Workflow Breakdown: Market Research for Auto Glass Leaders

Market research forms the backbone of competitiveness in the auto glass sector, providing actionable insights into customer preferences, emerging trends, and rival strategies. By systematically analyzing the market landscape, leaders can make informed decisions that drive innovation and growth. Competitor insights are particularly valuable—studying their pricing models, service gaps, and customer feedback reveals opportunities for differentiation. For instance, if rivals lack mobile repair services, introducing this offering could capture untapped market segments.

To optimize your research workflow:

- 🎯 Define Objectives: Specify goals like identifying new markets or improving customer retention.

- 📊 Gather Data: Utilize tools like RivalSense to track competitors across websites, social media, and registries.

- 🔍 Analyze Insights: Identify patterns in competitor weaknesses (e.g., slow response times).

- 🚀 Implement Strategies: Address gaps through service enhancements or targeted marketing.

- 📈 Monitor Results: Track KPIs like customer acquisition cost monthly.

Pro Tip: Refresh research quarterly using automated alerts for competitor activities to maintain agility.

Analyzing Competitor Hiring Trends for Strategic Insights

Hiring patterns offer a transparent window into competitors' strategic priorities and expansion plans. Roles like 'Head of Reward and Pensions' signal investments in talent retention or benefits innovation, indicating internal restructuring or growth phases. Monitoring these moves helps anticipate market shifts—such as EV glass specialization—before they impact your positioning.

Example: RivalSense detected Autoglass UK seeking a Head of Reward and Pensions. This insight reveals their focus on employee-centric strategies, which could indicate efforts to reduce turnover or enter new markets. Tracking such hires helps benchmark your talent initiatives against industry leaders.

Action Plan:

- 🔔 Set Job-Alerts: Use automated tools to track competitor postings on LinkedIn/Indeed.

- 🧩 Decode Role Significance: Prioritize executive/niche roles signaling major investments.

- 🌍 Map Expansion: Correlate location-specific hires with market entry plans.

- ⚖️ Benchmark: Compare hiring velocity in R&D/service roles against your strategy.

Leveraging Contract Wins to Gauge Market Position

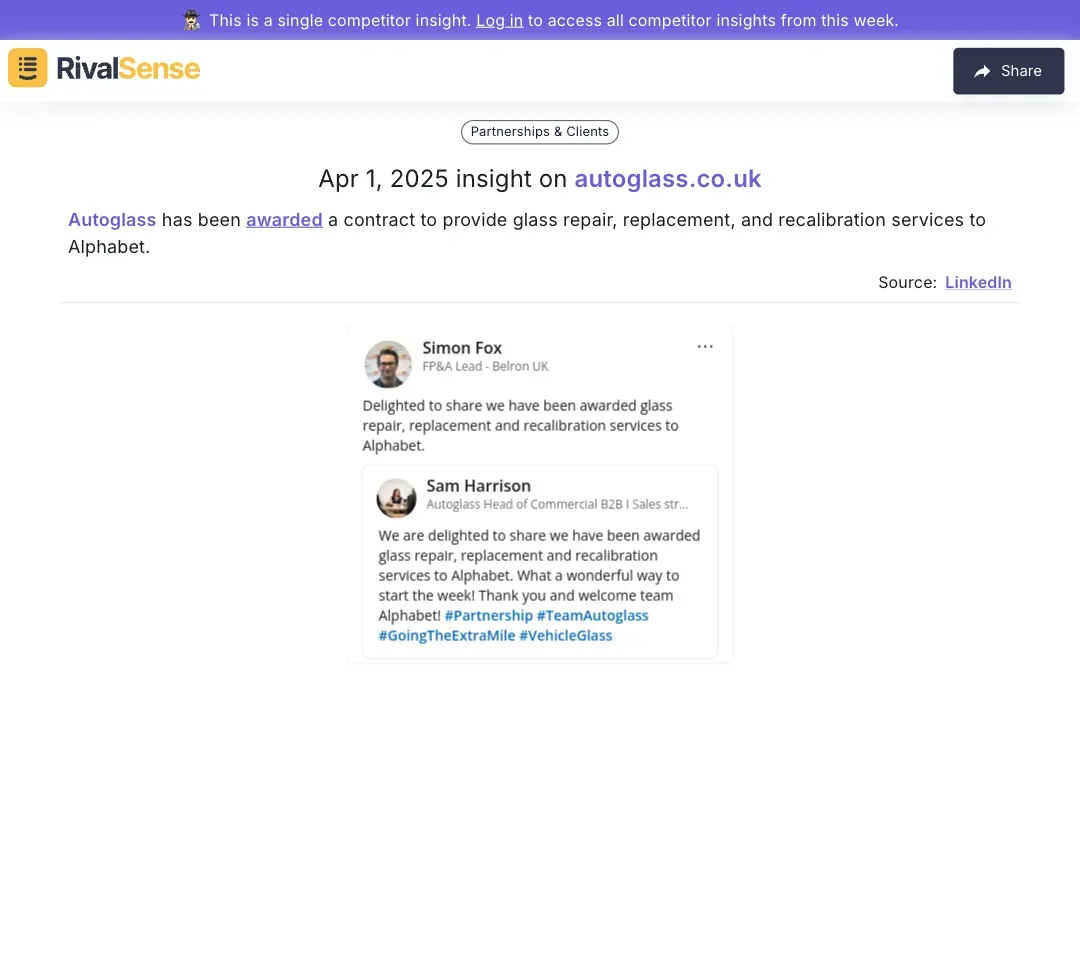

Major contract announcements—like servicing fleet partnerships—signal technological prowess and reliability, directly influencing market perception. Analyzing these wins helps identify industry standards (e.g., recalibration services) and uncovers gaps where your offerings can outperform rivals.

Example: RivalSense captured Autoglass securing a contract with Alphabet for glass repair/recalibration services. Such insights validate their technical capabilities and highlight partnership trends, helping you refine bids for similar clients.

Implementation Checklist:

| Task | Purpose |

|---|---|

| Track contract scope (duration/value) | Assess competitor scalability |

| Analyze service differentiators | Identify your unique selling points |

| Compare client portfolios | Target underserved segments |

| Reverse-engineer bidding tactics | Strengthen proposal strategies |

Legal and Compliance Insights from Competitor Moves

Legal staffing changes often foreshadow regulatory challenges or market entries. Hiring specialized counsel (e.g., environmental law) suggests compliance preparations for new regulations—giving you lead time to adapt proactively.

Example: RivalSense flagged Autoglass recruiting a UK Legal Counsel. This move hints at upcoming compliance needs, allowing you to audit similar risks early.

Tactical Steps:

- 📋 Maintain Legal Watchlists: Monitor hires via registries or PACER.

- ⏱️ Preempt Regulations: If competitors bulk-hire compliance staff, consult your legal team.

- 💡 Analyze Filings: Study public statements for lobbying trends.

Integrating Competitor Insights into Your Business Strategy

Translating raw data into strategy requires systematic collection, prioritization, and cross-departmental alignment. Begin by cataloging competitors using digital tools—focusing on pricing, feature updates, and partnership announcements.

Execution Framework:

1. Collect → Identify rivals via industry reports + social listening

2. Analyze → SWOT matrix highlighting service/pricing gaps

3. Prioritize → Rank insights by revenue impact (e.g., mobile repair demand)

4. Act → Launch targeted campaigns addressing weaknesses

5. Measure → Track customer acquisition cost monthly

Case Study: Syngenta boosted engagement 174% by acting on competitive intelligence—mirroring this, an auto glass firm gained market share after introducing AI-powered quotes when rivals lagged in digital adoption.

Conclusion and Next Steps for Auto Glass Leaders

Proactive market research—fueled by competitor tracking—enables anticipation of trends like EV glass demand or regulatory shifts. Embed these practices into your workflow: assign a team to review insights weekly, update SWOT analyses monthly, and invest in automation to eliminate manual tracking.

Immediate Actions:

- ✅ Subscribe to auto glass industry newsletters

- ✅ Audit competitor service gaps quarterly

- ✅ Train sales teams on rival weaknesses

Accelerate your strategy: Discover how RivalSense simplifies tracking product launches, pricing shifts, and hiring moves. Get your first competitor report today—no credit card needed!

📚 Read more

👉 How Competitor Hiring & Layoffs Reveal Financial Strategies

👉 Decoding Meta's Bangkok Training: Actionable Insights for Competitors

👉 How to Respond When Competitors Restructure: Multitude Case Study

👉 Turning Competitor Pricing Shifts into Your Advantage: The 1Password Case

👉 Decoding Numerade's Flashcard Update: A Competitor Analysis Blueprint