Best Practices for Mobility Trade Show Strategy to Outpace Competitors

In the rapidly evolving mobility sector, trade shows have transformed from mere networking events into strategic battlegrounds where market positions are won or lost. Events like MOVE London, IT-TRANS, and Smart City Expo World Congress serve as real-time market intelligence hubs where you can observe competitors' product launches, partnership announcements, and strategic positioning. Proactive trade show planning begins with a competitive intelligence checklist: 1) Map competitor booth locations and traffic patterns, 2) Document product demonstrations and pricing discussions, 3) Analyze partnership announcements and hiring trends, 4) Monitor social media engagement during the event. This intelligence directly informs your business strategy by revealing market gaps, emerging technologies, and partnership opportunities. The mobility companies that consistently outpace competitors treat trade shows as live competitive laboratories, gathering insights that shape product roadmaps, marketing messaging, and partnership strategies months before traditional market research would surface them.

Pre-Show Intelligence: Analyzing Competitor Moves Before the Event

Pre-show intelligence transforms reactive competition into proactive strategy. Start by monitoring competitor partnerships and social initiatives—like transportation safety agreements or sustainability pledges—which reveal their positioning narrative months before the event. Track executive movements and talent acquisition patterns: sudden hires in autonomous vehicle technology or mobility-as-a-service roles signal strategic pivots. For example, RivalSense identified that CARLA KRAMIS left DiDi Global as Head of Sales Operations in Mexico to become Senior Director of Revenue Operations at Clip.

This type of insight into executive changes is valuable for business strategy as it can indicate internal restructuring, new market focuses, or competitive talent wars, helping you anticipate shifts in competitor priorities.

Analyze financial performance and international expansion trends to gauge momentum; companies expanding into Southeast Asia while maintaining strong margins likely have aggressive growth plans.

Practical steps:

- Create a competitor dashboard tracking partnership announcements, executive changes, and financial results

- Set Google Alerts for key competitors + "partnership," "hiring," and "expansion" terms

- Analyze LinkedIn for talent flow patterns (who they're hiring from)

- Review quarterly earnings calls for international market mentions

- Map competitor booth locations from previous years to anticipate their event focus areas

Tip: The most revealing intelligence often comes from connecting seemingly unrelated data points—like a safety partnership announcement followed by autonomous vehicle talent acquisitions, signaling a coordinated positioning strategy.

On-Site Competitive Intelligence Gathering at Mobility Trade Shows

Trade shows offer unparalleled access to competitor strategies in real-time. Implement a systematic approach to maximize your intelligence gathering efforts. Create a competitor tracking worksheet with categories for booth design (layout, interactive tech like AR/VR demos), messaging themes, and traffic patterns. Assign team members specific zones to monitor.

For networking intelligence, use these techniques: attend competitor presentations posing as a potential customer, engage suppliers about recent orders, and participate in industry roundtables. Ask open-ended questions like "What's the most exciting mobility innovation you've seen here?" to gather insights indirectly.

Document everything systematically: photograph booth layouts, collect marketing materials, and note partnership announcements. Use a mobile app to timestamp observations. Key checklist items include: record demo queue lengths, document new product specifications, track competitor staffing levels, and note which industry influencers visit their booths.

Pro tip: Schedule daily debriefs to consolidate findings while details are fresh. This real-time intelligence helps you adjust your messaging and identify gaps in competitor offerings during the show itself.

Strategic Differentiation: Standing Out in a Crowded Mobility Market

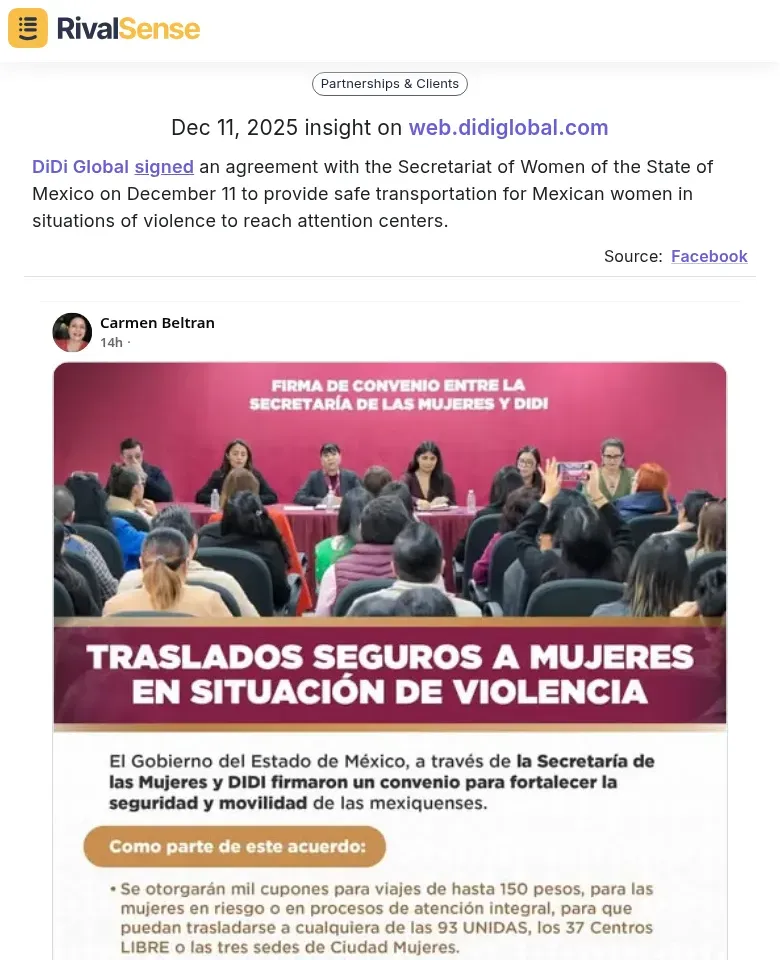

In the crowded mobility market, strategic differentiation requires going beyond product specs and highlighting unique value propositions. One powerful approach is to lead with social responsibility initiatives that resonate with customers and partners. For instance, RivalSense tracked that DiDi Global signed an agreement with the Secretariat of Women of the State of Mexico to provide safe transportation for Mexican women in situations of violence.

Understanding such partnerships is valuable for business strategy as it reveals how competitors are building brand loyalty and addressing social issues, which can inspire your own initiatives or highlight areas for competitive advantage.

Here’s how to stand out at trade shows:

1. Lead with Social Responsibility:

- Create a dedicated booth section showcasing your women’s safety initiatives with interactive displays

- Feature real-world impact metrics (e.g., "50% reduction in safety incidents in partner cities")

- Host panel discussions with female mobility leaders to demonstrate authentic commitment

- Checklist: Impact data visualization, testimonial videos, partnership logos, measurable outcomes

2. Prove Market Traction:

- Display interactive maps highlighting international expansion with revenue growth overlays

- Use large format graphics showing year-over-year growth percentages (e.g., "300% revenue increase in APAC markets")

- Feature case studies from successful international deployments

- Tip: Use before/after comparisons showing market penetration progress

3. Showcase Organizational Strength:

- Create an "Executive Leadership Wall" highlighting key hires from industry leaders

- Feature talent acquisition metrics (e.g., "40% increase in engineering talent from top-tier companies")

- Host meet-and-greets with newly hired executives to demonstrate industry credibility

- Practical Step: Include organizational charts showing strengthened departments

Key Differentiator: Combine all three elements in your booth narrative. Show how social responsibility drives international success, which attracts top talent, creating a virtuous cycle that competitors can’t easily replicate. Use QR codes linking to detailed reports for deeper engagement.

Post-Show Analysis and Competitive Response Planning

The real work begins after the trade show ends, where systematic analysis transforms observations into actionable strategies. Start by consolidating all gathered intelligence and comparing it with ongoing competitor activities. For example, RivalSense reported that DiDi Global saw an 8.6% rise in third-quarter revenue with international revenue growing 35%, indicating strong expansion momentum.

Monitoring financial performance like this is valuable for business strategy as it helps assess competitor health, investment capacity, and market confidence, informing your own growth plans and competitive responses.

Create a competitive intelligence dashboard tracking: 1) New product launches and features, 2) Pricing changes and packaging, 3) Partnership announcements, 4) Marketing messaging shifts, and 5) Target customer segments revealed. Use tools like RivalSense to monitor competitor website updates, social media posts, and press releases that often follow major trade show reveals.

Translate this intelligence into actionable strategy adjustments within 72 hours. Conduct a SWOT analysis comparing your offerings against competitor weaknesses identified. For example, if a competitor launched a product with limited integration capabilities, accelerate your API development roadmap. If they announced a partnership in a new geographic market, evaluate your expansion timeline.

Develop specific response plans using this framework:

- Immediate (30-day) actions: Tactical marketing campaigns highlighting your advantages.

- Short-term (90-day) initiatives: Feature enhancements or partnership explorations.

- Long-term (6-12 month) strategic shifts: Product roadmap or market positioning changes.

Assign clear ownership and metrics for each response. Remember: The goal isn’t just to match competitors, but to leverage their moves to identify market gaps you can own.

Building a Sustainable Competitive Advantage Through Trade Shows

Building a sustainable competitive advantage requires moving beyond one-off trade show observations to create a continuous competitor monitoring system. Establish a structured intelligence framework that captures competitor activities year-round, not just during events. Use tools like RivalSense to track competitor booth designs, product demos, messaging themes, and attendee engagement patterns across multiple shows.

Integrate trade show intelligence into your ongoing competitive strategy by creating a centralized repository where marketing, sales, and product teams can access real-time competitor insights. Develop quarterly competitive briefings that analyze trends from recent shows and identify emerging threats or opportunities. This enables proactive strategy adjustments rather than reactive responses.

To measure ROI and competitive impact over time, implement a multi-dimensional tracking system:

- Lead quality metrics comparing pre- and post-show conversion rates

- Market share changes in key segments post-event

- Competitor response tracking (how quickly they counter your show announcements)

- Brand perception shifts measured through social listening

Practical checklist:

- Assign dedicated competitive intelligence roles for each major trade show

- Create standardized competitor assessment templates

- Schedule quarterly strategy sessions to review trade show intelligence

- Track competitor booth traffic patterns and engagement metrics

- Monitor post-show competitor marketing campaigns for response patterns

By treating trade shows as continuous data points in your competitive intelligence ecosystem, you transform temporary event advantages into lasting market leadership.

Put Your Competitive Intelligence into Action with RivalSense

To effectively implement the strategies outlined, you need a reliable way to track competitor moves across websites, social media, and registries. RivalSense delivers weekly email reports with insights on product launches, pricing updates, event participations, partnerships, regulatory changes, management shifts, and media mentions—exactly the intelligence you need to stay ahead.

Try RivalSense for free today at https://rivalsense.co/ and get your first competitor report to start transforming trade show insights into competitive advantage.

📚 Read more

👉 Quick Tips: Monitor Competitor Hiring & Layoffs via Regulatory Filings

👉 How to Respond to Competitor Pricing Changes: A Case Study on Vivigo

👉 Key Account Management Tools Comparison 2025: The Ultimate Guide for Business Leaders

👉 Actionable Strategies to Track Key Account Milestones for Insurance Brokers

👉 How Zyte's Copilot Rebrand Helped Competitors Accelerate Product Development