Real-World Competitor Insights: Hiring and Layoff Patterns for Key Account Strategy

Workforce changes are the most transparent window into competitor strategy. When rivals hire specialized account managers or lay off entire sales teams, they're signaling their strategic priorities in real-time. These patterns reveal which market segments they're doubling down on, which accounts they're targeting, and where they're retreating—intelligence that directly informs your key account strategy.

Practical steps to leverage this intelligence:

- Monitor hiring patterns: Track when competitors post roles for enterprise account executives, strategic account managers, or industry-specific specialists. This signals which verticals or account segments they're prioritizing.

- Analyze layoff announcements: When competitors cut sales or account teams, identify which regions or industries are affected. This reveals market weaknesses you can exploit.

- Connect talent movements to account opportunities: If a competitor lays off their healthcare account team, those accounts may be vulnerable. Proactively target them with tailored outreach.

- Build proactive intelligence systems: Set up alerts for competitor job postings, LinkedIn team changes, and industry news about workforce adjustments. Don't wait for quarterly reports—act on real-time signals.

Proactive workforce intelligence transforms you from reactive follower to strategic leader. While others analyze last quarter's results, you're identifying next quarter's opportunities based on current competitor movements.

👔 Decoding Leadership Changes: What Executive Moves Reveal About Market Strategy

Executive leadership changes offer powerful signals about competitor strategy. When analyzing key accounts, understanding these moves can reveal market intentions and strategic shifts. Track these patterns to anticipate competitor actions and adjust your key account approach.

Predicting Market Expansion:

- New CRO or Sales VP appointments often precede geographic or vertical expansion

- Example: A SaaS company hiring a healthcare industry veteran likely signals healthcare market entry

- Actionable tip: Monitor LinkedIn for executive promotions to new roles with expanded responsibilities

Understanding Talent Flows:

- Cross-company executive moves reveal which competitors are poaching talent from whom

- Pattern analysis: Track where departing executives land - are they moving to startups, larger players, or adjacent industries?

- Practical step: Create a talent flow map showing executive movements between your top 5 competitors

Assessing Strategic Consistency:

- Leadership stability (2+ years in role) suggests strategic continuity

- High turnover (multiple C-suite changes in 12 months) signals strategic pivots or internal challenges

- Checklist: Quarterly review of executive tenure at key accounts to identify stability patterns

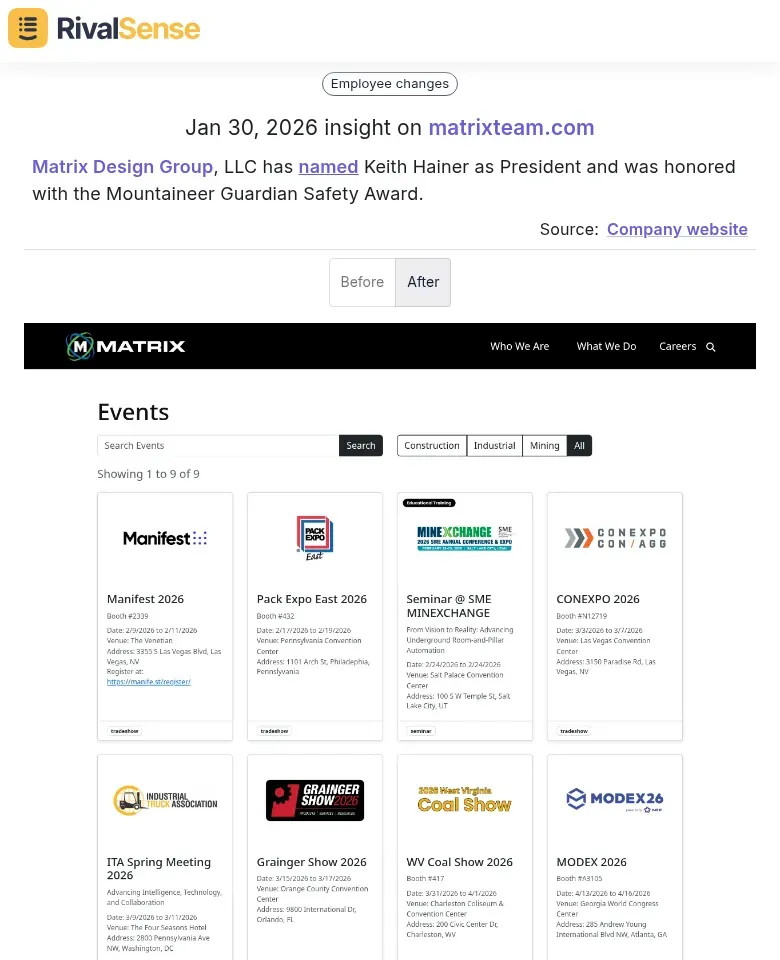

Real-World Example: RivalSense tracked that Matrix Design Group, LLC named Keith Hainer as President and was honored with the Mountaineer Guardian Safety Award. 🏆 This type of insight is valuable because leadership appointments often signal strategic priorities or operational shifts, allowing you to anticipate changes in market focus or competitive positioning.

Pro Tip: Combine executive movement data with hiring/layoff patterns for complete strategic intelligence. A competitor hiring executives while laying off staff may indicate restructuring toward new priorities.

🌐 Geographic and Functional Hiring Patterns: Mapping Competitor Expansion

When tracking competitor expansion, geographic and functional hiring patterns reveal strategic priorities. These patterns provide early warnings of where competitors are investing resources and which markets they are targeting. Country-specific leadership hires signal market entry intentions—when a competitor hires a Country Manager or Sales Director in a new region, they're likely preparing for localized account targeting.

Analyze functional role creation to understand capability building. If competitors suddenly hire multiple Customer Success Managers, they're likely strengthening retention for key accounts. Similarly, increased Product Marketing hires indicate upcoming feature launches targeting enterprise clients.

Connect regional hiring patterns to account targeting strategies by monitoring:

- Leadership hires in specific countries (market entry signals)

- Functional team expansion (capability priorities)

- Timing of hires relative to product launches

- Job descriptions mentioning target industries or account sizes

Real-World Examples from RivalSense:

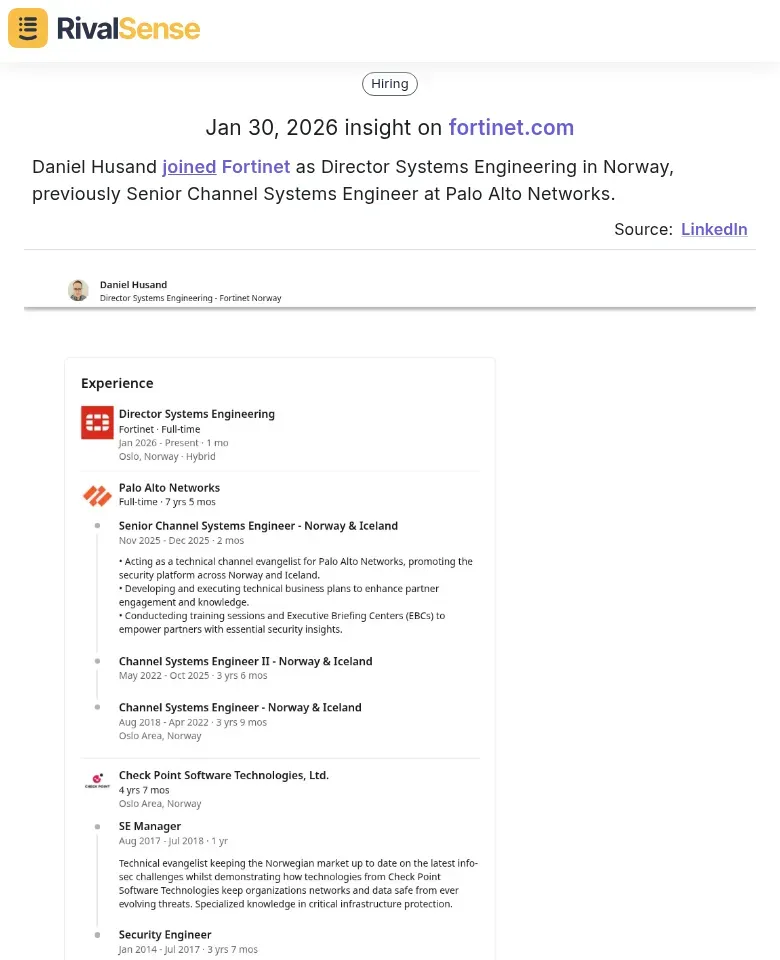

- Daniel Husand joined Fortinet as Director Systems Engineering in Norway, previously Senior Channel Systems Engineer at Palo Alto Networks. 🌍 This hiring insight reveals geographic expansion into Norway and potential talent poaching from a competitor, indicating Fortinet's strategic focus on the Nordic market.

- Alan Lim joined Tenable as Country Manager - Singapore in Singapore. 🗺️ Such appointments are clear signals of market entry or strengthening presence in specific regions, enabling you to adjust your account strategy in those areas proactively.

Practical steps: Track competitor job postings monthly, categorize by location and function, and correlate with their recent customer wins in those regions. Use this intelligence to anticipate which accounts they'll target next and strengthen your positioning accordingly.

📉 Layoff Analysis: Reading Between the Lines of Workforce Reductions

When competitors announce layoffs, the key question is: Are these strategic restructurings or reactive cost-cutting? Strategic moves typically target specific functions while preserving customer-facing roles, whereas reactive cuts are broad-based across departments. Understanding the nature of layoffs helps you identify vulnerabilities and opportunities in key accounts.

Practical steps to analyze layoff patterns:

- Track which departments are affected - reductions in support functions (customer success, account management) signal vulnerability in key accounts

- Monitor geographic impact - retrenchment from specific markets creates opportunity windows

- Analyze timing - sudden cuts vs. planned restructuring reveal financial health

When competitors reduce support staff, their high-value accounts become vulnerable. These clients may experience service degradation, creating an opening for your sales team. Create a targeted outreach list of accounts likely affected by competitor layoffs.

Market retrenchment presents clear opportunities. If a competitor exits a region or industry vertical, immediately assess your capacity to fill the gap. Develop a rapid-response playbook for these scenarios, including localized marketing campaigns and sales enablement materials.

Remember: Layoffs often precede strategic pivots. Monitor what functions competitors are hiring for simultaneously - this reveals their future direction while current weaknesses create immediate opportunities.

🛠️ From Insights to Action: Building a Workforce Intelligence System

To build a workforce intelligence system, start by creating automated tracking for competitor hiring and layoff announcements. This proactive approach ensures you're not missing critical signals that could impact your key account strategy. Set up Google Alerts for key competitors with terms like "[Competitor Name] hiring," "[Competitor Name] layoffs," and "[Competitor Name] talent acquisition." Use LinkedIn Sales Navigator to track key personnel changes at target accounts.

Next, develop frameworks to connect talent movements to account opportunities. Create a scoring system: when a competitor lays off sales or account management staff, flag those accounts as vulnerable. When competitors hire aggressively in specific regions or verticals, identify potential expansion threats. Map talent movements to your CRM to visualize which accounts are most affected.

Establish regular review cadences to translate insights into strategy. Hold monthly workforce intelligence meetings where sales, marketing, and strategy teams review competitor talent patterns. Create action checklists:

- ✅ Identify 3-5 vulnerable accounts after competitor layoffs

- ✅ Adjust messaging for accounts where competitors are hiring aggressively

- ✅ Update account plans based on talent intelligence

This systematic approach turns workforce insights into concrete competitive advantages.

🏆 Conclusion: Turning Workforce Intelligence into Key Account Wins

Workforce intelligence transforms competitor hiring and layoff patterns from passive observations into active key account opportunities. To systematically convert these insights into wins, implement a three-step framework that aligns your team with real-time market signals.

Three-Step Framework for Implementation:

- Opportunity Identification: When a competitor lays off key account managers or specialists, immediately flag their former accounts as vulnerable. Create a target list of 5-10 accounts per quarter based on competitor talent departures.

- Proactive Outreach: Within 48 hours of confirmed departures, initiate contact with decision-makers at affected accounts. Reference the personnel change as context for discussing how your solution better addresses their needs.

- Competitive Positioning: When competitors hire aggressively in specific regions or verticals, adjust your account strategy to reinforce your strengths in adjacent areas they're neglecting.

Practical Implementation Checklist:

- Set up automated alerts for competitor job postings and LinkedIn departures

- Create a shared dashboard tracking competitor team changes by region/vertical

- Train sales teams on how to reference competitor instability tactfully

- Allocate 20% of quarterly account planning to workforce-driven opportunities

Next Steps: Start by monitoring 3-5 key competitors' hiring patterns this quarter. Identify one high-value account affected by recent competitor turnover and develop a tailored outreach strategy.

🚀 Ready to leverage workforce intelligence for your key account strategy? Try out RivalSense for free at https://rivalsense.co/ to track competitor product launches, pricing updates, event participations, partnerships, regulatory aspects, management changes, and media mentions—all delivered in a weekly email report. Get your first competitor report today and stay ahead of the curve!

📚 Read more

👉 Decoding Competitor Moves: A Real-World Analysis of Paige Powers' Transition to Fortinet

👉 The Complete Guide to Key Account Tracking Integration: Practical Strategies for 2026

👉 The Ultimate Competitor Customer Acquisition Checklist for Data Processing Outsourcing

👉 How Zapier's LinkedIn AI Partnership Alerted Competitors to Act

👉 Optimizing Key Account Management with Competitor Website Intelligence