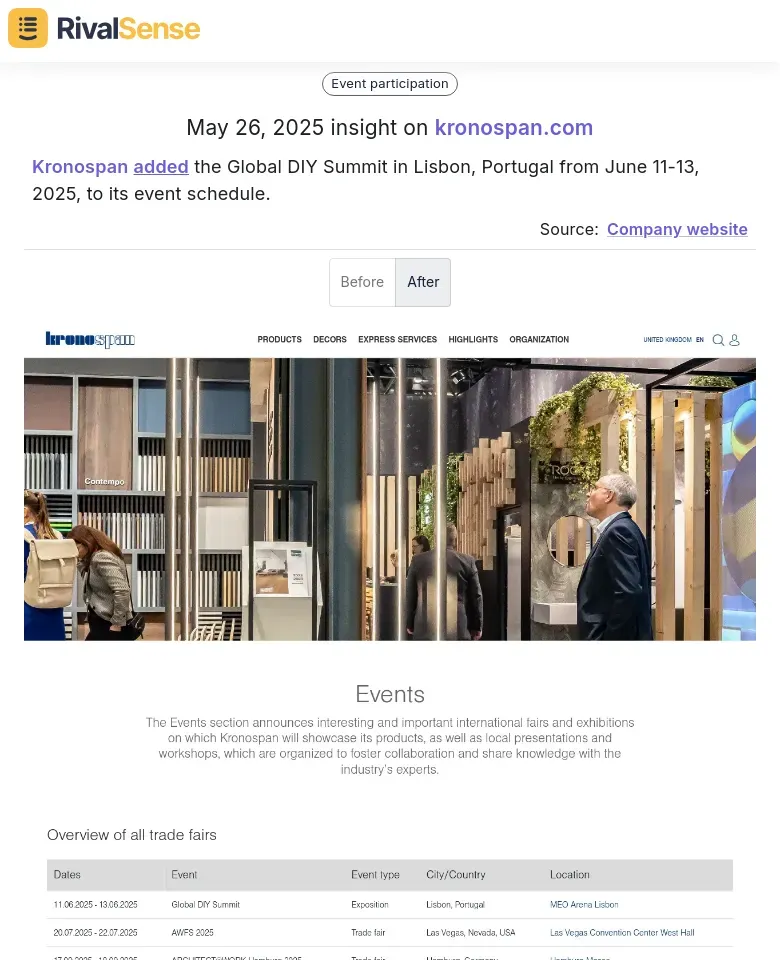

For example, RivalSense detected that Kronospan added the Global DIY Summit in Lisbon (June 11-13, 2025) to their event schedule. This signals their focus on the growing DIY market segment—intelligence that could influence your own event participation decisions.

Why it matters: Event tracking identifies market priority shifts and partnership opportunities before they become mainstream knowledge.

Practical event intelligence framework:

| Phase | Action Items |

|---|---|

| Pre-event | • Research attending competitors • Analyze their announced focus areas |

| On-site | • Document product demonstrations • Note partnership discussions |

| Post-event | • Compare competitor presence to yours • Identify strategic gaps |

Maximize event ROI:

- Attend workshops on emerging technologies like sustainable adhesives

- Network with suppliers for indirect competitor intelligence

- Collect competitor marketing materials for messaging analysis

Analyzing Product Launches for Market Trends

Competitor product launches are treasure troves of market intelligence, revealing consumer preferences and innovation directions. Systematic analysis of new collections provides early signals about material trends, pricing strategies, and feature evolution within the industry.

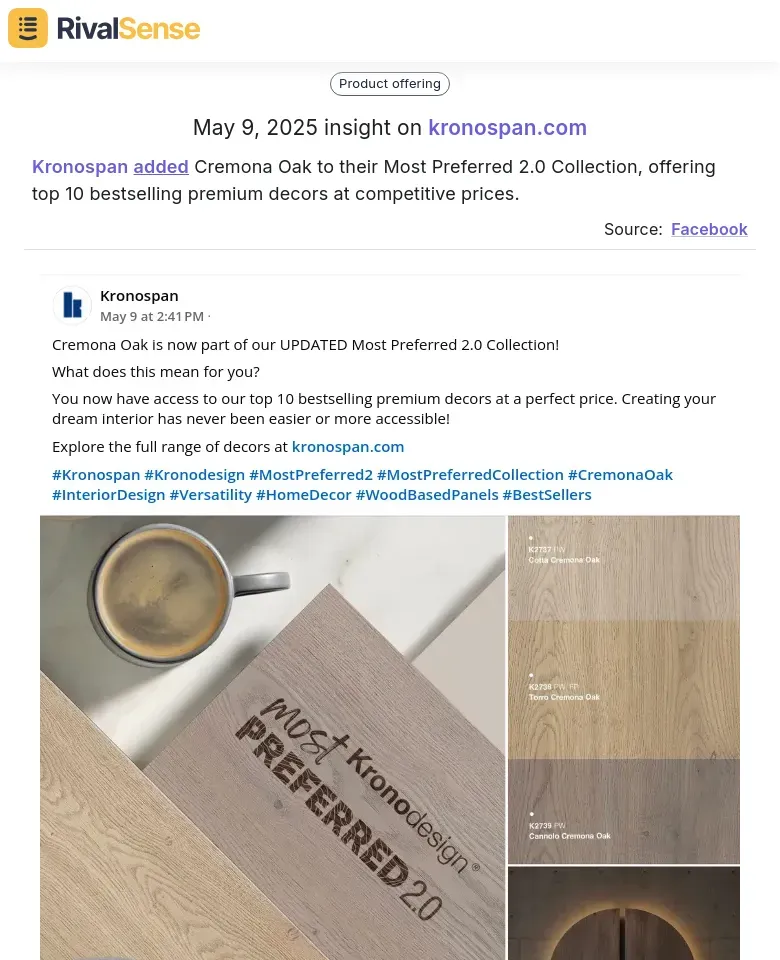

RivalSense captured Kronospan's addition of Cremona Oak to their Most Preferred 2.0 Collection—a move showcasing their focus on premium decors at competitive price points. This indicates both design preferences and pricing strategies worth monitoring.

Why it matters: Product launch tracking helps anticipate design trends and adjust your development pipeline accordingly.

Product intelligence checklist:

- [ ] Track launch timing and market positioning

- [ ] Analyze featured technical specifications

- [ ] Compare pricing against quality tiers

- [ ] Monitor initial customer reviews

- [ ] Identify gaps in your own offerings

Actionable responses:

- If oak finishes dominate launches, expand your sustainable oak alternatives

- When competitors bundle products, test similar package deals

- Match promotional cadence to competitor launch cycles

The Role of Key Figures in Competitive Strategy

Executive movements and visibility patterns provide invaluable insights into organizational priorities and strategic shifts. Tracking leadership activities helps decode unannounced market expansions, culture transformations, or innovation focus areas before formal announcements.

When RivalSense identified Dagmara Mach and Bartosz Panas prominently welcoming guests at Kronospan's Hausmesse 2025 (June 3), it signaled their emphasis on leadership-driven relationship building in the Polish market.

Why it matters: Leadership tracking reveals organizational priorities and potential market focus shifts months before operational changes manifest.

Executive intelligence tactics:

- Monitor public appearances at industry events

- Analyze communication themes in speeches/interviews

- Track career movements for strategic hires

- Note board composition changes for governance shifts

Turn insights into action:

- If competitors emphasize technical leadership, boost your CTO's visibility

- When rivals hire sustainability experts, accelerate your eco-initiatives

- Mirror effective thought leadership formats in your content

Integrating Competitive Insights into Business Strategy

Translating competitive intelligence into operational decisions separates market leaders from followers. Effective integration requires systematic processes that connect insights to specific business functions, ensuring intelligence drives tangible outcomes rather than sitting in reports.

Start by mapping competitor activities to your strategic pillars. When rivals adjust pricing, immediately evaluate your margin structures. When they launch new products, conduct gap analyses on your offerings. This creates a responsive intelligence ecosystem.

Implementation framework:

flowchart LR

A[Collect Data] --> B[Analyze Patterns]

B --> C[Assign Actions]

C --> D[Measure Impact]

D --> A

Department-specific applications:

| Function | Intelligence Application |

|---|---|

| R&D | Prioritize features lacking in competitor offerings |

| Marketing | Counter competitor messaging gaps in campaigns |

| Sales | Develop competitive battle cards for pricing negotiations |

| Leadership | Adjust long-term strategy based on market movements |

Maintenance checklist:

- [ ] Establish weekly competitor alert reviews

- [ ] Create cross-functional CI action teams

- [ ] Automate data collection where possible

- [ ] Quantify CI impact quarterly

Conclusion: Staying Ahead with Proactive Competitive Intelligence

In the dynamic wood-based panel industry, consistent competitive intelligence delivers the foresight needed to navigate market shifts confidently. By transforming competitor activities into strategic insights, you position your organization not just to react, but to lead through informed innovation and precise market positioning.

Ready to elevate your competitive strategy? Try RivalSense for free at https://rivalsense.co/ and get your first automated competitor report today. Our platform tracks product launches, pricing changes, leadership movements, and event participation—delivering actionable insights directly to your inbox weekly.

📚 Read more

👉 5 Actionable Competitive Intelligence Insights for Product Strategy

👉 Decoding Noom's Muscle Defense™ Launch: Turning Competitor Insights into Action

👉 How to Track Competitor Funding and Growth: A Strategic Guide

👉 Predictive Market Intelligence for Green Business Innovation

👉 How Vivid Money's Rate Shift Empowered Competitors: Strategic Lessons for Business Leaders