Maximizing Warehousing & Distribution Competitor Benchmarking: Best Practices for B2B Leaders

In today's hyper-competitive warehousing and distribution landscape, competitor benchmarking has evolved from a reactive monitoring exercise to a proactive strategic imperative. By systematically comparing your operations against industry leaders, you can identify gaps, uncover opportunities, and drive continuous improvement. Supply chain leaders who master this discipline transform operational data into competitive advantage, moving beyond simply tracking rivals to anticipating market shifts and optimizing performance.

Why Benchmarking is Non-Negotiable:

- Performance Gap Analysis: Compare your on-time shipments (typically 95-98% for leaders), dock-to-stock cycle times, and order picking accuracy against industry benchmarks

- Strategic Positioning: Identify whether you're competing on cost leadership, customer service excellence, or operational innovation

- Resource Allocation: Focus investments where they deliver maximum competitive impact

Practical Implementation Checklist: 📊

- Start with WERC's DC Measures - Track 45 key metrics across customer, operations, financial, capacity, and employee categories

- Benchmark Beyond Healthcare - Like Intermountain Healthcare, compare against best-in-class operators outside your immediate industry

- Focus on Top 7 Universal Metrics - On-time shipments, warehouse capacity utilization, dock-to-stock cycles, picking accuracy, internal order cycles, peak capacity, and total order cycles

- Shift from Reactive to Proactive - Use benchmarking to anticipate competitor moves rather than just reacting to them

Direct Impact on Profitability: Effective benchmarking directly correlates with 15-25% operational efficiency improvements and 5-10% cost reductions through process optimization and strategic alignment with market-leading practices.

Defining Your Benchmarking Framework: What to Measure and Why

To build an effective warehousing & distribution benchmarking framework, start by identifying critical KPIs across three categories. For warehousing, measure order accuracy (target: 99.5%+), inventory turnover ratio (industry average: 8-12x annually), and space utilization (optimal: 85-90% of cubic capacity). These operational metrics reveal efficiency gaps versus competitors. For distribution, track on-time delivery rates (aim for 95%+), transportation costs per unit (calculate as total shipping ÷ units shipped), and fulfillment cycle times (from order receipt to shipment). Compare these against top performers to identify optimization opportunities.

Practical Checklist: 🔍

- Prioritize 8-12 core metrics across operational, financial, and customer service categories

- Use industry benchmarks from associations like WERC or CSCMP

- Normalize data for fair comparison (adjust for company size, geography)

- Include leading indicators (e.g., warehouse labor productivity) alongside lagging ones

- Review quarterly to track competitive positioning trends

Select a balanced mix: 40% operational metrics, 30% financial (cost per order, ROI), and 30% customer-focused (perfect order rate, returns ratio). This comprehensive approach reveals both efficiency gaps and strategic advantages versus competitors.

Data Collection Strategies: Gathering Actionable Competitive Intelligence

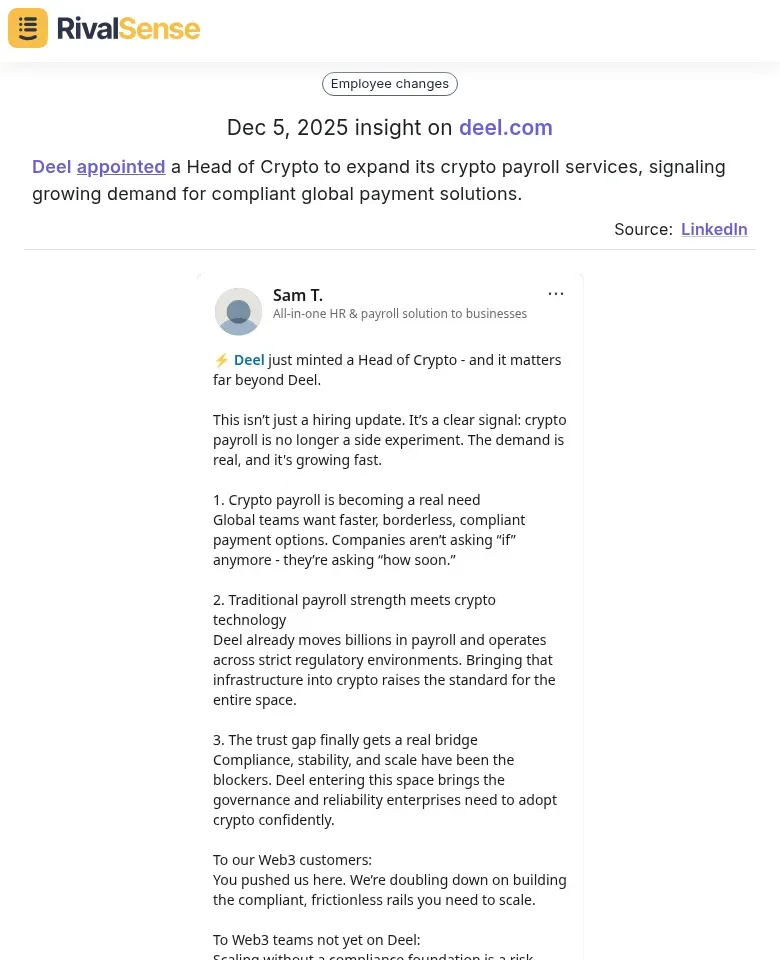

Effective data collection is the foundation of actionable competitive intelligence in warehousing and distribution. Start by systematically gathering data from multiple sources: analyze public financial reports for capacity insights, benchmark against industry standards for operational metrics, and leverage market intelligence tools for real-time competitor monitoring. For instance, tracking competitor appointments can reveal strategic shifts, such as when Deel appointed a Head of Crypto to expand its crypto payroll services, signaling growing demand for compliant global payment solutions. This type of insight is valuable because it highlights how competitors are adapting to market trends, allowing you to anticipate changes in service offerings or technology investments.

Practical Implementation Steps:

- Automate Tracking: Use tools like RivalSense to monitor competitor pricing, inventory levels, and fulfillment times automatically

- Multi-Source Validation: Cross-reference data from SEC filings, industry associations, and customer reviews

- Normalize Metrics: Standardize measurements (e.g., convert all fulfillment times to hours, normalize pricing per unit)

Quality Assurance Checklist: ✅

✓ Verify data timeliness (within 30 days)

✓ Check source credibility and bias

✓ Normalize geographic and seasonal variations

✓ Validate through customer feedback channels

Pro Tip: Set up automated alerts for competitor capacity changes or pricing adjustments to respond strategically. Combine quantitative data with qualitative insights from customer reviews and industry forums for complete competitive understanding. Regular data validation ensures your benchmarking remains relevant and actionable for strategic decision-making.

Analysis and Interpretation: Turning Data into Strategic Insights

Once you've gathered competitor warehousing and distribution data, the real work begins: transforming raw numbers into strategic insights. Start with comparative analysis techniques: conduct gap analysis to identify where competitors outperform you (e.g., 24-hour fulfillment vs. your 48-hour), track trend identification to spot emerging patterns (like Amazon's shift to regional fulfillment centers), and create performance rankings across key metrics (order accuracy, shipping costs, returns processing). For example, when Pratt & Whitney AeroPower Rzeszow won the Employer - Safe Work Organizer contest in the large companies category, it highlighted their operational excellence in safety and employee management. This insight is valuable because awards and recognitions can signal competitor strengths in areas like workplace culture or regulatory compliance, informing your own operational priorities.

Practical Steps:

- Create a competitor scorecard with weighted metrics

- Map your performance gaps visually using heat maps

- Look beyond obvious metrics—sometimes a competitor's "hidden advantage" is their supplier integration or reverse logistics efficiency

Key Insight: The biggest opportunities often emerge from analyzing why competitors excel in specific areas. If a rival has 30% lower shipping costs, don't just match their carrier—analyze their packaging optimization, route planning, and volume discounts. Translate findings into actionable improvements: prioritize quick wins (like adopting a competitor's successful packaging method) while planning strategic investments (automation where gaps are widest). Remember: benchmarking isn't about copying—it's about understanding the 'why' behind performance differences to build your unique competitive edge.

Implementation and Continuous Improvement: Making Benchmarking Work for You

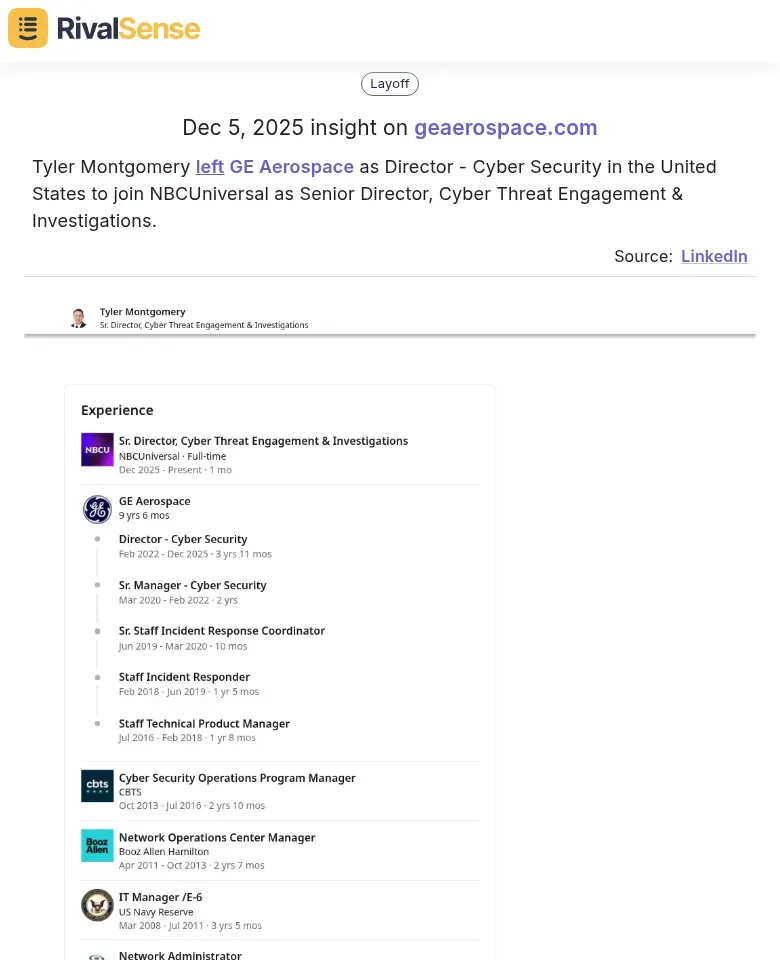

To maximize warehousing & distribution competitor benchmarking benefits, start by developing targeted action plans. When you identify performance gaps—like a competitor's 20% faster order fulfillment—create specific initiatives: "Reduce picking time by 15% through zone optimization within 90 days." Assign clear owners and KPIs for accountability. Tracking management changes can also provide strategic clues; for instance, Tyler Montgomery left GE Aerospace as Director - Cyber Security to join NBCUniversal as Senior Director, Cyber Threat Engagement & Investigations. This insight is valuable because personnel moves can indicate shifts in competitor focus, such as increased investment in cybersecurity, which might affect their supply chain resilience and risk management strategies.

Establish regular benchmarking cycles aligned with business rhythms. Conduct quarterly reviews comparing metrics like inventory turnover, shipping accuracy, and cost per unit. Use tools like RivalSense to automate data collection, ensuring you're tracking real-time changes in competitor strategies, such as new fulfillment centers or technology adoptions.

Create a Culture of Continuous Improvement: 🔄

- Monthly competitor website scans for pricing/logistics changes

- Bi-annual deep-dive analysis on 3-5 key rivals

- Quarterly action plan updates based on findings

This ongoing monitoring turns data into proactive strategy, keeping your operations agile and competitive.

Conclusion: Sustaining Competitive Advantage Through Systematic Benchmarking

To sustain competitive advantage, integrate benchmarking into your strategic planning cycles. Make it a quarterly ritual where insights directly inform decisions on capacity expansion, technology investments, and service improvements. Create a simple dashboard that tracks key metrics against top competitors, ensuring leadership reviews it before major planning sessions. Measure ROI by linking benchmarking outcomes to tangible business results. For example, if benchmarking reveals a 15% faster order fulfillment rate at a competitor, calculate the revenue impact of matching that speed. Track cost savings from adopting best practices in inventory management or labor efficiency. Present these figures in executive summaries to demonstrate clear business value.

Future-proof operations through adaptive benchmarking. Set up automated alerts for competitor moves like new warehouse openings, technology adoptions, or service changes. Conduct scenario planning: 'If Competitor X automates their picking process, how do we respond?' Regularly update your benchmarking criteria as market conditions evolve, ensuring you're always measuring what matters most. This proactive approach turns benchmarking from a periodic exercise into a continuous competitive intelligence system that drives sustained advantage.

Ready to take your competitor benchmarking to the next level? Try RivalSense for free at https://rivalsense.co/ to automate tracking of competitor product launches, pricing updates, event participations, partnerships, and more—delivered in a weekly email report. Get your first competitor report today and start transforming data into strategic insights!

📚 Read more

👉 How to Counter Competitor Advances Like Xometry's Formlabs SLA Partnership

👉 Track Key Account Team Changes: Website Monitoring Workflow for Competitor Insights

👉 Beginner's Guide to Strategic Account Tracking in Music Streaming

👉 Competitor Partnership & Client Analysis Framework: Strategic Templates

👉 Leveraging Competitor Insights: OpenAI's Model Tests and Your Strategy