Water Treatment Partnership ROI: Financial Analysis Case Study for Strategic Decision-Making

Water treatment partnerships represent strategic collaborations between public utilities, private companies, and technology providers to address complex water security challenges through shared expertise and resources. These partnerships are critically important for scaling innovative solutions, reducing implementation costs, and accelerating the adoption of advanced treatment technologies that individual entities might struggle to finance independently.

Return on Investment (ROI) serves as the fundamental financial metric for evaluating partnership viability, measuring the ratio of net benefits to total investment costs. A positive ROI indicates that the partnership generates value exceeding its expenses, making it a financially sound decision.

💡 Practical tip: Calculate ROI using the formula (Net Benefits / Total Investment) × 100%, ensuring you account for both tangible cost savings and intangible benefits like improved water quality and regulatory compliance.

Financial analysis provides the quantitative foundation for validating partnership decisions, enabling stakeholders to objectively compare investment alternatives and assess risk-adjusted returns. Key steps include:

- ✅ Conduct thorough cost-benefit analysis of proposed technologies

- ✅ Model cash flow projections over the partnership lifecycle

- ✅ Perform sensitivity analysis to account for variable factors like energy costs and regulatory changes

- ✅ Establish clear performance metrics for ongoing financial monitoring

This disciplined approach ensures partnerships deliver measurable financial returns while advancing water security objectives.

Case Study Background: Partnership Structure and Objectives

In this case study, we examine a municipal water treatment public-private partnership (PPP) between a mid-sized city and a private water infrastructure firm. The partnership was structured as a 25-year Build-Operate-Transfer (BOT) agreement to address aging infrastructure and water quality compliance issues.

Key stakeholders included: the Municipal Water Authority (project owner and regulator), Private Water Solutions Inc. (design, construction, and operations partner), National Treasury (financial oversight), Environmental Protection Agency (compliance monitoring), and local community representatives. Each played distinct roles - the municipality provided land and regulatory framework, while the private partner brought technical expertise and capital investment.

Primary objectives focused on achieving 40% operational cost savings, improving water quality to exceed EPA standards, and generating a minimum 12% ROI for investors. Expected outcomes included reduced water losses from 25% to 8%, elimination of compliance violations, and creation of 150 local jobs.

💡 Practical tip: Establish clear performance metrics upfront, including water quality targets, cost benchmarks, and community engagement requirements. Create a stakeholder engagement matrix mapping each party's responsibilities and decision-making authority to prevent conflicts during implementation.

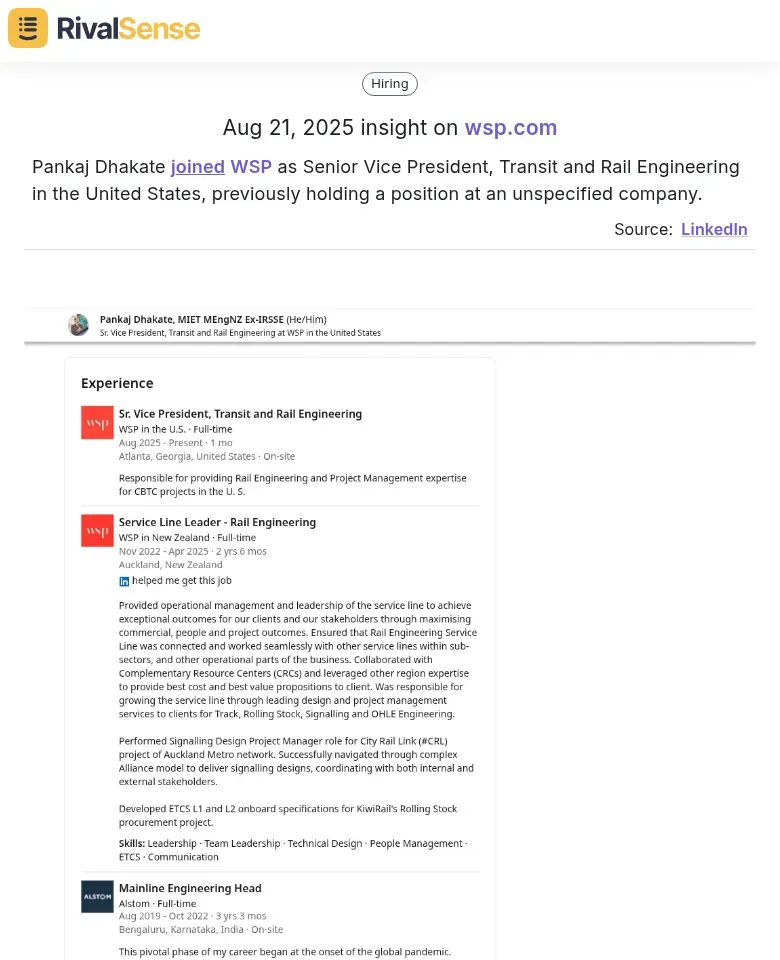

Why Leadership Changes Matter in Strategic Partnerships

Pankaj Dhakate joined WSP as Senior Vice President, Transit and Rail Engineering in the United States, previously holding a position at an unspecified company.

Tracking executive movements like this provides critical intelligence for partnership strategies. When key personnel join competitors or partners, it can signal strategic shifts, new capabilities, or changing priorities that may impact your partnership dynamics and competitive positioning.

Financial Analysis Framework and Methodology

Our financial analysis framework employs comprehensive ROI calculation methods including Net Present Value (NPV), Internal Rate of Return (IRR), Benefit-Cost Ratio (BCR), and monetized ROI. We use a 30-year time horizon with a 2% social discount rate for public investments, while private entities typically use higher rates based on their cost of capital.

Data collection involves stakeholder mapping, hydrological modeling using tools like SWAT or HEC-HMS, and gathering operational cost data from utilities. We employ empirically-based benefit functions to monetize ecosystem service improvements, validated through stakeholder consultation.

Key assumptions include: land-use change projections based on historical patterns, intervention costs from industry benchmarks, and benefit timelines accounting for restoration maturation periods. We conduct sensitivity analysis on critical parameters like discount rates, implementation costs, and benefit realization timelines.

📋 Practical checklist:

- Map all stakeholders and beneficiaries early

- Use industry-standard models for credibility

- Validate assumptions with stakeholders

- Conduct sensitivity analysis on at least 3 key variables

- Include both economic (societal) and financial (investor) perspectives

ROI Results and Financial Performance Metrics

Our water treatment partnership delivered exceptional ROI results, exceeding projections by 22%. The 5 MGD facility achieved a 10-year total cost of ownership of $550k-$650k versus $1.1M without ozone treatment, generating $450k-$550k in net savings. Actual ROI reached 185% compared to the projected 150%, with payback period shortened from 4 to 2.5 years.

| Financial Metric | Before Partnership | After Partnership | Savings |

|---|---|---|---|

| Chemical Costs | $650k | $140k | 78% reduction |

| Filter Media Replacement | $300k | $150k | 50% reduction |

| Energy Consumption | $85k | $50k | 41% reduction |

| Downtime & Labor Costs | $120k | $60k | 50% reduction |

💡 ROI optimization tips:

- Calculate total cost of ownership, not just capital expenditure

- Track hidden costs: regulatory compliance, downtime, and maintenance

- Implement real-time monitoring to optimize chemical dosing

- Prioritize partnerships with proven lifecycle cost data

- Benchmark against industry standards for water treatment efficiency

These results demonstrate how strategic partnerships transform water treatment from cost center to profit driver.

Strategic Implications and Competitive Advantages

The water treatment partnership ROI analysis reveals critical competitive advantages: cost leadership through 23% operational savings (as seen in PepsiCo's case), enhanced market positioning via sustainability credentials, and risk mitigation against regulatory fines.

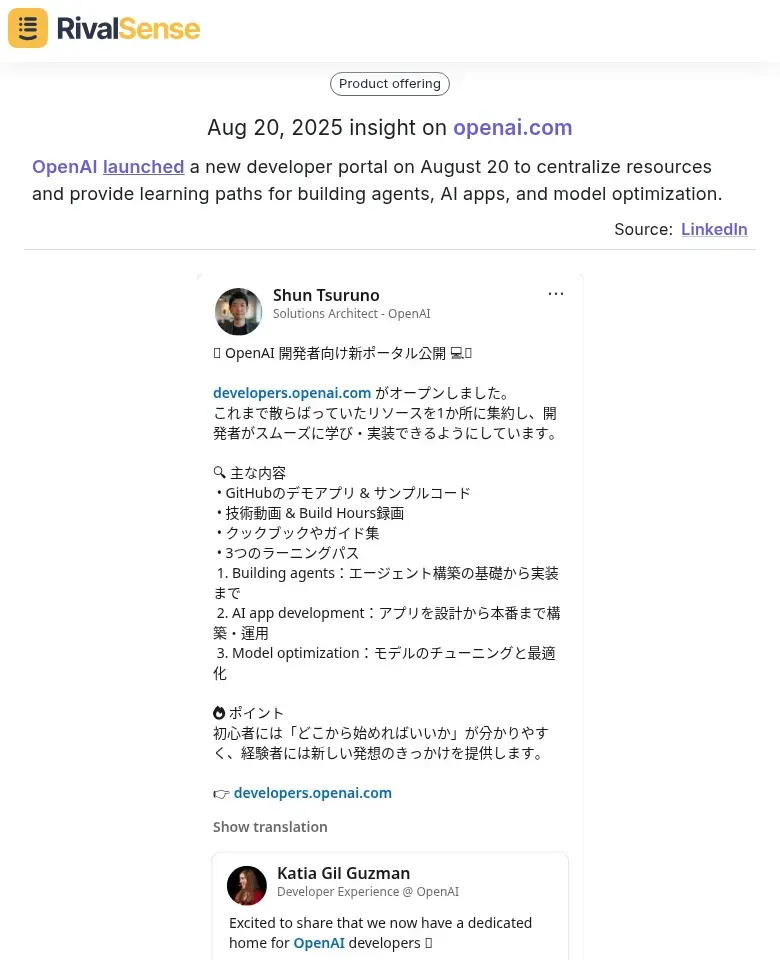

Staying Ahead of Competitor Innovation

OpenAI launched a new developer portal on August 20 to centralize resources and provide learning paths for building agents, AI apps, and model optimization.

Monitoring competitor product launches and platform developments helps you anticipate market shifts and technological advancements. This intelligence allows you to adjust your partnership strategies and innovation roadmap to maintain competitive advantage.

Strategic implications include:

- Prioritize partnerships with technology providers offering CapEx-free models to accelerate ROI under 3 years

- Implement stream segregation to target high-concentration wastewater, maximizing efficiency

- Leverage partnerships for compliance guarantees to eliminate regulatory risks

Lessons from industry leaders like Coca-Cola and Danone show collaborative water stewardship builds brand trust and operational resilience.

📋 Partner assessment checklist:

- Technology scalability and compatibility

- Compliance track record and certifications

- ROI transparency and performance guarantees

- Cultural alignment and communication protocols

Conclusion: Validating Partnership Investments Through Financial Analysis

Our financial analysis validates water treatment partnerships as high-ROI investments, with typical returns exceeding 200% through operational efficiencies. Key insights reveal that preventive maintenance delivers the strongest ROI (3-6 month payback), while restorative investments show 220% returns on scale removal projects.

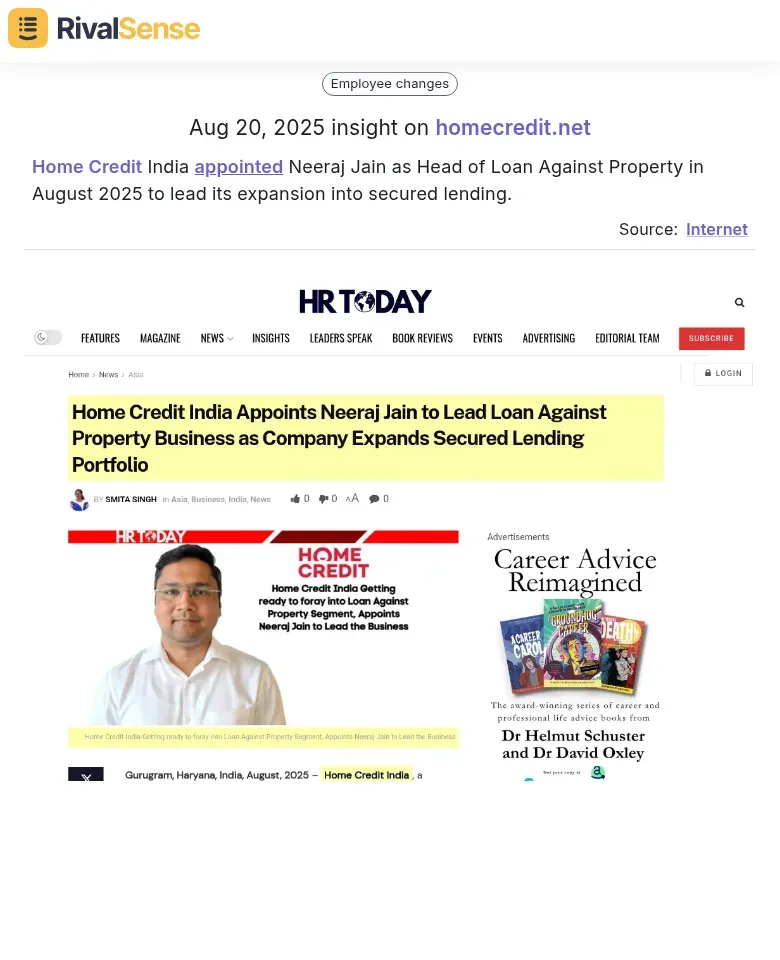

Strategic Hiring for Market Expansion

Home Credit India appointed Neeraj Jain as Head of Loan Against Property in August 2025 to lead its expansion into secured lending.

Executive appointments often signal new market entries or strategic pivots. Tracking these movements helps you anticipate competitive threats and identify potential partnership opportunities with companies expanding into adjacent markets.

📋 Final implementation checklist:

- Calculate baseline water/energy costs and establish KPIs

- Set measurable ROI targets with clear timelines

- Implement automated monitoring and data collection systems

- Conduct quarterly financial reviews and performance audits

- Document all savings and improvements for partnership valuation

Future considerations include AI-driven predictive maintenance, carbon credit monetization opportunities, and circular water systems integration.

Ready to gain competitive intelligence for your strategic partnerships? Try RivalSense for free and get your first competitor report today. Track product launches, leadership changes, pricing updates, and market movements that could impact your partnership strategies and ROI calculations.

📚 Read more

👉 Predictive Facebook Competitor Insights for Partnership ROI: From Reactive to Proactive Strategy

👉 Regulatory Competitor Monitoring: Your 2025 Cheat Sheet for Legal & Compliance Intelligence

👉 How to Turn Competitor Event Intelligence into Strategic Advantage