5 Common Mistakes in Tracking Competitor Breaches in Ride-Hailing

In the fast-paced world of ride-hailing, staying ahead of competitors requires constant vigilance. Tracking competitor breaches—whether service disruptions, PR mishaps, or strategic shifts—provides critical intelligence for seizing opportunities. Many companies stumble by making avoidable errors that obscure valuable insights. By understanding these pitfalls, you can transform competitor monitoring into a growth accelerator.

Why Track Competitor Breaches?

- 🚀 Strategic Advantage: Identify service gaps to position your brand as the reliable alternative.

- 🤝 Customer Trust: Learn from others' mistakes to proactively fortify your operations.

- 📊 Market Positioning: Use breaches as benchmarks to elevate your service standards.

The 5 Critical Mistakes:

- Overlooking strategic collaborations

- Ignoring key executive movements

- Underestimating promotional campaigns

- Failing to adapt to market trends

- Neglecting real-time monitoring

Let’s dissect each to build your competitive edge.

Overlooking Strategic Collaborations

Partnerships between ride-hailing players can reshape markets overnight, yet many dismiss them as background noise. These alliances often signal pricing shifts, service expansions, or tech integrations that directly threaten your market share. For instance, collaborations can enable competitors to bundle services or enter new regions faster than solo players.

Example: inDrive exploring a partnership with nordmotion to offer Nigerians luxury rides at affordable rates. Monitoring such moves reveals pricing innovations and geographic priorities.

Why this matters: Collaborations expose competitor growth tactics and unmet customer needs. Spotting them early lets you counter with alliances or differentiated offerings.

Action Plan:

- 🔔 Set automated alerts for partnership announcements

- 📈 Analyze how collaborations affect pricing/service models

- 💡 Identify gaps (e.g., premium ride demand) to inform your strategy

✅ Pro Tip: Track indirect competitors too—their alliances might unlock unexpected threats or opportunities.

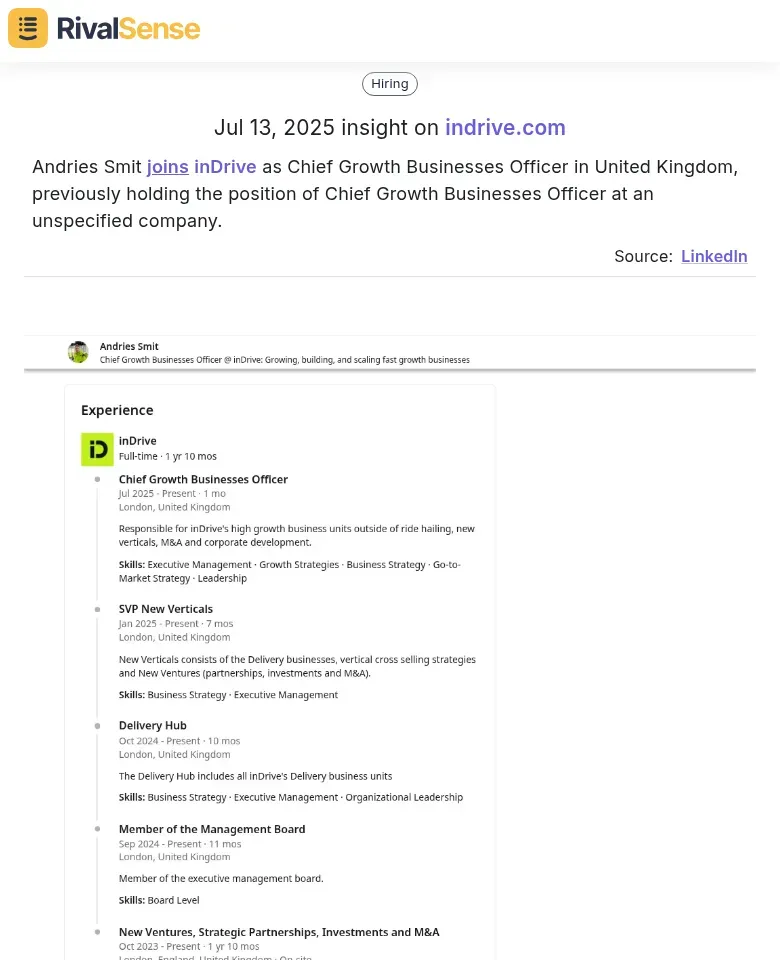

Ignoring Key Executive Movements

Leadership changes are rarely just HR updates—they’re strategic chess moves. A new executive often brings fresh priorities, like market expansions or tech overhauls, that reshape competitive dynamics. Overlooking these shifts leaves you reacting instead of anticipating.

Example: Andries Smit’s appointment as Chief Growth Officer at inDrive hinted at aggressive scaling plans. His background in growth roles signals potential market pivots.

Why this matters: Executive hires reveal competitor focus areas (e.g., AI, international markets), letting you preempt their next play.

3-Step Monitoring Framework:

- Identify pivotal roles (CEO/CTO/CMO) at top competitors

- Cross-reference hires with product/funding news for patterns

- Forecast impacts (e.g., a tech-heavy hire → autonomous vehicle push)

✅ Pro Tip: Use LinkedIn alerts combined with regulatory filings for real-time tracking.

Underestimating Promotional Campaigns

Discounts or cash rewards might seem temporary, but they reveal competitor priorities like customer retention or market penetration. Ignoring these signals blindsides you to shifting customer expectations and acquisition tactics.

Example: inDrive’s Peru campaign rewarded users with cash via Yape—highlighting their focus on first-time user conversion and local payment integrations.

Why this matters: Campaigns expose competitor resource allocation and market tests, helping you refine your promotions.

Battle-Tested Response Tactics:

- 🎯 Benchmark campaign performance (e.g., app store reviews/social engagement)

- 🔄 A/B test counter-offers (e.g., match rewards in target regions)

- 📊 Analyze if campaigns indicate long-term strategy shifts (e.g., loyalty programs)

✅ Pro Tip: Monitor social sentiment daily—campaign backlash often surfaces there first.

Failing to Adapt to Market Trends

Ride-hailing evolves rapidly—think eco-friendly fleets or luxury tiers. Companies that dismiss trends as fads lose ground to agile rivals. Competitor innovations signal where customer expectations are headed, making trend analysis non-negotiable.

Critical Trend Indicators:

- 🚗 New vehicle tiers (e.g., budget vs. premium)

- 💰 Dynamic pricing experiments

- 🌱 Sustainability initiatives (e.g., EV partnerships)

Adaptation Framework:

- Map competitor feature launches to customer feedback

- Pilot small-scale tests (e.g., luxury rides in one city)

- Integrate trends without compromising core values

✅ Pro Tip: Assign a team member to compile weekly trend reports from competitor apps/news.

Neglecting Real-Time Monitoring

Manual checks miss time-sensitive breaches like flash sales or regulatory filings. Delayed insights create costly gaps, letting competitors capture market momentum while you play catch-up.

Consequences of Delay:

- 🚫 Missed partnership countermoves

- 📉 Lagging behind pricing shifts

- ⚖️ Unpreparedness for regulatory changes

Automation Fixes:

- ⏰ Use AI tools to track websites/social media/registries

- 📧 Get digestible weekly reports (e.g., service disruptions or license updates)

- 🚨 Set alerts for urgent breaches (e.g., safety incidents)

✅ Pro Tip: Prioritize alerts by impact level—not every update needs immediate action.

Conclusion: Build Your Competitive Shield

Tracking competitor breaches isn’t about paranoia—it’s about proactive growth. Avoid these 5 mistakes: overlooking collaborations, ignoring executives, underestimating campaigns, resisting trends, and relying on manual checks. Instead:

- 🛠️ Automate monitoring to capture real-time insights

- 📆 Schedule weekly reviews to connect dots (e.g., hires + product launches)

- 🎯 Act swiftly—convert competitor missteps into your opportunities

Ready to transform guesswork into strategy? Try RivalSense free to automatically track competitor product launches, pricing changes, executive moves, and campaigns—delivered in a weekly email. Get your first competitor report today and stay steps ahead!

📚 Read more

👉 Strategic Competitor Insights: Mastering Partnerships & Client Intelligence

👉 Apify's LinkedIn Scraper Update: Strategic Implications and Action Steps

👉 Competitor Customer Acquisition Analysis: A Practical Guide for Business Leaders

👉 B2B Dropshipping: Crisis Response Tactics from Top Competitors