Predictive Monitoring: How Insurance Brokers Can Anticipate Competitor Moves

The insurance brokerage landscape in 2025 is defined by unprecedented volatility and consolidation. Multibillion-dollar acquisitions like Brown & Brown's $10 billion purchase of Accession Risk Management Group signal intense market concentration, while embedded channels threaten to redirect $70 billion in global P&C premiums away from traditional intermediaries. Auto lines alone face a 20% shift toward point-of-sale integration as non-insurance platforms leverage real-time data to seamlessly embed coverage into consumer journeys.

Traditional competitive monitoring methods—manual market scans, periodic competitor analysis, and reactive news tracking—are dangerously insufficient in this environment. They fail to capture real-time pricing shifts, API-driven capacity changes, or emerging embedded partnerships that can redirect billions in premiums overnight.

🚀 Practical steps for brokers:

- ✅ Implement automated tracking of competitor API integrations and embedded partnerships

- ✅ Monitor real-time pricing data across specialty lines where margins are compressing 17%

- ✅ Establish alerts for M&A activity and market consolidation patterns

- ✅ Track emerging InsurTech collaborations that could disrupt traditional distribution channels

What is Predictive Monitoring and How It Works for Competitor Intelligence

Predictive monitoring transforms competitor intelligence from reactive to proactive by using AI algorithms to forecast competitor moves before they happen. Unlike traditional competitive analysis that looks backward at historical data, predictive monitoring analyzes real-time patterns from multiple sources—including regulatory filings, market announcements, and financial disclosures—to identify emerging trends and potential launches.

AI-driven algorithms process this data continuously, detecting subtle signals like rate filing changes, coverage adjustments, or regulatory submissions that indicate upcoming product launches or market expansions. For insurance brokers, this means getting alerts when competitors file new policies or adjust pricing strategies, allowing you to respond strategically rather than reactively.

📊 Practical steps to implement predictive monitoring:

- ✅ Set up automated alerts for competitor regulatory filings in your target states

- ✅ Monitor market announcements and press releases for expansion signals

- ✅ Use AI tools to analyze pricing patterns and coverage changes over time

- ✅ Track regulatory approval timelines to anticipate launch dates

- ✅ Benchmark against industry patterns to validate predictions

💡 Tip: Focus on data sources with high predictive value—rate filings often precede product launches by 30-90 days, giving you crucial lead time.

Key Signals to Monitor for Predicting Competitor Launches

Predicting competitor launches requires monitoring three key signal categories that precede market entry. First, track regulatory filings and licensing applications through state insurance departments—new entity registrations, product filings, or expansion applications often surface 6-12 months before launch. Set up alerts with NAIC databases and state regulatory portals for competitor names and related entities.

Second, analyze talent acquisition patterns. Hiring spikes for specialized roles like product development actuaries, compliance specialists, or niche underwriters signal imminent launches. Monitor LinkedIn and job boards for positions requiring 'new product development' or 'market expansion' experience. A 30%+ increase in hiring within 60 days often indicates preparation for launch.

Third, watch technology partnerships and vendor relationships. New integrations with insurtech platforms, CRM systems, or data analytics providers reveal capability building. Check for API integrations, cloud service expansions, or partnerships with specialized insurance software vendors. These partnerships typically materialize 3-6 months before public announcement.

📋 Practical checklist:

- ✅ Subscribe to state insurance department filing alerts

- ✅ Set up Google Alerts for competitor + 'new license'/'filing'

- ✅ Monitor LinkedIn for hiring pattern changes

- ✅ Track job postings for specific technical roles

- ✅ Review competitor technology stack changes quarterly

- ✅ Follow industry partnership announcements

Early detection of these signals provides 3-9 months lead time to develop counter-strategies.

Real-World Competitive Intelligence Examples

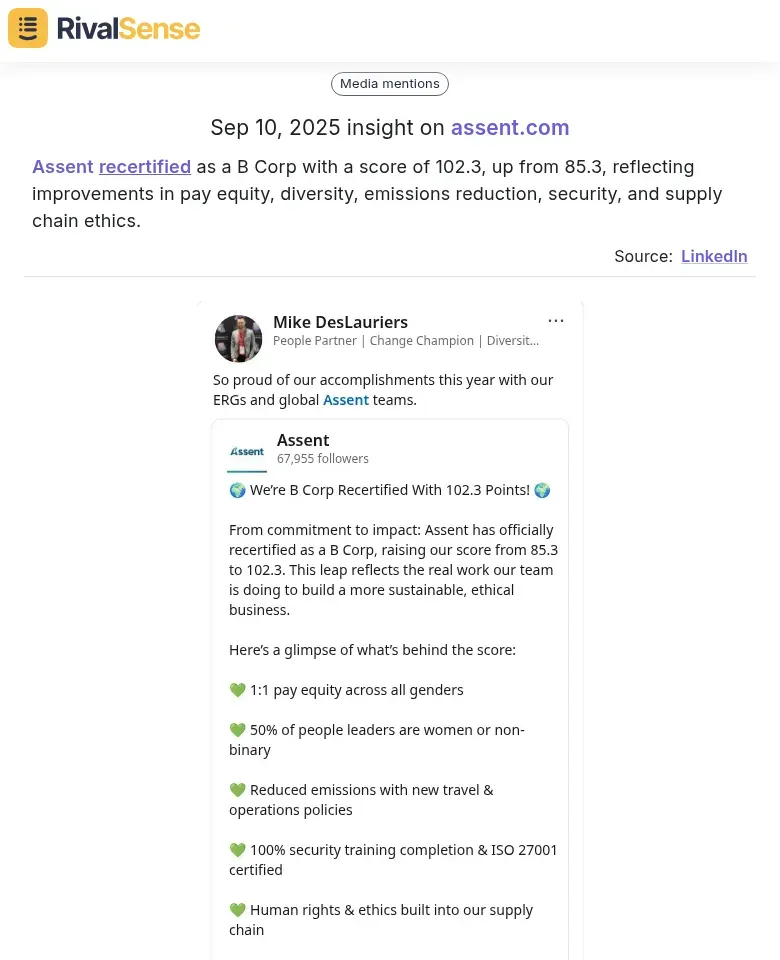

Monitoring certifications and sustainability achievements can reveal important shifts in competitor positioning and market strategy. For instance, when a company enhances its B Corp certification score significantly, it often signals deeper commitments to ethical practices that could impact customer trust and competitive differentiation:

Why it matters: Tracking ESG improvements helps anticipate how competitors might leverage sustainability credentials in marketing and client acquisition, particularly in industries where ethical sourcing and environmental responsibility are becoming decision factors.

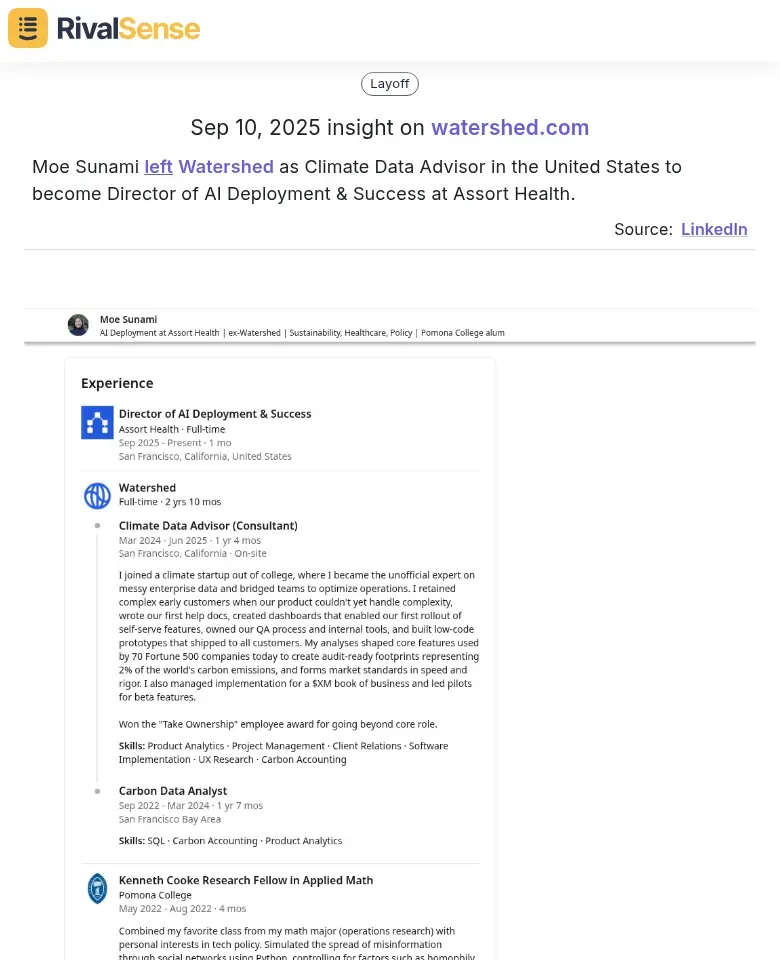

Personnel movements between competing organizations can provide early signals of strategic shifts or new market focuses. When key executives move between companies in adjacent sectors, it often indicates where talent and expertise are flowing:

Why it matters: Executive moves between climate tech and AI deployment roles can signal emerging intersections between sustainability and artificial intelligence that might indicate new service offerings or market expansions.

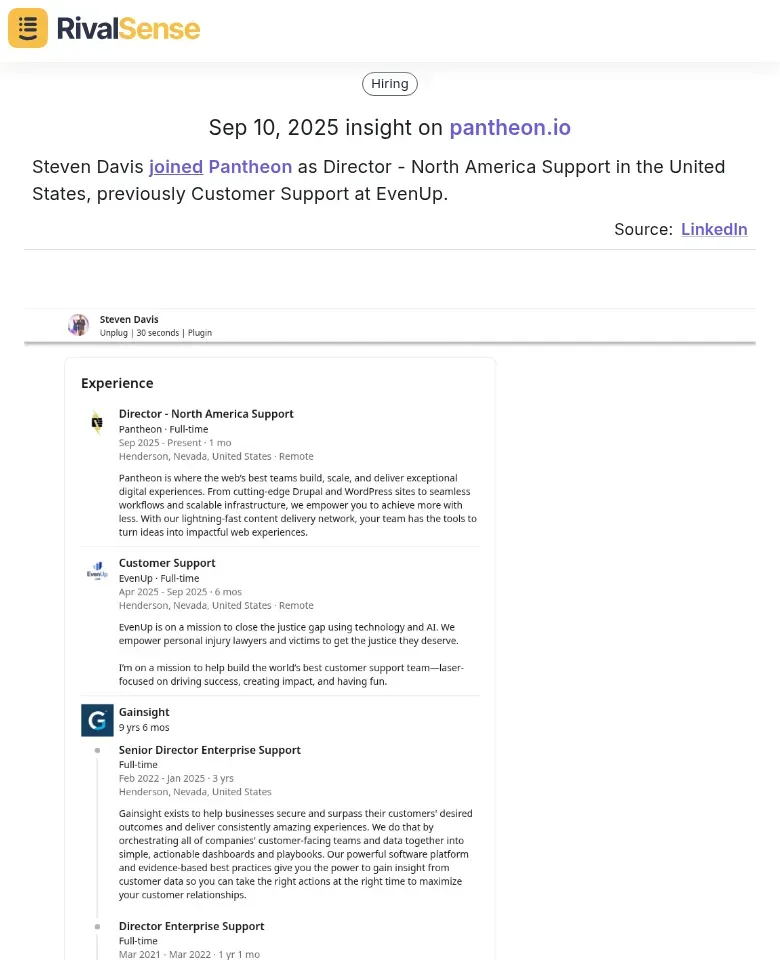

New senior appointments often precede organizational changes or market expansions. Tracking when competitors hire experienced directors from related industries can reveal growth plans or strategic pivots:

Why it matters: Monitoring key hires helps anticipate competitor capacity building, service expansion, or geographic growth plans before they're publicly announced.

Case Study: WTW's Radar Vision - A Blueprint for Predictive Monitoring

WTW's Radar Vision exemplifies predictive monitoring excellence for insurance brokers. This AI-driven tool automates model monitoring by leveraging proprietary algorithms to analyze real-time data on competitor activity, inflation trends, claims patterns, and customer behavior. Unlike traditional solutions that rely on obsolete data, Radar Vision provides early, actionable insights that detect emerging market shifts before competitors.

🎯 Key lessons from WTW's approach:

- ✅ Automate manual monitoring processes to identify performance deviations faster

- ✅ Use AI to uncover previously inaccessible competitor intelligence

- ✅ Focus on real-time data analysis rather than historical snapshots

Actionable insights generated include underwriting profitability optimization through early detection of pricing anomalies and growth opportunities by identifying underserved market segments.

📋 Practical checklist for implementation:

- ✅ Integrate AI-powered monitoring with existing analytics platforms

- ✅ Establish real-time data feeds for competitor activity tracking

- ✅ Set automated alerts for performance deviations exceeding 5%

- ✅ Create cross-functional teams (underwriting, claims, pricing) to act on insights

- ✅ Conduct weekly reviews of emerging trends and competitor movements

Implementing Predictive Monitoring in Your Brokerage Operation

Implementing predictive monitoring requires a strategic technology stack: cloud-based analytics platforms (AWS, Azure, or Google Cloud), machine learning tools (Python/R with scikit-learn), and real-time data processing systems. Integrate with your existing CRM (Salesforce, HubSpot) via APIs to sync competitor data and customer insights. Connect to business intelligence tools (Tableau, Power BI) for visualization.

Build cross-functional teams including data scientists, marketing analysts, and sales representatives. Establish clear workflows: data collection → analysis → actionable insights → execution. Use automated alerts for competitor launches and market shifts. Regularly review predictive models for accuracy and adjust strategies based on insights to stay ahead.

Future Outlook: Predictive Monitoring as Competitive Advantage

The insurance broker tools market is projected to reach $1.46 billion in 2025, growing at an 8.1% CAGR, creating a critical inflection point where predictive monitoring will separate market leaders from laggards. Top performers will leverage AI-driven predictive analytics to anticipate competitor product launches, pricing shifts, and market expansions 3-6 months in advance, while traditional brokers relying on reactive monitoring will face significant competitive disadvantages.

🎯 Strategic recommendations for brokers:

- ✅ Implement AI-powered competitor tracking tools that analyze digital footprints, regulatory filings, and market signals

- ✅ Develop predictive models using machine learning to forecast competitor pricing strategies and product innovations

- ✅ Establish real-time monitoring of competitor digital marketing campaigns and customer acquisition tactics

- ✅ Create cross-functional competitive intelligence teams that translate predictive insights into actionable strategies

- ✅ Invest in cloud-based predictive analytics platforms that scale with market complexity

📋 Practical checklist:

- ✅ Monitor competitor job postings for expansion signals

- ✅ Track patent filings for innovation clues

- ✅ Analyze social media sentiment for brand positioning shifts

- ✅ Benchmark pricing against predictive market models monthly

Ready to transform your competitive intelligence? Try RivalSense for free and get your first competitor report today. Our platform tracks competitor movements across product launches, pricing changes, executive appointments, and regulatory developments—delivering actionable insights directly to your inbox every week.

📚 Read more

👉 Actionable Internet Monitoring Strategies for Competitor Press Releases

👉 Toy Industry CRM Benchmarking: How to Track Key Accounts and Outperform Competitors

👉 Advanced Tactics: Uncover Competitor Product Secrets via Backlink Analysis

👉 Why Tracking Competitor Executive Hires Matters: The Gigi Janelidze Case