Strategic Competitor Insights: A CEO’s Guide to Outmaneuvering the Competition

In today’s competitive landscape, understanding competitors' moves across all channels—not just Facebook—is essential for survival and growth. For CEOs, comprehensive competitor intelligence informs smarter decisions across product development, partnerships, and market expansion. While social media offers valuable signals, combining these with broader insights creates a holistic advantage.

Effective competitor tracking reveals marketing tactics, customer engagement patterns, and emerging trends through multiple touchpoints. By monitoring these activities systematically, you can identify strategic gaps in your approach and uncover opportunities to differentiate your brand. This guide delivers actionable frameworks to transform competitor data into growth catalysts.

Leveraging Product Development Insights

Monitoring competitors' R&D pipelines accelerates your innovation cycles while preventing market surprises. Analyzing their product launches helps identify whitespace opportunities in your offerings—without imitation. Speed-to-market is increasingly critical; understanding rivals' development velocity allows you to benchmark and optimize your processes.

Agile methodologies become competitive advantages when informed by competitor timelines. Notice how quickly they prototype, test, and iterate. Also track technological collaborations that might signal capability gaps or partnership opportunities. Three actionable steps:

- 🔔 Set automated alerts for competitor patent filings or launch announcements

- ⏱️ Benchmark development cycles against industry leaders

- 🤝 Reverse-engineer innovation partnerships that fuel their progress

Example: BAE Systems developed a combat drone prototype in just over a year—tracking such breakthroughs helps anticipate market shifts and adjust R&D investments.

Valuable because: Real-time product intelligence prevents disruptive surprises and reveals innovation patterns to emulate or counter.

Exploring Partnership and Collaboration Opportunities

Strategic alliances multiply market reach and credibility while reducing expansion costs. Analyzing competitors' partnerships reveals untapped networks and validates collaboration models. Successful collaborations often target specific customer segments or geographic markets—decoding these patterns informs your alliance strategy.

Focus on partnerships that align with your brand values but address audience needs competitors overlook. Educational initiatives, for instance, build trust while expanding talent pipelines. Evaluate partnership ROI through engagement metrics and co-branded campaign performance. Follow this checklist:

- [ ] Map competitors’ top 3 partnership categories (e.g., academia, tech providers)

- [ ] Identify shared audiences in collaborations

- [ ] Assess longevity of alliances (>2 years = high value)

- [ ] Note regulatory advantages gained through partners

Example: FOM College Karlsruhe partnered with Social Matching for career advice—spotting such collaborations reveals emerging HR tech trends and potential alliance targets.

Valuable because: Partnership intelligence uncovers growth accelerators while highlighting relationship gaps in your strategy.

Understanding Market Expansion and Localization Strategies

Competitor geographic moves signal market viability before committing resources. Analyze their entry patterns: phased rollouts versus aggressive launches indicate regional confidence levels. Localization efforts—from product adaptations to culturally tailored messaging—reveal nuanced market understanding you can leverage.

Pay special attention to regulatory navigation tactics and local partnerships that ease market access. These often provide shortcuts through compliance complexity. Four localization leverage points:

| Strategy Component | CEO Action Item |

|---|---|

| Regional Prioritization | Identify 3 underserved markets competitors ignore |

| Cultural Adaptation | Audit localized content gaps in your offerings |

| Regulatory Partnerships | Forge relationships with local compliance experts |

| Pilot Testing | Launch minimum-viable localized products in 60 days |

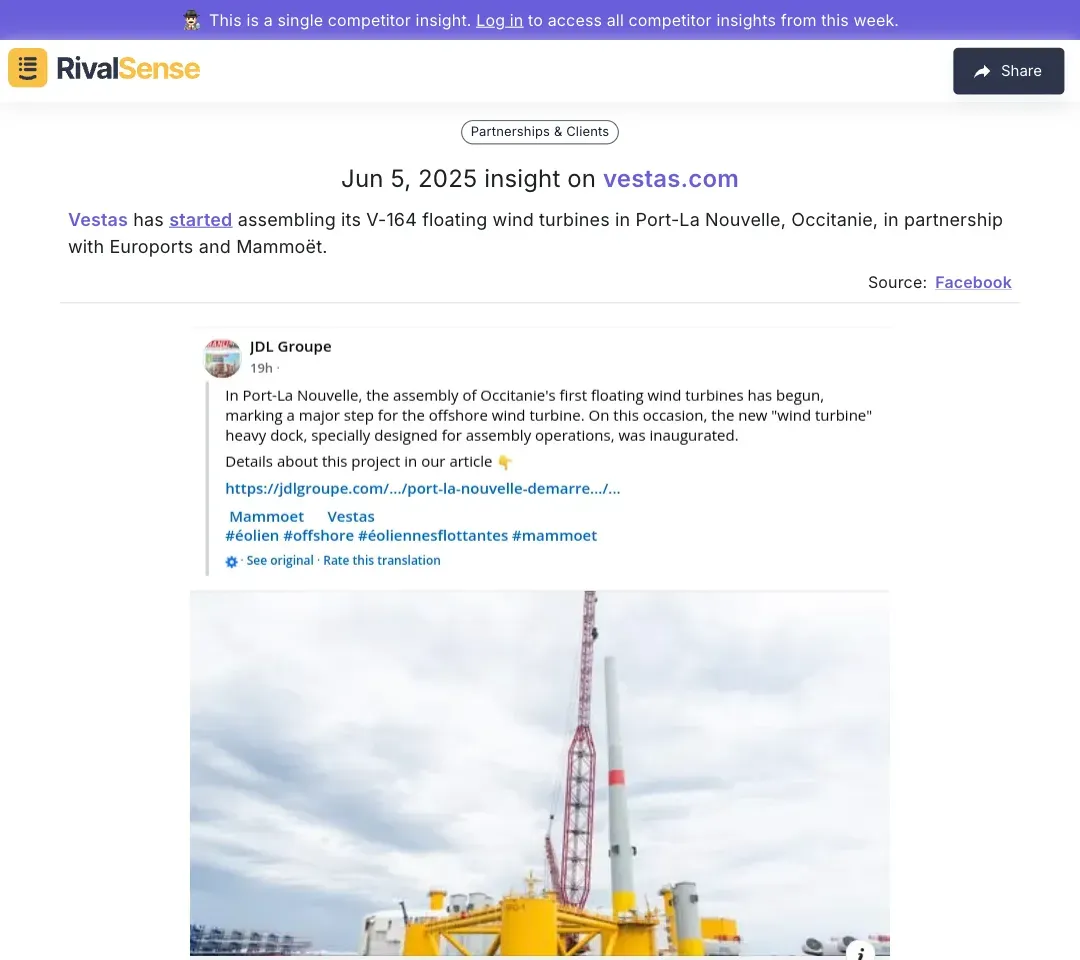

Example: Vestas assembling floating turbines in France signals renewable energy infrastructure investments—spotting such expansions helps time your market entries strategically.

Valuable because: Localization intelligence reduces expansion risks and identifies regional whitespace ahead of competitors.

Analyzing Engagement and Community Building Tactics

Social media engagement metrics reveal how competitors build audience trust at scale. Facebook specifically showcases content resonance through shares, comments, and reaction patterns. Track not just what they post, but how audiences emotionally respond—this uncovers unmet community needs.

Prioritize three engagement dimensions: educational content that positions them as thought leaders, responsiveness that builds loyalty, and values-driven initiatives that deepen emotional connections. Implement through:

- 📚 Educational Campaigns: Launch weekly “how-to” series mirroring top-performing competitor content

- ⏰ Response Protocols: Beat competitor reply times by 25% (measure with social listening tools)

- 🌱 Community Initiatives: Co-create CSR programs with audience input

Pro Tip: Audit competitors’ top 5 engaged posts monthly—replicate formats but improve depth.

Implementing Insights into Your Business Strategy

Converting competitor intelligence into action requires systematic processes. Start by identifying 3-5 primary competitors across all monitored channels—not just social media. Assign team members to track specific insight categories using standardized templates for apples-to-apples comparison.

Integrate findings into quarterly planning through competitive SWOT analysis. For example, if competitors accelerate partnerships while lagging in localization, double down on geographic customization. Measure impact through:

- 🚀 Market share shifts in targeted segments

- 📈 Engagement rate growth versus competitors

- 💰 Partnership-driven revenue streams

Automate tracking where possible: Use tools to monitor competitor websites, registries, and social channels. Set monthly competitive review rituals to pressure-test strategies against fresh intelligence.

Conclusion: Turn Intelligence into Advantage

Consistent competitor insight transforms reactive strategy into proactive market leadership. By systematically tracking product developments, partnerships, and expansion patterns, you’ll identify opportunities before they become obvious. Remember—the goal isn’t imitation, but strategic differentiation based on market gaps.

Ready to operationalize these insights?

Try RivalSense for free and get your first competitor report today. Track product launches, pricing changes, regulatory shifts, and partnership moves—all consolidated in weekly executive briefings. Gain your advantage now.

📚 Read more

👉 Naval Giants: Comparative Analysis for Shipbuilding Leaders

👉 How to Track Competitor Hiring and Layoffs for Strategic Insights

👉 5 Key Business Growth Strategies for 2025: Outperform Your Competitors

👉 Productivity Hacks in Competitor Analysis: Leveraging RivalSense for Strategic Advantage

👉 Decoding JobNimbus' FRSA Event Strategy: What It Means for Competitors