Risk Management in Key Account Strategy: A Practical Guide

In today's volatile business landscape, risk management isn't just a defensive strategy—it's the bedrock of sustainable key account relationships. High-value clients represent significant revenue streams, making proactive risk identification essential for preventing catastrophic revenue loss and preserving long-term account value.

Enterprise risk management principles intersect powerfully with key account practices through systematic frameworks. Start with these actionable steps:

✅ Conduct quarterly risk assessments mapping client vulnerabilities against market trends

✅ Implement early-warning indicators for contract compliance and satisfaction metrics

✅ Develop scenario playbooks for common risk categories (competitive threats, operational failures, economic shifts)

✅ Establish cross-functional risk committees that include sales, legal, and operations perspectives

Remember: The most effective risk management transforms from reactive firefighting to proactive partnership preservation, turning potential threats into opportunities for deeper client engagement and value demonstration.

Core Risk Management Terminology for Account Managers

Key Risk Indicators (KRIs): Quantifiable metrics that serve as early warning signals for potential risks. Monitor KRIs like customer churn rates, payment delays, or compliance violations weekly. Set thresholds: if churn exceeds 10% or payments are 30+ days late, escalate immediately.

📊 Practical tip: Use automated dashboards to track KRIs in real-time.

Risk Appetite vs. Risk Tolerance: Risk appetite is your strategic willingness to accept risk for growth (e.g., "We'll take moderate risks to expand market share"). Risk tolerance defines operational limits (e.g., "Maximum 15% revenue fluctuation per quarter"). For each account, document both: appetite as a qualitative statement, tolerance as quantitative metrics.

📋 Checklist: Align tolerance with client contracts and internal policies.

Inherent Risk vs. Residual Risk: Inherent risk is the baseline exposure without controls (e.g., a new client in a volatile industry has high inherent risk). Residual risk is what remains after mitigation (e.g., after due diligence and contracts, risk is reduced).

🔄 Steps: 1) Assess inherent risk using a scoring matrix, 2) Implement controls like audits or insurance, 3) Reassess residual risk quarterly.

💡 Hint: Residual risk should always align with your risk tolerance levels.

Key Account-Specific Risk Categories and Profiles

Strategic Risk Profile: Assess risks from adverse business decisions or market changes by conducting quarterly SWOT analyses with key stakeholders.

📈 Practical tip: Create a risk matrix scoring likelihood (1-5) and impact (1-5) for each identified risk. Example: A client's merger could shift priorities—proactively align services to new objectives.

Operational Risk Profile: Identify process failures and internal control weaknesses through regular process audits.

🔍 Checklist: Document all key account processes, test controls quarterly, and implement redundancy for critical steps. Example: If delivery timelines slip, establish backup suppliers and cross-train team members.

Reputation Risk Profile: Manage risks to brand perception and customer trust by monitoring social sentiment and conducting Voice of Customer interviews.

📢 Step: Set up Google Alerts for client mentions and schedule bi-annual trust surveys.

⚡ Hint: Address negative feedback within 24 hours to demonstrate commitment and prevent escalation.

Competitive Intelligence: Turning Competitor Insights into Risk Management Assets

Staying ahead of competitor moves is crucial for effective risk management. Real-time intelligence about competitor product updates, pricing changes, and leadership shifts can help you anticipate market shifts and protect your key accounts.

For example, when Shopify introduced fullscreen mode for Sidekick to handle bigger conversations and complex workflows, this signaled enhanced capabilities that could impact competitive positioning:

Tracking such product updates helps you assess competitive threats early and adjust your value proposition before clients consider alternatives.

Leadership changes at competitors also present both risks and opportunities. When Gigi Janelidze joined Salmon as Head of Design in Georgia, this indicated strategic focus on design capabilities in that region:

Monitoring management changes helps you anticipate strategic shifts and identify potential talent opportunities or competitive threats.

Risk Assessment and Mitigation Framework for Key Accounts

Conduct comprehensive risk assessments using a likelihood-impact matrix to prioritize key account risks. Score each risk on a 1-5 scale for both probability and severity, then multiply to calculate risk scores. Categorize risks into three zones: Generally Acceptable (low impact/unlikely), As Low As Reasonably Possible (medium risk), and Generally Unacceptable (high impact/likely).

Develop targeted mitigation strategies using the 4T framework:

- Transfer (share risk)

- Treat (reduce impact)

- Tolerate (accept risk)

- Terminate (avoid risk)

Create action plans with specific owners, deadlines, and success metrics. For high-risk accounts, implement immediate controls like enhanced communication protocols, contract reviews, or contingency planning.

Establish continuous monitoring through quarterly risk reviews, automated alerts for trigger events, and regular client check-ins. Use dashboards to track risk scores and mitigation progress. Maintain a risk register that's updated in real-time and accessible to all stakeholders. Conduct annual comprehensive reassessments to identify emerging threats and validate control effectiveness.

Essential Risk Management Tools and Methodologies

Account Mapping & Stakeholder Analysis: Start by creating a comprehensive stakeholder map using a multi-dimensional approach that assesses influence, interest, impact, criticality, position, and effort for each stakeholder. Use a power/interest grid to categorize stakeholders into four quadrants: high power/high interest (manage closely), high power/low interest (keep satisfied), low power/high interest (keep informed), and low power/low interest (monitor).

👥 Practical tip: Conduct quarterly stakeholder reviews to track changes in influence and sentiment, and use relationship mapping to visualize connections between stakeholders for better risk anticipation.

Relationship Intelligence & Customer Journey Mapping: Develop detailed customer journey maps that identify all touchpoints from awareness to advocacy. Use both quantitative data (CRM analytics, web tracking) and qualitative insights (customer feedback, interviews) to map emotional states and pain points at each stage.

🗺️ Checklist: Identify 3-5 critical risk points in the journey, assign risk scores based on impact and likelihood, and create mitigation plans for each.

Contract Renewal & Large Deal Risk Assessment: Create a 10-step risk assessment checklist for every major contract. For large deals, conduct scenario planning for worst-case outcomes and establish early warning indicators for contract performance issues.

Pricing and Regulatory Intelligence: Critical Risk Factors

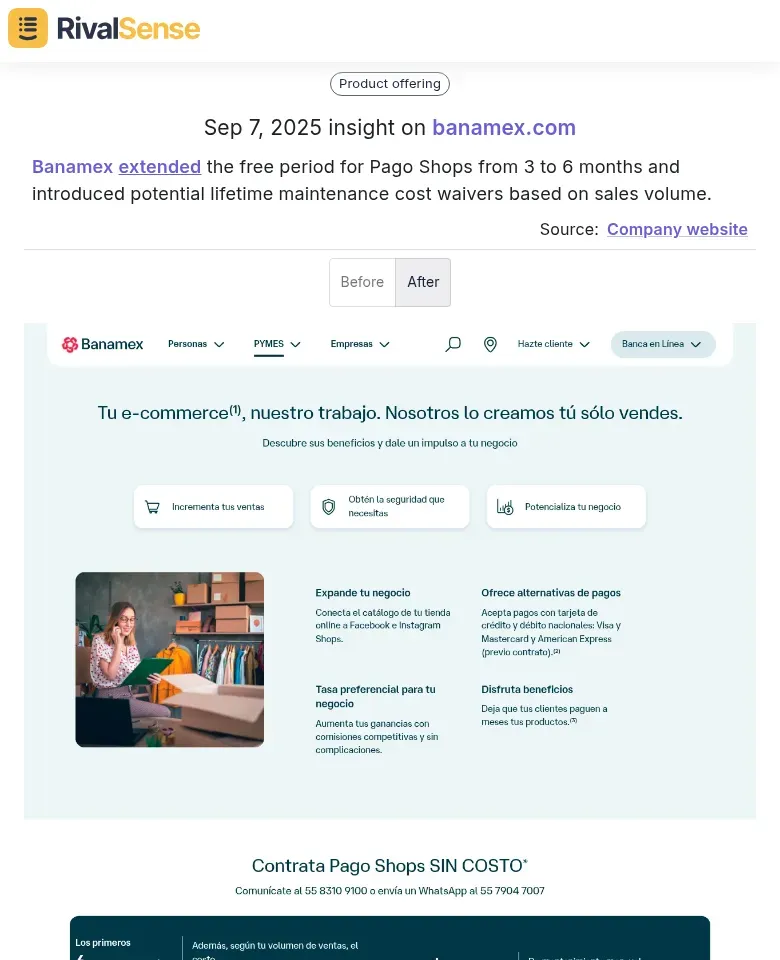

Pricing changes and regulatory updates can significantly impact your key account relationships. When Banamex extended the free period for Pago Shops from 3 to 6 months and introduced potential lifetime maintenance cost waivers based on sales volume, this created new competitive dynamics:

Monitoring pricing updates helps you stay competitive and identify when clients might be getting better offers elsewhere. Similarly, tracking regulatory changes ensures compliance and prevents costly violations that could damage client relationships.

Building a Risk-Aware Key Account Management Culture

Building a risk-aware key account management culture requires systematic integration of risk protocols into your core processes. Start by embedding risk assessment as a mandatory agenda item in quarterly business reviews—dedicate 15-20 minutes specifically to risk identification, impact analysis, and mitigation planning. Use a standardized risk matrix template that evaluates both probability and business impact.

Train account teams through quarterly risk workshops covering:

- Early warning signal identification (financial distress indicators, executive turnover patterns)

- Scenario-based response protocols for common risks like contract non-renewal threats or competitive displacement

- Communication frameworks for sensitive risk discussions with clients

Establish clear accountability structures: Assign each key risk to a specific owner (not a department) with defined escalation thresholds. Implement a three-tier escalation protocol: Level 1 (account manager handles), Level 2 (escalate to sales/CS leadership), Level 3 (executive committee intervention). Maintain a risk register with monthly review cadence and automated alert triggers for high-priority risks exceeding predefined thresholds.

Take Your Risk Management to the Next Level

Effective risk management requires continuous monitoring of both internal factors and external competitive landscape. Staying informed about competitor moves, market changes, and industry trends is essential for protecting your key accounts.

Ready to enhance your risk management strategy? Try RivalSense for free and get your first competitor report today. Track product launches, pricing changes, leadership moves, and regulatory updates—all delivered in a comprehensive weekly email that keeps you ahead of potential risks.

📚 Read more

👉 How Adyen Capitalized on Stripe's Blockchain Bet: A Strategic Playbook for B2B Leaders

👉 Twitter Competitor Insights: Actionable Cultural Alignment Strategies

👉 7 Aviation Defense Productivity Boost Techniques: From Talent to Tech

👉 Event Intelligence Workflow: Uncover Competitor Strategies for Key Account Loyalty