Actionable Step-by-Step Guide to Uncover Banking Competitor Sales Tactics

In today's hyper-competitive banking landscape, understanding competitor sales tactics isn't just beneficial—it's essential for survival and growth. Competitive intelligence has evolved from a peripheral function to a core strategic capability, with 76% year-over-year increase in AI adoption within CI teams enabling real-time analysis of massive data volumes. For banking leaders, this means moving beyond traditional product benchmarking to holistic sales tactic analysis that reveals market positioning and uncovers growth opportunities.

Practical tip: Start by tracking competitor pricing strategies, promotional campaigns, and customer acquisition channels through CI tools. Monitor how rivals position their digital offerings versus traditional services, and analyze their cross-selling approaches to existing customers. This shift from reactive tracking to proactive intelligence allows you to anticipate market moves, differentiate your value proposition, and identify untapped customer segments before competitors do.

Analyzing Hiring Patterns and Talent Acquisition Strategies

Analyzing competitor hiring patterns reveals strategic focus areas and future market moves. In 2024, banks like Santander concentrated 100% of senior hires on technology groups, signaling a push into digital banking and fintech. Tracking specialized hiring can uncover expansion into high-growth sectors before public announcements.

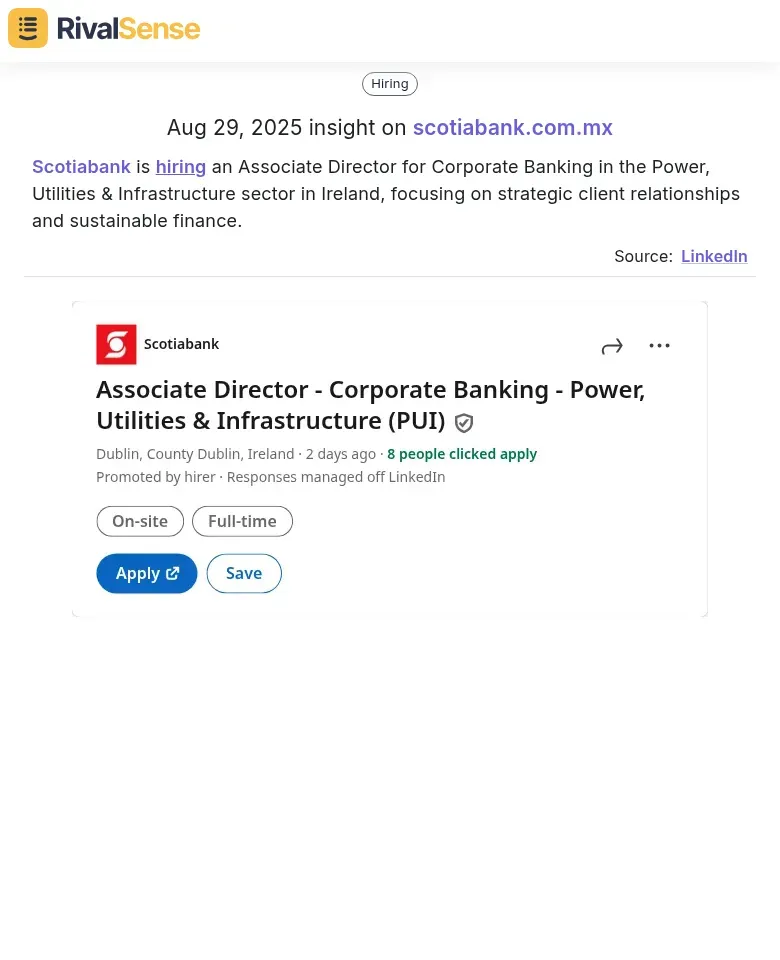

Scotiabank's hiring of an Associate Director for Corporate Banking in the Power, Utilities & Infrastructure sector signals strategic focus on sustainable finance and infrastructure lending in Ireland. This type of insight helps predict market expansion and competitive positioning in emerging sectors.

To uncover these insights:

- Track sector-specific hiring: Monitor job postings for roles in sustainable finance, infrastructure lending, or AI/ML—these indicate expansion into high-growth areas

- Analyze lateral moves and poaching: When top talent moves from competitors, it highlights competitive advantages and potential market shifts

- Predict new offerings: Hiring trends precede market entry—surges in specific roles often mean new service launches

Practical tip: Create a hiring dashboard with key metrics—roles filled, departments expanded, and geographies targeted—to spot trends early and adjust your strategy accordingly.

Decoding Sales Team Structures and Leadership Moves

Decoding your banking competitors' sales team structures and leadership moves provides critical intelligence on their strategic priorities. Executive transitions often signal major strategy shifts, whether toward digital transformation, market expansion, or new service offerings.

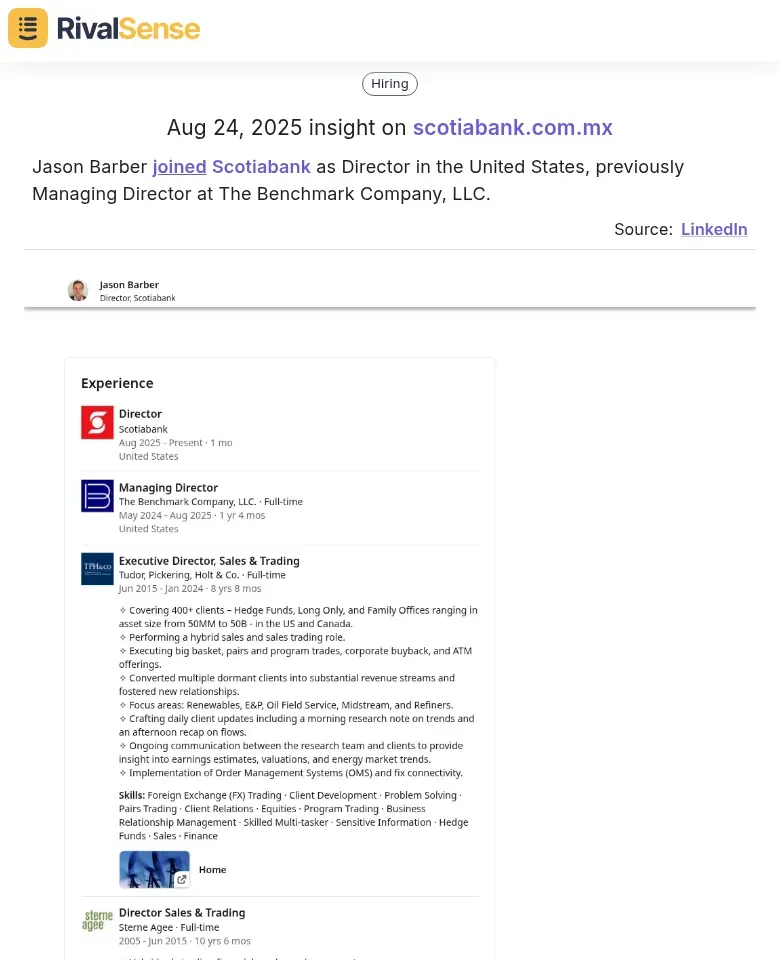

Jason Barber's move to Scotiabank as Director, previously from The Benchmark Company, indicates strategic hiring from specialized financial firms. Leadership changes like this often precede new business initiatives or market focus shifts, making them valuable for anticipating competitor moves.

Start by monitoring executive transitions through LinkedIn, press releases, and financial filings. When a competitor hires a new Chief Revenue Officer from a fintech background, this signals a digital-first sales strategy shift. Track organizational changes like new regional sales teams or specialized units for small business banking - these reveal market expansion priorities.

Practical steps:

- Create a leadership change tracker with columns for name, previous role, background, date of change, and likely impact

- Analyze patterns - multiple hires from consumer banking may indicate retail focus expansion

- Monitor if key account managers follow executives to new roles, indicating potential client migration opportunities

Monitoring Market Expansion and Geographic Strategies

Monitoring regional hiring patterns is a powerful way to uncover competitor market expansion strategies. Track job postings in specific geographic areas to identify where banks are building new teams—this often signals market entry before official announcements. For example, if a competitor suddenly posts multiple roles in Southeast Asia, they're likely expanding there.

Practical steps:

- Use professional networks and job boards to monitor competitor hiring by location

- Set up alerts for key regions you're targeting

- Analyze hiring volume trends over time to spot acceleration

- Focus on roles like "Market Manager" or "Regional Head" for expansion clues

Learn from competitor focus on specific client segments by tracking specialized roles. If they hire wealth management experts in a region, they're targeting high-net-worth clients there. Cross-border expansion becomes visible through international hiring trends—look for compliance officers in new countries, indicating regulatory preparation.

Tip: Create a dashboard to visualize competitor hiring heatmaps by geography and function. This reveals their strategic priorities and helps you anticipate their moves, allowing you to counter or accelerate your own expansion plans accordingly.

Leveraging Competitive Intelligence for Strategic Advantage

Leveraging competitive intelligence transforms reactive banking strategies into proactive market dominance. Start by analyzing competitor sales tactics through win/loss analysis and customer feedback loops. Identify patterns in their pricing models, product bundling, and cross-selling approaches.

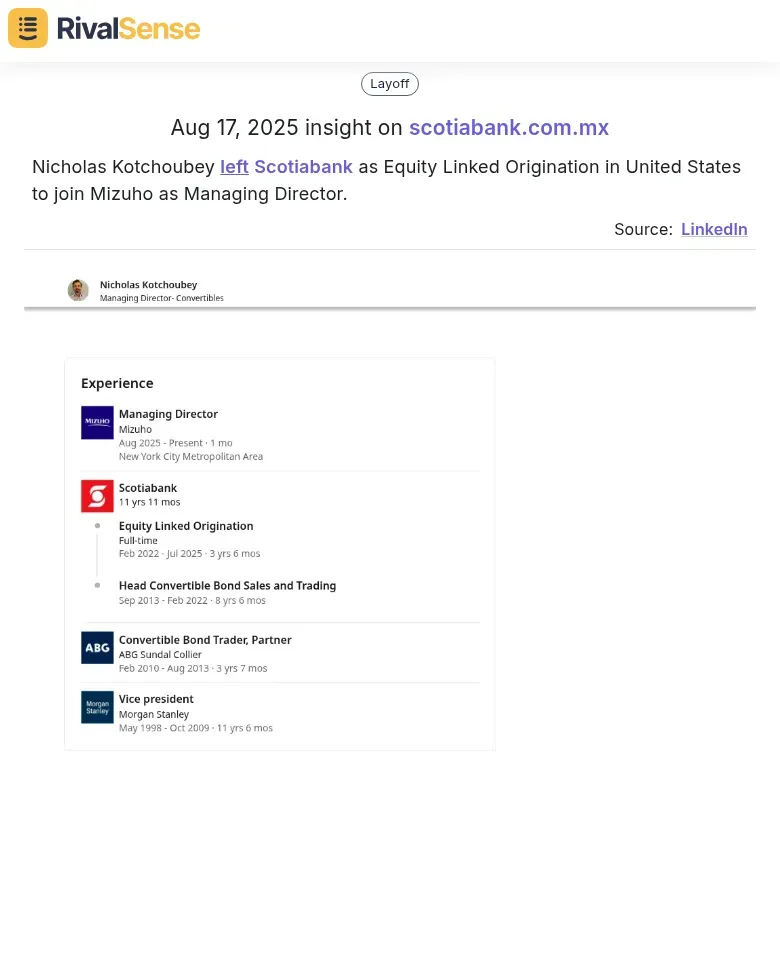

Nicholas Kotchoubey's departure from Scotiabank to join Mizuho as Managing Director highlights the importance of tracking key personnel movements. Such departures can signal internal challenges or create opportunities to acquire talent with specific expertise, while also indicating competitor strengthening in certain areas.

For example, if competitors offer free financial planning with premium accounts, develop counter-strategies like enhanced digital tools or personalized advisory services. Optimize talent strategies by monitoring competitor job postings and employee reviews to understand compensation benchmarks and workplace benefits.

Establish continuous monitoring with these steps:

- Set up alerts for competitor website changes, pricing updates, and social media activity

- Create a centralized dashboard tracking key metrics: market share movements, customer sentiment shifts, and regulatory compliance updates

- Schedule weekly intelligence briefings to ensure strategic decisions are data-driven and timely

Put These Insights Into Action

Tracking competitor movements manually can be overwhelming, especially with the volume of data available. Tools like RivalSense automate this process by monitoring competitor product launches, pricing updates, hiring patterns, leadership changes, and market expansions across multiple data sources.

RivalSense delivers comprehensive weekly reports that include:

- 🎯 Product launches and updates

- 💰 Pricing strategy changes

- 👥 Key hiring and leadership moves

- 🌍 Market expansion signals

- 🤝 Partnership announcements

- 📰 Media coverage and regulatory updates

Ready to gain actionable competitive intelligence? Try RivalSense for free and get your first competitor report today to start uncovering valuable insights that drive your banking strategy forward.

📚 Read more

👉 How Tracking Competitor Production Shifts Can Reveal Market Opportunities

👉 Key Account KPIs Tracking: The Ultimate 2025 Guide for Strategic Growth

👉 5 Advanced HR Consulting Tactics to Transform Key Account Decision-Making