Maersk's Branded Containers Land in Nigeria: Tracking Strategic Milestones

In competitive intelligence, spotting physical infrastructure changes provides concrete evidence of strategic shifts. Tracking assets like branded containers helps decode expansion priorities and resource allocation patterns across global markets.

🔍 Breaking Down Maersk's Nigerian Milestone

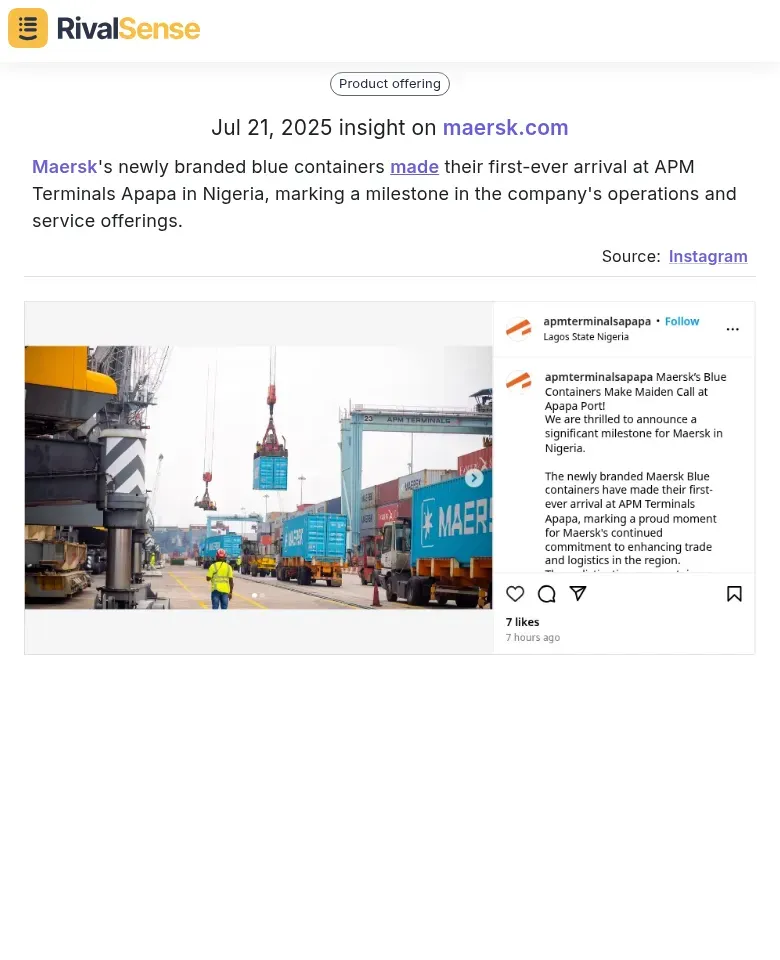

Maersk's newly branded blue containers arriving at APM Terminals Apapa represents more than aesthetic branding—it signals deliberate market reinforcement. This first-ever occurrence in Nigeria suggests targeted investment in West African trade corridors and potential service upgrades. Physical infrastructure deployments often precede pricing or service changes, making them critical early indicators.

Branded assets create visibility advantages in high-traffic ports

⚖️ Why Physical Asset Tracking Matters

Infrastructure deployments require substantial capital commitment, revealing long-term market confidence. Competitors' equipment branding often correlates with service differentiation strategies. Noting deployment locations helps map geographic priorities—here, Nigeria's status as Africa's largest economy makes this particularly noteworthy for logistics players.

✅ Actionable Intelligence Framework

- Correlate with pricing data: Check if new surcharges or premium services accompany physical rollouts

- Monitor port partnerships: Exclusive terminal access often enables such branded deployments

- Track asset circulation: Observe whether branded units concentrate in specific trade lanes

- Compare branding cycles: Note if competitors refresh physical assets simultaneously

💡 Turning Observations into Strategy

Logistics competitors should audit their Nigerian service capabilities against Maersk's visible commitment. Freight forwarders might leverage this visibility to negotiate port partnerships, while regional players could highlight local expertise as counterstrategy. Infrastructure investments typically trigger 6-18 month follow-on announcements—watch for related service launches.

🔔 Pro Tip: Set Google Alerts for "[Competitor] + [Country] + terminal/port" with image search enabled to catch similar physical deployments.

Tracking granular moves like branded container deployments manually consumes significant resources. Platforms like RivalSense automate detection of physical infrastructure changes, partnership shifts, and location-based expansions across global registries and visual sources. Try RivalSense free to get your first competitor report today: https://rivalsense.co/

📚 Read more

👉 Market Intelligence for Threats: A Practical Guide for Business Leaders

👉 Mastering HR Competitive Threat Monitoring: Frameworks, Templates & Real-World Insights

👉 Turning Competitor Expansions into Opportunities: Lessons from Tokmanni's 271-Item Cosmetics Boost

👉 Advanced Instagram Intelligence: Decoding Competitor Webinar Promotion Tactics

👉 Actionable Strategies for Retail Training Program Research