Mastering IoT Competitor Benchmarking: A Strategic Guide for Smart Industrial Devices

In today's hyper-competitive IoT landscape, industrial device manufacturers can't afford to operate in isolation. Understanding your rivals' moves isn't just helpful—it's fundamental to survival and growth. Smart industrial devices are revolutionizing sectors from manufacturing to energy management, making competitive intelligence especially critical for market leadership.

The core objectives of effective benchmarking are threefold: identifying key players, evaluating their capabilities, and extracting actionable insights to sharpen your competitive edge. Start with these practical steps:

✅ Competitor shortlisting: Identify 5-10 primary rivals in your niche

✅ Multi-dimensional analysis: Examine product features, pricing, customer feedback

✅ Continuous monitoring: Track technological advancements and partnerships

🔍 Pro Tip: Use tools like RivalSense for automated tracking of competitor activities across websites, social media, and registries—delivered in weekly digestible reports.

Identifying Key Competitors in the IoT Space

Pinpointing relevant competitors requires strategic filtering beyond surface-level recognition. Focus on companies matching your target segments, geographic reach, and technological sophistication. For smart industrial devices, prioritize competitors with similar integration capabilities and scalability profiles.

Industrial IoT leaders like Siemens and Honeywell dominate through comprehensive ecosystems, while disruptors like Samsara gain traction with specialized solutions. Analyze their:

- Product portfolios and technical specifications

- Customer case studies and review patterns

- Market positioning and growth trajectories

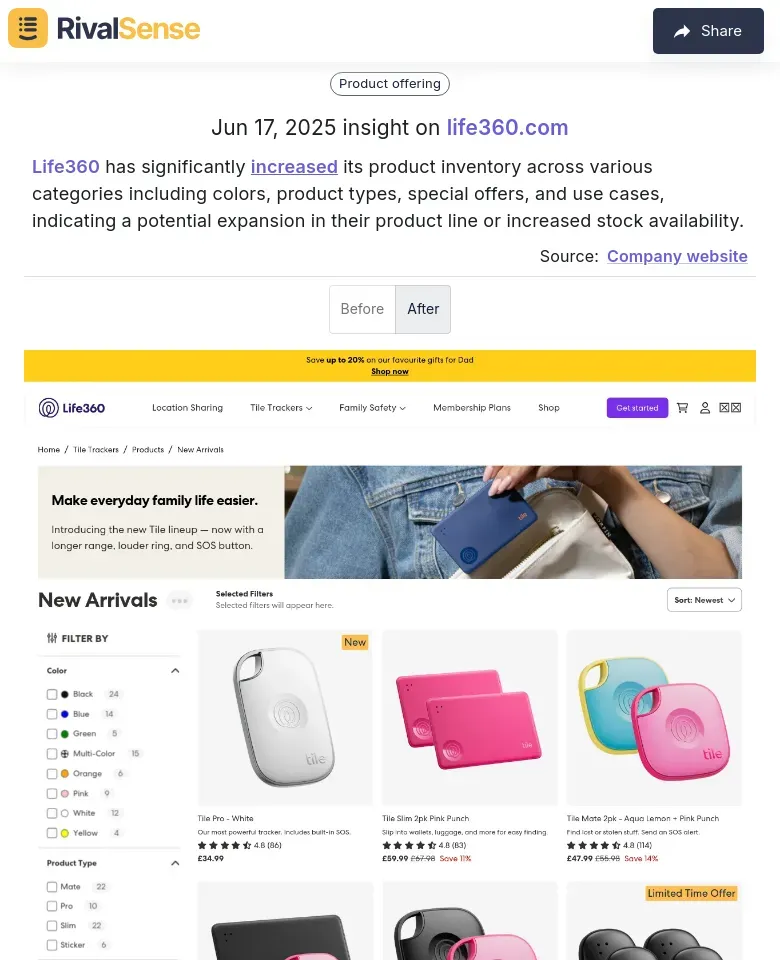

Example: When RivalSense detected Life360's significant product inventory expansion across categories, it signaled strategic diversification. Tracking such moves helps anticipate market shifts and resource allocation:

🔍 Why it matters: Product expansion insights reveal competitor growth strategies early, allowing you to counter-position or accelerate innovation.

Methodology for Benchmarking Analysis

Effective benchmarking requires structured data collection and relevant KPIs. Combine automated monitoring with manual validation for comprehensive insights. Prioritize data from product documentation, technical forums, and industry certifications.

Critical KPIs for smart industrial devices include:

| KPI Category | Examples |

|---|---|

| Performance | Uptime %, Response latency |

| Efficiency | Energy consumption, Data processing speed |

| Reliability | Failure rates, Maintenance intervals |

| Compliance | Certifications, Audit results |

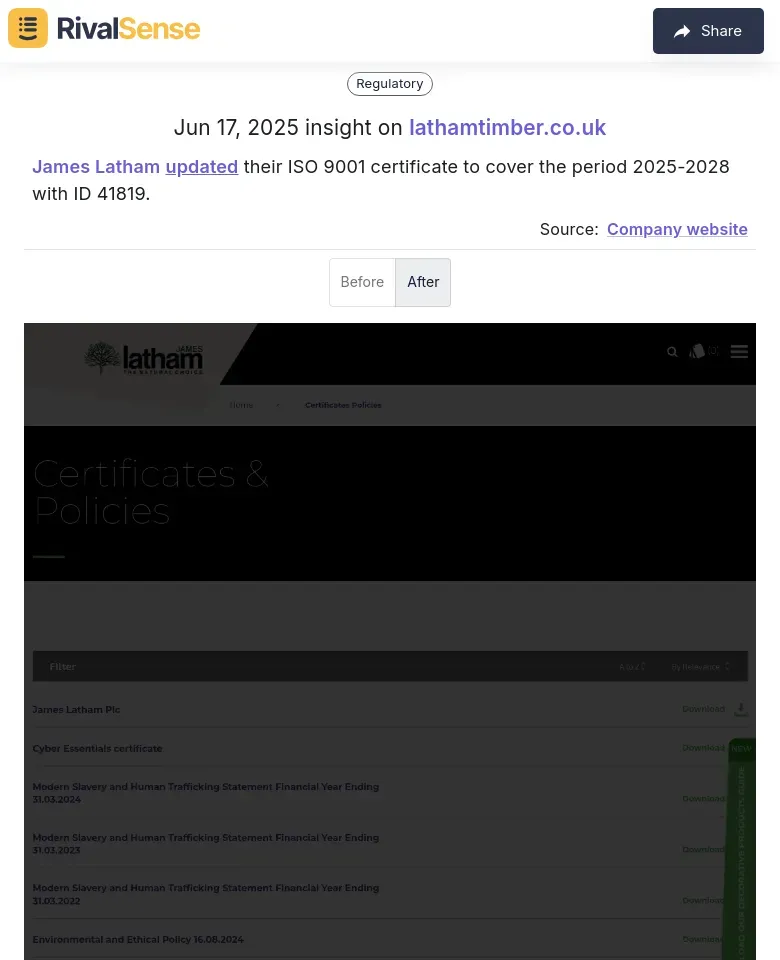

Example: RivalSense alerted users when James Latham updated their ISO 9001 certification—a key quality indicator. Such compliance tracking ensures you match industry standards:

🔍 Why it matters: Certification updates signal operational maturity, helping you benchmark quality processes and avoid compliance gaps.

Comparative Analysis of Smart Industrial Devices

Objective feature comparisons reveal competitive advantages and vulnerabilities. Map your offerings against rivals across connectivity protocols, security frameworks, and API ecosystems. Industrial buyers prioritize reliability, so analyze failure rates under stress conditions.

Practical comparison framework:

- Feature parity assessment:

- Must-have vs. differentiating features

- Compatibility with legacy systems

- Performance benchmarking:

- Third-party testing data

- Real-world case studies

- User experience evaluation:

- Setup complexity

- Maintenance requirements

🔍 Pro Tip: Create a scoring matrix weighting factors by your customers' priorities (e.g., 40% reliability, 30% integration ease, 30% TCO).

Strategic Insights and Recommendations

Our analysis reveals consistent gaps in cross-platform interoperability and cybersecurity across industrial IoT players. Simultaneously, AI-driven predictive maintenance and energy optimization emerge as high-opportunity differentiators.

Actionable recommendations:

- 🛡️ Boost security investments: Implement zero-trust architectures following ISO 27001 frameworks

- 🤝 Drive interoperability: Co-develop standards with complementary solution providers

- ⚡ Embed AI capabilities: Develop predictive failure algorithms using sensor data

- 🌱 Prioritize sustainability: Integrate energy-monitoring sensors into all devices

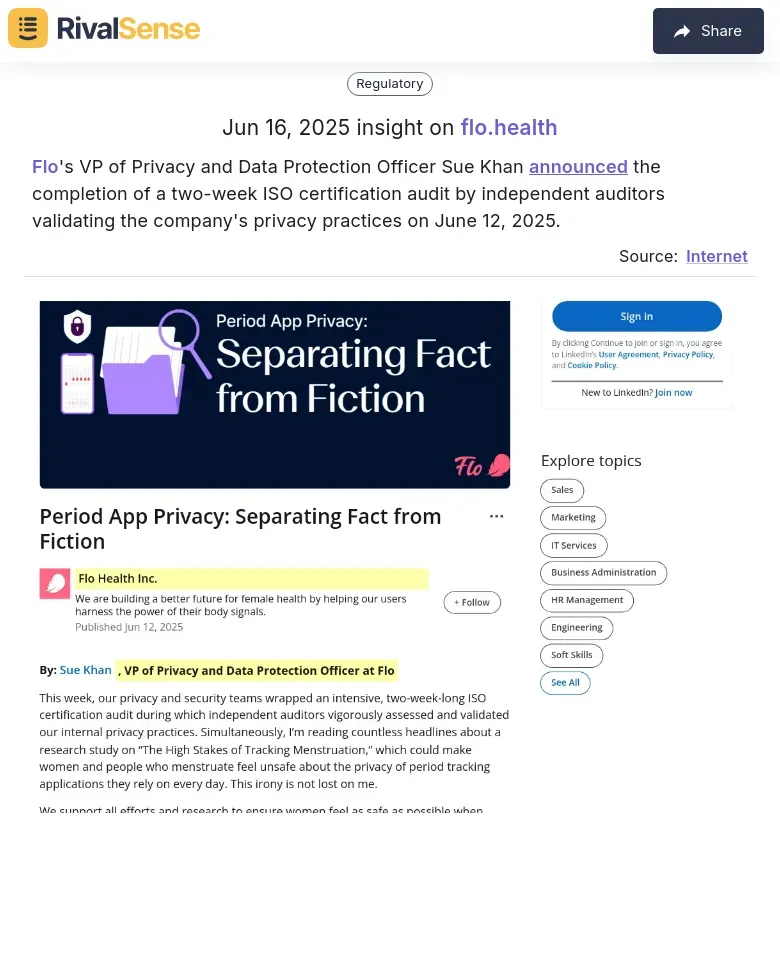

Example: When Flo announced their ISO certification audit completion, it demonstrated competitive commitment to privacy—a key trust factor for industrial buyers:

🔍 Why it matters: Audit insights validate competitors' operational rigor, prompting you to enhance your own trust indicators.

Emerging trends to monitor:

- Edge computing adoption rates

- 5G integration timelines

- Carbon footprint tracking features

Conclusion and Next Steps

Consistent competitor benchmarking transforms market intelligence into strategic advantage. Key takeaways include the dominance of ecosystem players, rising importance of AI capabilities, and persistent interoperability challenges.

Immediate actions for leadership teams:

✅ Conduct SWOT analysis using latest benchmark data

✅ Prioritize 1-2 key differentiators from gap analysis

✅ Establish continuous monitoring protocols

Maintain competitive agility by automating intelligence gathering. Tools like RivalSense track competitor product launches, pricing changes, certifications, and leadership moves—delivering actionable insights weekly.

🚀 Try RivalSense free today → https://rivalsense.co/

Get your first competitor intelligence report and start outmaneuvering rivals immediately.

📚 Read more

👉 How Reverse Health's Obesity Calculator Update Ignited Competitive Responses

👉 LinkedIn Competitor Insights: Practical Research Templates

👉 Decoding Competitor Support Strategies: A Restaurant Tech Playbook

👉 How to Track Competitor Media Mentions & Content Alerts for Strategic Advantage

👉 Decoding Vivid Money's Crypto Rate Shifts: A Competitor Analysis Example