Actionable Competitive Intelligence for Gaming: Track Competitor Keywords to Stay Ahead

In the hyper-competitive gaming industry, keyword tracking isn't just about SEO—it's your strategic radar for competitor intelligence. By monitoring your rivals' keyword strategies, you gain unprecedented visibility into their market positioning, content priorities, and upcoming moves. This approach transforms raw data into actionable insights, helping you anticipate shifts before they impact your market share.

Practical Steps to Get Started:

- Identify 3-5 key competitors and track their top 50 ranking keywords monthly.

- Monitor keyword shifts around major industry events (E3, Gamescom, GDC).

- Set up alerts for competitor brand + product launch keywords (e.g., "[Competitor] new game 2026").

- Analyze keyword difficulty changes to spot emerging competitive threats.

Keyword intelligence reveals competitor strategies through their content focus—are they targeting "mobile RPG games" or shifting to "cloud gaming platforms"? This data shows market positioning shifts before they become obvious. The most valuable insight? Keyword tracking often predicts product launches 3-6 months in advance. When competitors start ranking for new game genres, platforms, or technology keywords, they're signaling their development roadmap.

Early warning signals come from keyword analysis: when competitors drop keywords they previously dominated, they're likely pivoting. When they aggressively target your core keywords, they're coming for your market share. Track these movements weekly to stay ahead.

Quick Checklist:

- [ ] Monitor competitor keyword rankings weekly.

- [ ] Analyze keyword intent changes (informational → transactional).

- [ ] Track seasonal keyword patterns in gaming.

- [ ] Set up competitive keyword gap analysis quarterly.

Strategic Talent Acquisition Insights Through Keyword Monitoring

Tracking competitor hiring patterns reveals strategic focus areas and skill gaps. By monitoring job postings for keywords like "AI/ML engineer," "blockchain developer," or "metaverse specialist," you can identify emerging priorities before they become public. For instance, if a rival suddenly posts multiple roles for "Unity3D developers" and "VR experience designers," they're likely expanding into immersive gaming. This intelligence helps you align your talent strategy with market trends.

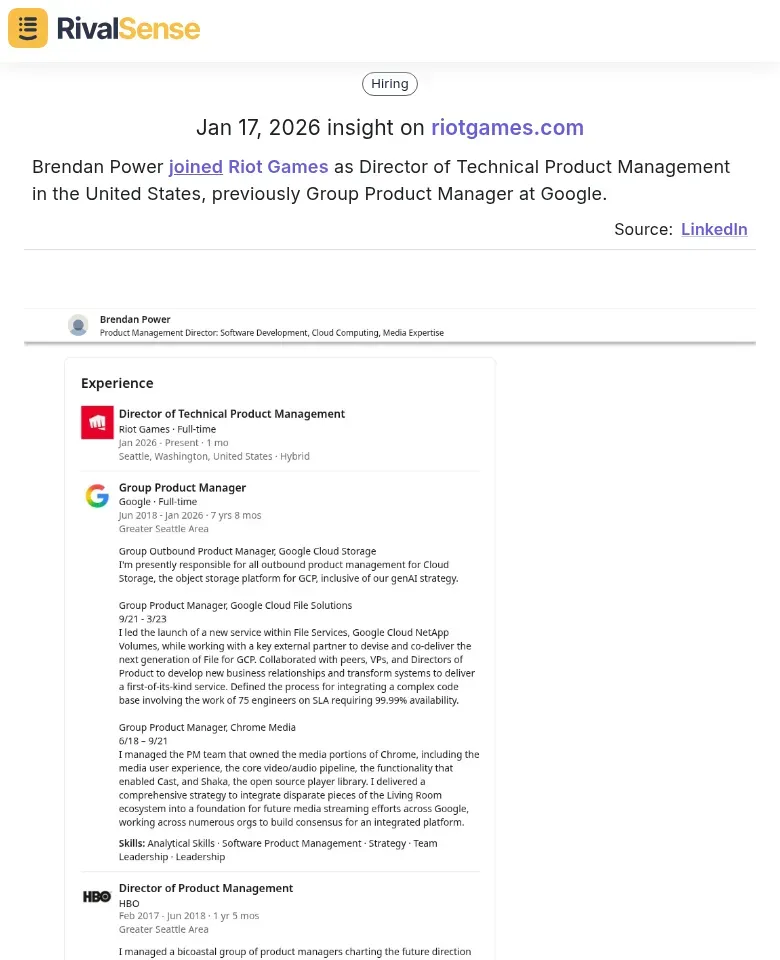

Beyond keywords, direct tracking of management changes can provide deep insights into strategic shifts. For example, RivalSense recently detected that Brendan Power joined Riot Games as Director of Technical Product Management, previously at Google.

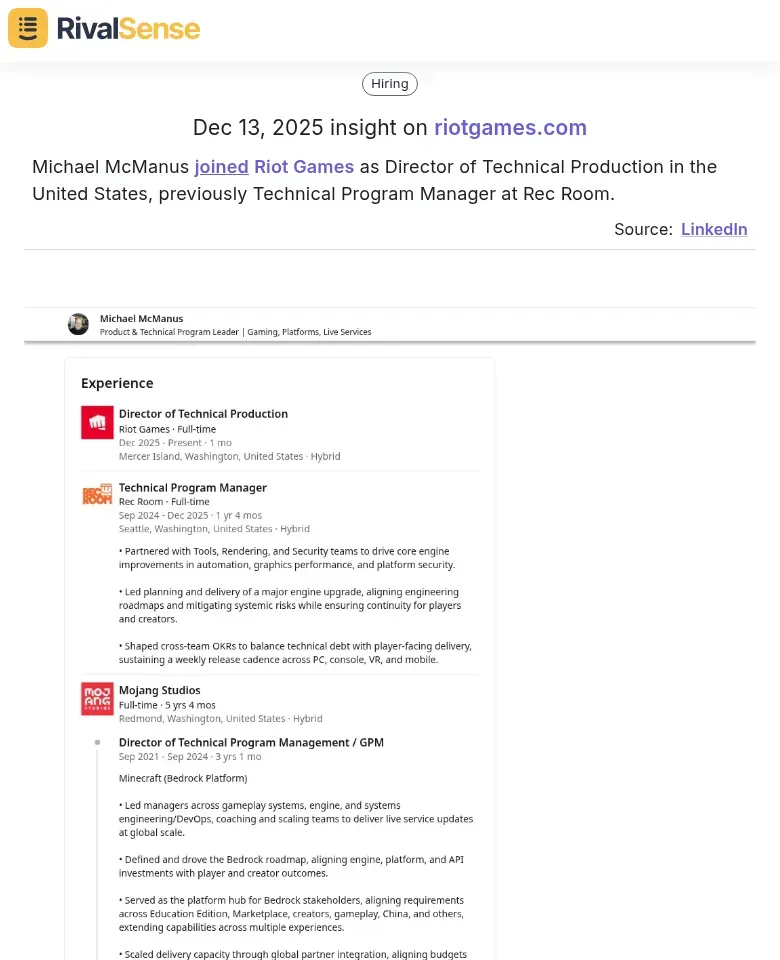

Such insights into key hires are valuable because they indicate investments in specific areas—here, technical product management might signal enhanced focus on product innovation or scaling live services. Similarly, Michael McManus joined Riot Games as Director of Technical Production, from Rec Room.

Tracking these management changes helps predict organizational priorities, such as strengthening production pipelines or exploring new gaming formats, giving you a head start in adjusting your own strategies.

Practical Steps:

- Set up alerts for competitor job postings using tools like RivalSense.

- Categorize keywords by department (engineering, design, marketing).

- Track frequency changes over time to spot trends.

- Compare your talent acquisition keywords against industry leaders.

- Identify gaps where you need to recruit or upskill.

Use keyword intelligence to benchmark talent acquisition strategies. If top studios consistently hire for "data analytics" and "player retention," prioritize these areas. This approach transforms hiring data into predictive intelligence, helping you anticipate market shifts before they happen.

Product Launch Intelligence: Decoding Competitor Roadmaps Through Keywords

Keyword tracking reveals competitor product roadmaps months before official announcements. Monitor keyword shifts like sudden increases in "cross-platform," "cloud gaming," or "VR integration" terms to anticipate competitor release schedules and platform strategies. For example, when a major studio starts heavily targeting "mobile port" keywords, they're likely preparing a console-to-mobile expansion. This proactive insight allows you to time your launches or marketing campaigns effectively.

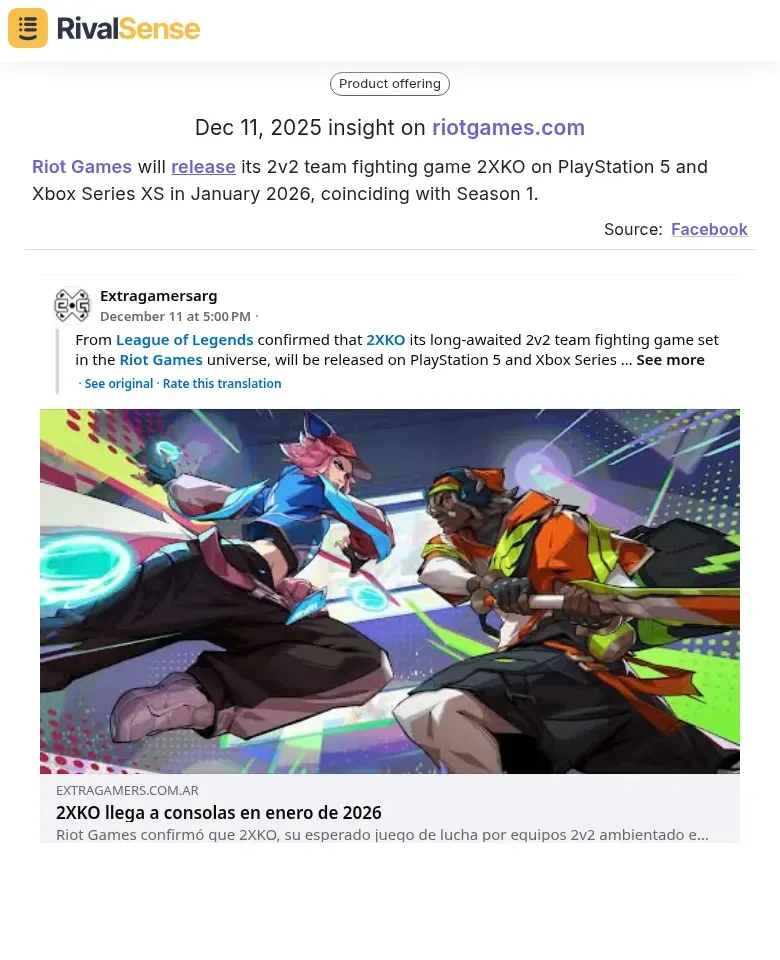

Direct product launch announcements are equally critical. RivalSense captured that Riot Games will release its 2v2 team fighting game 2XKO on PlayStation 5 and Xbox Series X|S in January 2026, coinciding with Season 1.

Tracking such product launches is invaluable for business strategy as it helps you anticipate market movements, assess competitive threats, and identify opportunities for differentiation or partnership. By knowing when and what competitors are launching, you can plan your resource allocation and promotional efforts accordingly.

Practical Steps:

- Set up keyword monitoring for 5-10 competitor brands plus industry terms.

- Track seasonal patterns—gaming keywords spike before major events (E3, Gamescom, holiday seasons).

- Create alerts for sudden keyword volume increases (50%+ month-over-month).

- Analyze keyword gaps where competitors aren't targeting but search volume exists.

Seasonal keyword analysis reveals optimal launch timing. Gaming searches peak September-November (holiday season) and March-May (post-tax refund spending). Launch your competitive titles 2-3 weeks before these peaks to capture early buzz.

Identify untapped opportunities through keyword gaps. If competitors focus on "battle royale" and "MMO" keywords but ignore "cozy gaming" or "narrative-driven" terms with growing search volume, you've found a market opening. Track emerging genre keywords like "soulslike" or "roguelite" before they become saturated.

Checklist:

- [ ] Monitor competitor trademark filings alongside keyword changes.

- [ ] Track platform-specific keyword adoption (Switch, PlayStation, Xbox, PC).

- [ ] Analyze keyword difficulty vs. search volume for opportunity assessment.

- [ ] Set quarterly keyword strategy reviews to adjust to market shifts.

Pro tip: Combine keyword data with job posting analysis—when competitors hire for specific platform expertise (mobile, VR, cloud), expect corresponding keyword strategy shifts within 3-6 months.

Actionable Keyword Tracking Framework for Gaming Companies

Building an actionable keyword tracking framework starts with establishing a real-time monitoring system using tools like SEMrush, Ahrefs, or RivalSense. Set up automated alerts for competitor keyword movements, new ranking positions, and emerging search trends. Create a centralized dashboard tracking 50-100 core gaming keywords across your top 5 competitors. This framework ensures you're always informed and ready to act on competitive intelligence.

Categorize competitor keywords by intent:

- Informational ("how to play Valorant", "game mechanics guide") - indicates market education stage.

- Commercial ("best FPS games 2025", "top mobile RPGs") - shows comparison shopping behavior.

- Navigational ("Steam store", "Epic Games login") - reveals brand strength and direct traffic patterns.

Establish performance metrics to measure competitive positioning:

- Keyword Share of Voice: Percentage of target keywords where you rank vs. competitors.

- Ranking Velocity: Speed of keyword position changes over time.

- Intent Distribution: Ratio of informational vs. commercial keywords dominated.

- Gap Analysis: Identify keywords competitors rank for but you don't.

Practical Checklist:

- Audit competitor keyword portfolios monthly.

- Track ranking fluctuations weekly.

- Analyze SERP feature ownership (featured snippets, video carousels).

- Monitor local keyword variations by region.

- Set up alerts for competitor content targeting new keywords.

Pro tip: Gaming companies should prioritize tracking keywords around new game releases, seasonal events, and emerging genres to anticipate market shifts before they happen.

Turning Keyword Data into Strategic Gaming Industry Decisions

Turning keyword data into strategic decisions requires a systematic approach. Start by categorizing competitor keywords into three buckets: 1) Core gameplay features (e.g., "procedural generation RPG," "AI-driven NPCs"), 2) Monetization terms ("battle pass system," "cosmetic-only monetization"), and 3) Community engagement ("modding support," "cross-platform progression"). This categorization helps align insights with specific business functions, from product development to marketing.

For product development, prioritize features based on search volume-to-competition ratio. If competitors rank for "cloud save sync" with high volume but low competition, accelerate this feature. Create a quarterly keyword roadmap that maps search trends to your development sprints. In marketing, analyze competitor keyword clusters to identify content gaps. If rivals dominate "mobile RPG beginner guides" but ignore "advanced combat mechanics," create comprehensive tutorials targeting experienced players.

For partnerships, identify keyword gaps where neither you nor competitors rank. Terms like "educational gaming partnerships" or "corporate team-building games" reveal untapped B2B opportunities. Create a partnership matrix: high search volume + low competition = immediate outreach targets.

Practical Checklist:

- Weekly keyword gap analysis.

- Monthly competitor content audit.

- Quarterly partnership opportunity review.

- Real-time trend monitoring for rapid response.

Remember: In 2026's attention economy, keyword intelligence isn't just marketing—it's your strategic compass for navigating gaming's hyper-competitive landscape.

Advanced Competitive Intelligence: Beyond Basic Keyword Tracking

Advanced competitive intelligence moves beyond basic keyword tracking by integrating multiple data streams for holistic analysis. Start by combining keyword data with social media mentions, funding announcements, job postings, and product updates to create a comprehensive competitor profile. For example, if a rival suddenly increases bids on "mobile gaming monetization" keywords while simultaneously hiring mobile ad specialists, they're likely launching a new monetization strategy. This integrated view prevents blind spots and enhances prediction accuracy.

Develop predictive models by analyzing keyword trend patterns over time. Track seasonal keyword spikes, correlate keyword investments with product launches, and identify emerging keyword clusters before they become mainstream. Create a simple scoring system: assign weights to keyword volume growth, bid increases, and new keyword adoption to forecast competitor priorities. This proactive approach allows you to stay ahead of the curve rather than reacting to market changes.

Implement Automated Alert Systems with These Practical Steps:

- Set up real-time monitoring for sudden keyword bid changes (+20% threshold).

- Create alerts for new high-value keyword adoption in your category.

- Monitor competitor keyword expansion into adjacent gaming genres.

- Track keyword cannibalization patterns within competitor portfolios.

Use this integrated approach to anticipate competitor moves weeks before they materialize in the market, enabling proactive strategy adjustments rather than reactive responses.

Put Your Competitive Intelligence into Action

Keyword tracking and broader competitive intelligence are essential for staying ahead in the gaming industry. By monitoring keywords, management changes, product launches, and more, you can decode competitor strategies and identify opportunities. However, manually tracking all these signals can be overwhelming.

That's where RivalSense comes in. It tracks competitor product launches and updates, pricing changes, event participations, partnerships, regulatory aspects, management changes, and media mentions across company websites, social media, and various registries. All this intelligence is delivered in a weekly email report, saving you time and providing actionable insights.

Ready to elevate your competitive strategy? Try RivalSense for free today at https://rivalsense.co/ and get your first competitor report to start making smarter, data-driven decisions. Don't wait—get ahead of the competition now!

📚 Read more

👉 Step-by-Step Guide: Uncover Competitor Event Strategies for Enterprise Key Accounts

👉 Analyzing Competitor Advertising Launches: Lessons from Uber Advertising's New Format

👉 Key Account Tracking Best Practices: The 2026 Strategic Guide for Business Leaders

👉 Mastering Key Account Management: A Practical Implementation Guide for B2B Leaders

👉 How IDnow's Regulatory Hire Enabled Competitors to Counter EU Wallet Strategy