Nubank News | Sep 05, 2024

Nubank now allows cash deposits directly into Nu accounts at over 4000 locations across Mexico.

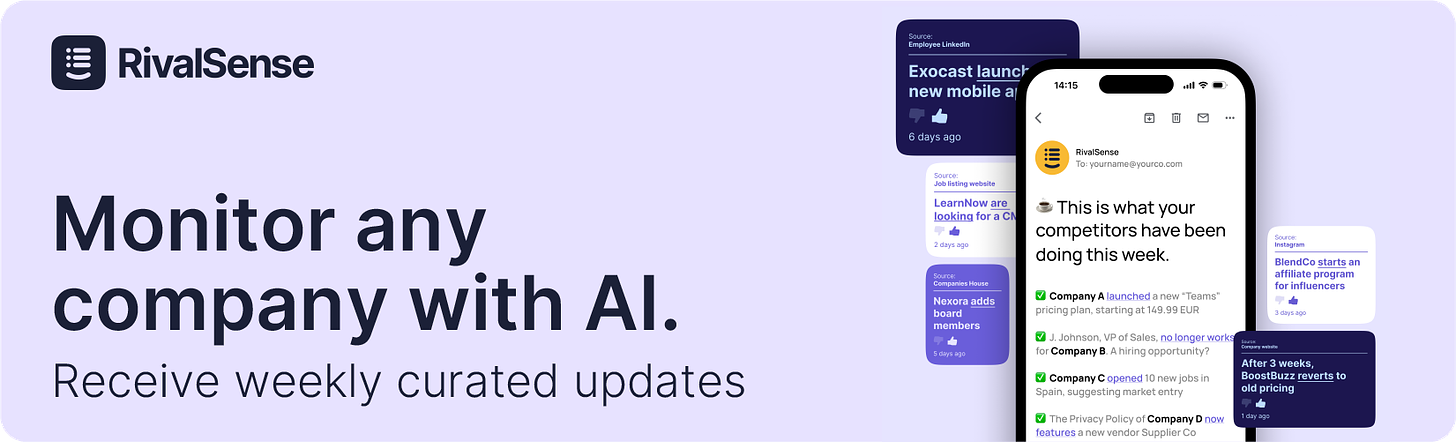

Brought to you by RivalSense - an AI tool for monitoring any company.

RivalSense tracks the most important product launches, fundraising news, partnerships, hiring activities, pricing changes, tech news, vendors, corporate filings, media mentions, and other developments of companies you're following 💡

Nubank is a leading digital banking platform founded in 2013, headquartered in São Paulo, Brazil. It aims to simplify financial services and empower individuals by providing innovative, low-cost, and user-friendly financial solutions. With over 80 million customers across Brazil, Mexico, and Colombia, Nubank focuses on financial inclusion and has transformed the financial landscape in Latin America through its proprietary technology and data-driven approach.

- Nubank now allows cash deposits directly into Nu accounts at over 4000 locations across Mexico.

- A new Central Bank law in Brazil prohibits Nubank from certain credit card operations starting in 2024.

- Nubank will end a free service in its app by the end of 2024, requiring customers to pay R$ 24.90 monthly starting January 1, 2025.

- Nubank has partnered with 99 to allow its 95 million customers in Brazil to use NuPay for secure, one-click payments for rides starting in the coming weeks.

- Nubank finalized negotiations for seven new agreements to expand its digital payroll loan service, NuConsignado, including contracts with the Brazilian Armed Forces and several municipalities.

- Nubank reached its highest market value in history at R$ 366 billion, making it one of the top 3 most valuable companies in Brazil.

- Pablo Villegas Ruiz joined Nubank as CMO Nu Colombia - Marketing Director in Colombia, previously serving as CMO Colombia Argentina Uruguay + Marketing head Courriers at Rappi from January 2023 to May 2024.

- Tyler Horn joined Nubank as Chief Credit Officer in the United States after serving as Vice President - Divisional Credit Officer; US Card at Capital One from January 2022 to August 2024.

- Jiachen (Priscila) Zhang joined Nubank as Chief of Staff in Brazil, previously holding a position at another company.

- Nubank now allows customers to open accounts for individuals under 18 years old.

- Nubank's CEO David Vélez sold $404 million worth of shares as the company's stock hit record highs, with shares surging over 69% this year.

- Nubank collaborated with Lightspark to bring Bitcoin Lightning Network to 100 million customers.

- Nubank partnered with Uber Brasil to create nupay.

- Nubank launched 'Querido Futuro,' an interactive experience in Bogotá's Zona T until August 19, to help users set and achieve savings goals with Cuenta Nu.

- Nubank's Q2 2024 net income surged to $487 million, with revenue hitting $2.8 billion and the customer base growing to 104.5 million.

- Nubank's second-quarter profits more than doubled from a year earlier, driving a rally in shares despite concerns over rising delinquency rates and falling provisions for bad loans.

- Nu Asset, Nubank’s investment fund manager, took its first steps into the institutional investor segment through a distribution agreement with Itajubá Investimentos.

- Nubank migrated from Matic to Pol.

- David Vélez, creator of Nubank, received the Order of Democracy Simón Bolívar in the Grade of Grand Knight from Representative Saray Robayo Bechara on September 4.

- On September 5, Nubank was showcased as a success story in partnership with SAP at SAP NOW.

- Juliana Roschel from Nubank is a finalist for the 'Most Innovative Marketer' award at the Latam 2024 #PremiosMarketers.

- Nubank is offering 10 GB of free internet for one month to customers with the Ultravioleta card, surpassing major operators like Vivo, Claro, and TIM.

- David Vélez from Nubank will be a guest at the LATAM Fintech Market in Barranquilla on September 5-6.

- Nubank is preparing for a new product launch called Lana.

- David Vélez, founder and CEO of Nubank, announced plans to donate a large part of his wealth to social causes.

- David Vélez, CEO of Nubank, discussed the opportunity to provide banking services to the poor and protect them from predatory lenders in an interview on September 1.

- Nubank has introduced methods to make its NuPay credit card loan options more visible to users.

- David Vélez, CEO of Nubank, was praised for his leadership and influence in Colombia by Diana Rojas Fierro, Customer Excellence Analyst at Nubank.

- Mariana de Aguiar Moraes has joined Nubank as Marketing Director High Income and PJ in Brazil, previously serving as Marketing and CRM Director at C&A Brasil.

- Fausto Ibarra has joined Nubank as VP and General Manager, Insurance in the United States, previously working as a Startup Mentor at Endeavor.

- Daniel Ribeiro Silva has joined Nubank as Director of Machine Learning in the United States, previously serving as Co-Founder at hyperplane.

- Nubank has removed the daily cashback earnings display feature, causing dissatisfaction among users.

- Joseph Forero Foe met Nubank CEO and co-founder David Vélez, expressing admiration for him as a role model and marketer.

- Nubank has reportedly canceled a PJ account, causing issues with payment records since January.

- Nubank has improved security against mobile phone theft and recently enhanced its investment and dollar account services.

- Nubank is testing a new Pix-related feature in its app with selected users to enhance payment versatility and security.

- Nubank announced that starting 1 January 2025, it will end the free Rappi Pro subscription for its cardholders, giving customers 4 months to adapt.

- Erick Martinez Carrillo joined Nubank as Head of Finance Risk in Mexico after serving as Head of Financial & Credit Risk Management at Openbank from May 2022 to August 2024.

- Cesar Rincon Gomez joined Nubank as Director of Information Technology Strategy in Colombia, previously working as Director of Information Technology Strategy at Nu.

- Nubank's savings accounts in Colombia reached $2.1 billion in deposits by mid-August 2024, as announced by Marcela Torres, the company's manager in Colombia.

Did you find it useful?

If you liked this report, consider following your own companies of interest. Receive weekly insights directly to your inbox using RivalSense AI.