The Beginner's Guide to Tracking Competitor Website Changes for Key Account Success

In the competitive landscape of B2B sales, protecting your key accounts is paramount. Competitor website tracking is not just about observation; it's a strategic tool that can make or break your client relationships. When competitors update their websites—whether launching new enterprise pricing, adding features, or showcasing client testimonials—these changes signal strategic shifts that can threaten your most valuable accounts. For example, a competitor's new product page targeting your client's industry indicates a direct assault on your revenue base.

Practical steps to implement systematic tracking:

- Set up automated alerts for homepage, pricing, and product page changes using tools like RivalSense

- Create a weekly review checklist: monitor career postings (hiring signals), blog content (strategic direction), and client case studies (target accounts)

- Connect website updates to business signals: new leadership pages may indicate organizational changes affecting client relationships

- Use insights to anticipate competitor moves 4-6 weeks before formal announcements

This approach turns web monitoring from passive observation into actionable intelligence, allowing you to address client concerns before they become retention risks and identify opportunities to strengthen your position with key accounts.

What to Monitor: Key Website Elements That Reveal Strategic Moves

To effectively track competitor websites, you need to know where to look. Focusing on specific elements can unveil their strategic directions and potential threats. Here are the key areas to monitor:

-

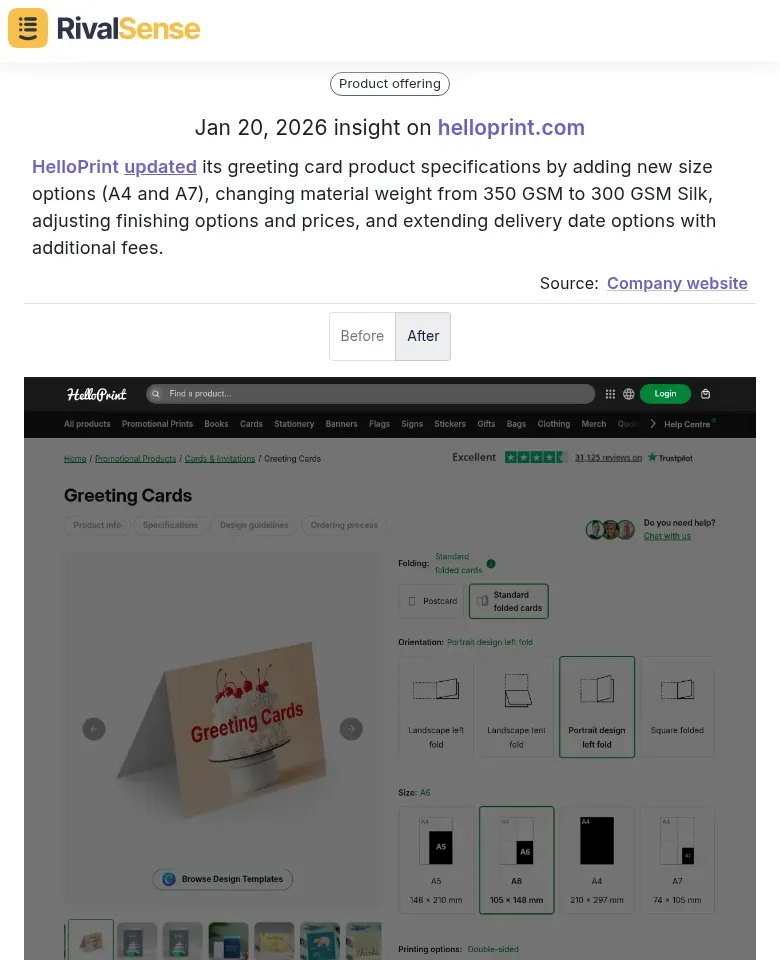

Product & Service Updates: Changes in products or services often indicate market positioning shifts. For instance, RivalSense tracked that HelloPrint updated its greeting card product specifications by adding new size options (A4 and A7), changing material weight from 350 GSM to 300 GSM Silk, adjusting finishing options and prices, and extending delivery date options with additional fees.

This insight is valuable because it reveals how competitors are adapting to market demands, optimizing costs, or targeting new customer segments, allowing you to adjust your offerings proactively.

This insight is valuable because it reveals how competitors are adapting to market demands, optimizing costs, or targeting new customer segments, allowing you to adjust your offerings proactively.Checklist for monitoring:

- Product pages and specifications

- Pricing tables and tier changes

- Service descriptions and features

- Delivery and logistics options

-

Leadership & Team Changes: Executive appointments and organizational restructurings signal priority areas and strategic focus. RivalSense captured that Yahoo added Sean Zadig as Chief Information Security Officer, expanded Lisa Moore's role to include leadership development, promoted Alicin Reidy Williamson to Chief Diversity & Culture Officer with broader responsibilities, and added Yahoo DSP to Matt Sanchez's oversight.

Monitoring such changes helps you understand where competitors are investing leadership talent, which can indicate new initiatives or strengthened defenses in critical areas like security or diversity.

Monitoring such changes helps you understand where competitors are investing leadership talent, which can indicate new initiatives or strengthened defenses in critical areas like security or diversity.Practical tip: Set up alerts for 'About Us' page updates, leadership bios, and press releases about management changes.

-

Corporate Filings & Compliance: Regulatory updates and filings reveal business health and compliance status. For example, RivalSense reported that Condell filed a confirmation statement on 12 January 2026 with updates, following the termination of director James Stanley Gibson Mcmeckan on 31 July 2025.

This type of insight is crucial for assessing competitor stability, legal standing, and potential restructuring, which can impact their ability to serve clients or launch new products.

This type of insight is crucial for assessing competitor stability, legal standing, and potential restructuring, which can impact their ability to serve clients or launch new products.Actionable step: Check 'Investor Relations' sections quarterly for annual reports, compliance statements, and regulatory filings.

Pro tip: Use automated monitoring tools like RivalSense to track these elements across multiple competitors simultaneously. When you spot changes, ask: 'What strategic move does this signal?' and 'How should we respond?' This systematic approach transforms website watching into actionable competitive intelligence.

How to Set Up Your Monitoring System: Practical Steps for Beginners

Getting started with competitor monitoring requires a clear plan and the right tools. By following these practical steps, you can build a system that keeps you informed without overwhelming your resources.

Begin by identifying your 3-5 most critical competitors—focus on those targeting similar audiences or winning deals from you. Track their homepage, pricing pages, product/service pages, and blog/announcement sections. Use tools like RivalSense for automated monitoring; set up alerts for specific page changes (e.g., pricing updates, new features) to get real-time notifications via email or Slack.

Establish a weekly review cycle: Dedicate 30 minutes each Monday to check alerts and manually review tracked pages. Create a simple scoring system: rate changes on impact (1-5 scale) and urgency (low/medium/high). For example, a competitor's price drop gets high impact/urgency, while a blog post might be low. Prioritize high-scoring items for immediate action, like adjusting your strategy or messaging.

Tip: Use a spreadsheet to log changes with dates, scores, and notes.

Checklist for setup:

- List competitors and key pages to monitor

- Set up automated alerts using a tool like RivalSense

- Schedule a weekly review time

- Score changes based on impact and urgency

- Act on top priorities to stay proactive

Analyzing Website Changes: Extracting Strategic Insights from Updates

Analyzing competitor website changes goes beyond noting updates; it involves extracting strategic insights that inform your business decisions. By decoding these changes, you can anticipate moves and refine your own strategy.

Product Specification Changes: When competitors modify product features or specifications, analyze what this reveals about market demands. Are they adding enterprise security features? Expanding integrations? These changes signal where they're investing to meet customer needs and how they're positioning against you. Create a change log to spot patterns over time and correlate them with market trends.

Leadership & Team Changes: New executive hires or organizational restructuring often precede strategic shifts. A new VP of Enterprise Sales suggests increased focus on large accounts. Team expansions in specific regions indicate geographic priorities. Monitor LinkedIn for announcements and update your competitive intelligence database quarterly to keep track of talent movements.

Corporate Filings & Compliance: Regulatory updates, privacy policy changes, and terms of service revisions reveal business focus and stability. New compliance certifications (SOC 2, ISO 27001) show investment in enterprise readiness. Financial disclosures in press releases hint at funding rounds or profitability timelines, giving you clues about their financial health.

Practical Checklist for Analysis:

- Set up automated monitoring for key competitor pages

- Create a structured template to categorize changes (product, team, compliance)

- Schedule monthly review sessions to analyze patterns

- Cross-reference website changes with social media and news mentions

- Document insights in your competitive intelligence system for sales enablement

Turning Insights into Action: Proactive Strategies for Key Account Protection

Gathering competitor insights is only the first step; the real value comes from turning those insights into proactive actions. By implementing targeted strategies, you can protect your key accounts and seize opportunities.

-

Targeted Counter-Strategies: When competitors change products or pricing, don't just react—outmaneuver them. Example: If a rival lowers prices, highlight your superior customer support and ROI metrics in your next client meeting.

- Checklist for counter-strategies:

(a) Identify the specific change

(b) Analyze its impact on your value proposition

(c) Develop 2-3 counter-messaging points

(d) Schedule immediate client touchpoints

- Checklist for counter-strategies:

-

Preemptive Action Plans: Monitor organizational changes (new hires, funding rounds, office expansions) as early warning signals. When a competitor hires a sales leader in your territory, immediately:

- Review your account health scores

- Schedule strategic business reviews with at-risk clients

- Prepare case studies showcasing your unique implementation expertise

-

Proactive Client Conversations: Use competitor weaknesses as conversation starters, not defensive reactions. Tip: Frame discussions around "industry trends" rather than direct comparisons. Example: "We've noticed some providers cutting corners on security—here's how our SOC 2 certification protects your data." Prepare a 3-point strength comparison before each quarterly review.

Practical step: Create a 90-day action plan template that maps competitor changes to specific account protection activities, assigning owners and deadlines for each initiative.

Measuring Success and Optimizing Your Monitoring Framework

To ensure your competitor monitoring efforts are effective, you need to measure success and continuously optimize your framework. Tracking the right metrics will help you demonstrate ROI and refine your approach.

Track Core Business Metrics:

Link monitoring activities directly to outcomes by tracking:

- Competitive win rate improvements (aim for 15-25% increase)

- Sales cycle compression (target 20-30% faster deal closure)

- Customer retention rates in competitive accounts

- Deal size growth through better positioning (10-15% increase)

Practical Checklist for Measurement:

✓ Create a dashboard with these 4 metrics

✓ Set baseline measurements before implementing monitoring

✓ Review monthly with sales leadership

✓ Attribute specific wins to intelligence gathered

Establish Quarterly Optimization Cycles:

Every 90 days, conduct a structured review:

- Scope Assessment: Are you monitoring the right competitors? Remove low-impact targets, add emerging threats

- Signal-to-Noise Analysis: Which alerts drive action vs. create noise? Adjust sensitivity settings

- Resource Allocation: Are you spending time on high-value intelligence? Reallocate as needed

Tip: Use the "80/20 Rule" - focus 80% of monitoring on the 20% of competitors causing 80% of competitive losses.

Create Sales Feedback Loops:

Implement a structured process:

- Weekly Sync: 15-minute meetings where sales shares competitive encounters

- Intelligence Priority Board: Sales team votes on most valuable competitor intel needs

- Win/Loss Analysis: Document how competitor intelligence influenced outcomes

- Field Intelligence Capture: Simple form for reps to submit competitor insights from customer meetings

Pro Tip: Create a "Competitive Intelligence Scorecard" that sales teams complete after each competitive deal, linking specific monitoring alerts to deal outcomes. This creates a virtuous cycle where better intelligence leads to better results, which justifies continued investment in monitoring capabilities.

Ready to transform your competitor tracking into actionable intelligence? Try out RivalSense for free at https://rivalsense.co/ to get automated insights on competitor product launches, pricing updates, event participations, and more. Sign up today and get your first competitor report delivered to your inbox.

📚 Read more

👉 How Fleet Management Leaders Monitor Competitor Regulatory Filings for Strategic Advantage

👉 Predictive Analysis: Forecast Competitor Event Participation for B2B Success

👉 Leveraging Executive Moves for Competitive Edge: A Real-World Example

👉 The Ultimate Key Account Management Playbook for 2026: A Strategic Guide for Business Leaders

👉 Advanced Tactics: Monitor Key Account Growth for Commercial Insurance Brokers