The Ultimate Guide to Competitor Target Audience Analysis: 7 Steps to Uncover Hidden Opportunities

In today's crowded B2B landscape, understanding your competitors is no longer optional—it's essential for survival. But here's what most businesses miss: knowing who your competitors are targeting is often more valuable than knowing what they're selling. When you analyze your competitors' target audiences, you're not just gathering data—you're uncovering hidden market opportunities, identifying underserved customer segments, and discovering gaps in your competitors' strategies that you can exploit.

"Most companies focus on competitor product features or pricing, but the real goldmine is understanding who they're talking to and how they're connecting with those audiences," says marketing strategist Alex Chen. "This reveals where you can differentiate and where you can win."

The 7-Step Framework for Competitor Target Audience Analysis

Step 1: Map Your Competitive Landscape

Before diving into audience analysis, you need a clear map of who you're up against. This foundational step ensures you're analyzing the right players in your market. Start by identifying not just your direct competitors, but also:

- Primary competitors: Companies offering similar solutions to the same audience

- Secondary competitors: Companies with overlapping but different offerings

- Emerging threats: Startups or adjacent players who could pivot into your space

- Indirect competitors: Companies solving the same problem with different approaches

Practical Tip: Create a competitive matrix with columns for each competitor and rows for target audience segments, messaging, and channels.

Step 2: Analyze Competitor Messaging and Positioning

Go beyond surface-level analysis to understand how competitors communicate with their audience. Look for patterns in:

- Value propositions: What pain points do they emphasize?

- Language and tone: Are they speaking to technical decision-makers or business leaders?

- Content themes: What topics dominate their blogs, whitepapers, and webinars?

- Case studies: Which industries and company sizes do they highlight?

Checklist for Messaging Analysis:

- [ ] Review 10+ recent blog posts

- [ ] Analyze 3-5 case studies

- [ ] Examine website copy and headlines

- [ ] Review social media bios and descriptions

- [ ] Analyze email newsletter content

Step 3: Investigate Their Content Strategy

Content reveals who a company is trying to reach and what resonates with them. Analyze:

- Content formats: Do they focus on technical whitepapers or executive briefs?

- Distribution channels: Where do they publish and promote content?

- Engagement patterns: What content gets the most shares, comments, or downloads?

- SEO focus: What keywords are they targeting in their content?

Example: If a competitor's most popular content is "Enterprise Security Implementation Guides," they're likely targeting large enterprises with complex security needs.

Step 4: Examine Social Media and Community Engagement

Social media provides real-time insights into audience engagement and preferences. Look at:

- Follower demographics: Who follows them on LinkedIn, Twitter, etc.

- Engagement patterns: Which posts get the most interaction?

- Community participation: What industry forums or groups do they engage with?

- Influencer relationships: Who are they partnering with or mentioning?

Practical Tip: Use social listening tools to track competitor mentions and see what their audience is saying about them.

Step 5: Analyze Customer Reviews and Testimonials

Customer feedback reveals who's actually buying and why, offering direct insight into audience satisfaction. Examine:

- Review platforms: G2, Capterra, Trustpilot, etc.

- Testimonial patterns: Common themes in customer success stories

- Complaint trends: Recurring issues or unmet needs

- Demographic data: Company size, industry, roles mentioned

Checklist for Review Analysis:

- [ ] Collect 20+ recent reviews

- [ ] Identify common praise themes

- [ ] Note recurring complaints

- [ ] Analyze reviewer demographics

- [ ] Compare sentiment across competitors

Step 6: Track Their Marketing and Advertising Activities

Where competitors spend money reveals their priorities and target audience focus. Monitor:

- Paid advertising: Google Ads, LinkedIn campaigns, industry publications

- Event participation: Conferences, webinars, sponsorships

- Partnership announcements: Technology integrations, channel partners

- PR and media coverage: Industry publications, analyst reports

Practical Tip: Set up Google Alerts for competitor names plus keywords like "partnership," "integration," "webinar," and "sponsor."

Step 7: Synthesize Insights and Identify Opportunities

Now, turn your analysis into actionable strategies that drive business growth. Focus on:

- Identify underserved segments: Which customer groups are competitors ignoring?

- Spot messaging gaps: What pain points aren't being addressed?

- Find channel opportunities: Where could you reach audiences competitors aren't?

- Discover content gaps: What questions aren't being answered?

- Recognize partnership potential: Who could you collaborate with that competitors haven't?

The Challenge: Manual Analysis is Time-Consuming and Incomplete

Here's the reality most founders face: conducting comprehensive competitor target audience analysis manually is incredibly time-consuming. You're looking at:

- Hours each week spent monitoring multiple platforms

- Missed opportunities because you can't track everything

- Outdated information by the time you compile your analysis

- Limited scope because you can only track a few competitors

This is where modern competitive intelligence tools make all the difference. Instead of spending hours each week manually checking websites, social media, and review platforms, you need a system that automatically tracks competitor movements and delivers insights directly to you.

How RivalSense Streamlines Competitor Target Audience Analysis

At RivalSense, we've built a competitor tracking platform specifically designed to solve this problem for B2B founders and business leaders. Here's how it works:

Comprehensive Tracking Across 80+ Sources:

We monitor competitor websites, social media channels, review platforms, news sites, regulatory filings, and more—giving you a complete picture of who they're targeting and how.

Weekly Intelligence Reports:

Every week, you receive a curated email report highlighting:

- New content themes and messaging shifts

- Target audience expansion or refinement

- Partnership announcements and integrations

- Event participation and speaking engagements

- Media coverage and PR activities

- Pricing changes and product updates

Real-World Examples from RivalSense Insights:

-

Product Updates: For instance, RivalSense tracked that ActivTrak enhanced its encryption by adding cryptographic signatures (HMAC-SHA256) to detect and log tampering attempts. This type of insight is valuable because it shows how competitors are strengthening product features for security-conscious audiences, helping you anticipate shifts in enterprise targeting and adjust your own value proposition.

-

Management Changes: When Kapil Hetamsaria joined Neo4j as Chief Business Officer, it signaled a strategic focus on growth and new market segments. Tracking such changes helps you understand leadership-driven shifts in target audience strategy, allowing you to prepare for competitive moves in advance.

-

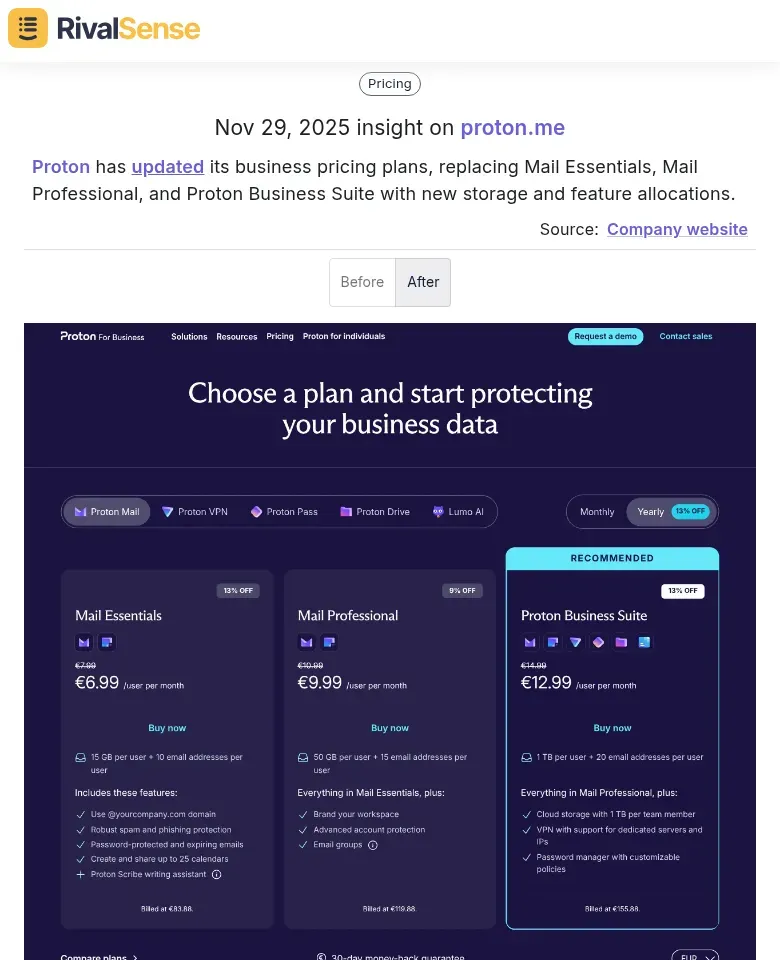

Pricing Updates: Proton's update to its business pricing plans, with new storage and feature allocations, reveals how competitors reposition for different business segments. Monitoring pricing changes helps you infer which customer segments competitors are prioritizing, enabling you to identify opportunities for competitive pricing or tailored offers.

Practical Applications for Your Business:

- Identify Emerging Audience Segments: When a competitor starts publishing content for a new industry vertical, you'll know immediately.

- Spot Messaging Shifts: If competitors change their value proposition or start targeting different pain points, you can adjust your positioning.

- Discover Partnership Opportunities: See which companies your competitors are partnering with and identify similar opportunities.

- Optimize Your Content Strategy: Learn what content resonates with your shared target audience.

- Stay Ahead of Market Trends: Identify emerging customer needs before they become mainstream.

Actionable Checklist for Immediate Implementation

This Week:

- [ ] Identify your top 5 competitors

- [ ] Analyze their website messaging and positioning

- [ ] Review their recent blog content and case studies

- [ ] Check their social media engagement patterns

This Month:

- [ ] Collect customer reviews across multiple platforms

- [ ] Monitor their advertising and event activities

- [ ] Identify 2-3 underserved audience segments

- [ ] Develop targeted messaging for those segments

Ongoing:

- [ ] Set up systematic competitor tracking

- [ ] Regularly update your competitive analysis

- [ ] Test new messaging with identified segments

- [ ] Measure results and refine your approach

Key Takeaways for B2B Founders

- Competitor target audience analysis isn't about copying—it's about differentiation. The goal is to find gaps and opportunities, not to replicate what others are doing.

- The most valuable insights come from patterns, not single data points. Look for trends in messaging, content, and engagement over time.

- Automation is essential for staying current. Manual tracking can't keep up with today's fast-moving markets.

- Actionable intelligence requires synthesis. Raw data is useless unless you turn it into strategic insights.

- Continuous monitoring beats periodic analysis. Markets change quickly, and yesterday's insights may not apply today.

Next Steps for Your Business

Start by implementing the 7-step framework outlined above. Focus on one competitor at a time, and build your analysis systematically. As you gather insights, look for patterns and opportunities that align with your business strengths.

Remember: The goal isn't to become your competitors—it's to understand them well enough to beat them. By knowing who they're targeting and how they're reaching those audiences, you can develop more effective strategies, create more compelling messaging, and ultimately win more customers.

Ready to take your competitor analysis to the next level? Try RivalSense for free today and get your first competitor report to start uncovering hidden opportunities in your market. Sign up here to get started and gain immediate insights into your competitors' target audiences.

📚 Read more

👉 Strategic Visioning Trends: How Dedicated Key Account Managers Drive Project Governance

👉 How RivalSense Alerted Competitors to Folksam's 2026 Pension and Premium Strategy

👉 Mastering Competitor Insights: A Digital Framework for Key Account Managers

👉 Rideshare Key Account Management: Centralized Data Benefits Cheat Sheet

👉 Competitor Pricing Cheat Sheet: Monitor Key Account Growth Insights