The Essential Guide to Tracking Competitor Media Mentions and Content Strategy

In today's hyper-competitive business landscape, tracking competitor media mentions isn't just a nice-to-have—it's a strategic imperative. Media coverage reveals how competitors are positioning themselves in the market and how customers perceive their brand. For instance, when a competitor consistently appears in industry publications discussing AI innovation, they're signaling market leadership in that space.

Practical tip: Set up Google Alerts for competitor names and key executives to monitor their media footprint. Analyze which publications feature them most frequently—this reveals their target audience and positioning strategy.

Content strategy insights from competitors provide a blueprint for your own approach. By examining their most-shared articles, whitepapers, and social media content, you can identify topics resonating with your shared audience. Look for patterns in their content calendar, format preferences, and engagement metrics.

✅ Checklist item: Create a spreadsheet tracking competitor content types, publication frequency, engagement rates, and key themes. This data informs where to allocate your content resources.

Industry awards and recognition patterns offer valuable competitive intelligence. When competitors win specific awards, it signals their strategic priorities and areas where they're investing resources. Track which awards they pursue annually—this reveals their long-term positioning goals.

Actionable step: Monitor industry award cycles and note which competitors consistently submit entries. This helps anticipate their strategic moves and identify gaps in your own recognition strategy.

Setting Up Your Competitor Media Monitoring Framework

Establishing a robust monitoring framework is the foundation of effective competitor tracking. It allows you to systematically gather data and derive insights. To build an effective competitor media monitoring framework, start by identifying your core competitors and their brand variations. Don't just track direct competitors—include adjacent players and emerging threats. Create a master list with official names, common misspellings, product names, and key executive names for comprehensive coverage.

Next, select appropriate monitoring tools based on your budget and needs. For startups, start with free tools like Google Alerts and social media listening. As you scale, consider specialized platforms like RivalSense for deeper competitive intelligence. Set up tracking parameters including specific keywords, geographic filters, and source types (news, blogs, forums, social media).

Establish a systematic categorization system for mentions. Create categories like: positive/negative sentiment, product launches, partnerships, funding announcements, and thought leadership. Use a simple spreadsheet or dedicated dashboard to organize findings. Set up weekly review cadences to analyze patterns and identify strategic opportunities.

📋 Practical checklist:

- Create competitor matrix with 5-10 key players

- Set up alerts for each competitor and their variations

- Define clear categorization criteria

- Schedule regular analysis sessions

- Document insights and action items

Tip: Start small with 2-3 competitors and expand as you refine your process. Focus on quality insights over quantity of mentions.

Analyzing Competitor Awards and Industry Recognition

Tracking competitor awards reveals strategic positioning beyond marketing. Awards and recognitions are public validations of a company's strengths and priorities. Start by creating a spreadsheet of industry awards (G2, Capterra, industry-specific) and track which ones competitors target. Look for patterns: Are they focusing on product innovation, customer satisfaction, or industry leadership? A bronze-to-silver progression signals growth investment, while targeting niche categories reveals specialized focus areas.

Here are real-world examples from RivalSense insights that demonstrate the value of tracking awards for business strategy:

- ViewSonic won the Excellence in Best Edtech Solution Brand Award at the 17th Edition of DT Awards 2025.

This insight is valuable because it highlights ViewSonic's focus on the education technology sector, signaling to competitors where they are building brand authority and potentially investing in R&D.

This insight is valuable because it highlights ViewSonic's focus on the education technology sector, signaling to competitors where they are building brand authority and potentially investing in R&D. - Turkish Airlines won the gold award in the tourism, travel, and logistics category at the Campaign Türkiye Brand of the Year event.

Monitoring such awards helps understand how competitors are excelling in specific verticals, revealing strategic priorities in market positioning and customer perception.

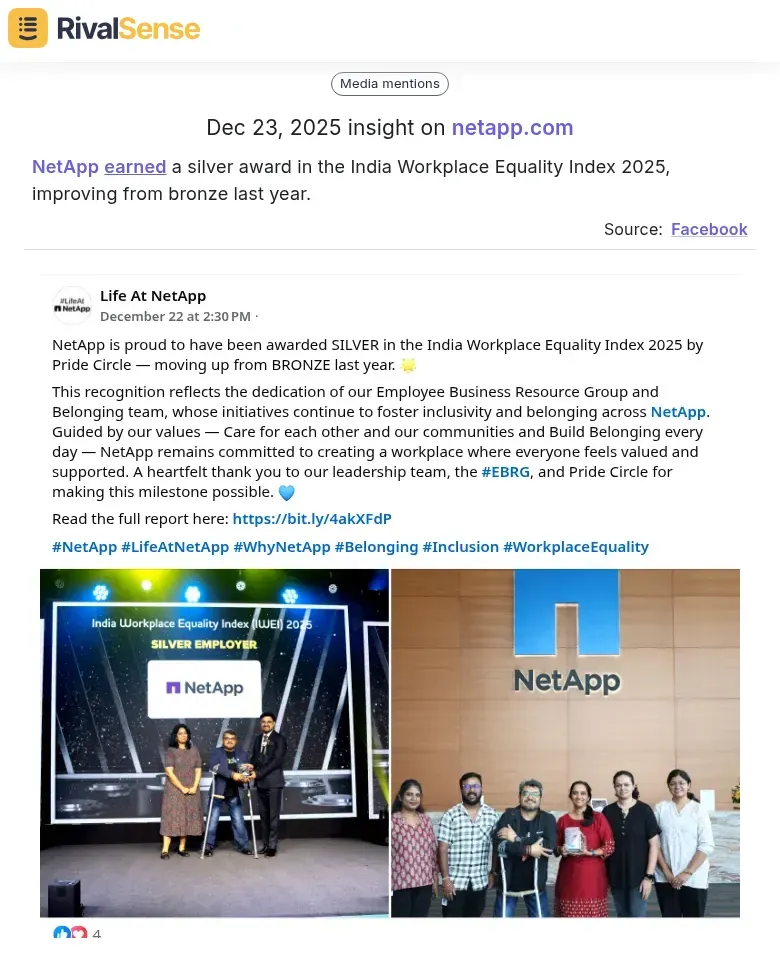

Monitoring such awards helps understand how competitors are excelling in specific verticals, revealing strategic priorities in market positioning and customer perception. - NetApp earned a silver award in the India Workplace Equality Index 2025, improving from bronze last year.

Tracking award improvements like this shows NetApp's commitment to workplace diversity, which can enhance talent attraction and brand reputation, offering insights into their HR and CSR strategies.

Tracking award improvements like this shows NetApp's commitment to workplace diversity, which can enhance talent attraction and brand reputation, offering insights into their HR and CSR strategies.

Practical steps:

- Identify 5-10 key industry awards

- Monitor submission cycles (quarterly/annual)

- Track award criteria changes

- Analyze press releases post-win

- Compare award mentions across competitors

🔍 Key insights: Award categories targeted show strategic priorities. Customer service awards indicate retention focus, while innovation awards signal R&D investment. Track year-over-year improvements to predict competitor growth trajectories and resource allocation.

Decoding Competitor Content Strategy Through Media Mentions

Media mentions offer a transparent window into competitors' content strategy effectiveness. By analyzing the type and frequency of coverage, you can uncover their core messaging and target audiences. Start by categorizing their coverage: Are they featured for thought leadership (white papers, research reports), product innovation (launch announcements), or customer success stories? Each category reveals different strategic priorities.

Practical Steps:

- Content-Type Analysis: Track which formats generate coverage—data-driven reports often secure industry publications, while case studies attract trade media.

- Theme Identification: Note recurring topics in coverage. If competitors consistently get mentioned for "AI integration" or "sustainability initiatives," these are resonant industry themes.

- Messaging Decoding: Analyze how publications frame competitors' stories. Are they positioned as "innovators" or "reliable partners"? This reveals their core messaging strategy.

Pro Tips:

- Set up Google Alerts for competitor names + "featured in" or "interview with"

- Benchmark your own coverage against theirs monthly

- Reverse-engineer successful pitches by analyzing publication angles

Competitors often use media mentions to validate content themes, creating a feedback loop where coverage reinforces their strategic narratives. By decoding these patterns, you can identify content gaps and opportunities to secure your own authoritative coverage.

Extracting Actionable Insights from Competitor Media Data

Once you've collected competitor media data, the real value comes from extracting actionable insights. This process transforms raw data into strategic advantages for your business. Start by analyzing patterns: Are competitors consistently featured in specific publications? What topics generate the most coverage? These patterns reveal media opportunities you can pursue.

Identify content gaps by comparing competitor coverage to your own. If competitors are getting traction with case studies in industry publications but you're not, that's a clear opportunity. Look for messaging gaps too - if all competitors focus on 'cost savings' but none address 'implementation ease,' you've found a unique positioning angle.

Develop response strategies based on competitor positioning. Create a simple checklist:

✅ Map competitor media mentions by publication type and topic

✅ Identify coverage gaps where you can provide unique value

✅ Note competitor messaging themes and find differentiation points

✅ Prioritize media outlets where competitors have established presence

✅ Develop counter-messaging for areas where competitors are vulnerable

Practical tip: Create a 'media opportunity matrix' with competitor coverage on one axis and your strengths on another. Where they intersect, you'll find your most promising media targets. Remember, competitor media data isn't just about tracking - it's about finding the white space where your story can shine.

Implementing and Measuring Your Competitor Tracking Program

To implement an effective competitor tracking program, start by establishing clear metrics. A well-structured program ensures that insights are consistently applied to drive business decisions. Track share of voice (percentage of industry mentions), sentiment analysis (positive/negative coverage), content performance (engagement rates, backlinks), and media placement quality (tier 1 vs. tier 3 outlets). Use tools like RivalSense to automate data collection and set up weekly or monthly dashboards.

Create a structured review process: schedule bi-weekly meetings to analyze findings, update tracking parameters based on competitor shifts (e.g., new product launches), and adjust your strategy quarterly. Maintain a competitor insights repository accessible to marketing and leadership teams.

Integrate insights into your business strategy by identifying content gaps (topics competitors cover that you don't), benchmarking your performance against theirs, and spotting emerging trends early. For example, if a competitor gains traction with webinar content, test a similar format. Actionable tip: Start with 2-3 key competitors and 5-7 core metrics to avoid overwhelm, then expand as you refine your process.

Take Action with Competitor Tracking

Now that you understand the importance of tracking competitor media mentions and content strategy, it's time to put these insights into practice. For a streamlined approach, consider using a dedicated tool like RivalSense, which automates the tracking of competitor product launches, pricing updates, event participations, partnerships, regulatory aspects, management changes, and media mentions across various sources, delivering a weekly email report.

Ready to get started? Try RivalSense for free at https://rivalsense.co/ and get your first competitor report today to gain a competitive edge in your market.

📚 Read more

👉 How Executive Moves Like Rebecca Kaplan's Reveal Competitive Strategies

👉 The Strategic Guide to Tracking Key Account Milestones: A B2B Leader's Playbook

👉 Case Study: How Project Governance Unlocks Competitor Pricing Advantages

👉 How Import.io's Managed Web Scraping Service Enables Competitor Innovation

👉 Uncover Competitor Innovation Advantages Through Twitter Intelligence