The Ultimate Competitor Customer Acquisition Checklist for Data Processing Outsourcing

In the competitive B2B data processing outsourcing landscape, customer acquisition presents unique challenges: long sales cycles, complex technical requirements, and intense price competition. Traditional approaches often leave providers reacting to market shifts rather than anticipating them. This is where competitor intelligence transforms acquisition strategy from reactive to proactive.

By systematically tracking competitors' pricing models, service offerings, client case studies, and marketing messaging, outsourcing providers gain critical insights. You can identify underserved market segments, anticipate competitor moves before they happen, and position your services more effectively. For example, monitoring competitor website updates might reveal new service launches you can counter with enhanced offerings.

The ROI of systematic competitor tracking is substantial: reduced customer acquisition costs through targeted outreach, improved win rates by addressing competitor weaknesses, and faster market adaptation. Practical steps include creating a competitor dashboard, setting up alerts for competitor announcements, and analyzing their client acquisition patterns to identify your most promising prospects.

This checklist approach ensures you're not just competing—you're strategically outmaneuvering rivals at every stage of the customer journey.

📊 Mapping Your Competitive Landscape: Identifying Key Players and Their Positioning

Understanding your competitors is the foundation of any successful acquisition strategy. Without a clear view of who you're up against, you're flying blind. Start by mapping your competitive landscape systematically. First, identify direct competitors offering similar data processing services through keyword searches ("data entry outsourcing," "data cleansing services") and industry directories. Don't overlook indirect competitors like BPO providers expanding into data processing or AI automation tools replacing manual tasks.

Create a competitor matrix tracking:

- Service offerings (data entry, cleansing, validation, enrichment)

- Specializations (healthcare data, e-commerce, financial services)

- Target industries and client sizes

Analyze their positioning through website messaging - do they emphasize accuracy, speed, or cost? Study case studies for implementation approaches and client testimonials for pain points addressed.

✅ Practical tip: Use tools like RivalSense to monitor competitor website changes, service additions, and client announcements. Look for gaps where competitors under-serve specific industries or lack specialized expertise you can fill. This mapping reveals strategic opportunities for differentiation in the crowded data processing outsourcing market.

🚀 Analyzing Competitor Acquisition Channels and Marketing Strategies

Knowing where your competitors acquire customers can reveal gaps in your own strategy. By reverse-engineering their channels, you can identify overlooked opportunities. To effectively analyze competitor acquisition channels in data processing outsourcing, start with a systematic approach. First, reverse-engineer digital channels: Use tools like Ahrefs or SEMrush to identify competitors' top-ranking keywords for "data processing outsourcing" and related terms. Analyze their PPC campaigns through Google Ads Transparency Center to see which value propositions they emphasize. Map their content marketing funnel by examining blog topics, whitepapers, and case studies that address specific client pain points.

For offline strategies, monitor industry events like data management conferences where competitors exhibit. Track partnership announcements with complementary service providers (like AI platforms or CRM systems). Analyze referral programs by checking if competitors offer incentives for client introductions.

Monitor pricing models by regularly checking competitor websites for tiered packages (basic/enterprise), volume-based pricing, or AI-enhanced service premiums. Look for promotional offers like free pilot projects, implementation discounts, or bundled services. Create a tracking spreadsheet to document findings monthly, noting channel effectiveness based on competitor growth patterns. This systematic monitoring reveals gaps in your own strategy and identifies emerging acquisition trends in the data processing outsourcing space.

📝 Competitor Content and Thought Leadership Analysis

Content and thought leadership are key indicators of competitor strategy and market influence. Analyzing these areas helps you spot trends and positioning gaps. To analyze competitor content and thought leadership in data processing outsourcing, start by mapping their content ecosystem. Create a spreadsheet tracking their blog topics, whitepapers, webinars, and speaking engagements over the past 6-12 months. Look for patterns: Are they focusing on specific data processing challenges (like ETL optimization, real-time processing, or data quality)? What distribution channels yield the most engagement (LinkedIn, industry publications, their own platform)?

Evaluate content quality using a simple scoring system:

- Depth of technical insight

- Practical applicability

- Original research/data

- Production value

Notice which competitors consistently score high and why.

For thought leadership analysis, track their executive team's speaking engagements at key industry events (like Data Summit, Strata Data Conference) and their whitepaper topics. Are they positioning as innovators in specific niches like AI-powered data processing or GDPR-compliant outsourcing?

Identify content gaps by comparing competitor coverage against customer pain points. For example, if competitors focus heavily on cost savings but customers care more about data security, that's an opportunity. Create a "content opportunity matrix" plotting competitor coverage against market needs to spot underserved areas where you can establish authority.

🤝 Competitor Client Experience and Retention Strategies

Client experience and retention are critical for long-term success in outsourcing. Understanding how competitors handle these areas can highlight their weaknesses and your opportunities. To analyze competitor client experience and retention strategies in data processing outsourcing, start by mapping their onboarding journey. Sign up for their free trials or demos to experience their setup process firsthand. Document the timeline, required documentation, and initial training provided. Look for gaps where clients might struggle—complex technical requirements or slow response times are common weaknesses.

Next, evaluate their support structures. Monitor their response times across channels (email, chat, phone) and analyze their knowledge base quality. Check if they offer dedicated account managers or tiered support levels. Review client testimonials and case studies on their website—these often reveal retention strategies like regular business reviews, proactive issue resolution, or value-added reporting.

Identify service delivery weaknesses by examining client complaints on review sites (G2, Capterra) and social media. Look for patterns in negative feedback about communication gaps, missed deadlines, or inflexible processes. Create a checklist:

- ✅ Document onboarding steps and pain points

- ✅ Test support responsiveness weekly

- ✅ Analyze 10+ client success stories for retention tactics

- ✅ Track recurring complaints across platforms

This reveals opportunities to differentiate with smoother onboarding, proactive communication, and tailored retention programs.

👥 Tracking Competitor Management Changes for Strategic Insights

Organizational shifts at competitor companies can signal strategic pivots, expansions, or new focus areas. Monitoring these changes provides early warnings and helps you adapt your acquisition strategy proactively. For instance, tracking management hires can reveal a competitor's investment in new regions, services, or technologies, allowing you to preempt their moves or highlight your strengths in those areas.

Here are real examples from RivalSense that show how tracking such changes can inform your business strategy:

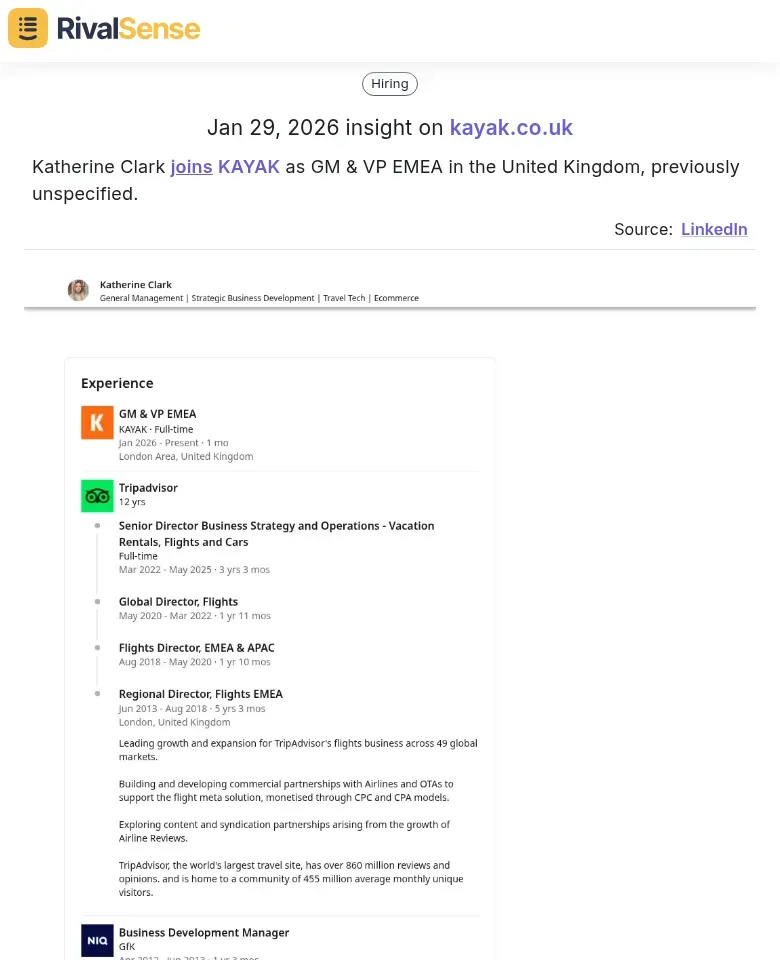

-

Katherine Clark joins KAYAK as GM & VP EMEA: This management change indicates KAYAK's strengthened focus on the European market. For a data processing outsourcing provider, similar insights could reveal competitors targeting new geographic regions, allowing you to preempt their moves or highlight your existing expertise in those areas.

-

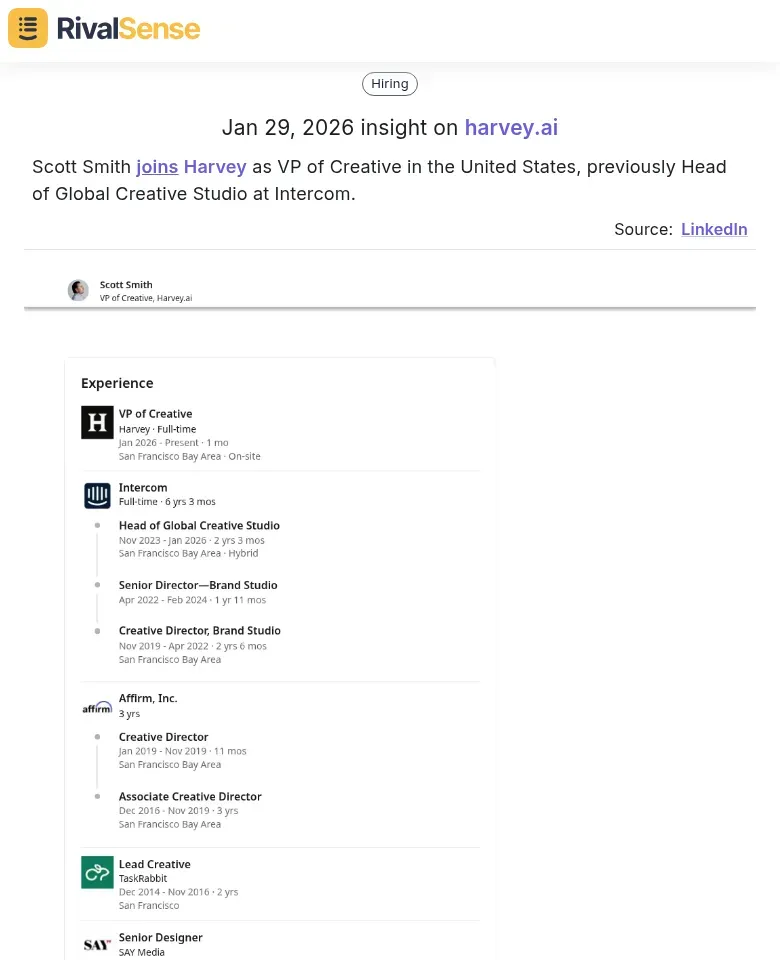

Scott Smith joins Harvey as VP of Creative: This hire suggests Harvey is investing in creative leadership, possibly to enhance brand positioning or marketing efforts. In your context, tracking such roles can signal competitors' emphasis on customer acquisition channels or rebranding initiatives.

-

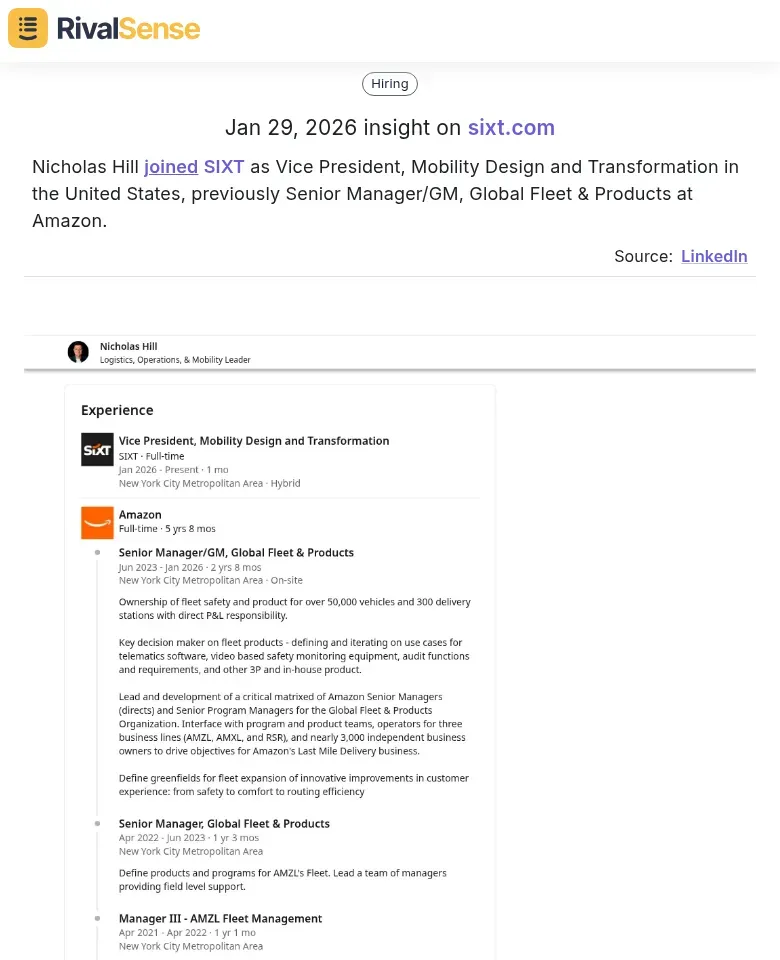

Nicholas Hill joined SIXT as Vice President, Mobility Design and Transformation: With a background at Amazon, this hire points to SIXT's focus on innovation and transformation in mobility services. For data processing outsourcing, similar insights might indicate competitors adopting new technologies or entering niche markets.

By monitoring these changes, you can gain valuable insights into competitor strategies and adjust your acquisition approach accordingly.

🏆 Building Your Actionable Acquisition Strategy Based on Competitor Insights

Now that you've gathered competitor intelligence, it's time to turn insights into action. A systematic framework ensures you capitalize on opportunities and address weaknesses. Transform insights into action with this acquisition strategy framework:

-

Differentiate Through Competitor Gaps: Analyze where competitors fall short - do they lack 24/7 support, have limited compliance certifications, or offer rigid pricing? Position your data processing outsourcing as the solution to these pain points. Example: If competitors only serve US clients, emphasize your GDPR expertise for European markets.

-

Launch Targeted Campaigns: Use competitor keywords, customer reviews, and case studies to create hyper-relevant content. Target their dissatisfied customers with ads highlighting your superior SLA guarantees or specialized industry expertise they lack.

-

Implement Continuous Monitoring: Set up alerts for competitor pricing changes, service expansions, and customer complaints. Use tools like RivalSense to track their marketing campaigns and hiring patterns - these signal strategic shifts you can preempt.

✅ Actionable Checklist:

- Map competitor weaknesses to your unique value propositions

- Create comparison content (whitepapers, webinars) showcasing your advantages

- Monitor competitor review sites for acquisition opportunities

- Set quarterly competitor strategy review meetings

- Track competitor employee LinkedIn updates for service expansion clues

Pro tip: The most successful acquisitions happen when you address competitor shortcomings before their customers even realize they need alternatives.

To streamline your competitor tracking and gain insights like the management changes highlighted above, try RivalSense for free at https://rivalsense.co/. Get your first competitor report today and stay ahead of the curve in data processing outsourcing customer acquisition.

📚 Read more

👉 How Zapier's LinkedIn AI Partnership Alerted Competitors to Act

👉 Optimizing Key Account Management with Competitor Website Intelligence

👉 Best Practices: How Competitors Attract Customers in Convergent TV Advertising

👉 Competitor Pricing Workflow Breakdown: Strategic Account Tracking Tools

👉 Turning Competitor Personnel Moves into Strategic Insights