Airline Competitive Intelligence Checklist: Track Rivals Like AirAsia 🛫

In the high-stakes world of aviation, competitive intelligence isn't just a nice-to-have—it's the secret weapon that separates market leaders from laggards. Strategic competitor tracking drives market leadership by revealing rivals' pricing strategies, route expansions, and customer experience innovations before they impact your bottom line. In volatile airline markets, real-time intelligence is critical for navigating fuel price fluctuations, regulatory changes, and shifting passenger demand patterns.

AirAsia demonstrates the power of systematic competitor monitoring through their data-driven approach to route optimization and dynamic pricing. By tracking competitors' seat availability, promotional campaigns, and operational changes, they've maintained profitability in one of the world's most competitive regions.

Practical Tip: Start by identifying your 3-5 key competitors and track their daily fare changes, route announcements, and social media sentiment. Use automated tools to monitor pricing across popular routes and set alerts for competitor press releases about fleet expansions or new partnerships. This systematic approach transforms raw data into actionable insights that inform your strategic decisions.

Monitor Strategic Partnerships and Market-Specific Promotions

Monitoring strategic partnerships and market-specific promotions is essential for understanding how competitors target new customer segments and enter emerging markets. These moves often reveal long-term strategies that can impact your market share and revenue streams.

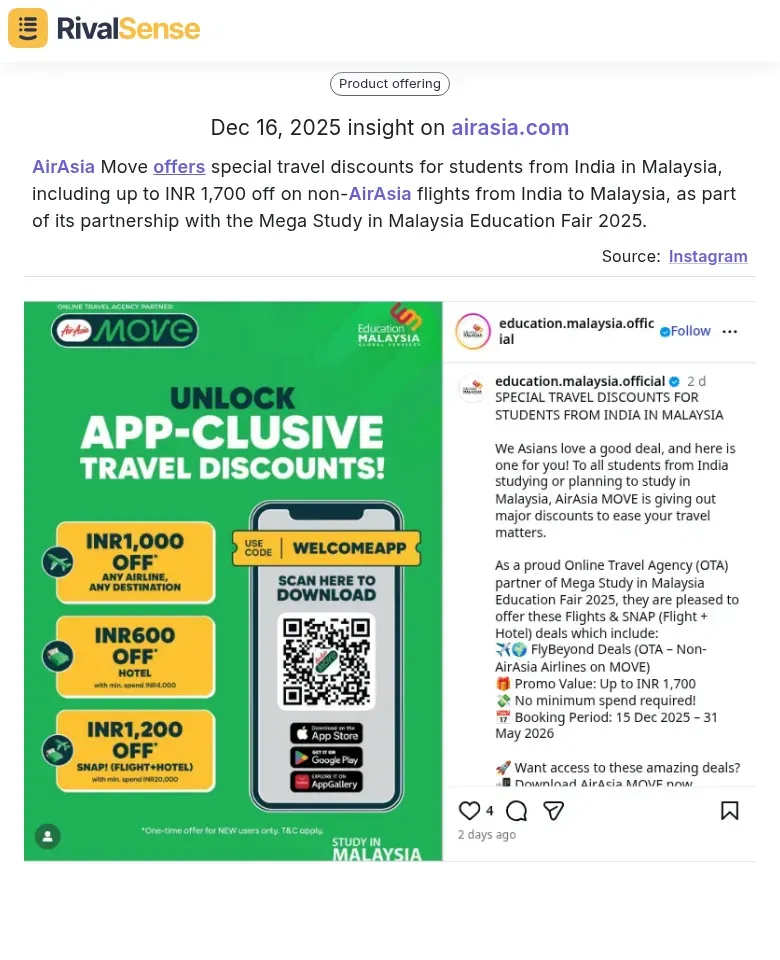

For instance, tracking educational partnerships can show how airlines are cultivating future loyal customers. When AirAsia Move offers special travel discounts for students from India in Malaysia, including up to INR 1,700 off on non-AirAsia flights, as part of its partnership with the Mega Study in Malaysia Education Fair 2025, it signals a targeted approach to capture the student travel market.

Why this insight matters: Such partnership announcements are valuable for business strategy as they highlight cross-industry collaborations and niche market targeting, allowing you to anticipate demand shifts and adjust your own promotional campaigns.

AirAsia's approach demonstrates three key areas to monitor:

-

Educational Partnerships & Student Promotions: Track back-to-school campaigns like AirAsia MOVE's 15% discount program for students traveling to Visayas and Mindanao. This reveals how airlines target new customer segments through educational initiatives. Practical tip: Set up alerts for "student discount," "back-to-school," and "educational partnership" mentions across competitor websites and social media.

-

Regional Market Entry Strategies: Analyze targeted discount campaigns in specific regions. AirAsia's Philippines-focused promotion signals strategic market penetration. Create a checklist: Monitor route-specific promotions, track frequency of regional campaigns, and analyze pricing patterns in emerging markets.

-

Cross-Industry Collaborations: Watch for partnerships beyond aviation. AirAsia's ecosystem includes logistics (Teleport), finance (BigPay), food delivery, and hotel bookings. Actionable step: Maintain a partnership tracker spreadsheet with columns for partner type, announcement date, target market, and strategic objective.

Key monitoring tools: Use competitor tracking software to capture partnership announcements, analyze promotional patterns, and identify emerging market focus areas. Set up Google Alerts for competitor names plus "partnership," "collaboration," and "promotion" keywords. Review quarterly earnings calls for partnership strategy discussions.

Track Geographic Expansion and Hub Development Plans

Tracking geographic expansion and hub development plans is crucial for anticipating market shifts and positioning your airline accordingly. Understanding where competitors are investing can help you identify growth opportunities and potential threats before they materialize.

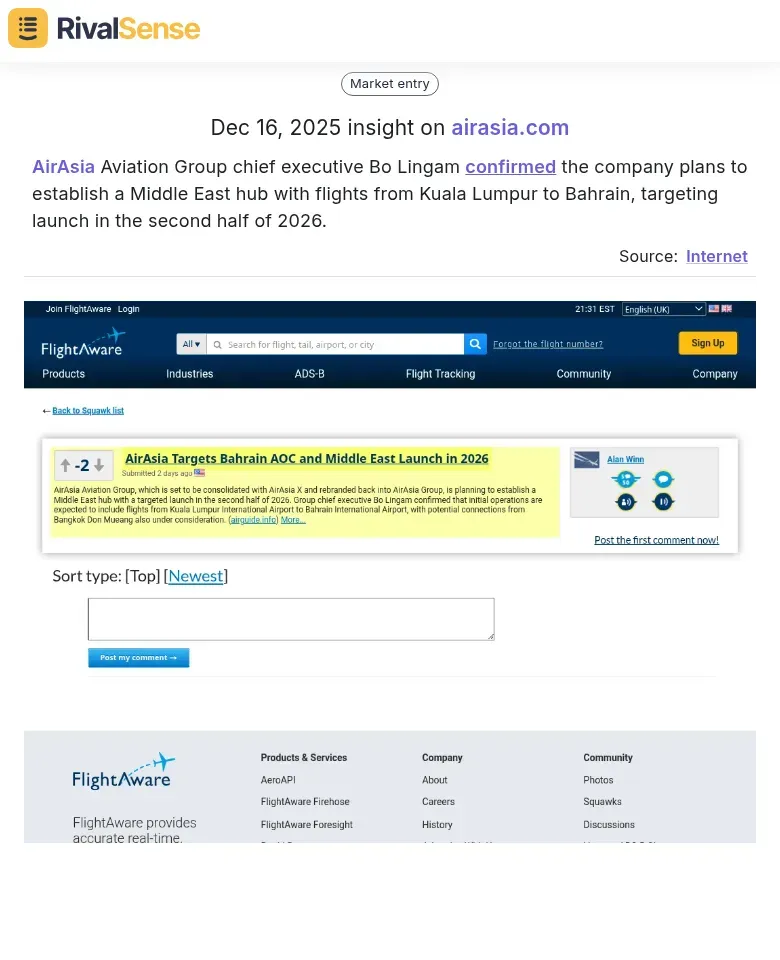

For example, when AirAsia Aviation Group chief executive Bo Lingam confirms plans to establish a Middle East hub with flights from Kuala Lumpur to Bahrain, targeting launch in the second half of 2026, it reveals strategic intent to tap into new regional markets.

Why this insight matters: Executive announcements about hub development are valuable for business strategy as they provide early warnings of long-term expansion plans, enabling you to adjust your own network strategy and prepare competitive responses.

To effectively track geographic expansion and hub development plans, implement these practical steps:

-

Monitor Announcement Channels: Set up alerts for airline press releases, regulatory filings, and airport authority announcements. AirAsia's expansion into new markets like Vietnam or India often starts with formal announcements before operational launch.

-

Analyze Timing Patterns: Track when competitors enter new markets relative to peak seasons or economic cycles. For example, if a rival launches Bali routes just before high season, they're targeting immediate revenue capture. Document these patterns to predict future moves.

-

Track Executive Commentary: Systematically review CEO interviews, investor presentations, and industry conference speeches. When AirAsia's CEO discusses "strategic hubs in ASEAN," map potential locations against your own expansion plans.

-

Create a Geographic Expansion Tracker: Build a simple spreadsheet with columns for: Target Market, Announcement Date, Expected Launch, Competitive Advantage Window (3-6 months typically), and Your Response Plan. Update weekly.

-

Watch Secondary Indicators: Monitor aircraft orders, pilot hiring in new regions, and airport slot acquisitions - these often precede formal announcements by months.

Practical tip: Assign team members specific regions to track, and hold monthly "expansion intelligence" meetings to connect dots between seemingly isolated announcements.

Analyze Route Network Development and Frequency Changes

Analyzing route network development and frequency changes provides direct insights into competitor priorities and market confidence. New routes and adjusted frequencies often indicate where airlines see growth potential or are responding to competitive pressures.

Take, for instance, AirAsia X launching direct flights to Samarkand three times a week. This move not only opens a new travel corridor but also signals confidence in demand from Central Asia.

Why this insight matters: Route launch announcements are valuable for business strategy as they reveal immediate operational changes that can affect market share on specific corridors, allowing you to quickly assess competitive threats and opportunities.

Practical Checklist for Route Analysis:

- Use Schedule Analysers: Tools like OAG Schedules Analyser or Cirium SRS Analyser weekly to detect new route filings.

- Set Frequency Alerts: Create alerts for frequency changes (+/- 20% threshold) on your core routes.

- Map Seasonal Patterns: Analyze how rivals adjust flights during different seasons, like Bali routes during monsoon vs. peak seasons.

- Benchmark Historical Data: Compare current frequencies with pre-pandemic levels to understand recovery and growth trends.

- Identify Hub Strengthening: Monitor increased frequencies from competitor hubs indicating network consolidation.

Pro Tip: Analyze frequency changes alongside aircraft type upgrades—switching from A320 to A321 on the same route indicates capacity growth without frequency increases. Seasonal route suspensions (like AirAsia's winter-only routes to ski destinations) reveal niche market testing before permanent commitment.

Build Your Airline Competitive Intelligence Framework

Building an effective airline competitive intelligence framework requires systematic monitoring and analysis to transform data into strategic insights. Without a structured approach, competitor tracking can become overwhelming and fail to deliver actionable value.

Start by establishing systematic monitoring of competitor announcements and executive statements. Set up Google Alerts for key competitors like AirAsia, and monitor their press releases, investor relations pages, and executive social media accounts. Track CEO statements for strategic direction hints.

Actionable Steps to Build Your Framework:

- Set Up Automated Alerts: Create specific alerts for route changes, pricing strategies, and partnership developments. Use flight tracking tools to monitor new routes and frequency changes.

- Monitor Pricing: Set price monitoring for key routes to identify pricing patterns and competitive responses.

- Watch for Partnerships: Track codeshare agreements, loyalty program partnerships, and alliance developments that could shift market dynamics.

- Develop Analysis Frameworks: Connect individual insights into strategic patterns. Create a monthly competitive intelligence dashboard that tracks:

- Route network changes

- Pricing trends on key corridors

- Capacity adjustments

- Partnership developments

- Marketing campaign themes

- Use SWOT Analysis: Regularly assess competitor strengths, weaknesses, opportunities, and threats to inform your own strategy.

Practical Checklist for Ongoing Intelligence:

- [ ] Set up automated alerts for 5-10 key competitors

- [ ] Create a centralized intelligence repository

- [ ] Schedule weekly review of competitor announcements

- [ ] Track pricing on 3-5 strategic routes monthly

- [ ] Monitor partnership announcements quarterly

- [ ] Update competitive positioning maps quarterly

- [ ] Share insights with revenue management and network planning teams

Tip: Focus on actionable intelligence—prioritize insights that can inform your own route planning, pricing strategies, and partnership decisions.

Conclusion: Implementing Your Airline Competitive Intelligence Program

Implementing your airline competitive intelligence program effectively requires integration into daily operations and strategic decision-making. It's not just about collecting data but using it to drive business outcomes.

Start by integrating competitor insights directly into strategic planning. Create a monthly review process where leadership teams analyze key competitor moves—like AirAsia's route expansions or pricing strategies—and adjust your own tactics accordingly. Establish a quarterly competitive intelligence dashboard that tracks metrics such as market share changes, pricing trends, and customer sentiment shifts.

Steps for Implementation:

- Set Review Cycles: Weekly for tactical moves (e.g., promotions), monthly for strategic analysis, and quarterly for deep dives into market positioning.

- Assign Ownership: Marketing for brand moves, operations for route changes—to ensure accountability.

- Use Automation Tools: Leverage platforms like RivalSense to automate tracking of rivals' digital footprints, from social media campaigns to website updates, delivering insights in weekly email reports.

Measure Impact: Link intelligence to business outcomes. Track how insights influence decisions: Did adjusting fares based on competitor data boost revenue? Did route optimization from market analysis improve load factors? Set KPIs like revenue growth from competitive moves or customer acquisition cost reductions.

Ready to take your competitive intelligence to the next level? Try out RivalSense for free at https://rivalsense.co/ to automate competitor tracking and get your first competitor report today. Stay ahead in turbulent skies by turning competitor moves into your strategic advantage.

📚 Read more

👉 How to Analyze Competitor Partnerships and Client Relationships for Strategic Insights

👉 Decoding Competitor Moves: A Real-World Analysis of Better Stack's Updates

👉 The Ultimate Guide to Competitive Pricing Analysis: Unlocking Benefits and Implementation for 2026

👉 Key Account Health Dashboard Case Study: Influencer Platform Success

👉 How VSPARTICLE's $1/kg Hydrogen Breakthrough Forced Competitors to Accelerate