Predictive Analytics for Forex: Maximizing Key Account Profitability in 2025

In today's volatile forex markets, data-driven decision making has become essential for maximizing key account profitability. Predictive analytics transforms traditional trading by leveraging AI and machine learning to forecast market movements with unprecedented accuracy, moving beyond reactive strategies to proactive, intelligence-based approaches.

Key profitability metrics to track include:

- ROI 📊 - Measuring overall return on investment

- Sharpe Ratio ⚖️ - Assessing risk-adjusted performance (aim for above 1.0)

- Profit Factor 💰 - Ratio of gross profit to gross loss

- Drawdown 📉 - Maximum loss from peak to trough

Practical tip: Start by integrating historical trade data with real-time market feeds into predictive models, focusing on currency pairs with high liquidity for better signal accuracy. Regularly backtest strategies against these metrics to refine your approach and ensure sustainable profitability in 2025's competitive landscape.

Core Predictive Analytics Techniques for Forex Profitability

Predictive analytics transforms Forex key account profitability through advanced techniques that go beyond traditional analysis. Machine learning algorithms like LSTM networks and CNNs can forecast market trends with impressive accuracy, but it's crucial to prioritize profit over pure accuracy metrics.

Key techniques include:

- Hybrid models combining convolutional layers for feature extraction and LSTM layers for temporal dependencies

- Risk assessment models that predict drawdowns by analyzing volatility and capital preservation metrics

- Behavioral analytics that identify trader patterns for improved client retention

Practical implementation checklist: ✅

- Use technical indicators (RSI, MACD) with historical data from reliable sources

- Implement position sizing based on account balance and volatility

- Diversify across multiple Forex symbols using ETF-inspired strategies

- Monitor trading frequency, win/loss ratios, and response to market events

- Segment traders by behavior and tailor retention strategies accordingly

Key Profitability Metrics and Performance Indicators

Mastering key profitability metrics is essential for predictive analytics in forex key account management. These metrics provide the foundation for data-driven decision making and strategic planning.

Core KPIs to track:

| Metric | Target | Calculation |

|---|---|---|

| Profit Factor | >1.5 | Gross profit / Gross loss |

| Win/Loss Ratio | 1:2 risk-reward | Profitable trades / Losing trades |

| Maximum Drawdown | <20% | Peak to trough decline |

Client Lifetime Value (CLV) prediction involves analyzing:

- Trading frequency patterns

- Deposit behaviors and trends

- Engagement metrics over time

Portfolio diversification requires correlation analysis between currency pairs. Aim for correlation coefficients between -0.5 and 0.5 for optimal diversification across uncorrelated pairs.

Weekly monitoring checklist: 📋

- Review all KPIs and performance metrics

- Set automated alerts for threshold breaches

- Analyze correlation matrices monthly

- Update CLV models quarterly

- Implement proactive churn prevention measures

Competitive Intelligence: Learning from Market Expansion Strategies

Competitive intelligence in forex requires analyzing how rivals expand geographically to uncover untapped markets and emerging opportunities. Monitoring competitor movements can reveal strategic insights before markets become saturated.

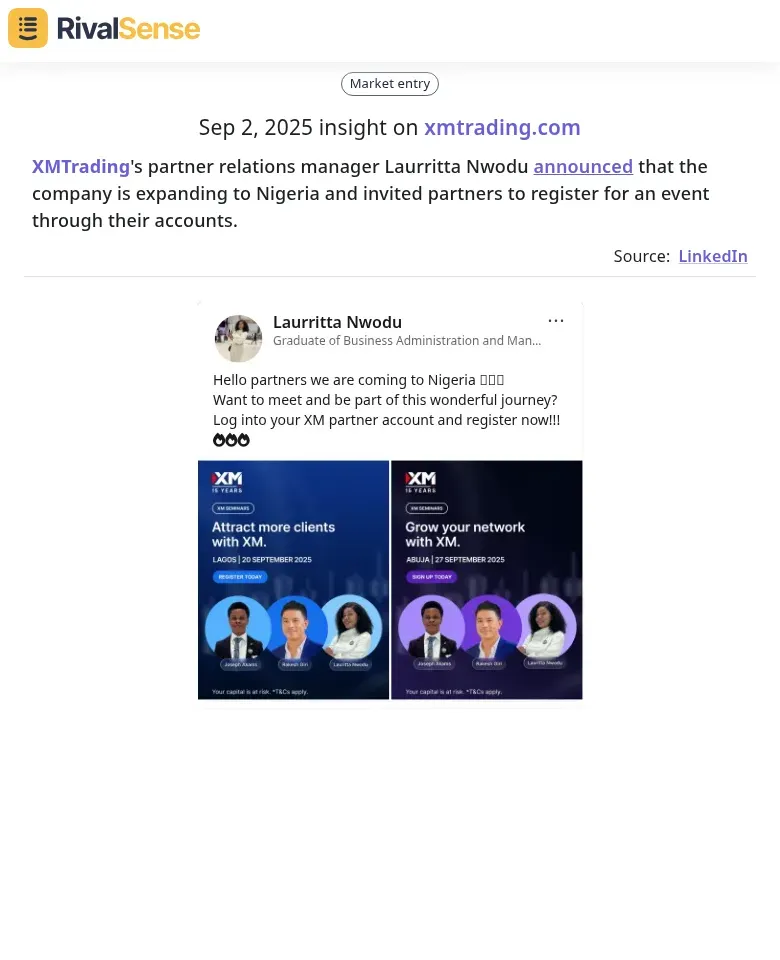

Real-world example: Our RivalSense platform recently detected that XMTrading's partner relations manager Laurritta Nwodu announced the company's expansion to Nigeria, inviting partners to register for events through their accounts. This type of insight is invaluable for understanding competitor geographic strategies and timing your own market entries effectively.

Practical competitive intelligence steps:

- Map competitor geographic expansion timelines

- Analyze PRM commission structures and affiliate programs

- Monitor event-driven market entries around economic calendar events

- Track regulatory compliance requirements per region

Key insight: Competitors entering markets during high volatility periods often capture premium clients. Their event-driven tactics around major economic announcements can reveal account growth patterns worth emulating.

Implementation Framework and Best Practices

Implementing predictive analytics for forex key account profitability requires a structured framework that ensures seamless integration with existing systems. The right approach can make the difference between success and failure in predictive modeling.

Essential components:

- API integration with existing CRM and trading platforms

- Real-time data flow management

- Automated data quality assurance and cleansing

- Continuous model validation and backtesting

Best practices checklist: ✅

- Use no-code solutions like Akkio and Altair AI Studio for easier implementation

- Validate forex tick data and handle missing values systematically

- Normalize currencies to prevent model drift

- Update algorithms monthly to adapt to market volatility

- Build scalable systems on cloud platforms like Azure Machine Learning

Practical tip: Create a comprehensive implementation checklist covering API integration, data hygiene protocols, model retraining schedules, and performance metrics to ensure adaptability to changing market conditions.

Future Trends and Strategic Recommendations

Looking ahead, predictive analytics in forex key account management is poised for transformative growth through emerging AI technologies. Staying ahead of these trends is crucial for maintaining competitive advantage.

Emerging technologies to watch:

- Generative AI models (GANs and diffusion networks) for scenario simulation

- Real-time data integration for instant fraud detection

- Advanced market adaptation algorithms

Regulatory compliance considerations: ⚖️

- EU AI Act (effective February 2025) mandates fairness audits and explainable AI

- DORA (effective January 2025) requires digital operational resilience

- Stress testing and third-party vendor management requirements

Strategic implementation roadmap: 🗺️

- Assess AI inventory and categorize by risk under EU AI Act

- Conduct gap analysis for DORA compliance

- Implement hybrid workflows combining AI predictions with human validation

- Deploy bias detection tools and real-time monitoring systems

- Establish cross-functional teams for ongoing governance

Final recommendation: Start with pilot projects on non-critical accounts to test predictive models before full-scale deployment, ensuring regulatory alignment and minimizing operational risk.

Ready to transform your competitive intelligence strategy? Try RivalSense for free and get your first competitor report today. Our platform tracks competitor movements across product launches, pricing updates, event participations, partnerships, and regulatory changes—delivering actionable insights directly to your inbox every week.

📚 Read more

👉 Competitor Media Analysis: Uncover Hidden Partnership Opportunities

👉 Why Tracking Competitor Executive Moves Matters: A Real-World Example

👉 The Ultimate Guide to Business Partnership Pilot Programs: Strategy, Steps, and Success Metrics

👉 7 CRM Integration Mistakes Systems Software Developers Must Avoid (+ How to Fix Them)

👉 How Supliful's Rebranding Uncovered Hidden Competitor Growth Opportunities