Win-Loss Analysis: Boost Productivity with Financial Competitor Insights

Win-loss analysis is a powerful strategic tool that helps you understand why deals are won or lost, uncovering key customer decision drivers and your position in the competitive landscape. By systematically reviewing feedback from both successful and unsuccessful opportunities, you can identify your strengths, weaknesses, and areas for improvement.

Financial competitor insights, such as revenue trends, pricing changes, and market share data, enhance this analysis by providing a quantitative backdrop. They reveal broader market dynamics, highlight performance gaps, and alert you to emerging trends, allowing for more efficient resource allocation and proactive strategy adjustments.

Here are some practical steps to get started:

- ✅ Conduct regular win-loss interviews immediately after deal decisions.

- ✅ Track competitors' financial metrics using tools like RivalSense.

- ✅ Cross-reference qualitative feedback with market data to spot inconsistencies.

- ✅ Use the combined insights to refine sales pitches and update product roadmaps.

This integrated approach boosts productivity by focusing efforts on high-impact areas, reducing guesswork, and accelerating business growth.

Leveraging Financial Performance Data for Competitive Edge

Financial performance data is a goldmine for gaining a competitive edge. By analyzing metrics like loan portfolio surges or revenue growth, you can spot market expansion opportunities and benchmark your performance against industry leaders.

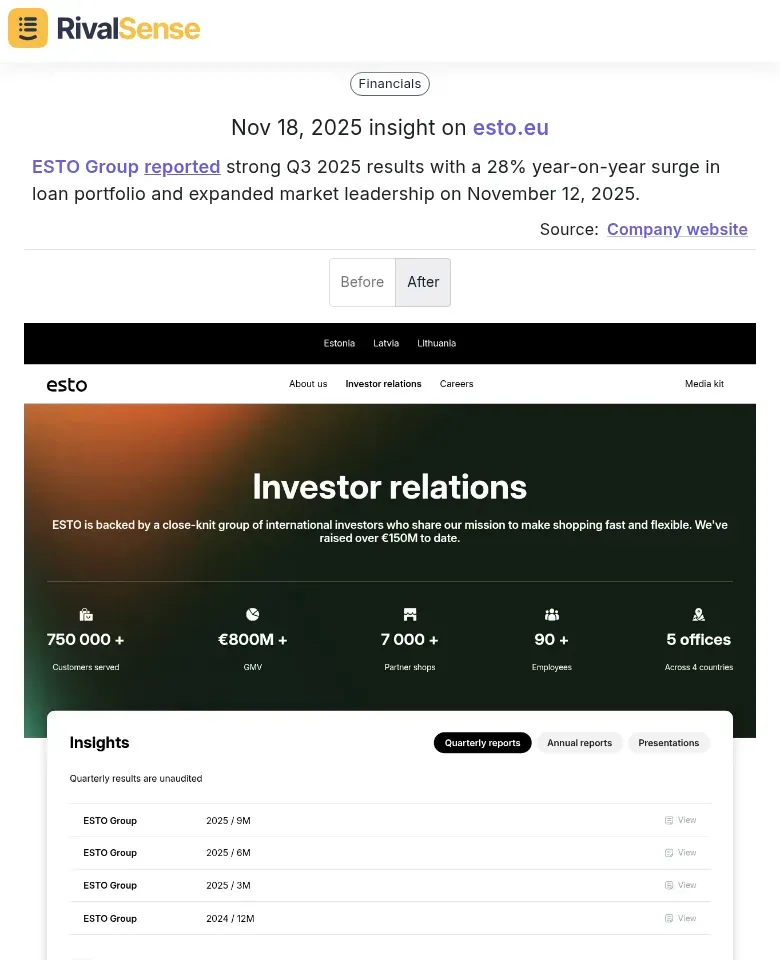

For example, RivalSense tracked that ESTO Group reported strong Q3 2025 results with a 28% year-on-year surge in loan portfolio and expanded market leadership. This type of financial insight is valuable because it helps you identify when competitors are entering new markets or sectors, allowing you to adjust your strategies proactively.

Use metrics such as return on assets (ROA) or cost-to-income ratios to benchmark your productivity. If top players maintain an ROA above 2%, set internal targets to close any gaps.

Practical steps to leverage this data:

- ✅ Monitor quarterly financial statements for anomalies and trends.

- ✅ Compare your efficiency ratios with peers using competitive intelligence tools.

- ✅ In win-loss interviews, ask how competitor financial stability influenced decisions.

This approach turns raw data into actionable strategies, sharpening your competitive edge and boosting overall productivity.

Extracting Productivity Lessons from Competitor Growth Stories

Studying competitor growth stories can reveal operational efficiencies that drive long-term productivity. By examining sustained growth patterns, you can learn from their successes and apply similar strategies to your own business.

For instance, RivalSense highlighted that Coop's Obs and Obs Bygg online stores achieved an average annual growth of 60% over the past 10 years. Analyzing such growth stories is valuable because it uncovers tactics like automation, data-driven resource allocation, and customer retention methods that can be adapted to enhance your operations.

Identify key productivity drivers, such as:

- 🔄 Automated customer onboarding processes.

- 📊 Data analytics for optimized resource use.

- 💡 High customer retention through loyalty programs.

Incorporate these insights into win-loss analysis by asking targeted questions about operational strengths during interviews.

Practical checklist for evaluation:

- [ ] Review competitor performance regularly to spot efficiency trends.

- [ ] Benchmark your sales cycles against industry leaders to shorten timelines.

- [ ] Adopt scalable tools, like CRM integrations, to automate repetitive tasks.

By embedding these lessons, you'll enhance productivity in sales, marketing, and beyond.

Integrating Ecosystem Insights from Strategic Acquisitions

Strategic acquisitions often signal how competitors are building integrated ecosystems to boost customer productivity. By tracking these moves, you can anticipate market shifts and refine your own offerings to stay competitive.

RivalSense reported that Zoom acquires Bonsai to integrate productivity, communication, and financial management tools into its Zoom Workplace ecosystem for small businesses. This type of insight is valuable because it shows how acquisitions can create bundled solutions that reduce customer friction and become key factors in win-loss decisions.

To leverage ecosystem insights:

- ✅ Track competitor M&A activity and analyze integration patterns.

- ✅ Map customer journeys to identify where bundled solutions eliminate pain points.

- ✅ Conduct win-loss interviews focusing on ecosystem advantages.

- ✅ Adapt your strategy by building integrations, forming partnerships, or highlighting unique efficiencies.

Practical tip: Maintain a quarterly acquisition watchlist to assess impacts on customer productivity and market expectations.

Implementing Win-Loss Analysis with Financial Competitor Data

Implementing a structured approach to win-loss analysis combined with financial competitor data can transform deal insights into a strategic advantage. Start by developing a framework with standardized interview questions that probe financial factors like competitor pricing and ROI calculations.

Integrate tools like RivalSense to track real-time financial metrics—such as pricing changes, funding rounds, and market share shifts—and feed this data into your CRM for seamless analysis.

Build dynamic dashboards to visualize correlations. For example, create a table of key metrics:

| Metric | Description |

|---|---|

| Win rate by competitor | Percentage of deals won against specific rivals |

| Deal size vs. competitor pricing | How your pricing stacks up in won/lost deals |

| Time-to-close against competitor financial health | Link between deal duration and competitor stability |

Use tools like Salesforce or Power BI to automate alerts when competitor moves impact your pipeline.

Training and workshops are essential:

- ✅ Conduct role-playing scenarios to practice interpreting dashboard data.

- ✅ Update battle cards with financial differentiators based on recent insights.

- ✅ Review competitor financial updates weekly and correlate with win-loss outcomes.

This proactive approach boosts productivity by enabling data-driven decisions that improve deal win rates.

Conclusion: Driving Business Growth with Integrated Insights

Integrating win-loss analysis with financial competitor insights transforms reactive strategies into proactive growth engines. By understanding deal outcomes alongside real-time intelligence on rivals, you can allocate resources more efficiently, anticipate market shifts, and refine your value proposition.

This synergy eliminates guesswork, shortens sales cycles, and enhances customer acquisition. Continuous monitoring is crucial in volatile markets—set up automated alerts for competitor financial filings and other key events to stay agile.

Leaders should adopt these practices by:

- ✅ Conducting quarterly win-loss reviews paired with financial benchmarking.

- ✅ Using tools like RivalSense to track competitor KPIs and cash flow trends.

- ✅ Embedding insights into product development and marketing campaigns.

Start small by auditing one lost deal against a rival's earnings report to identify patterns.

Ready to boost your competitive edge? Try RivalSense for free at https://rivalsense.co/ and get your first competitor report today to seamlessly integrate financial insights into your win-loss analysis!

📚 Read more

👉 Mastering Competitor Analysis: Insights from Global Events

👉 Track Key Account Feedback: A Practical Guide for B2B Leaders

👉 Cold Chain Logistics Competitor Financial Analysis: Essential Templates and Frameworks

👉 How Microsoft's Visual Studio 2026 Uncovered a Rival's Growth Strategy