Quick Tips: Monitor Competitor Hiring & Layoffs via Regulatory Filings

SEC Form 8-K filings are your secret weapon for competitor intelligence, providing real-time insights into organizational changes before they become public knowledge. By leveraging these filings, you can anticipate market shifts and adjust your strategies accordingly. When publicly-traded companies experience material events like executive departures, mass layoffs, or strategic hiring initiatives, they must file Form 8-K within four business days. This regulatory requirement gives you a strategic advantage by revealing competitor moves weeks before they appear in press releases or industry news.

Practical Checklist for Monitoring SEC Filings:

- Set up EDGAR alerts for key competitors to receive automatic notifications of new 8-K filings

- Focus on Item 5.02 (Departure of Directors or Certain Officers) and Item 2.05 (Costs Associated with Exit or Disposal Activities) for personnel changes

- Cross-reference hiring patterns with quarterly earnings reports to understand strategic priorities

- Monitor executive compensation disclosures for clues about retention challenges or growth initiatives

- Track geographic concentrations of new roles to anticipate market expansion

When a competitor files an 8-K announcing executive changes or workforce reductions, you gain early warning of strategic shifts. For example, mass layoffs in a specific department signal cost-cutting or market exit, creating opportunities to target vulnerable accounts. Conversely, hiring spikes in AI or enterprise sales reveal expansion plans you can counter-strategize against. By systematically analyzing these filings, you transform regulatory compliance data into actionable competitive intelligence.

Key Regulatory Filings to Monitor for Hiring & Layoff Intelligence

Understanding which regulatory filings to monitor is crucial for effective competitor intelligence. These documents provide structured data that can be analyzed for trends and signals.

SEC Form 8-K: Your Real-Time Alert System

Monitor Item 5.02 for executive appointments and departures. Companies must file within 4 business days of material events. Practical tip: Set up automated alerts for specific competitors' 8-K filings to catch leadership changes immediately.

Form 10-K and 10-Q: Workforce Trend Analysis

Review these annual and quarterly reports for:

- Human capital disclosures in MD&A sections

- Risk factors mentioning workforce challenges or restructuring

- Employment-related footnotes in financial statements

Checklist: Compare year-over-year employee count changes and read between the lines of risk factor updates for layoff signals.

International Equivalents: Global Competitor Tracking

For non-US competitors, track:

- Form 20-F for foreign companies listed on US exchanges

- Form 6-K for material information foreign companies disclose in home countries

- Form 40-F for Canadian companies

Pro advice: Use regulatory filing aggregators that cover multiple jurisdictions to streamline monitoring of global competitors' workforce movements.

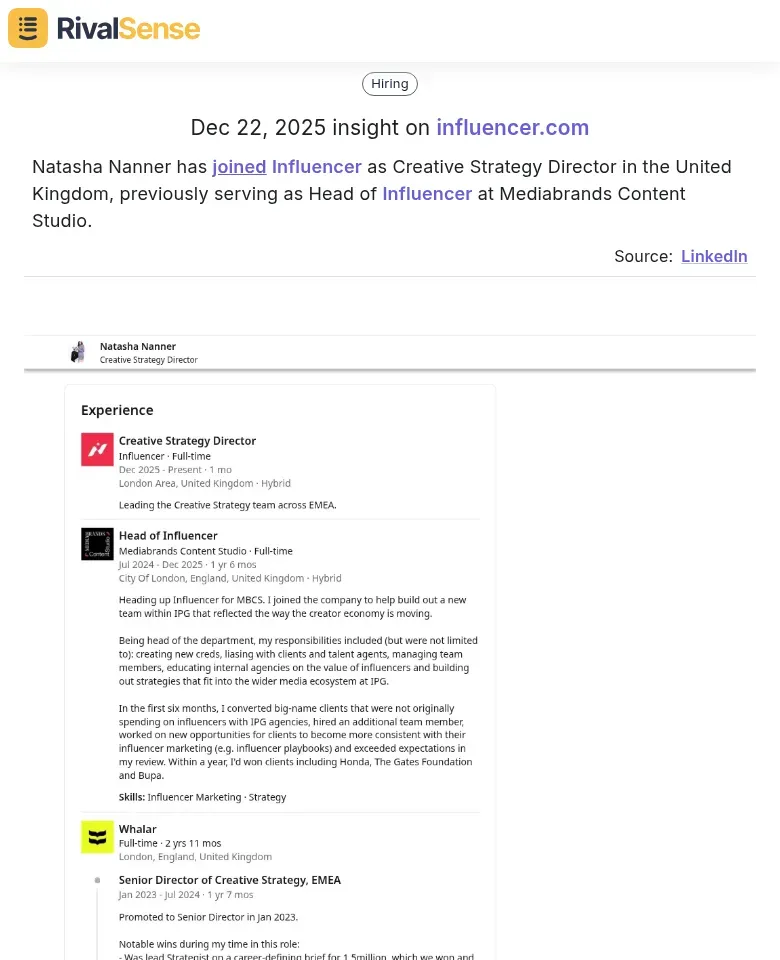

Example Insight from RivalSense: Tracking regulatory filings can reveal key appointments. For instance, RivalSense detected that Natasha Nanner has joined Influencer as Creative Strategy Director in the United Kingdom, previously serving as Head of Influencer at Mediabrands Content Studio.

This type of insight is valuable because it signals a competitor's strategic focus on creative direction and potential new campaigns or market expansions, allowing you to anticipate their moves.

Decoding Executive Moves: What Hiring Patterns Reveal About Competitor Strategy

Executive hiring patterns offer a transparent window into competitor strategy. By analyzing these moves, you can uncover hidden priorities and future directions. When a rival aggressively recruits AI specialists, they're likely building new AI-powered products. A surge in sales hires for a specific region signals market expansion plans. Track these moves through regulatory filings like SEC Form 8-Ks and LinkedIn's SEC-filed disclosures.

Key insights to monitor:

• Strategic priorities: Mass hiring in a department reveals investment focus

• Market expansion: Geographic hiring clusters indicate new territory targets

• Product development: Technical role spikes often precede launches

• Executive flow: Leaders moving between competitors highlight talent wars

Practical steps:

- Set up alerts for competitor SEC filings (8-K for executive changes)

- Monitor LinkedIn for pattern changes in competitor employee growth

- Analyze job description evolution for strategic clues

- Track executive transitions between direct competitors

- Correlate hiring spikes with subsequent product announcements

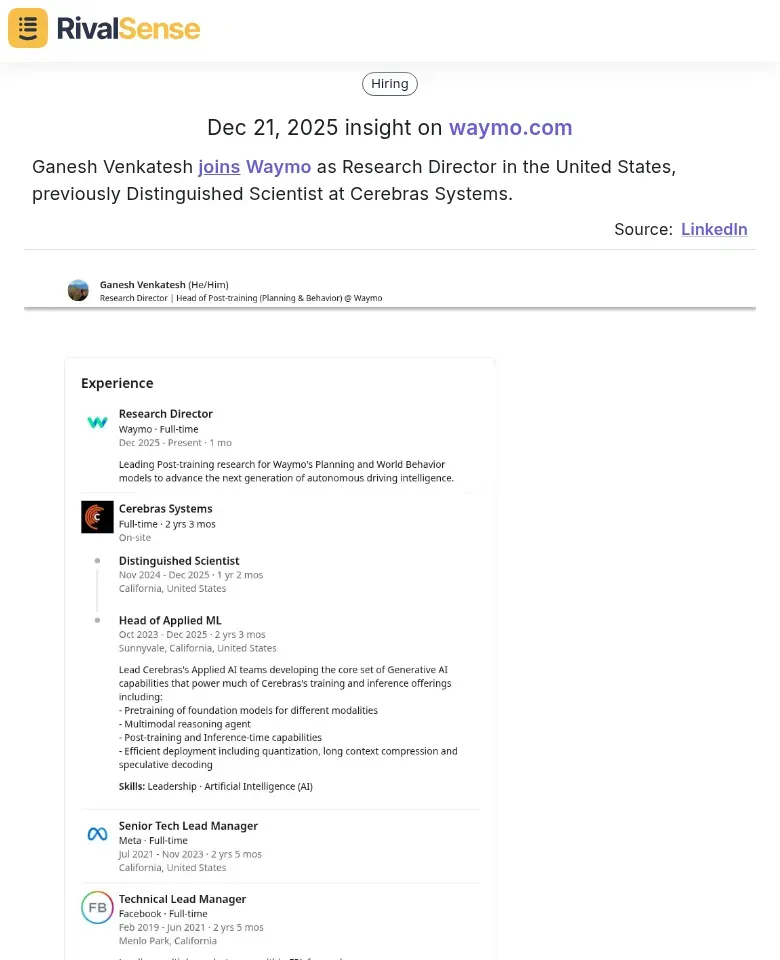

Example Insight from RivalSense: Consider Ganesh Venkatesh joining Waymo as Research Director in the United States, previously Distinguished Scientist at Cerebras Systems.

This hiring move is valuable for business strategy as it indicates Waymo's deepening investment in research and development, potentially signaling advancements in autonomous vehicle technology that could impact the market.

Interpreting Layoff Signals: Early Warning Signs of Competitor Challenges

Interpreting layoff signals requires careful analysis of regulatory filings for early warning signs. These signals can reveal financial pressures or strategic realignments before they become public. Look for restructuring patterns that indicate financial pressure—when competitors announce multiple rounds of layoffs within 12 months (like Intel's 15% cut followed by another 20%), it signals deeper issues than temporary adjustments. Strategic realignment often appears as targeted cuts in specific divisions (e.g., Amazon's 4% corporate workforce reduction to "shift resources to biggest bets").

Practical steps:

- Monitor SEC 8-K filings for "restructuring charges" or "workforce reductions"—these often precede public announcements by weeks.

📚 Read more

👉 How to Respond to Competitor Pricing Changes: A Case Study on Vivigo

👉 Key Account Management Tools Comparison 2025: The Ultimate Guide for Business Leaders

👉 Actionable Strategies to Track Key Account Milestones for Insurance Brokers

👉 How Zyte's Copilot Rebrand Helped Competitors Accelerate Product Development

👉 Avoid These Instagram Competitor Insight Mistakes for Better Key Account Tracking